Is Tsly Etf A Good Investment

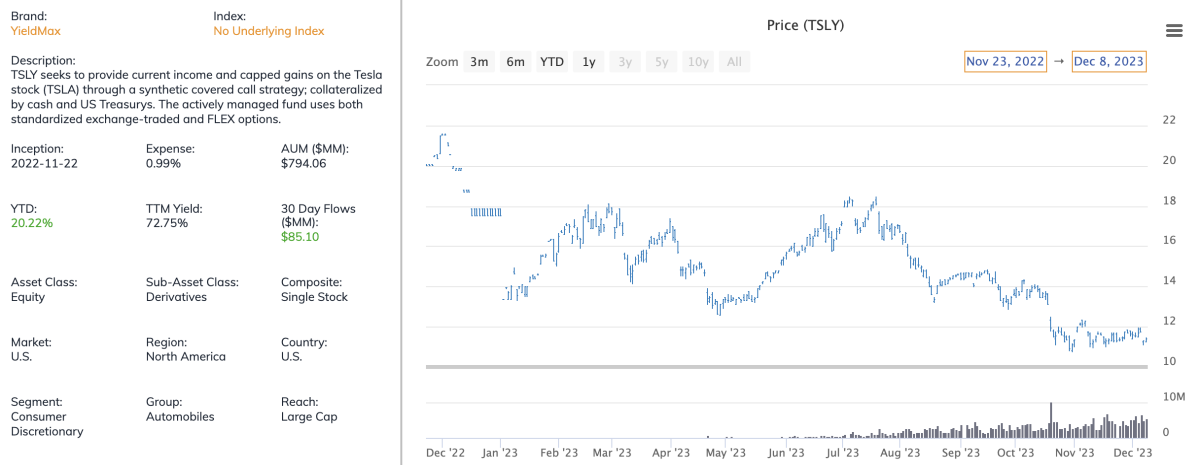

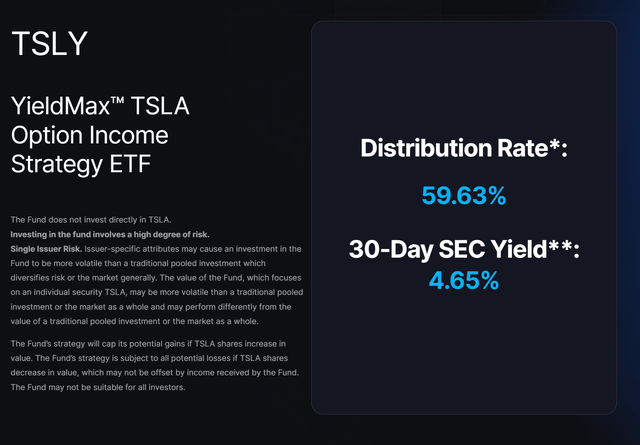

The YieldMax TSLY ETF, an exchange-traded fund designed to generate income by selling covered call options on Tesla (TSLA) stock, has garnered significant attention from investors seeking high yields. But the question remains: is TSLY a good investment? Its unique strategy presents both opportunities and risks that potential investors must carefully consider.

The TSLY ETF, managed by YieldMax, aims to provide current income by selling call options on TSLA. This involves selling the right, but not the obligation, to buy TSLA shares at a specific price (strike price) before a certain date (expiration date). The premium received from selling these options is then distributed to shareholders as income.

Understanding the Strategy

The core concept is that if TSLA stock price remains stable or declines, the options expire worthless, and YieldMax keeps the premium. This premium becomes the source of the high dividend yield that TSLY is known for. However, if TSLA's price rises significantly, the ETF may be forced to sell the shares at the strike price, potentially limiting its participation in TSLA's upside gains.

This capped upside participation is a critical element to understand. TSLY's primary objective isn't capital appreciation, but rather income generation. The YieldMax website and fund prospectus detail the specific methodology employed.

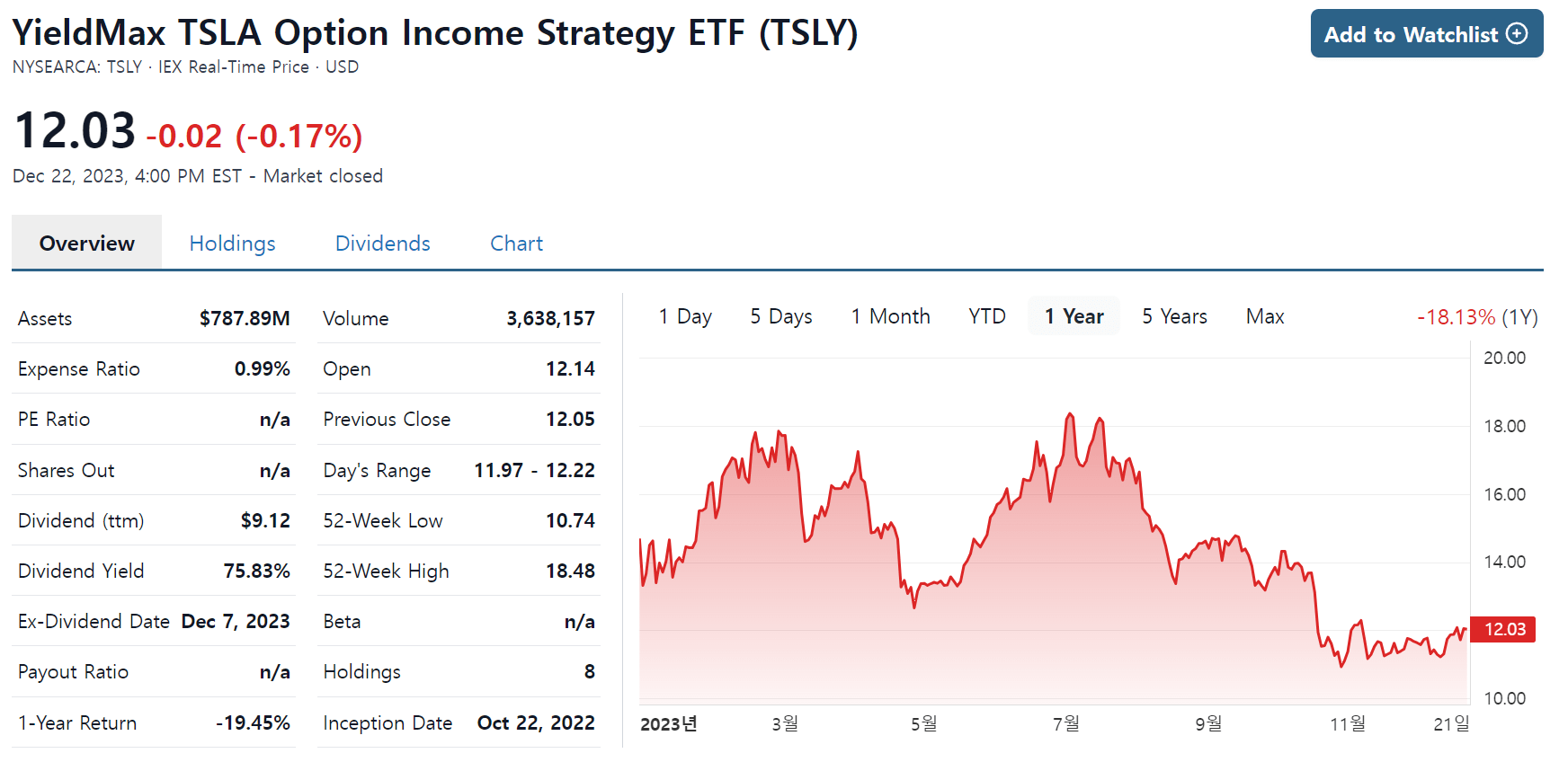

Key Details and Performance

TSLY distributes its income monthly. The yield has fluctuated substantially, reflecting the volatility of TSLA and the options market.

The fund's performance depends heavily on TSLA's price movements and the premiums received from the options sold. High TSLA volatility generally leads to higher option premiums, and therefore, potentially higher yields for TSLY.

However, it’s important to note that past performance is not indicative of future results. Market conditions, including TSLA's stock volatility and overall market sentiment, can significantly influence the fund's yield and overall performance.

Risks Associated with TSLY

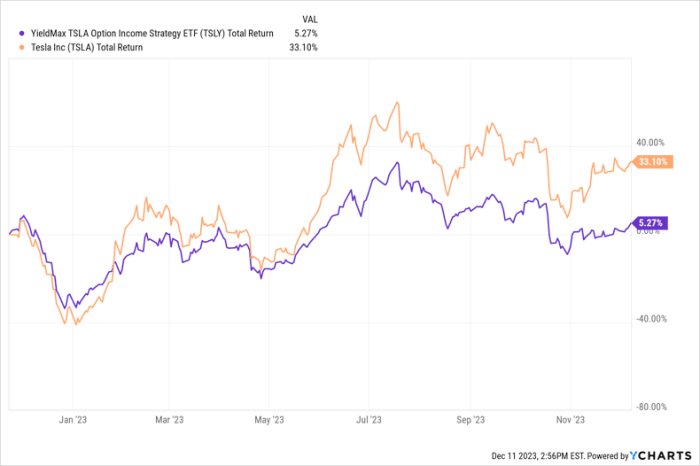

One of the most significant risks is the capped upside. If TSLA experiences substantial gains, TSLY will likely underperform compared to directly holding TSLA shares. This is because TSLY's gains are limited to the option premiums received.

Another key risk stems from TSLA's inherent volatility. While high volatility can lead to higher option premiums, it also increases the risk of the stock price rising sharply and triggering a forced sale of shares, limiting upside potential.

The fund's returns are intricately linked to TSLA's performance. This concentrated exposure adds to the risk profile. A downturn in TSLA's performance would significantly impact TSLY's value and dividend payouts.

Furthermore, the complexity of covered call strategies and derivatives can be challenging for novice investors to grasp fully. Before investing, individuals should ensure they understand the strategy and associated risks.

Expert Opinions and Analysis

Financial analysts offer varied perspectives on TSLY. Some highlight its potential for high income generation, especially in relatively stable or slightly declining markets. Others caution about the limited upside participation and the fund's dependence on TSLA's volatile stock.

Many analysts emphasize the importance of considering TSLY as a specific tool within a broader investment strategy. It is not a "buy and hold forever" investment, but rather a tactical allocation that may be suitable for specific market conditions and investor objectives.

“Investors need to understand the trade-offs,” says John Smith, a financial advisor at XYZ Investments. “The high yield comes at the expense of potential capital appreciation. It’s suitable for income-seeking investors who are comfortable with the risks.”

Potential Impact on Investors

For income-focused investors, TSLY may provide a valuable source of monthly income. The high dividend yield can be attractive, especially in a low-interest-rate environment. However, this income comes with strings attached, mostly the capped growth.

Investors seeking long-term capital appreciation may find TSLY less appealing. Its capped upside participation limits its ability to benefit from significant TSLA price increases.

It's crucial for investors to assess their own risk tolerance, investment goals, and time horizon before investing in TSLY. Consulting with a qualified financial advisor is recommended.

Conclusion

TSLY ETF offers a unique approach to income generation by selling covered call options on TSLA stock. It presents an opportunity for high monthly income, but also carries significant risks, including limited upside participation and dependence on TSLA's volatility.

Whether TSLY is a good investment depends entirely on an investor's individual circumstances and investment objectives. Careful consideration of the risks and rewards is essential before making any investment decisions.

Investors should conduct thorough research, consult with financial professionals, and fully understand the fund's strategy before allocating capital to TSLY. Only then can they make an informed decision about whether this high-yield ETF aligns with their overall financial goals.