Is Varo Money And Varo Bank The Same

In the increasingly crowded landscape of fintech and online banking, clarity about the roles and relationships between different entities is crucial for consumers. One question frequently asked is whether Varo Money and Varo Bank are the same thing.

To clarify, Varo Money was the initial fintech company that later obtained a national bank charter and became Varo Bank, N.A. This transition represents a significant step in the evolution of fintech companies, allowing them to offer a wider range of banking services directly to consumers.

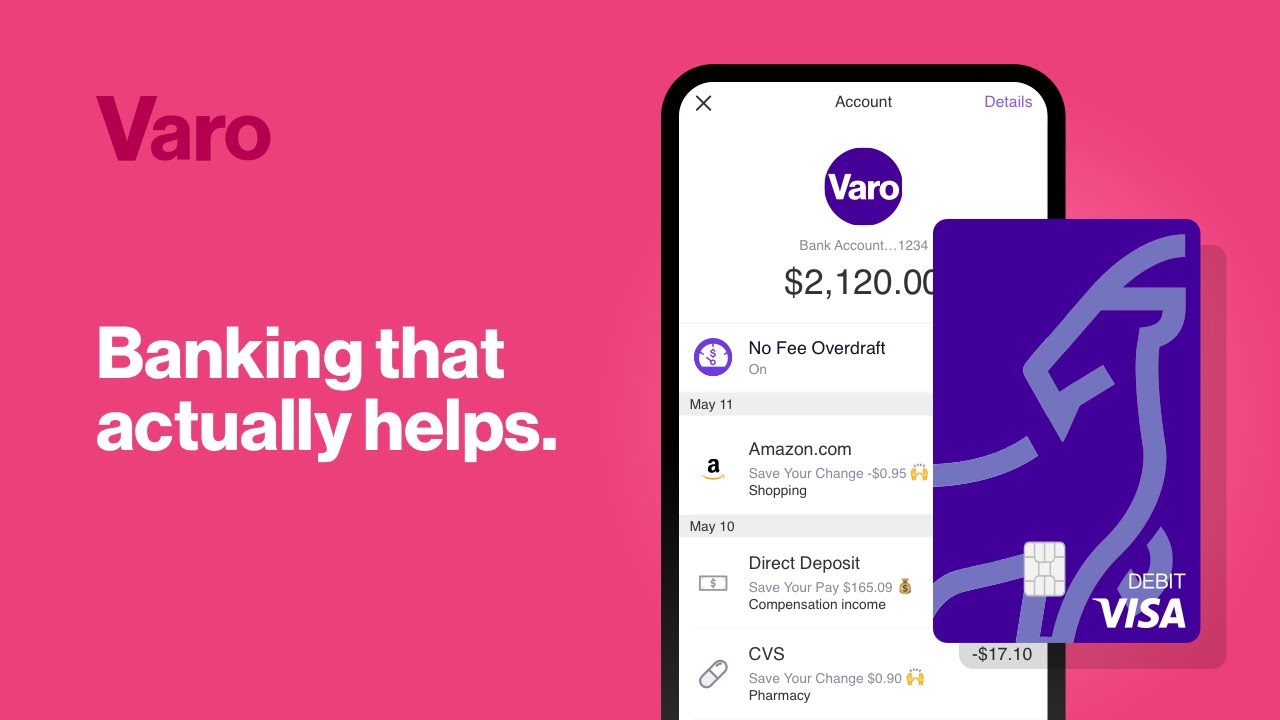

The key distinction is understanding that Varo Money was the precursor to Varo Bank. The story began with Varo Money, a mobile banking app launched with the aim of providing accessible and user-friendly financial services.

Founded in 2015, Varo Money initially partnered with other banks to provide banking services. This arrangement is common in the fintech industry, allowing companies to focus on technology and user experience without directly managing the complexities of banking regulations and infrastructure.

The Path to a National Bank Charter

The ambition of Varo Money was always to become a full-fledged bank. In 2020, after a rigorous application process, Varo Money achieved a significant milestone.

They were granted a national bank charter by the Office of the Comptroller of the Currency (OCC) and became Varo Bank, N.A. This marked a pivotal moment, making Varo the first fintech company in the U.S. to receive such a charter.

Obtaining a national bank charter is not an easy feat. It requires meeting stringent regulatory requirements, demonstrating financial stability, and establishing robust risk management systems.

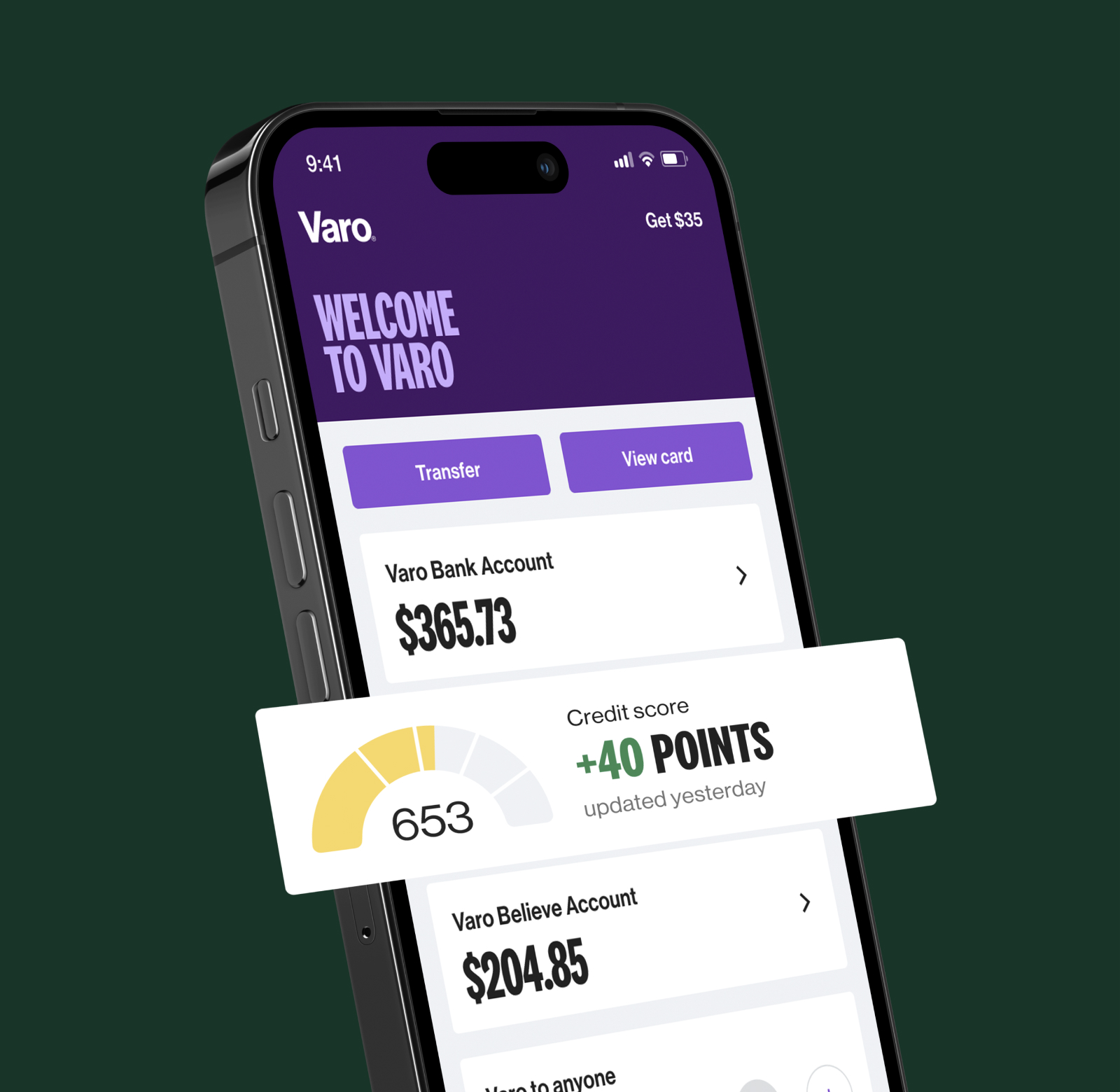

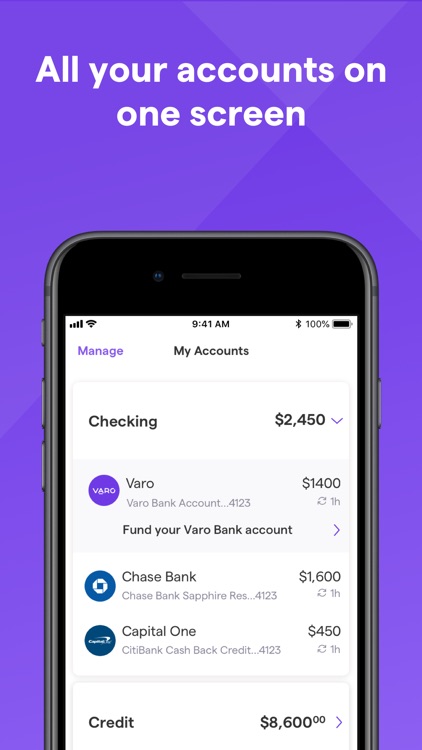

Becoming a bank allows Varo to directly hold deposits, issue loans, and offer a full suite of banking products without relying on intermediary banks. This also allows them to generate revenue in new ways, such as net interest margin from loans.

What Does This Mean for Consumers?

The transition from Varo Money to Varo Bank brings several benefits to its customers. First and foremost, deposits are now directly insured by the Federal Deposit Insurance Corporation (FDIC) up to the standard $250,000 per depositor.

Previously, this insurance was provided indirectly through partner banks.

Varo Bank can now offer a wider range of products and services, including personal loans and credit cards, directly to its customers. This increased control allows for more flexibility and innovation in designing financial products tailored to the needs of their user base.

The transition also streamlines operations and reduces reliance on third-party providers. Ultimately, this can translate to better customer service and more competitive pricing.

Key Takeaways:

Varo Money was the original fintech company.

Varo Bank, N.A. is the chartered bank that Varo Money became.

Deposits are FDIC-insured up to $250,000.

The evolution of Varo from a fintech app to a national bank underscores a broader trend in the financial industry. Fintech companies are increasingly seeking bank charters to gain more control over their operations and offer a more comprehensive suite of services.

However, it's crucial to remember that while the name may have changed, the core mission likely remains the same: providing accessible and innovative financial solutions to its users. As a chartered bank, Varo is now under more stringent regulatory oversight.

This offers increased security and stability for its customers.

For users, understanding the difference between Varo Money and Varo Bank is important for understanding the scope of services offered and the protections in place. It signifies a maturation of the company and a commitment to long-term stability in the financial sector.

![Is Varo Money And Varo Bank The Same Understanding Varo Cash Advance 2024 [Comprehensive Guide]](https://saltmoney.org/wp-content/uploads/2023/07/What-Is-Varo-Money-1.jpg)