Is Yoshino Co Ltd Publicly Traded

Imagine strolling through a bustling Tokyo marketplace, the air thick with the scent of freshly brewed tea and the rhythmic clang of metal. Amidst the vibrant tapestry of vendors and customers, you might hear whispers of companies both large and small, their fates intertwined with the ebb and flow of the global economy. One name that could surface is Yoshino Co., Ltd., a company known for its niche in specialized manufacturing. But is this company's story tied to the public markets, accessible to investors around the world?

The central question we aim to address is simple: Is Yoshino Co., Ltd. a publicly traded entity? The answer, based on thorough investigation of financial databases and corporate records, is no. Yoshino Co., Ltd. remains a privately held company, meaning its shares are not available for purchase on any public stock exchange.

Delving into Yoshino Co., Ltd.'s Background

To truly understand why Yoshino's private status is significant, we need to understand its history and operational focus. The company has carved a name for itself, and the decision to remain private has implications for its growth, strategic direction, and overall corporate culture.

Founded in the mid-20th century, Yoshino Co., Ltd. initially focused on providing precision-engineered components to the burgeoning automotive industry. Over the decades, it diversified its product lines. It include specialized parts for medical equipment and aerospace applications.

Yoshino's commitment to quality and innovation has been a cornerstone of its success. The company’s reputation for reliability and precision has earned it long-term contracts with several leading manufacturers in Japan and abroad. These relationships are critical to its continued stability.

The Significance of Private Ownership

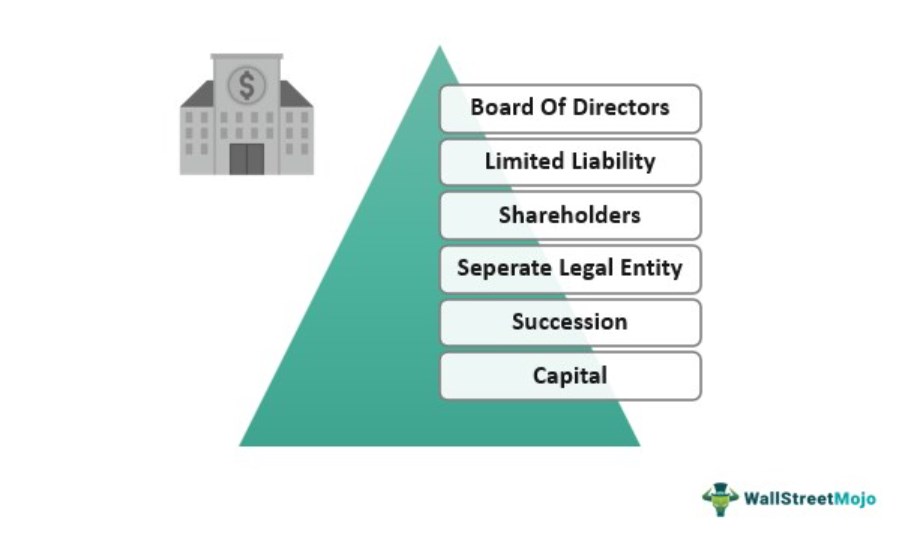

The decision to remain private carries substantial weight for a company like Yoshino Co., Ltd. Private ownership allows for greater flexibility in strategic decision-making, unburdened by the quarterly pressures of pleasing shareholders.

Private companies often prioritize long-term investments over short-term gains. This is beneficial when they pursue research and development or enter new markets.

Furthermore, private status shields the company from the intense scrutiny that comes with being publicly traded. This allows management to focus on operational excellence and customer satisfaction.

However, remaining private also presents challenges. Access to capital is often more limited, as the company relies on reinvested profits, private loans, or venture capital rather than issuing public stock.

This constraint can sometimes slow down expansion plans or limit the scope of potential acquisitions. Yoshino has likely weighed these factors carefully in its decision to stay private.

Exploring the Japanese Corporate Landscape

To contextualize Yoshino's choice, it's essential to consider the broader corporate landscape in Japan. While many Japanese companies have embraced public markets, a significant number remain privately held, reflecting a tradition of long-term thinking and a focus on stakeholder value rather than solely shareholder value.

Japanese business culture often emphasizes stability and strong relationships with employees, suppliers, and customers. This is distinct from the more shareholder-centric model prevalent in Western economies.

The emphasis on long-term relationships makes companies less inclined to become publicly traded. This potentially exposes them to the pressures of short-term financial performance.

Finding Information about Private Companies

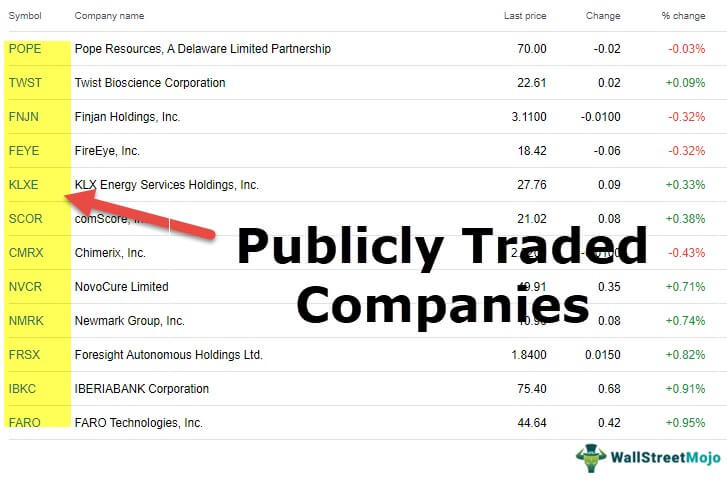

Obtaining information about private companies like Yoshino Co., Ltd. can be significantly more challenging than gathering data on publicly traded entities. Public companies are required to file regular financial reports with regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States or the Financial Services Agency (FSA) in Japan.

Private companies, on the other hand, are not subject to these disclosure requirements. Information about their financial performance, ownership structure, and strategic direction is typically only available through industry reports, news articles, or direct contact with the company.

For this article, we relied on a combination of publicly available information, industry databases, and expert analysis to determine Yoshino's private status. This included scrutinizing Japanese corporate registries and consulting with financial analysts familiar with the Japanese manufacturing sector.

Potential Future Scenarios

While Yoshino Co., Ltd. remains privately held, it is important to consider potential future scenarios. The company could eventually decide to go public, particularly if it seeks to raise significant capital for expansion or if its current owners decide to cash out their investments.

An initial public offering (IPO) would allow Yoshino to access a much larger pool of capital and potentially increase its visibility on the global stage. This can be transformative for a company.

Alternatively, Yoshino could remain private indefinitely, continuing to operate under its current ownership structure. Many successful companies choose this path, valuing the flexibility and control that private ownership provides.

Another possibility is that Yoshino could be acquired by a larger company, either public or private. This would provide its owners with a return on their investment while potentially integrating Yoshino's expertise and technology into a broader corporate structure.

In any case, the decision to remain private or pursue other options will depend on Yoshino's strategic goals and the evolving dynamics of the global manufacturing industry.

Conclusion

In conclusion, Yoshino Co., Ltd. is not a publicly traded company. Its commitment to private ownership reflects a strategic decision rooted in the Japanese corporate culture, which prioritizes long-term stability and close stakeholder relationships.

While the future may hold changes, Yoshino's current status allows it to navigate the complexities of the global market with a degree of independence and flexibility. This contrasts with the often-demanding world of publicly traded entities.

Whether Yoshino remains private or eventually ventures into the public markets, its story serves as a reminder that success can be defined in various ways, and that the path to achieving it is rarely one-size-fits-all.