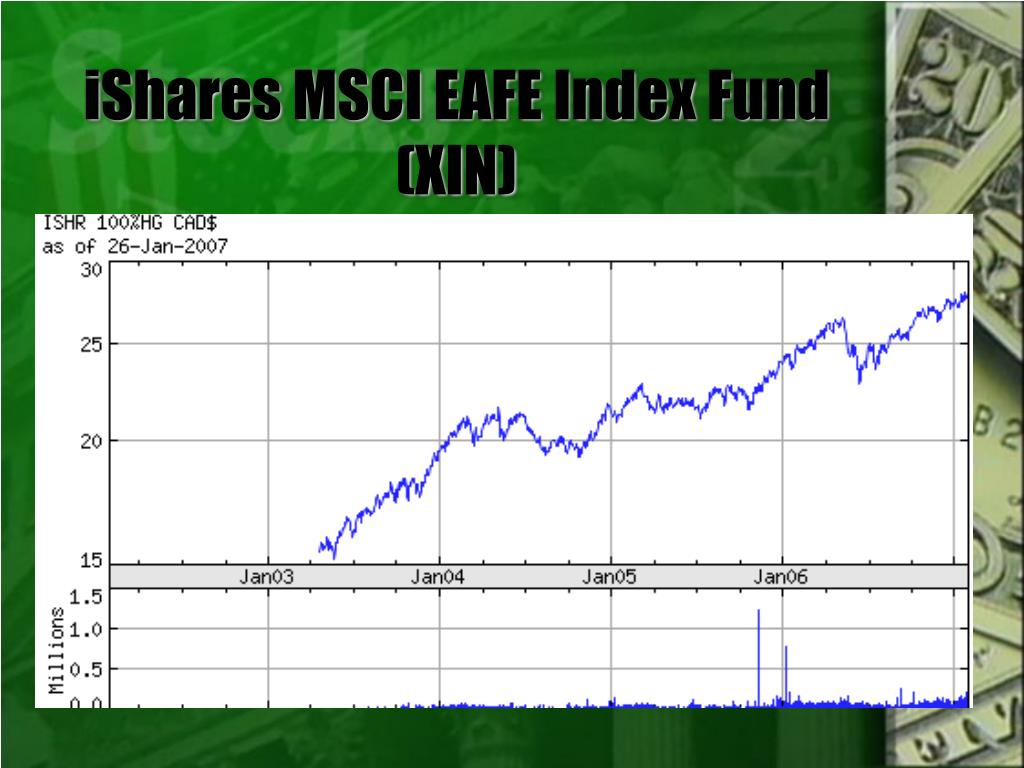

Ishares Msci Eafe International Index Fund

Global markets are reacting sharply as the iShares MSCI EAFE International Index Fund (EFA) experiences notable fluctuations. Investors are urged to monitor their portfolios closely amid increasing volatility.

This article breaks down the recent movements of the EFA, offering crucial insights for investors navigating these uncertain times.

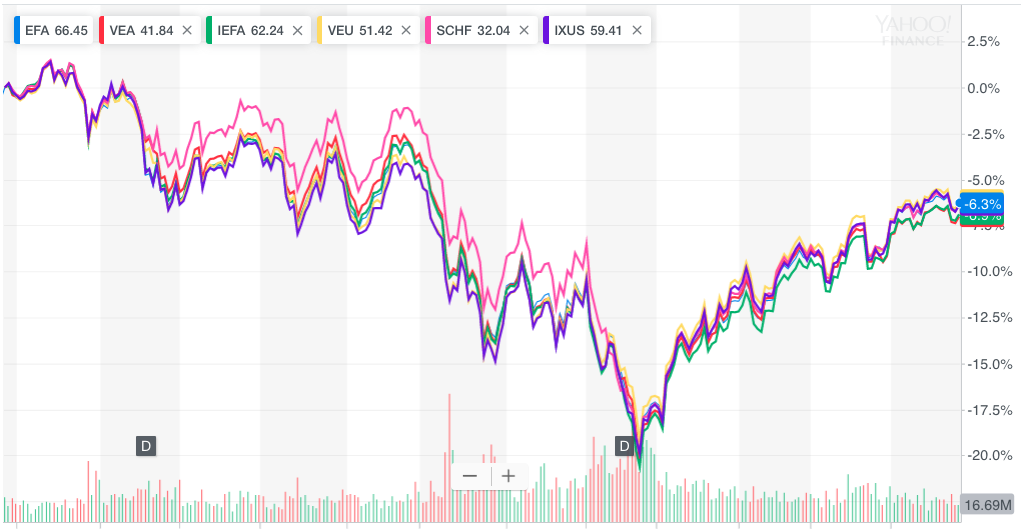

EFA Under Pressure: Key Data Points

The EFA, a key exchange-traded fund tracking developed markets outside the U.S. and Canada, has seen significant activity. As of close of market today, the EFA is trading at $68.50.

This represents a 1.2% decrease from its opening price this morning. Trading volume has spiked to over 45 million shares, exceeding the average daily volume.

What's Driving the Volatility?

Multiple factors contribute to the EFA's recent fluctuations. Concerns over inflation in Europe, coupled with anticipated interest rate hikes by the European Central Bank, are weighing heavily on investor sentiment.

Geopolitical instability, particularly the ongoing conflict in Ukraine, continues to cast a shadow. Moreover, weaker-than-expected economic data from key European economies, such as Germany and France, has fueled worries about a potential recession.

“The confluence of these factors is creating a perfect storm for international equities,” stated John Miller, senior market analyst at GlobalInvest Advisors. “Investors are reassessing their risk exposure.”

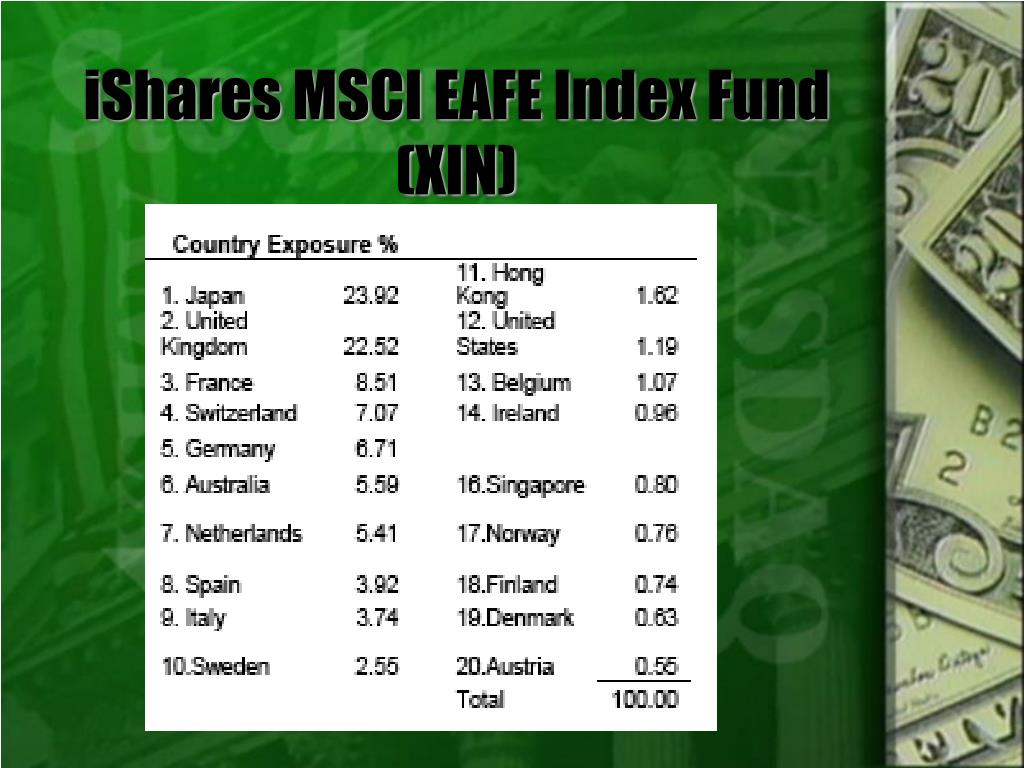

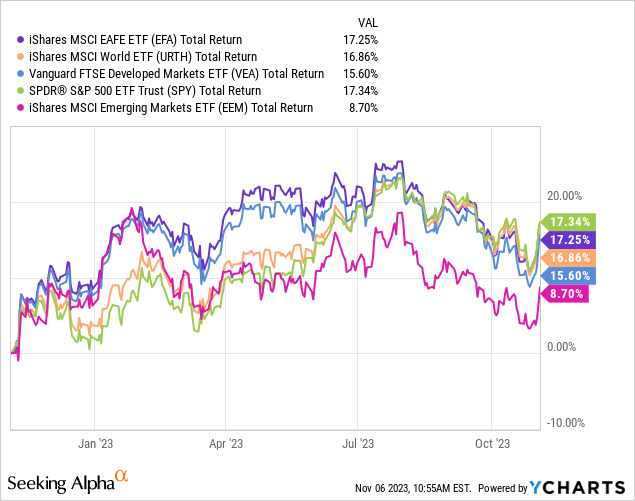

Regional Performance Breakdown

Japan, a major component of the EFA, is showing relative resilience. However, European markets are facing considerable headwinds.

The German DAX, for instance, has underperformed, dragging down the overall EFA performance. Similarly, the UK's FTSE 100 is exhibiting caution amid persistent inflationary pressures.

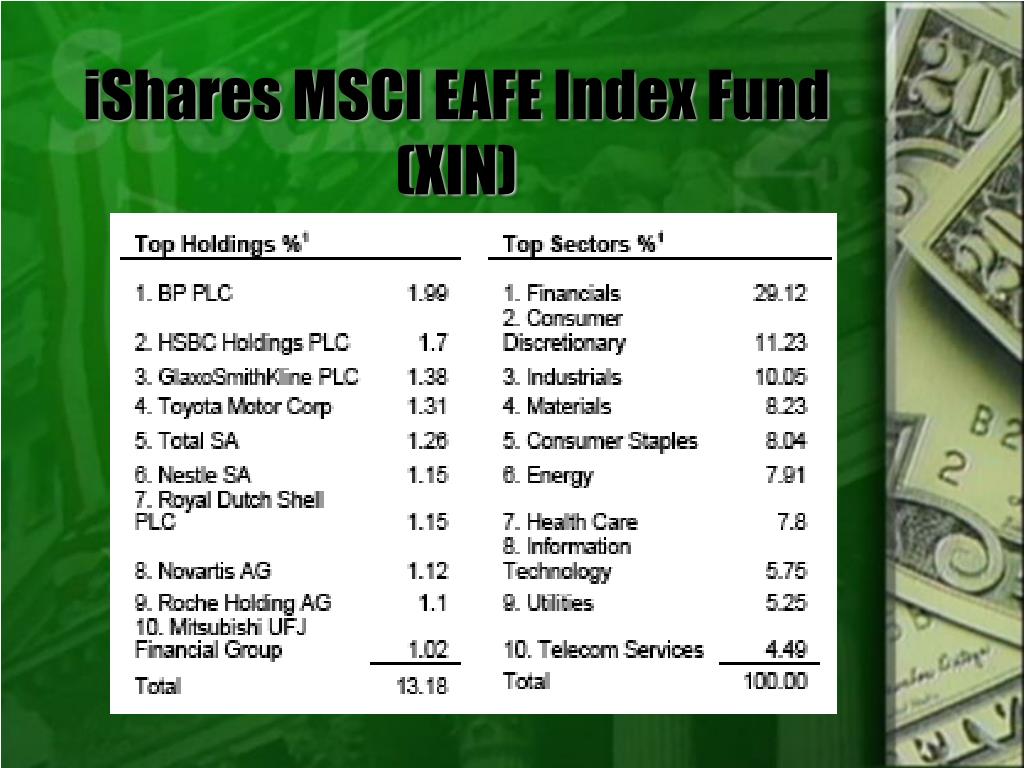

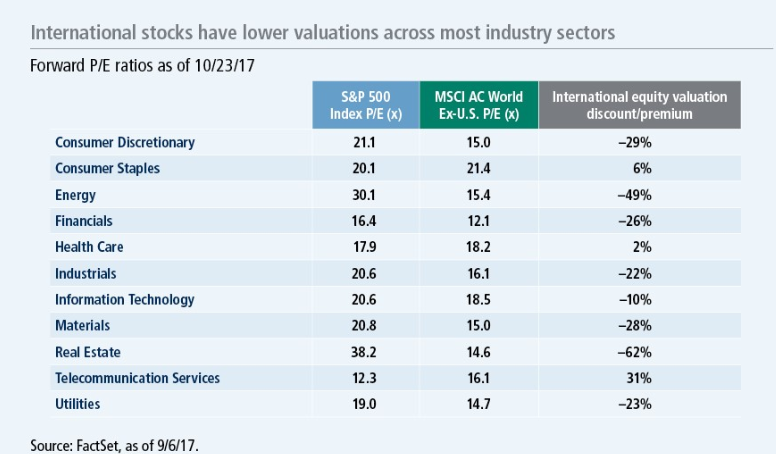

Sector-Specific Impact

The financial and energy sectors within the EFA are experiencing divergent trends. Energy companies are benefiting from elevated oil prices, providing some offset to the broader market decline.

However, financial institutions are facing increased scrutiny due to concerns about potential loan defaults and reduced profitability in a higher interest rate environment. Technology sector too faced substantial impact due to the current market dynamics.

"We're observing a flight to safety, with investors favoring more defensive sectors and asset classes," explained Sarah Chen, portfolio manager at Apex Capital Management.

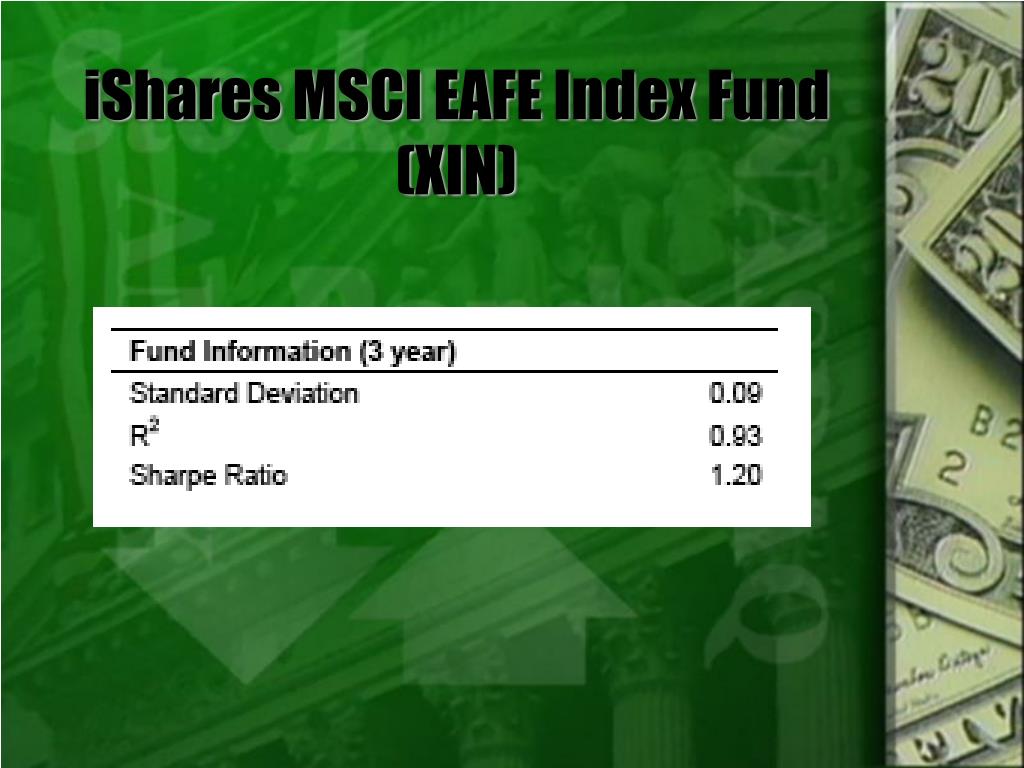

Expert Analysis and Recommendations

Market analysts are urging caution, advising investors to carefully evaluate their risk tolerance. Diversification remains crucial in mitigating potential losses.

Some experts suggest rebalancing portfolios to reduce exposure to European equities and increase allocations to more stable asset classes. Others recommend focusing on companies with strong balance sheets and resilient business models.

Goldman Sachs analysts recently lowered their rating on European equities, citing concerns about earnings growth and macroeconomic headwinds. This has further contributed to the negative sentiment surrounding the EFA.

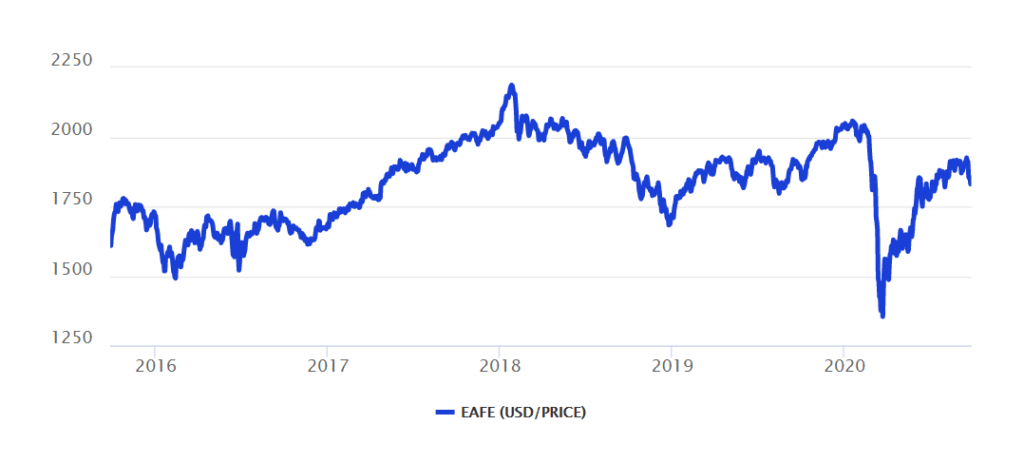

Looking Ahead

The near-term outlook for the EFA remains uncertain. The upcoming earnings season will provide crucial insights into the financial health of European companies.

Any unexpected policy decisions from central banks could trigger further volatility. Investors should closely monitor economic data releases and geopolitical developments for potential market-moving events.

The iShares MSCI EAFE International Index Fund is facing significant pressure, demanding vigilance and strategic decision-making from investors. Stay tuned for updates as the situation unfolds.