Issued Stock Refers To The Number Of Shares:

Imagine stepping into a bustling marketplace, the air thick with anticipation. Vendors call out their wares, each offering a piece of ownership in ventures both familiar and novel. This isn't just a physical space, but the modern stock market, where "issued stock" represents the keys to these diverse opportunities, keys held by countless investors around the globe.

At its core, issued stock represents the total number of shares a company has distributed to its shareholders. Understanding this figure is crucial for investors, analysts, and anyone seeking to gauge a company’s value, ownership structure, and potential for future growth. It is a fundamental piece of the financial puzzle, revealing not just the size of a company's publicly held equity, but also offering clues about its past, present, and future financial trajectory.

Understanding Issued Stock: The Basics

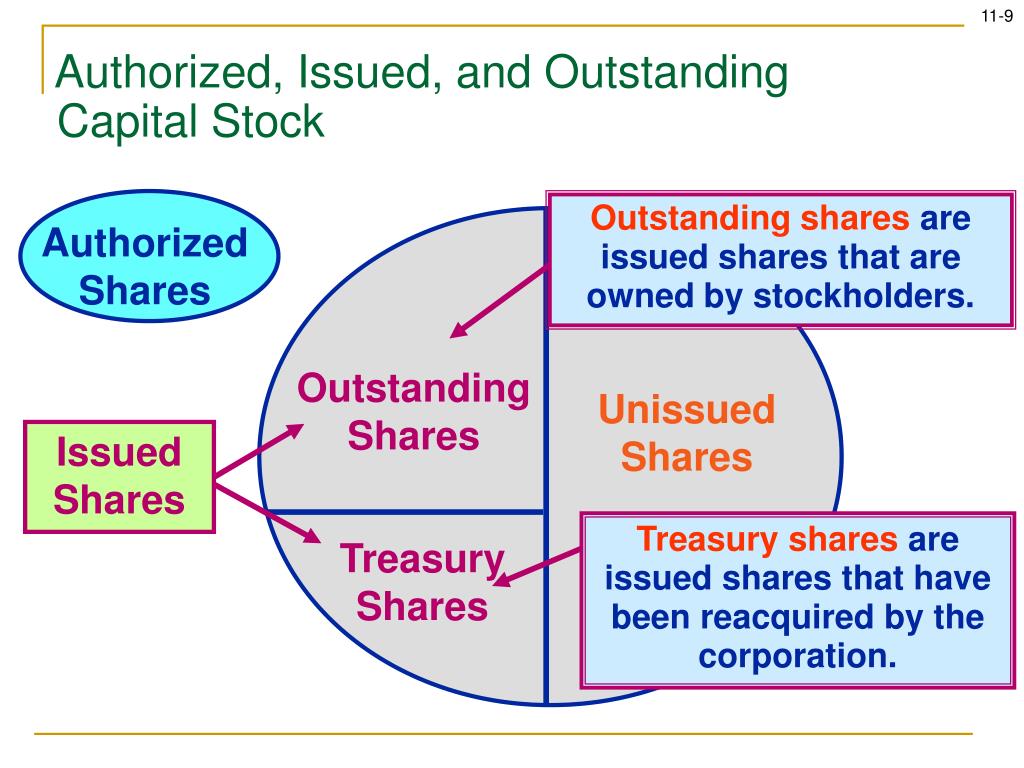

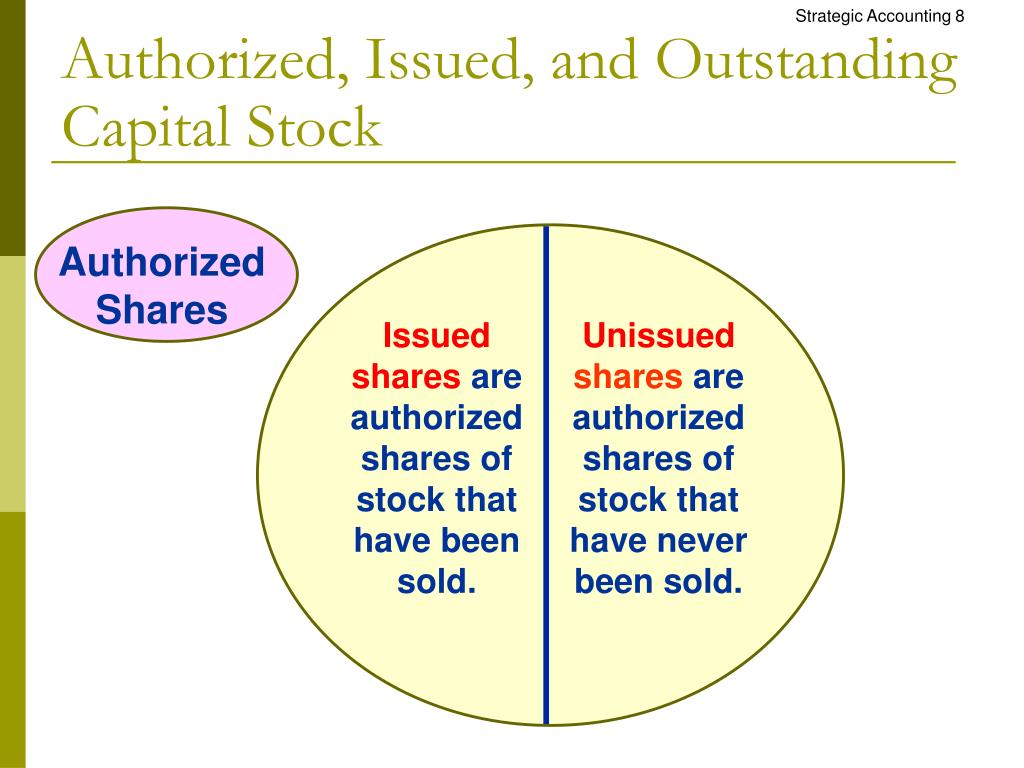

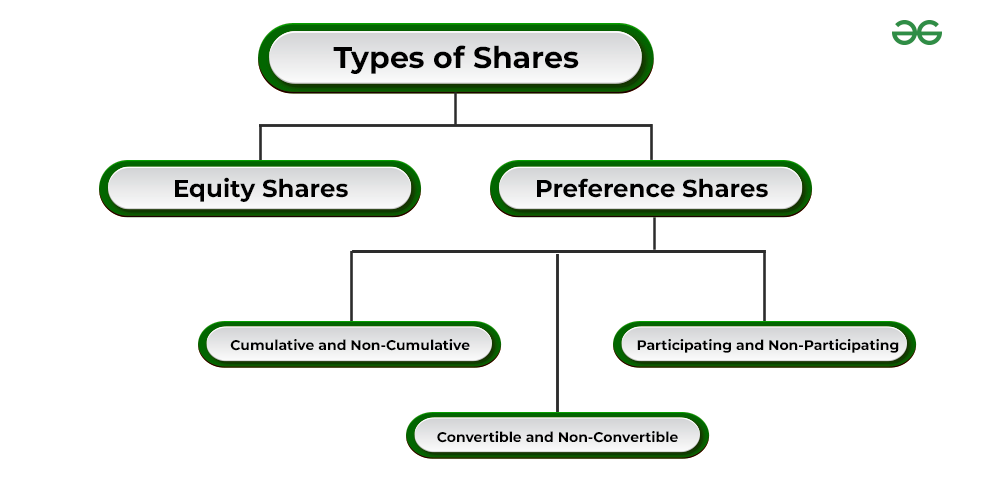

Issued stock, in simple terms, is the number of shares a company has sold or otherwise distributed to its shareholders. This figure encompasses all shares held by investors, company insiders, and even those repurchased by the company itself (treasury stock), but not yet retired.

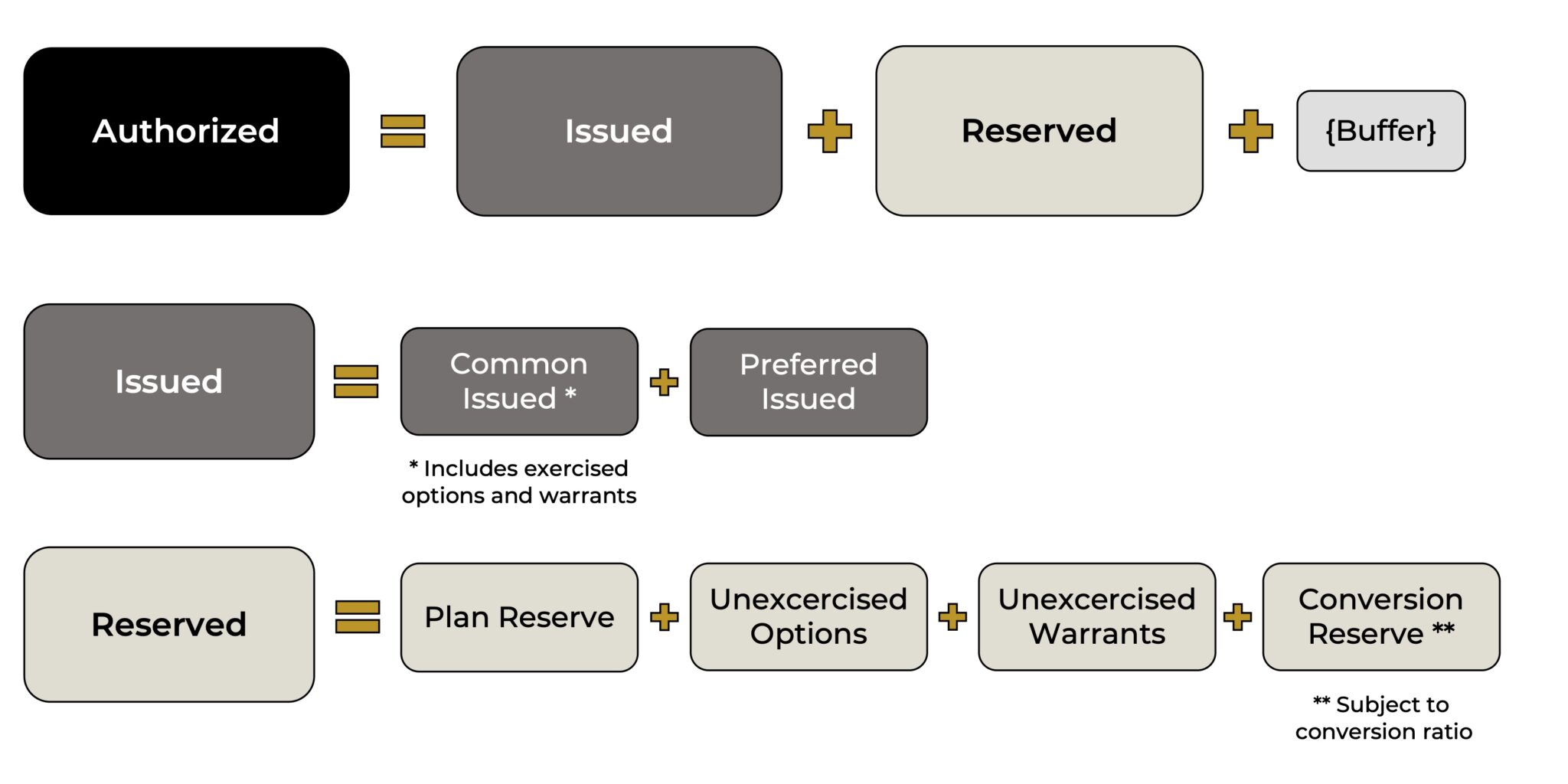

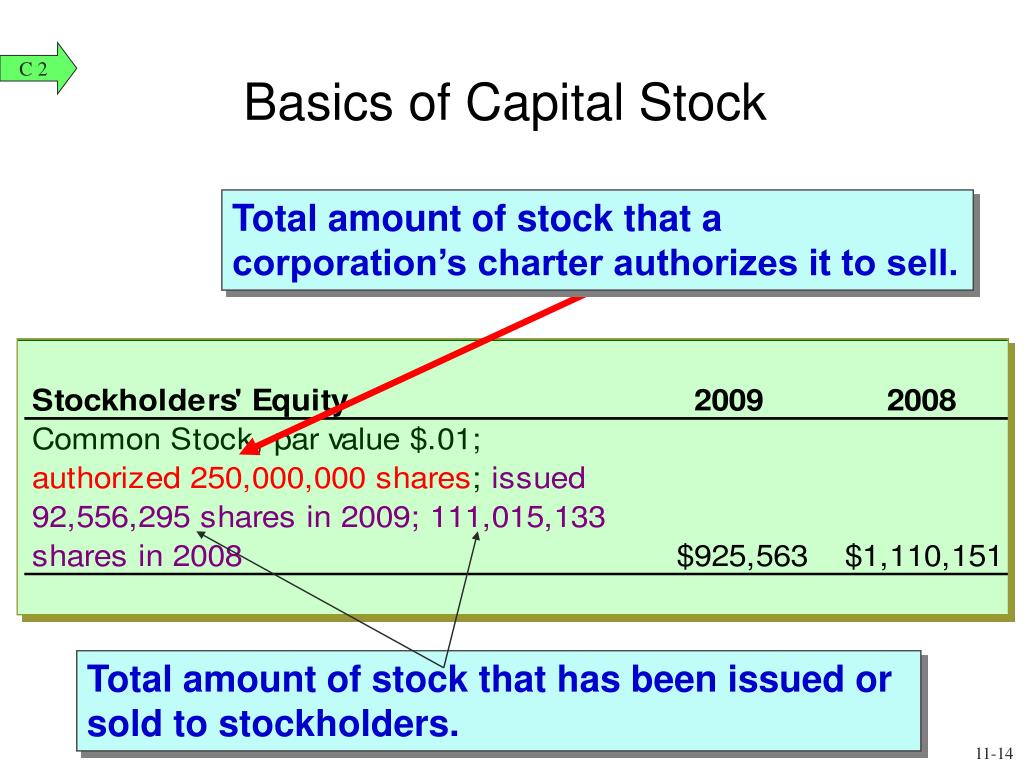

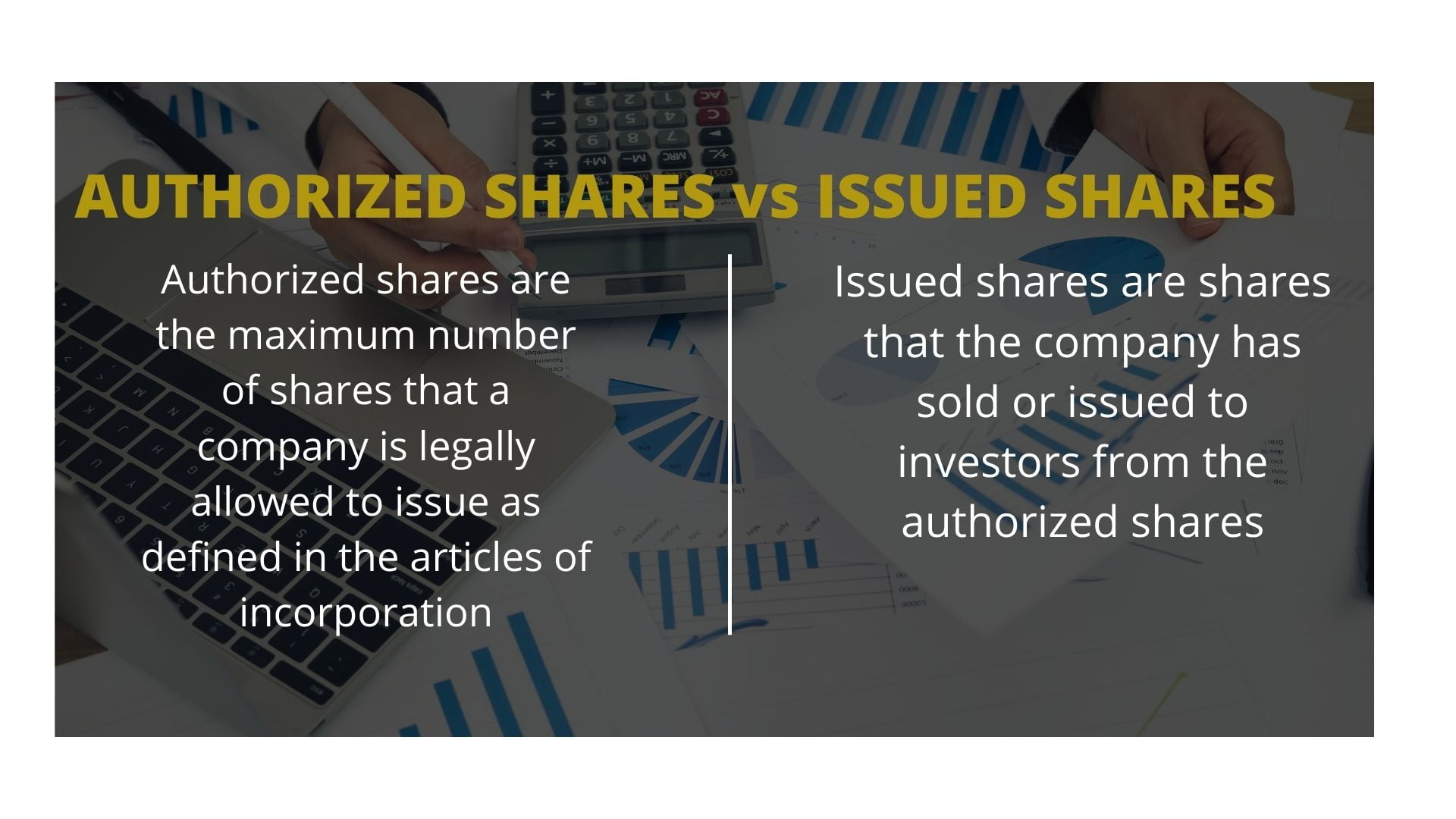

It's important to distinguish issued stock from authorized stock. Authorized stock is the maximum number of shares a company is legally allowed to issue, as stipulated in its corporate charter.

The company doesn't necessarily have to issue all of its authorized stock immediately. This allows for flexibility in raising capital in the future, through secondary offerings or employee stock option plans.

How Issued Stock Differs from Outstanding Stock

While related, issued stock and outstanding stock are not the same. Outstanding stock refers to the number of shares currently held by investors (both individual and institutional).

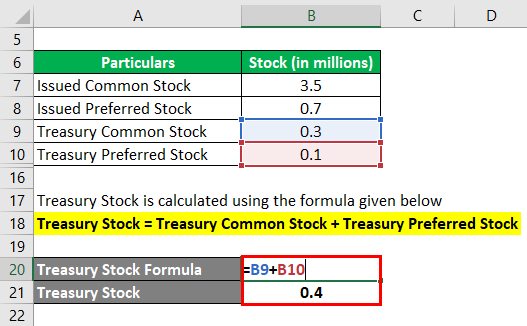

The key difference lies in treasury stock. Treasury stock is shares that the company has bought back from the market.

These shares are considered issued, but they are not outstanding because they are held by the company itself and do not carry voting rights or dividend entitlements.

The Significance of Issued Stock

The number of issued shares is a critical metric for several reasons. It is a key component in calculating a company's market capitalization.

Market capitalization, or market cap, is calculated by multiplying the current market price per share by the number of outstanding shares. This provides a quick snapshot of the company's overall value in the market.

It also informs important per-share metrics. Earnings per share (EPS), for example, is calculated by dividing a company's net income by the number of outstanding shares. This helps investors assess the profitability of a company on a per-share basis.

Issued Stock and Ownership Structure

Issued stock also sheds light on a company's ownership structure. By knowing the total number of issued shares, one can determine the percentage of ownership held by different shareholders, including institutional investors, company insiders, and individual investors.

This information is crucial for understanding the potential influence different groups may have on company decisions.

A company with a significant portion of its shares held by a few institutional investors may be more susceptible to activist shareholder campaigns, for instance.

Factors Influencing the Number of Issued Shares

The number of issued shares can change over time due to various corporate actions. A common factor is a stock split.

A stock split increases the number of issued shares while simultaneously reducing the price per share. This doesn't change the overall market capitalization of the company, but it can make the stock more accessible to smaller investors.

Reverse stock splits, on the other hand, decrease the number of issued shares and increase the price per share. Companies sometimes undertake reverse splits to avoid being delisted from exchanges that have minimum share price requirements.

Other Corporate Actions Affecting Issued Stock

Companies also issue new shares through secondary offerings, which are sales of new shares to the public after the initial public offering (IPO). This allows the company to raise additional capital for various purposes, such as funding acquisitions or expanding operations.

Employee stock option plans (ESOPs) and stock grants can also lead to an increase in issued shares. As employees exercise their options or receive stock grants, the company issues new shares to them.

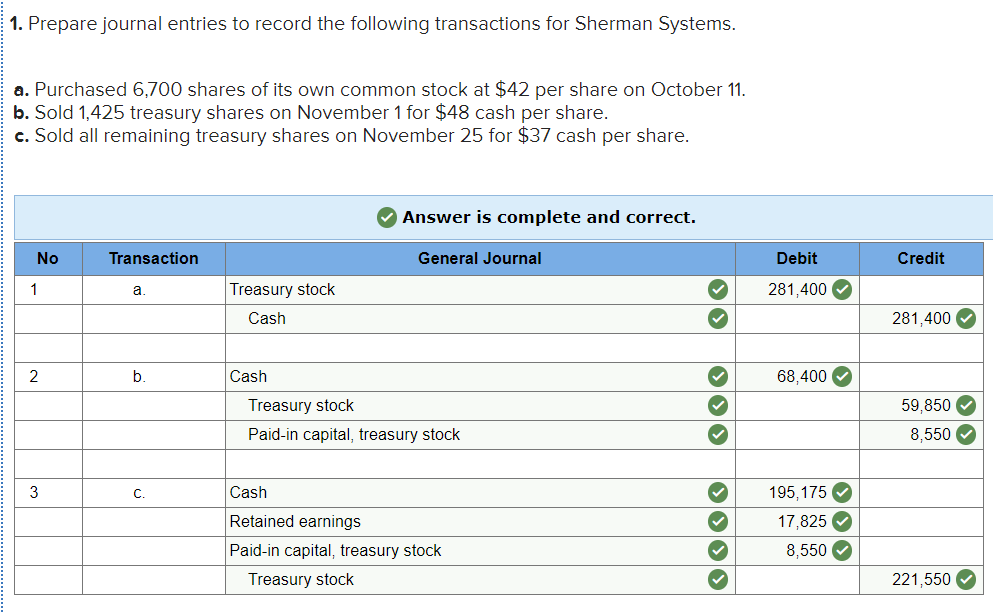

Share buybacks, as mentioned earlier, decrease the number of outstanding shares but do not affect the total number of issued shares. The repurchased shares become treasury stock.

Where to Find Information on Issued Stock

Information on issued stock is readily available from various sources. A company's quarterly and annual reports (10-Q and 10-K filings with the Securities and Exchange Commission (SEC) are primary sources.

These reports provide detailed information about the company's capital structure, including the number of authorized shares, issued shares, outstanding shares, and treasury stock.

Financial websites like Yahoo Finance, Google Finance, and Bloomberg also provide readily accessible information on issued stock and other key financial metrics.

“Understanding the number of issued shares is fundamental to understanding a company’s capital structure and valuation,” notes Dr. Anya Sharma, a finance professor at the University of Metropolitan City. “It’s a crucial piece of information for both novice and experienced investors.”

The Future of Issued Stock Tracking

As financial markets evolve, the tracking and analysis of issued stock is becoming increasingly sophisticated. Advanced data analytics and artificial intelligence are being used to identify patterns and predict future changes in the number of issued shares and their potential impact on stock prices.

Blockchain technology also holds promise for improving the transparency and efficiency of stock issuance and tracking. By using a distributed ledger, companies could potentially streamline the process of issuing and managing shares, reducing costs and increasing transparency.

Regulations around the tracking of issued shares and corporate governance are expected to tighten up over time to prevent unscrupulous financial practices, thereby ensuring greater investor safety.

Conclusion

In the vast and complex world of finance, understanding seemingly simple concepts like issued stock can unlock a wealth of knowledge. It is more than just a number; it is a window into a company’s ownership structure, financial health, and strategic decisions.

By grasping the nuances of issued stock, investors can make more informed decisions, analysts can develop more accurate valuations, and anyone interested in the financial markets can gain a deeper appreciation for the intricate dance of capital and ownership that shapes our modern economy.

So, the next time you hear about a company issuing stock, remember that you're not just hearing about a financial transaction; you're witnessing a piece of the puzzle that defines the ever-evolving landscape of business and investment.