Itr Verification Certificate By Ca Format

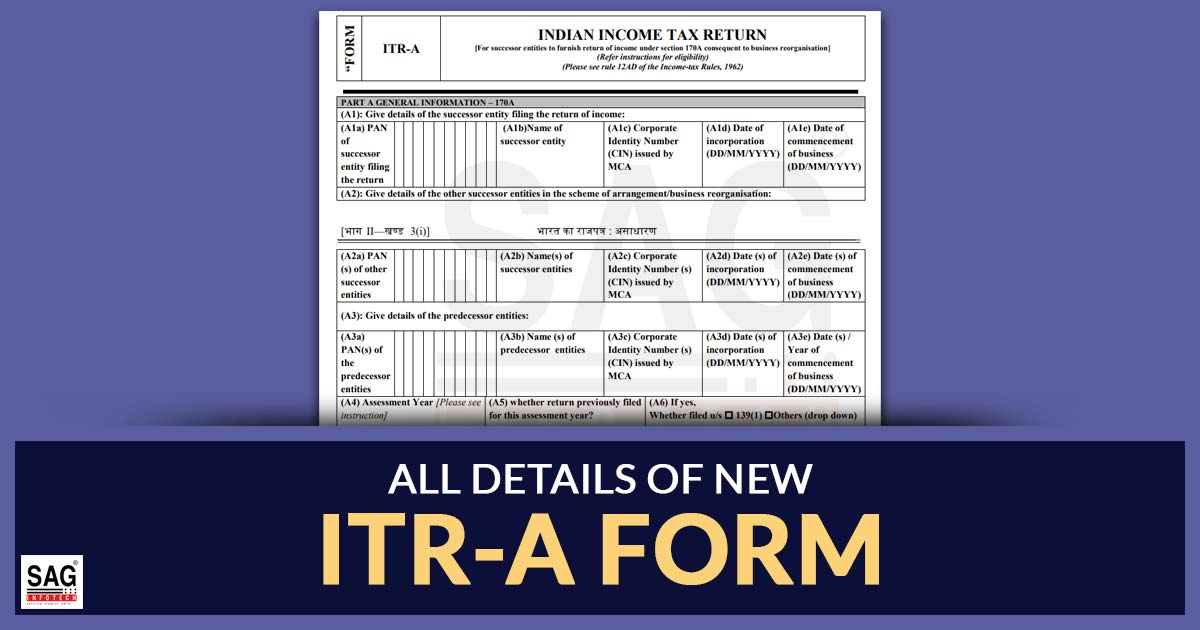

A standardized format for the Income Tax Return (ITR) Verification Certificate issued by Chartered Accountants (CAs) is gaining traction, aiming to streamline tax processes and enhance accountability. The move seeks to address inconsistencies and potential ambiguities in previously accepted formats, promoting uniformity across the auditing and tax filing ecosystem.

The implementation of a specific format, often referred to as the "ITR Verification Certificate by CA Format," is designed to bring clarity to the verification process. This standardization impacts taxpayers relying on CA certifications for ITR filing, as well as the CAs themselves responsible for issuing these crucial documents. The initiative is driven by regulatory bodies aiming to tighten tax compliance and reduce discrepancies.

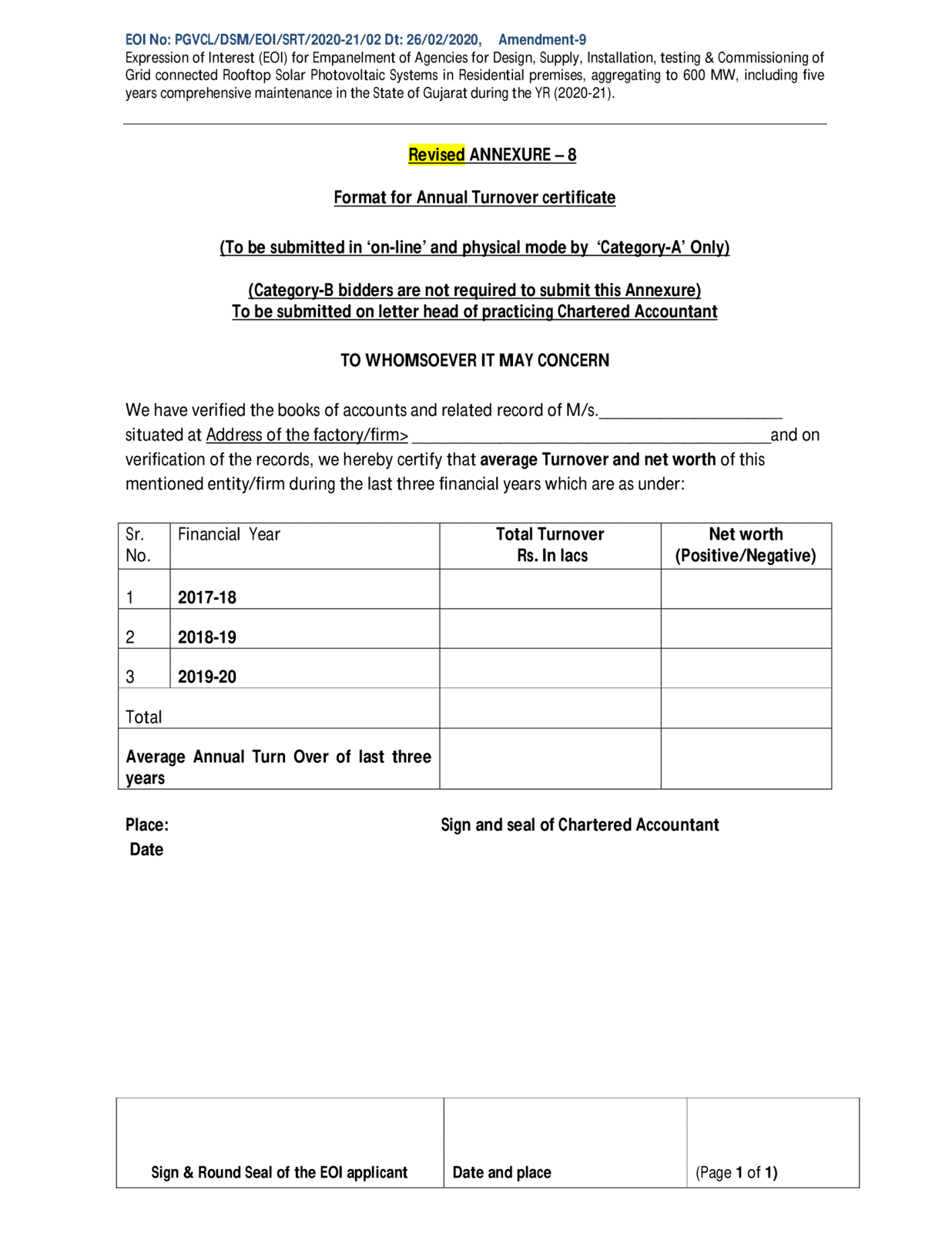

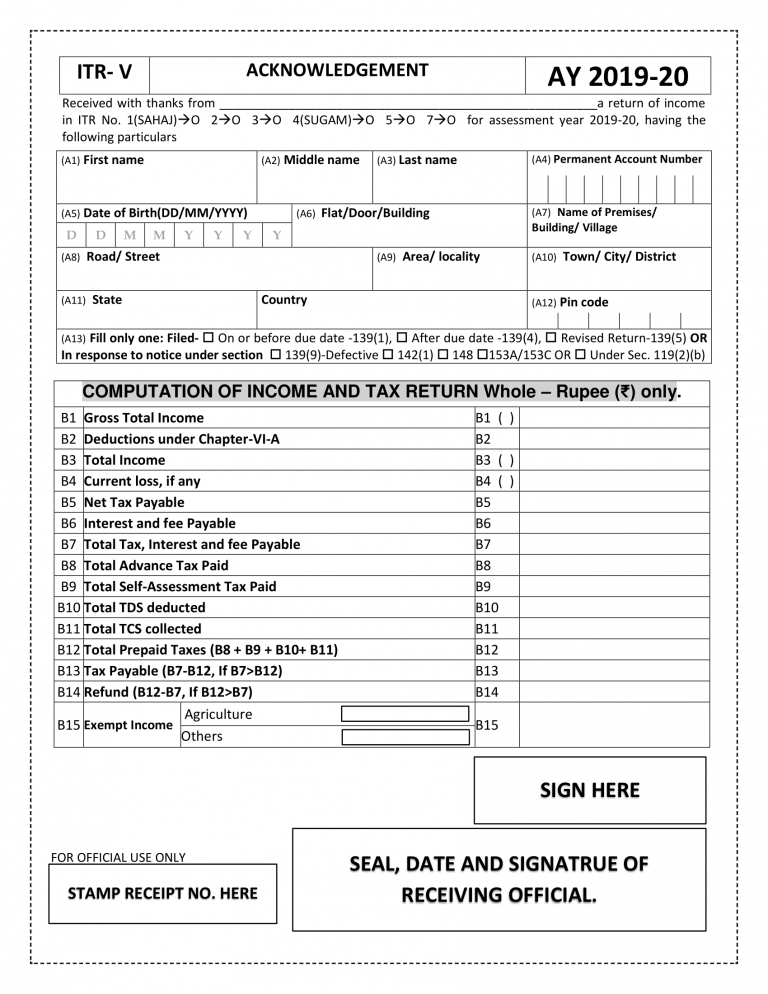

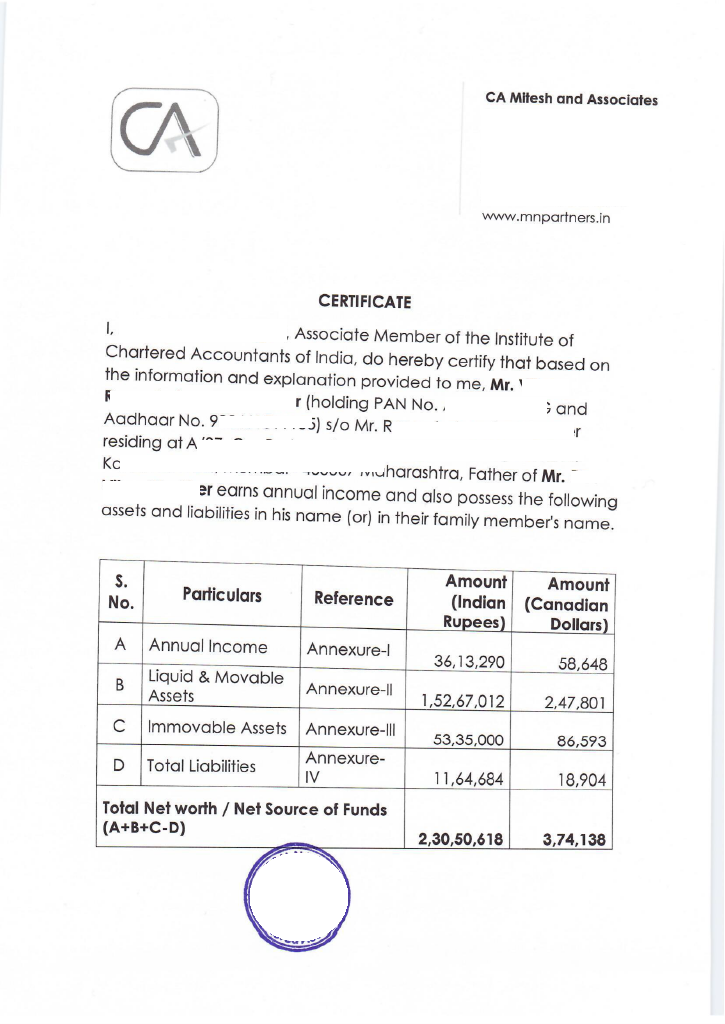

Key Details of the Standardized Format

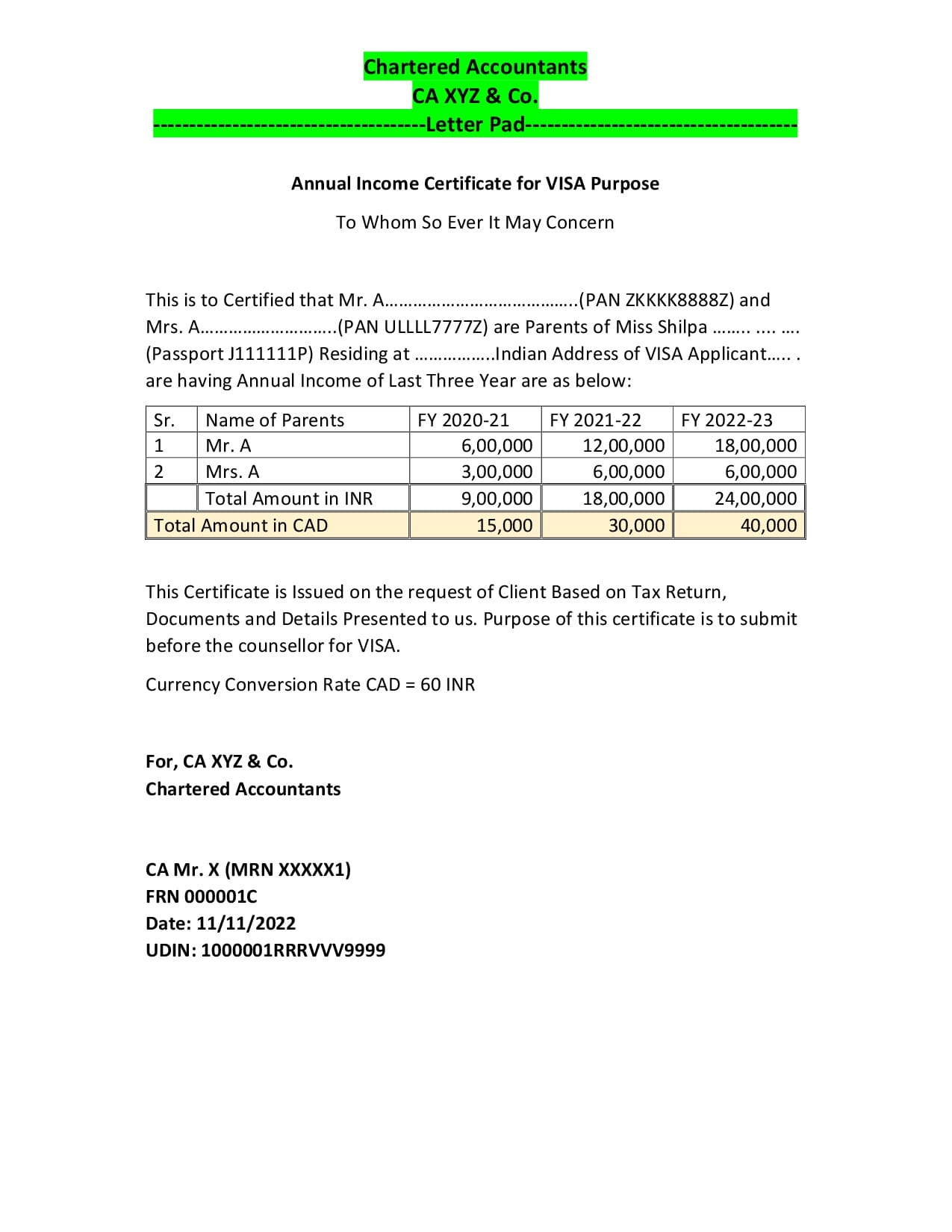

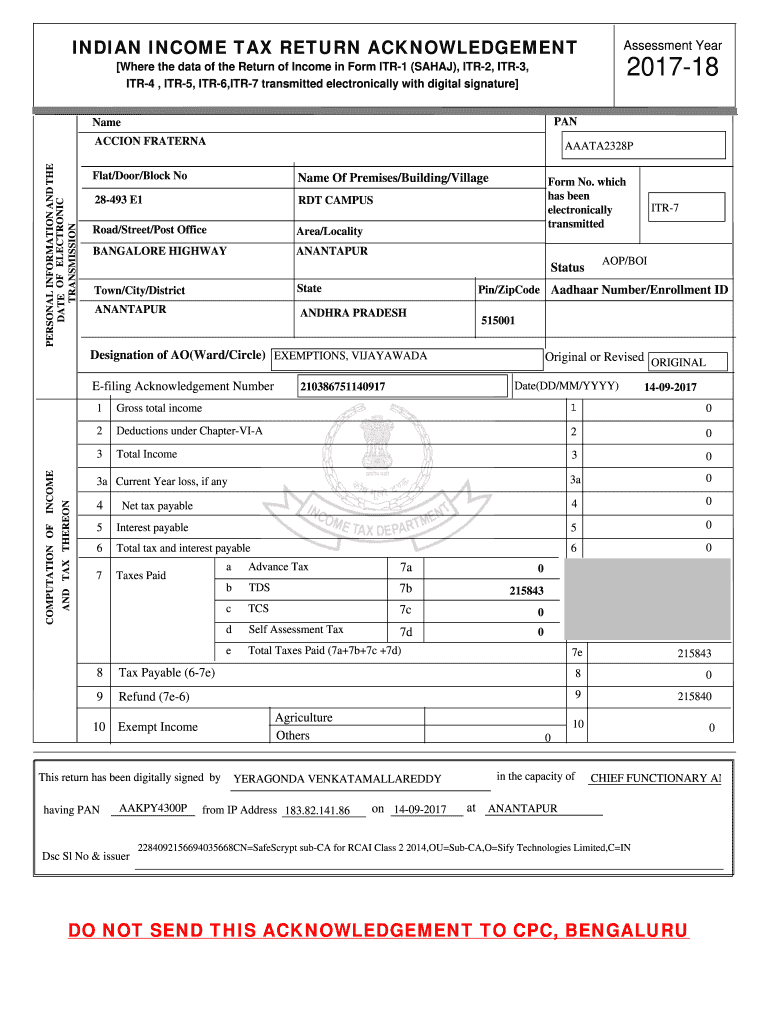

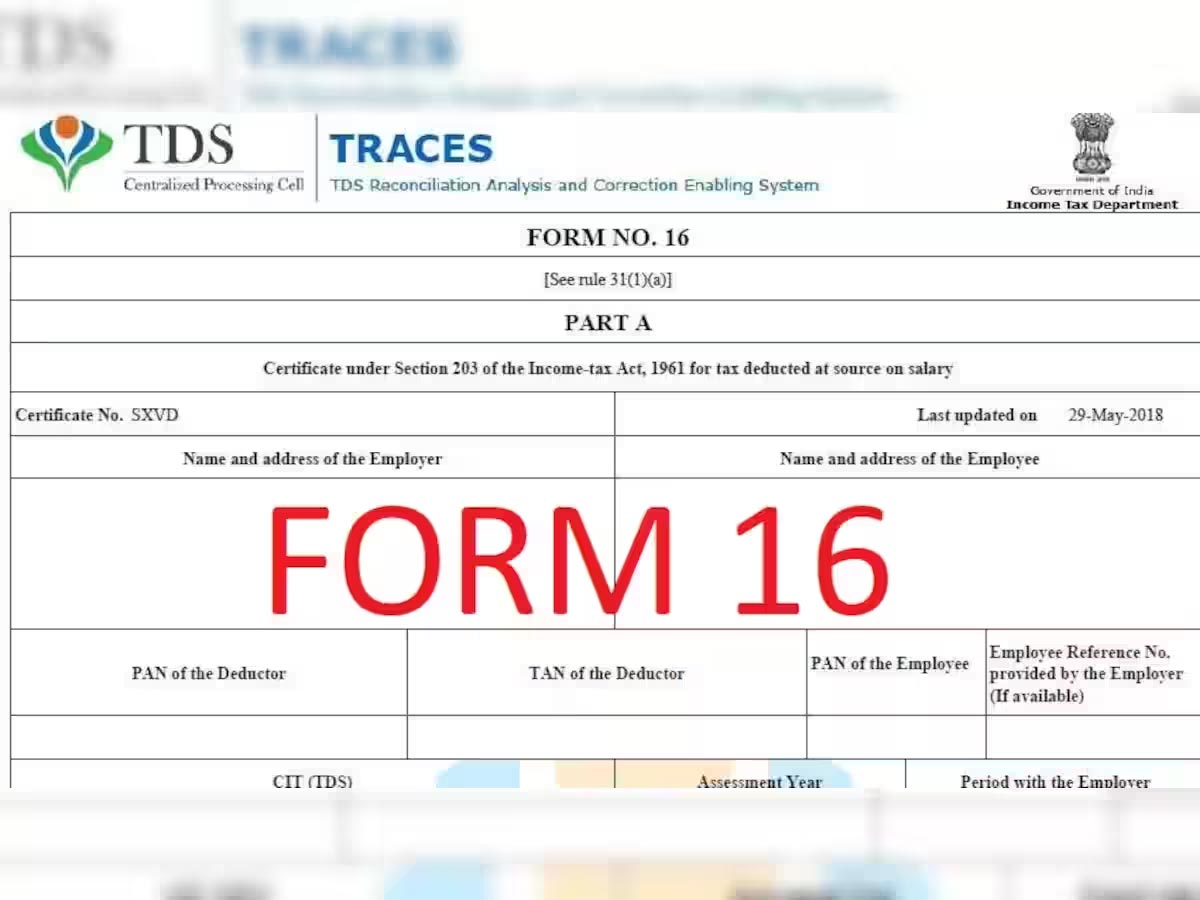

While the specific details of the standardized format can vary slightly depending on the jurisdiction and regulatory body involved, the core components generally remain consistent. These usually include the CA's name, membership number, and firm registration details.

The certificate also includes details of the taxpayer, such as their name, Permanent Account Number (PAN), and assessment year for which the ITR is being verified. Crucially, the format outlines specific areas requiring CA verification, covering aspects of income, deductions, and tax liabilities.

Who is Impacted?

The primary stakeholders impacted are individual and corporate taxpayers who rely on CAs for ITR filing and verification. CAs are also directly impacted, as they must adhere to the prescribed format and ensure accurate reporting.

Tax authorities benefit from increased standardization, facilitating easier auditing and reducing the potential for fraudulent claims. The standardization simplifies processes for all parties involved in the tax compliance process.

When and Where is it Applicable?

The applicability of the standardized format depends on the directives issued by relevant tax authorities and professional bodies like the Institute of Chartered Accountants of India (ICAI). The implementation is typically phased, allowing CAs time to adapt to the new requirements.

The format's adoption is primarily within the jurisdiction of the issuing tax authority, but its principles of clarity and accountability could influence similar initiatives globally. It is crucial for stakeholders to refer to official announcements and guidelines for specific implementation timelines and geographical scope.

Why Standardize the Format?

The main rationale behind standardizing the ITR Verification Certificate is to enhance transparency and reduce ambiguity. Previously, varied formats led to inconsistencies in the information provided, making it difficult for tax authorities to assess compliance.

A standardized format allows for easier data comparison, identification of discrepancies, and streamlined processing of ITRs. This ultimately contributes to a more efficient and reliable tax system, benefiting both taxpayers and the government.

"Standardization promotes clarity and accountability, fostering a more trustworthy tax compliance environment," stated a representative from a leading accounting firm.

How Does it Work?

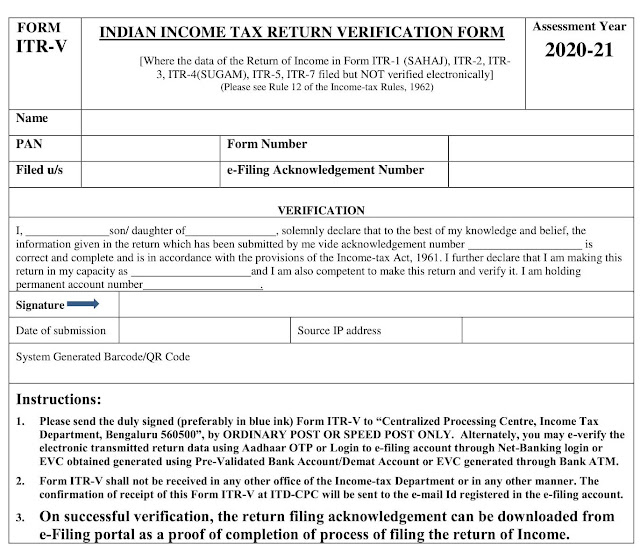

CAs are required to use the prescribed format when issuing ITR Verification Certificates. This typically involves filling out a template or using designated software that generates the certificate in the required format.

The certificate, once completed and signed by the CA, is then submitted along with the taxpayer's ITR. Tax authorities use the information provided in the certificate to verify the accuracy of the ITR and ensure compliance with tax laws.

Potential Impact and Challenges

The standardized format is expected to lead to improved tax compliance and reduced instances of fraud. Clearer reporting requirements will likely encourage greater accuracy in ITR filings.

However, some challenges may arise during the initial implementation phase. CAs may need time to adapt to the new format and ensure their systems are compatible.

Taxpayers may require guidance on understanding the standardized certificate and providing the necessary information to their CAs. Overcoming these challenges through clear communication and training is essential for successful implementation.

Ultimately, the standardization of the ITR Verification Certificate by CA Format represents a significant step towards a more transparent and efficient tax system. By promoting clarity and accountability, it aims to benefit all stakeholders involved in the tax compliance process.

)