Kulr Technology Financial Performance February 2025

KULR Technology Group, Inc., a developer of thermal management technologies, released its financial results for the fourth quarter and full year of 2024 in February 2025. The report detailed a year marked by significant growth in some sectors balanced against ongoing challenges in others, painting a mixed picture for investors and stakeholders.

The financial disclosure provides crucial insights into KULR's strategic direction, market positioning, and future prospects in the rapidly evolving thermal management industry. Understanding these results is essential for assessing the company's performance and its impact on the wider technology landscape, particularly regarding battery safety and high-performance computing solutions.

Key Financial Highlights

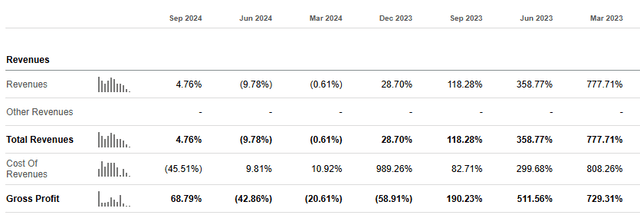

KULR's 2024 revenue showed a varied landscape. Sales in the energy storage systems (ESS) sector and high-performance computing cooling solutions saw considerable increases, driven by rising demand for safer battery technologies and advanced cooling systems for data centers.

However, revenues in other areas, such as certain defense contracts, experienced delays and shifts in project timelines, impacting overall revenue figures. The company's strategic focus on higher-margin products and services is evident in the shift in revenue composition.

Gross margins improved compared to the previous year, reflecting KULR's efforts to optimize its supply chain and manufacturing processes. Despite revenue variances, the improved margins signal enhanced profitability on each sale.

Revenue Breakdown

The revenue breakdown highlighted the growing importance of the ESS segment. This growth is attributed to increasing concerns about battery safety and the adoption of KULR's thermal management solutions in electric vehicles and energy storage systems.

High-Performance Computing (HPC) also experienced strong revenue growth. KULR's innovative cooling solutions for data centers and AI applications drove this expansion.

Defense sector revenues faced headwinds. Project delays and changes in government spending priorities affected the performance in this segment.

Expenses and Profitability

Operating expenses remained relatively stable, with increases in research and development (R&D) investments offsetting reductions in other areas. The increased R&D spending signals KULR's commitment to innovation and developing next-generation thermal management technologies.

Despite improved gross margins, the company reported a net loss for the year. This loss reflects the impact of lower revenue in some segments and ongoing investments in growth initiatives.

Strategic Initiatives and Future Outlook

KULR continued to focus on strategic partnerships and collaborations to expand its market reach and product offerings. Collaborations with leading battery manufacturers and technology companies are key to the company's growth strategy.

The company emphasized its commitment to sustainability and environmental responsibility. Its thermal management solutions contribute to improved battery efficiency and reduced energy consumption.

Looking ahead, KULR expects continued growth in the ESS and HPC segments. The company anticipates increased demand for its advanced thermal management solutions as the market for electric vehicles and high-performance computing expands.

"While we faced challenges in some areas, we are encouraged by the strong growth in our ESS and HPC businesses," said Michael Mo, CEO of KULR Technology Group, in a press release. "Our strategic investments in innovation and partnerships are positioning us for long-term success."

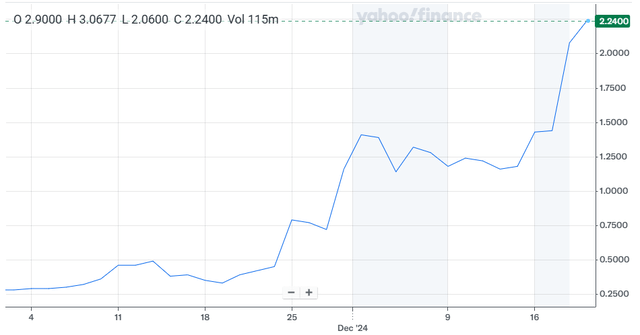

Market Reaction and Investor Sentiment

The market reaction to KULR's financial results was mixed. Shares initially saw a slight dip following the announcement.

Analysts expressed cautious optimism. They recognized the company's potential in the growing thermal management market.

Investors are closely watching KULR's ability to execute its growth strategy and achieve profitability in the coming years. The company's innovative technologies and strategic partnerships are key factors influencing investor sentiment.

Impact and Significance

KULR's performance is indicative of broader trends in the thermal management industry. The growing demand for safer and more efficient battery technologies is driving innovation and growth in this sector.

The company's contributions to high-performance computing are also significant. Its cooling solutions enable the development of more powerful and energy-efficient data centers and AI systems.

As the world continues to grapple with climate change, KULR's sustainable thermal management solutions are becoming increasingly important. The company's technologies can help reduce energy consumption and minimize the environmental impact of various industries.

In conclusion, KULR Technology Group's financial performance in 2024 reflects a company navigating a dynamic market landscape. While challenges remain, the company's strategic focus on high-growth sectors and its commitment to innovation position it for potential future success in the thermal management industry.