Lack Of Recent Revolving Account Information

The gears of the credit economy, usually humming with the constant flow of data, are showing signs of disruption. Millions of Americans are finding their credit scores, and subsequently their access to loans and favorable interest rates, potentially undermined by a growing lack of recently reported revolving account information. The silence from creditors is creating ripples of uncertainty across the financial landscape.

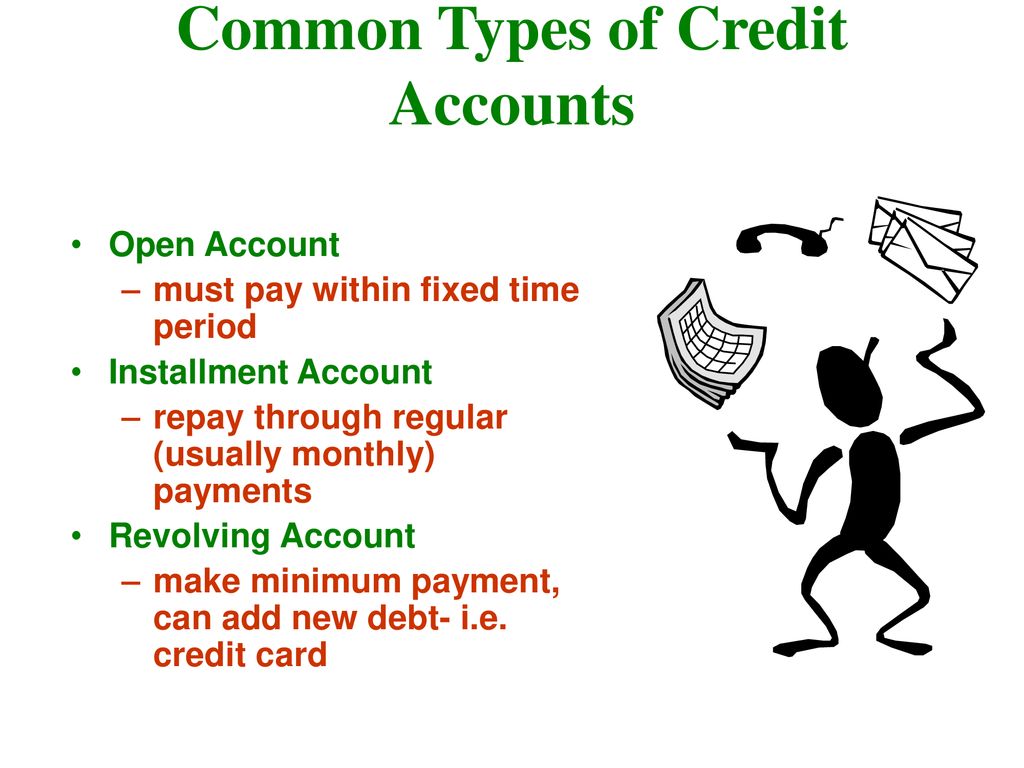

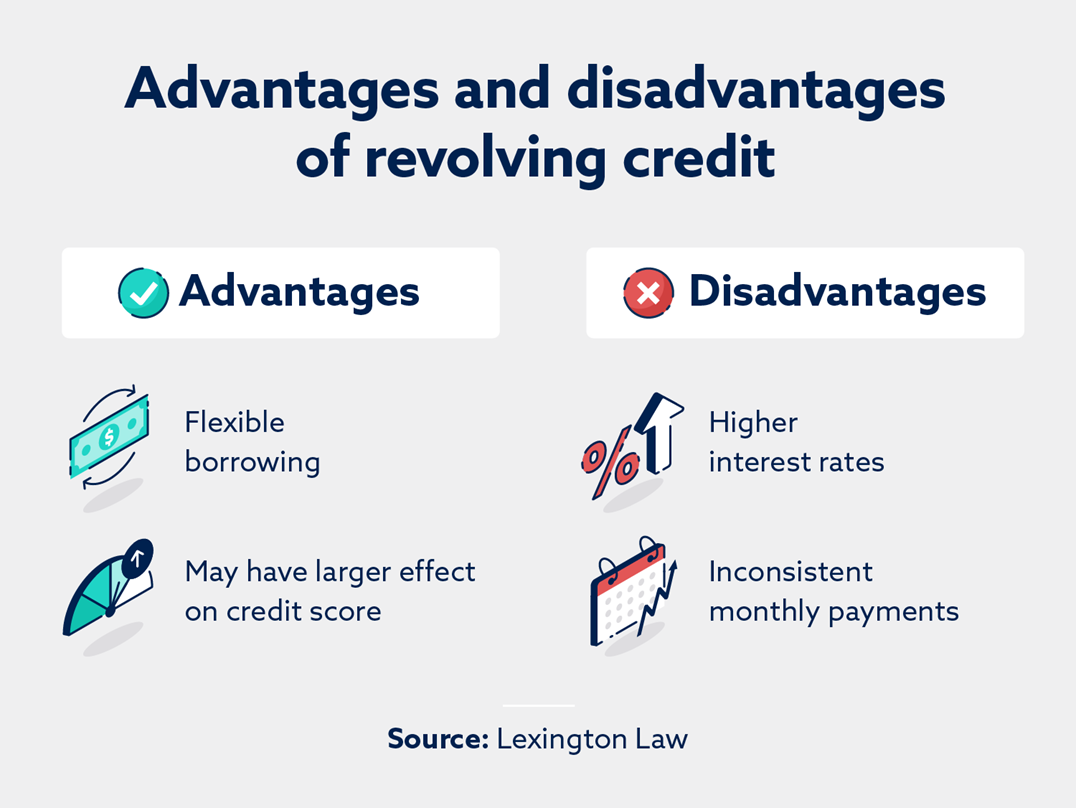

At the heart of this issue lies a significant slowdown in the reporting of revolving credit activity, like credit card balances and payments, to the major credit bureaus. This dearth of information, the "Nut Graf" if you will, impacts consumers by making it difficult for credit scoring models to accurately assess their current financial behavior. Consequently, individuals who consistently manage their credit responsibly may find their scores artificially depressed, while those with less-than-stellar histories might appear more creditworthy than they truly are.

The Scope of the Problem

The extent of this data drought is difficult to pinpoint precisely, but anecdotal evidence and preliminary data analysis suggest it's a widespread concern. Consumer advocacy groups are reporting a surge in complaints from individuals who have diligently used their credit cards but see no reflection of this positive activity in their credit reports. This information vacuum can have dire consequences.

According to a recent study by the Consumer Financial Protection Bureau (CFPB), a significant portion of the U.S. population relies on credit cards for everyday expenses and managing cash flow. When the data about how they manage is missing it's a problem. A flawed or outdated credit report can severely limit their access to these essential financial tools.

Possible Causes and Contributing Factors

Several factors are believed to be contributing to the reporting slowdown. One potential cause is related to the technological infrastructure used by smaller credit unions and community banks. These institutions, often lacking the resources of larger national banks, may experience delays or technical difficulties in transmitting data to the credit bureaus.

Another factor could be related to staffing shortages. The pandemic has had ripple effects with employees leaving and new staff needing training. This can affect the operational efficiency of credit reporting and potentially lead to delays in the timely submission of data.

Furthermore, some speculate that the changing economic landscape, including fluctuating interest rates and concerns about consumer debt levels, may be influencing creditor behavior. Financial institutions might be adopting a more cautious approach to reporting, focusing on high-risk accounts or prioritizing other data streams.

Impact on Consumers

The lack of revolving account information has far-reaching implications for consumers. A depressed credit score can translate to higher interest rates on loans, making it more expensive to finance a car, purchase a home, or even secure a personal loan. It could also affect their ability to rent an apartment or obtain insurance.

For instance, someone applying for a mortgage with a credit score that is artificially lowered by 50 points could face significantly higher monthly payments over the life of the loan. This could add tens of thousands of dollars in interest over the long term. Access to credit cards with favorable terms could also be affected.

Beyond the direct financial impact, the issue can create stress and anxiety for consumers who are unaware of the reporting slowdown and are suddenly confronted with an inaccurate credit report. This can lead to wasted time and effort in disputing errors and attempting to rectify the situation.

Industry Response and Potential Solutions

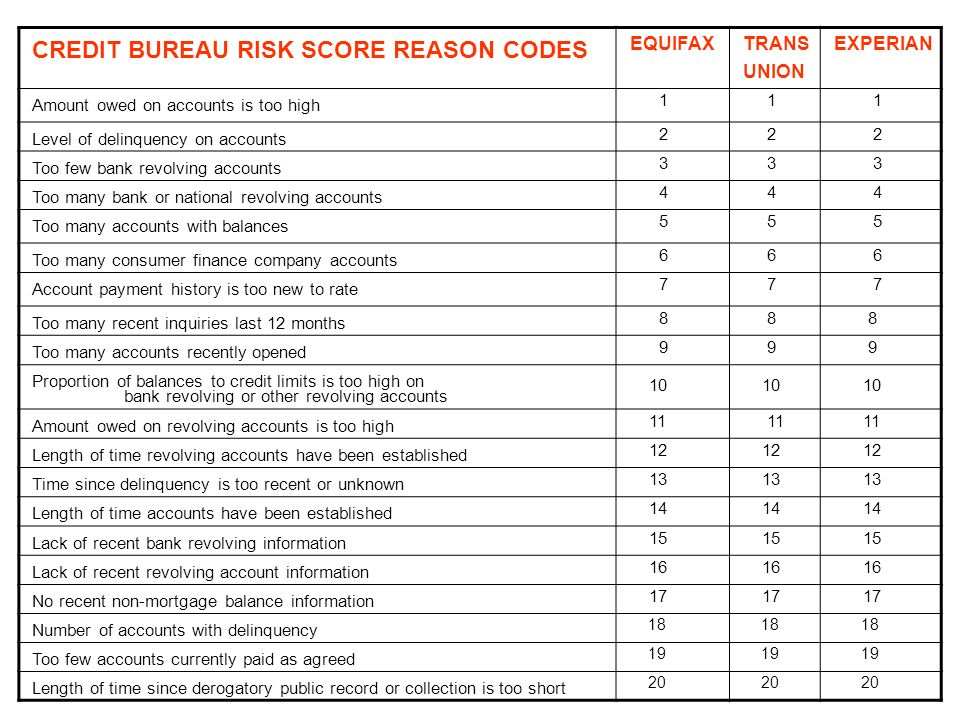

Credit bureaus are acknowledging the issue and are working with creditors to address the reporting gaps. Equifax, Experian, and TransUnion have issued statements emphasizing their commitment to data accuracy and are encouraging creditors to prioritize timely reporting.

Some industry experts suggest that the credit bureaus could implement enhanced monitoring systems to detect and flag instances of delayed or incomplete reporting. This would allow them to proactively reach out to creditors and work to resolve the underlying issues.

Another potential solution involves streamlining the data transmission process and providing technical assistance to smaller financial institutions. The creation of standardized reporting protocols and improved data security measures could also help to enhance the efficiency and reliability of the system.

Consumer Actions and Recommendations

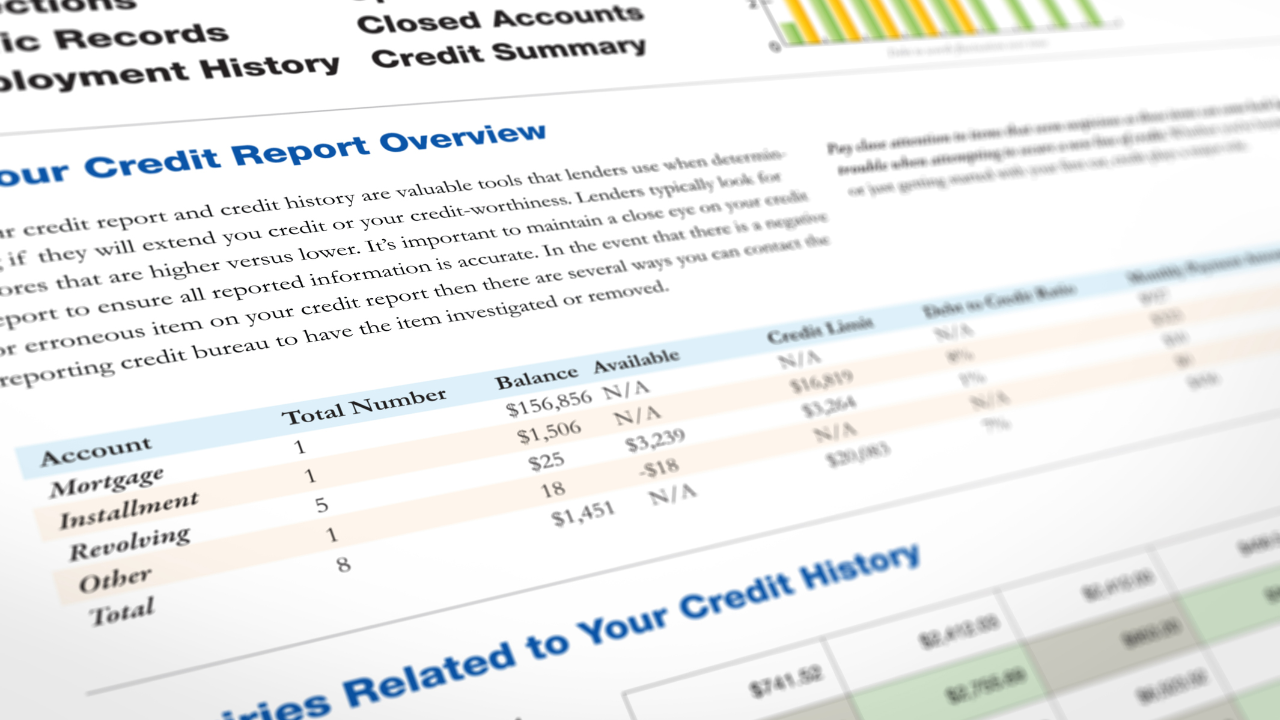

In the meantime, consumers can take steps to protect themselves from the potential impact of the reporting slowdown. Regularly checking their credit reports from all three major bureaus is crucial. Look for any discrepancies or missing information, particularly regarding revolving credit accounts.

Consumers are entitled to one free credit report per year from each bureau. They should take advantage of this and review their reports carefully. If they identify any errors or omissions, they should dispute them with the credit bureau and the creditor involved.

Maintaining documentation of credit card statements and payment records can provide valuable evidence in case of disputes. Finally, advocating for greater transparency and accountability within the credit reporting system is the best way to help yourself in the long run.

The Road Ahead

The lack of revolving account information highlights the need for a more robust and resilient credit reporting infrastructure. Addressing the underlying causes of the reporting slowdown and implementing effective solutions will require a collaborative effort from creditors, credit bureaus, regulators, and consumer advocacy groups. The flow of accurate and timely information to credit bureaus is essential to a healthy and equitable credit market.

As the economy continues to evolve, it's imperative that the credit reporting system adapts to meet the changing needs of consumers and businesses. Investing in technological upgrades, strengthening data security measures, and promoting greater transparency will be crucial to ensuring that credit scores remain a reliable and accurate reflection of individual creditworthiness. Only then can the credit economy operate at its full potential, benefiting both consumers and the broader economy as a whole.

.jpg)