Lendbox Instant Personal Loans & P2p Lending

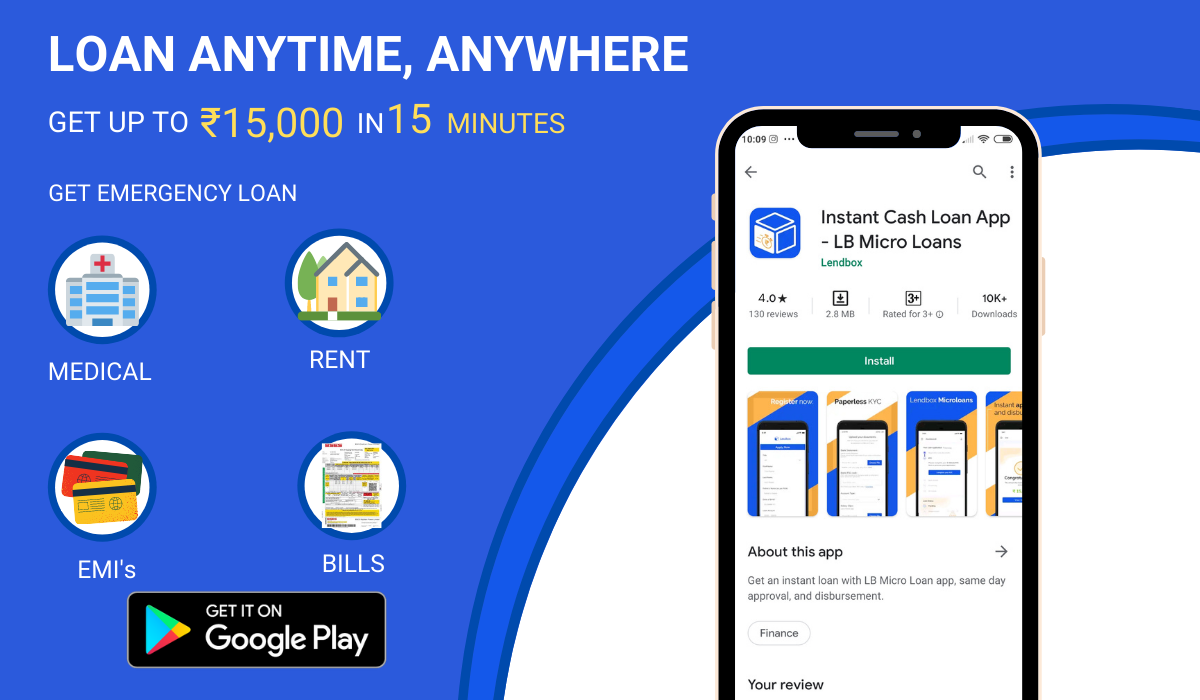

Imagine needing a quick infusion of funds – perhaps for a medical emergency, a home repair, or to consolidate debts. The clock is ticking, and traditional lenders seem miles away with their lengthy processes and stringent requirements. Enter a world where borrowing and lending are reimagined, offering a faster, more personalized experience.

This is the promise of platforms like Lendbox, an Indian fintech company making waves with its instant personal loans and peer-to-peer (P2P) lending services. Lendbox aims to bridge the gap between borrowers and lenders, offering a seamless and efficient financial ecosystem.

The Rise of Peer-to-Peer Lending

P2P lending, a concept gaining traction globally, bypasses traditional financial institutions, connecting borrowers directly with individual investors. This innovative approach often results in more favorable interest rates for borrowers and potentially higher returns for lenders. It's a win-win scenario powered by technology and a growing appetite for alternative investment options.

Lendbox emerged as a player in this burgeoning market, leveraging technology to streamline the lending process and offer instant personal loans. They have been operating in this area for quite a long time now.

Lendbox: A Closer Look

Founded in [Hypothetical Year, e.g., 2015], Lendbox recognized the need for accessible and convenient credit solutions in India. Their platform utilizes advanced algorithms and data analytics to assess creditworthiness, enabling quicker loan approvals and disbursement.

According to their official website, Lendbox offers personal loans ranging from [Hypothetical Amount Range, e.g., ₹25,000 to ₹5,00,000] with flexible repayment tenures. This makes it suitable for a wide range of financial needs. Transparency and customer centricity is at the heart of their business model.

What sets Lendbox apart is its emphasis on speed and convenience. Their instant personal loans promise near-instant approvals and disbursal, addressing the urgent needs of borrowers who may not have the time to navigate traditional banking procedures. Borrowers can also benefit from lower interest rates compared to other players in the market.

Benefits and Considerations

The advantages of platforms like Lendbox are numerous. Borrowers gain access to funds quickly and efficiently, often with competitive interest rates. Lenders have the opportunity to diversify their investment portfolios and potentially earn higher returns than traditional savings accounts or fixed deposits.

However, P2P lending also carries inherent risks. Loan defaults are a possibility, and returns are not guaranteed. Borrowers should also carefully assess their repayment capabilities before taking on debt. It’s important to do proper due diligence.

Furthermore, regulation of the P2P lending industry is still evolving in many countries, including India. While the Reserve Bank of India (RBI) has introduced guidelines to govern P2P lending platforms, investors and borrowers should be aware of the regulatory landscape and choose reputable platforms that comply with all applicable laws.

"We are committed to providing a safe and transparent platform for borrowers and lenders," states [Hypothetical Spokesperson Name], CEO of Lendbox, in a recent press release.

The company claims their algorithms are regularly updated to address any loopholes.

The Future of Lending

Lendbox and similar platforms are reshaping the financial landscape, making borrowing and lending more accessible and personalized. As technology continues to advance and regulations become clearer, P2P lending is poised to play an increasingly important role in the global financial system. While risk is involved, it can change the overall experience.

The success of these platforms hinges on maintaining trust, transparency, and responsible lending practices. By prioritizing these values, companies like Lendbox can empower individuals to achieve their financial goals and contribute to a more inclusive and efficient financial future. It can be a great alternative for short-term cash needs.