Liberty Mutual Right Track Hack Reddit

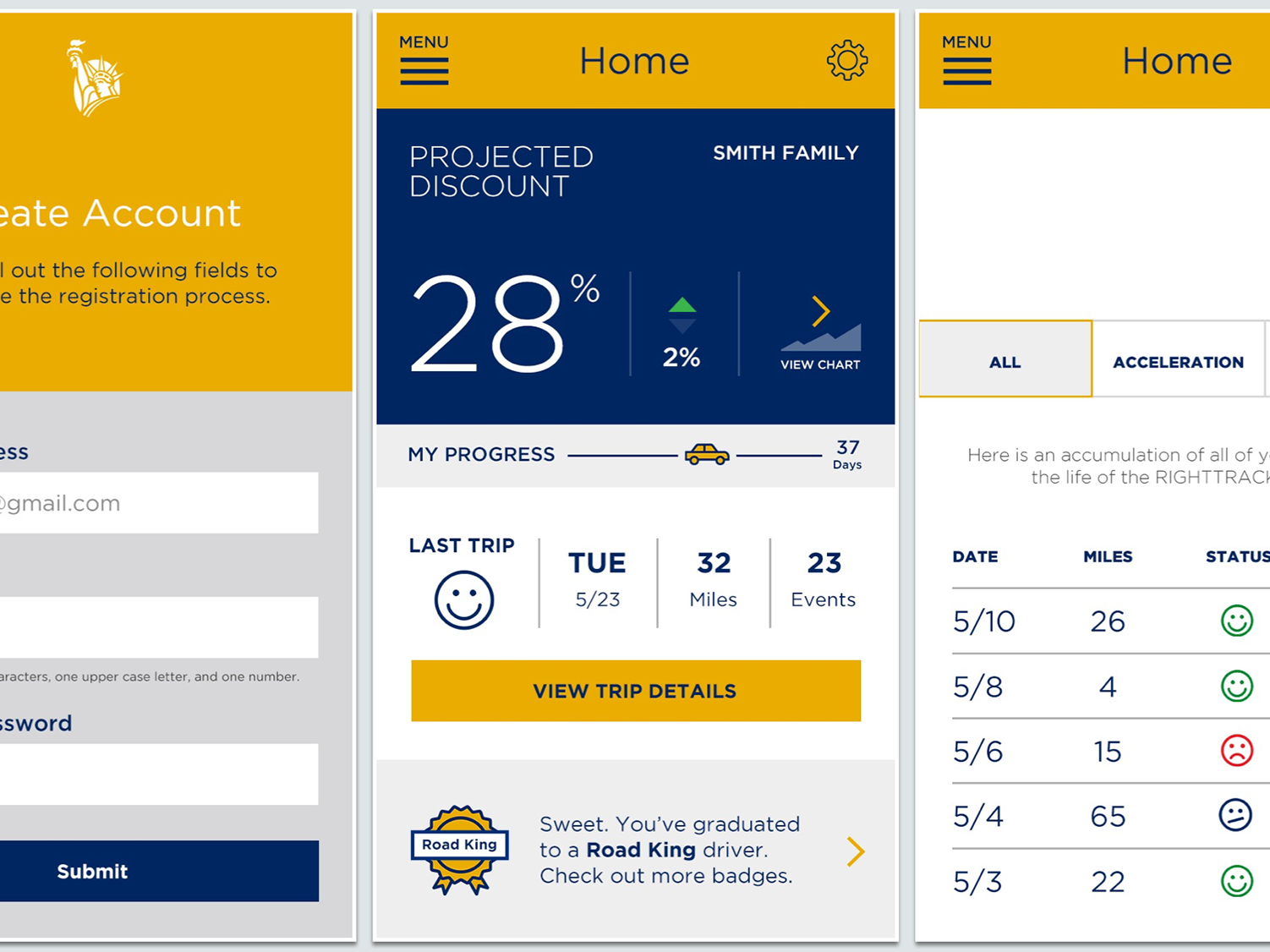

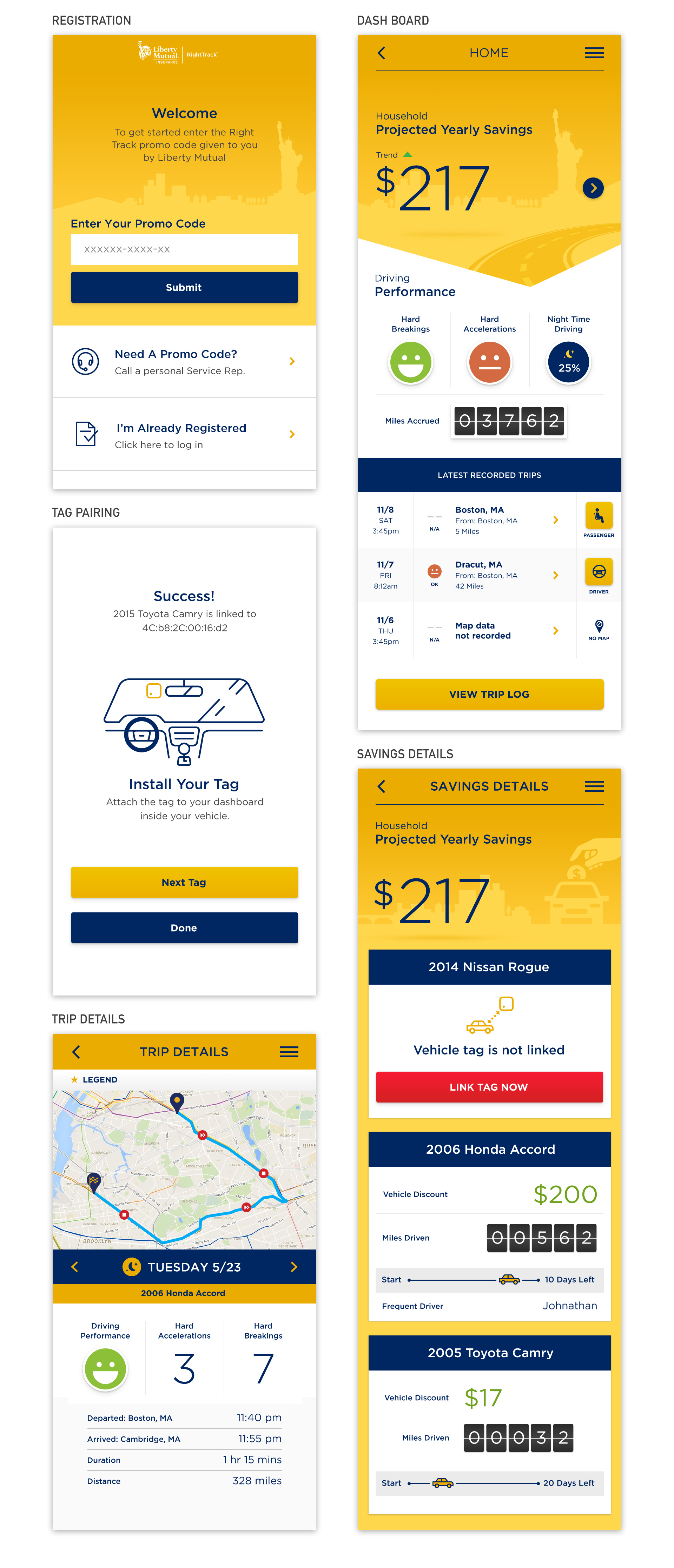

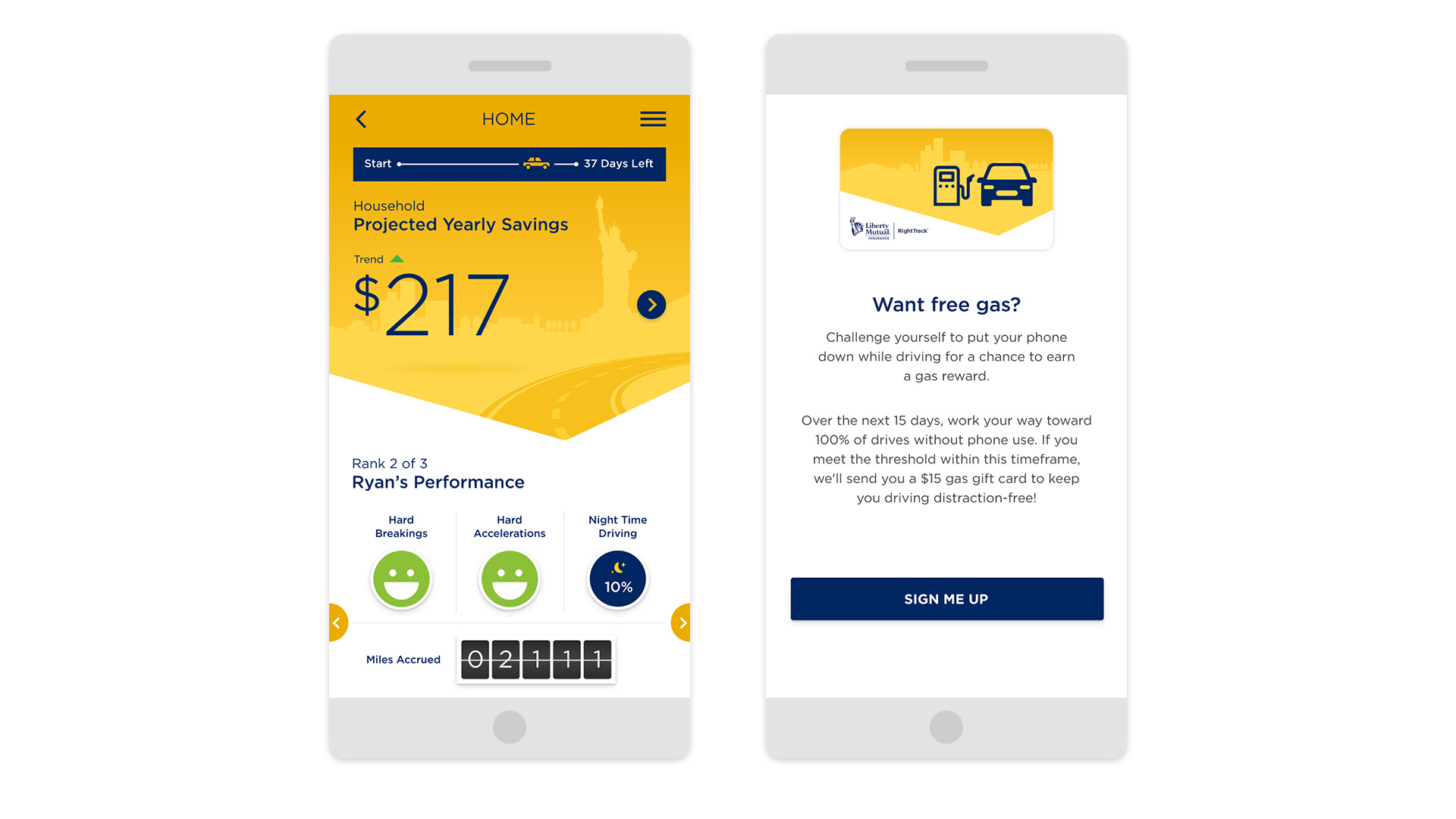

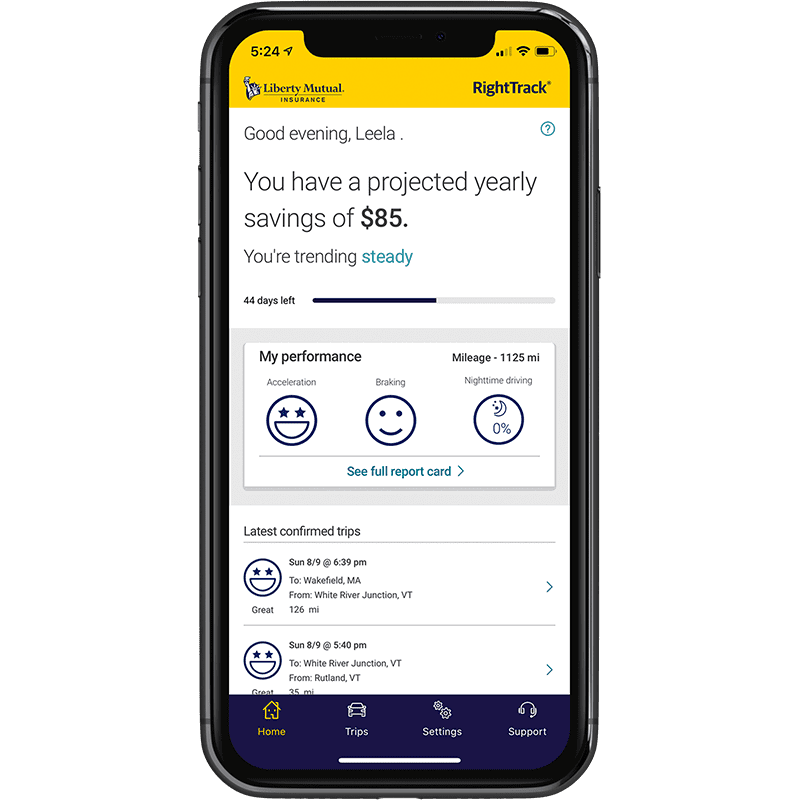

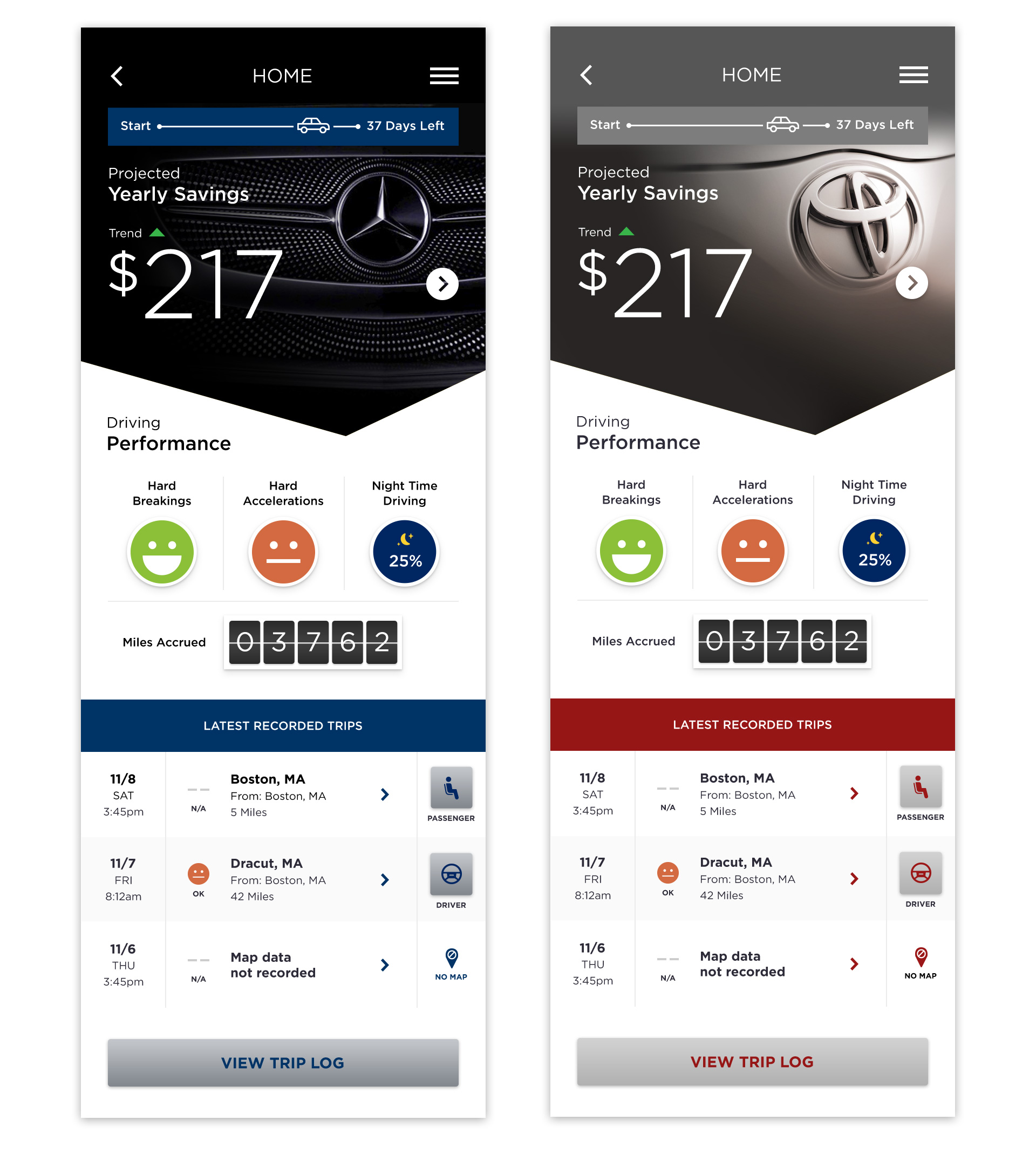

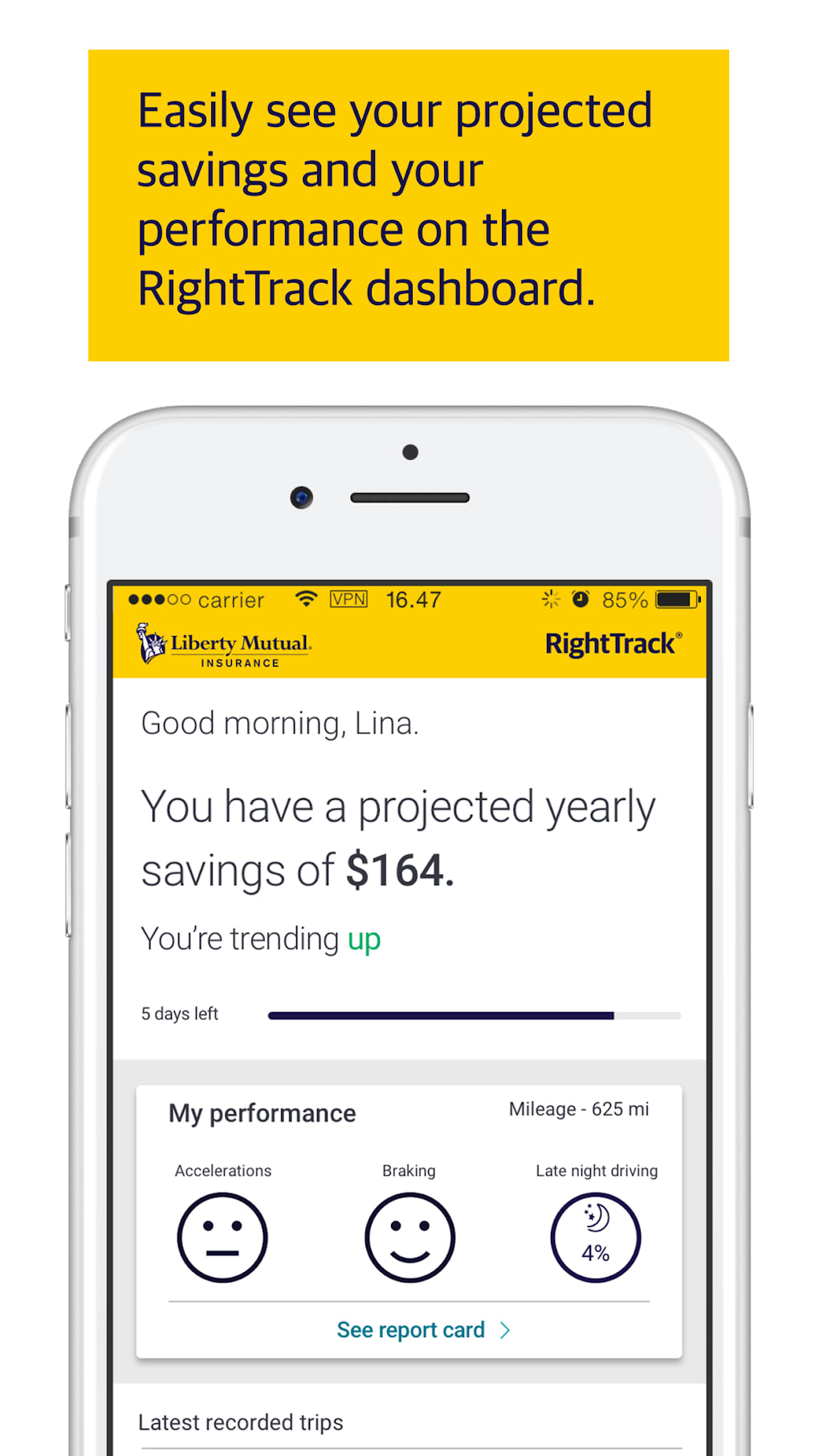

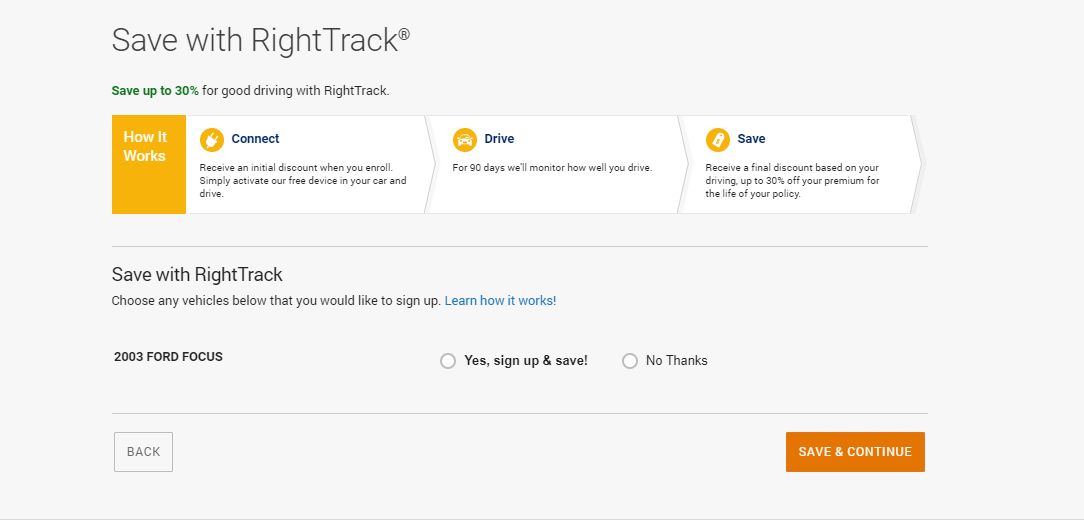

A storm is brewing around Liberty Mutual's Right Track program, a usage-based car insurance plan that monitors driving habits. Allegations of manipulation and circumvention techniques shared on Reddit are raising serious questions about the integrity of the program and the data it collects.

The core issue is that users are seemingly finding ways to "hack" the system, potentially receiving discounts they don't legitimately deserve. This manipulation involves altering or masking true driving behavior. It leads to concerns about fairness for other customers and the accuracy of risk assessment models.

The Allegations: Right Track "Hacks" Exposed

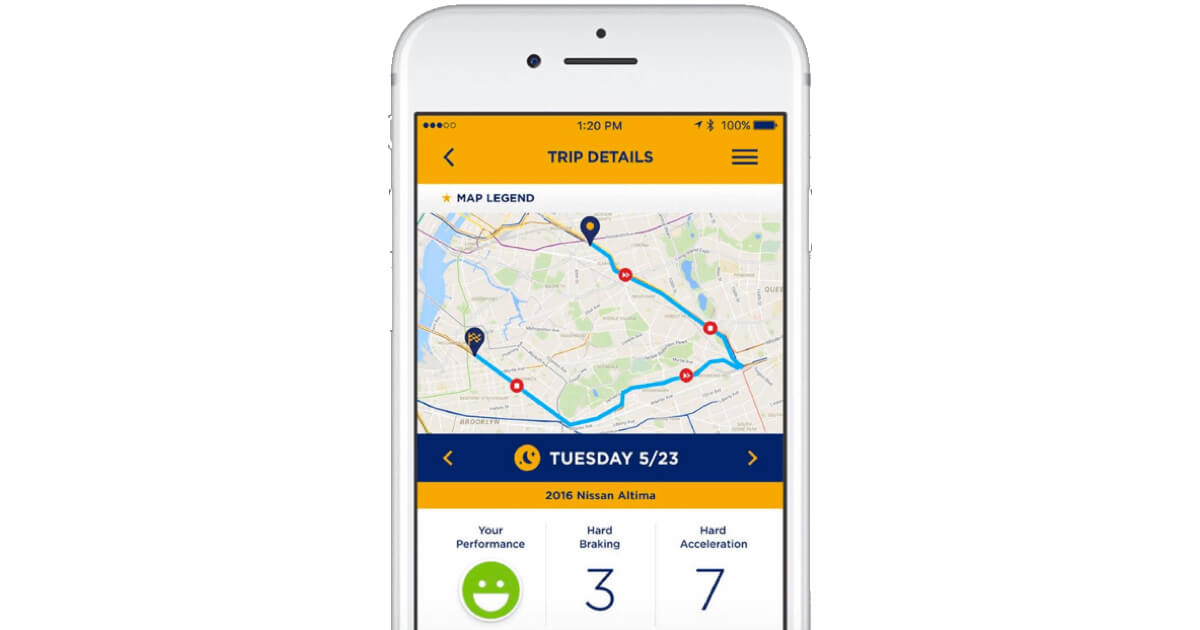

Reddit threads are now buzzing with discussions on methods to influence Right Track's data. Users are sharing experiences on achieving desired driving scores and obtaining discounts. These techniques range from gentle driving practices in specific areas to more questionable methods.

Some claim to have discovered loopholes in the data collection. They assert that the system can be tricked into recording safe driving even when behavior is far from it.

These so-called "hacks" raise several crucial points.

What Methods Are Being Discussed?

Details from Reddit forums reveal a wide range of purported "hacks." Some users report carefully selecting routes with optimal speed limits and low traffic density. Other methods are far more complex, attempting to manipulate the accelerometer and GPS data collected by the device or app.

Users discuss using weighted objects to simulate smooth driving while the car is parked. Some even explore ways to isolate the sensor from actual driving activity, allegedly masking aggressive behaviors.

Liberty Mutual has not publicly confirmed the validity of these specific methods.

Liberty Mutual's Response and Data Security Concerns

Liberty Mutual has released a statement acknowledging the situation.

The company stated it is "aware of discussions regarding potential manipulation of driving data" and that it "continuously monitors and updates its technology to prevent and detect fraudulent activity."

Liberty Mutual emphasizes its commitment to ensuring the integrity of the Right Track program. They also highlight that attempts to manipulate the system could be considered fraudulent, potentially leading to policy cancellation.

The Implications for Customers and the Insurance Industry

The repercussions of these alleged "hacks" extend beyond Liberty Mutual. If widespread manipulation is occurring, it distorts the risk pool.

Honest drivers could end up subsidizing the discounts obtained by those manipulating the system. This could lead to higher premiums for everyone involved.

Furthermore, the integrity of usage-based insurance (UBI) as a whole is at stake. If UBI models are built on flawed data, their ability to accurately assess risk diminishes.

“The accuracy of the data collected is paramount for fair and accurate pricing,” says insurance analyst, Mark Johnson. “If that data is compromised, the entire model collapses.”

Moving Forward: Addressing the Vulnerabilities

Liberty Mutual is likely undertaking a thorough review of its Right Track program.

This review will likely involve strengthening data security measures and refining algorithms to detect anomalies. The company also needs to clearly communicate the consequences of fraudulent activity to its customers.

The future of UBI depends on addressing these vulnerabilities. The industry must improve the robustness of its data collection methods to prevent manipulation and ensure fair pricing for all drivers.