Lic New Endowment Plan Surrender Value

The Life Insurance Corporation of India (LIC) has recently announced changes to the surrender value calculation for its new endowment plans, a move that is generating considerable interest and discussion among policyholders and financial analysts.

These revisions, effective from [Insert Effective Date - e.g., November 1st, 2024], aim to provide a more transparent and potentially beneficial surrender value structure, especially for policies surrendered in the later years of their term. The updated policy aims to address concerns about low surrender values, particularly for early withdrawals.

Understanding the Changes

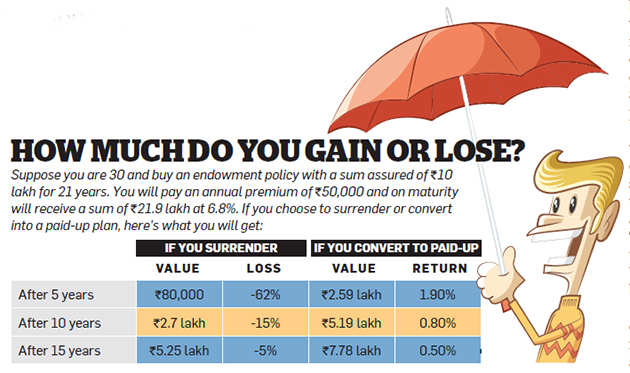

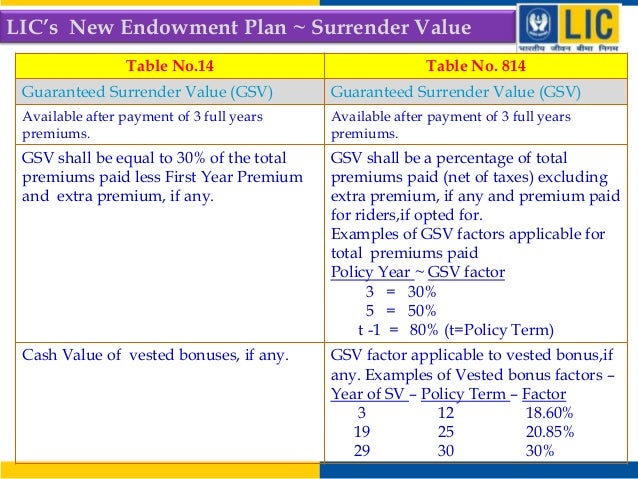

The core of the change lies in the revised formula used to calculate the surrender value. The previous method often resulted in policyholders receiving a significantly lower amount than the premiums paid, especially if the policy was surrendered within the first few years.

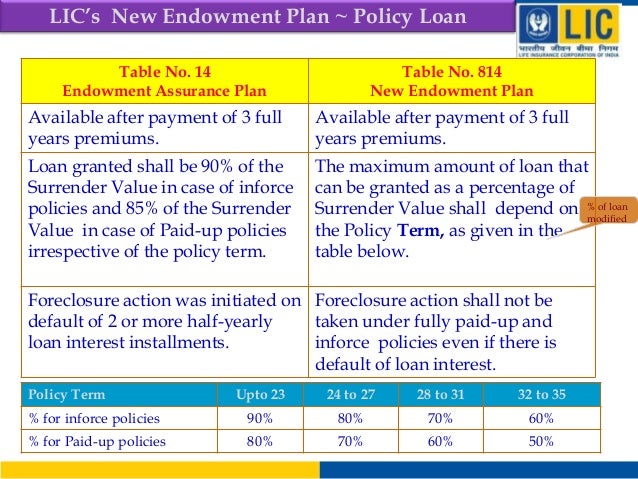

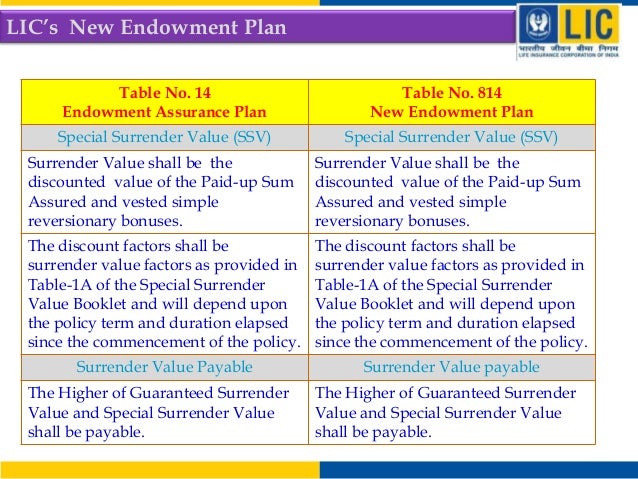

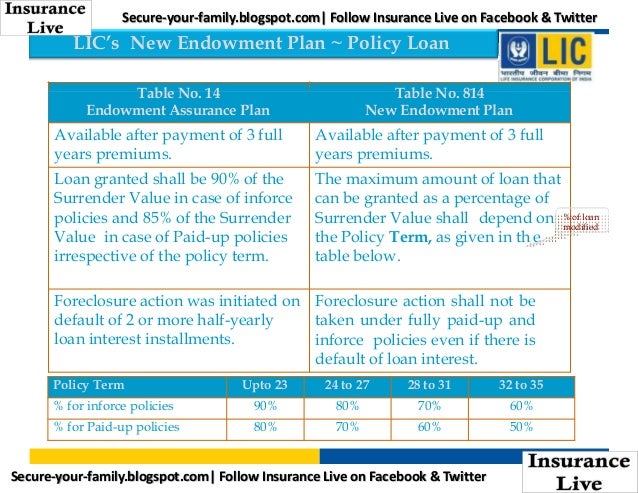

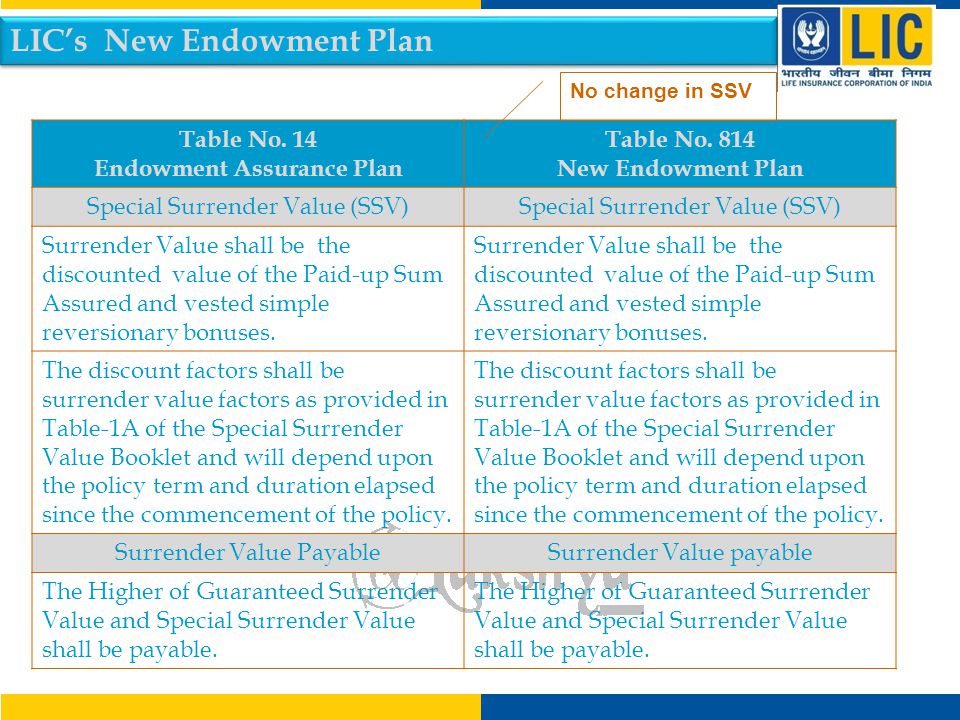

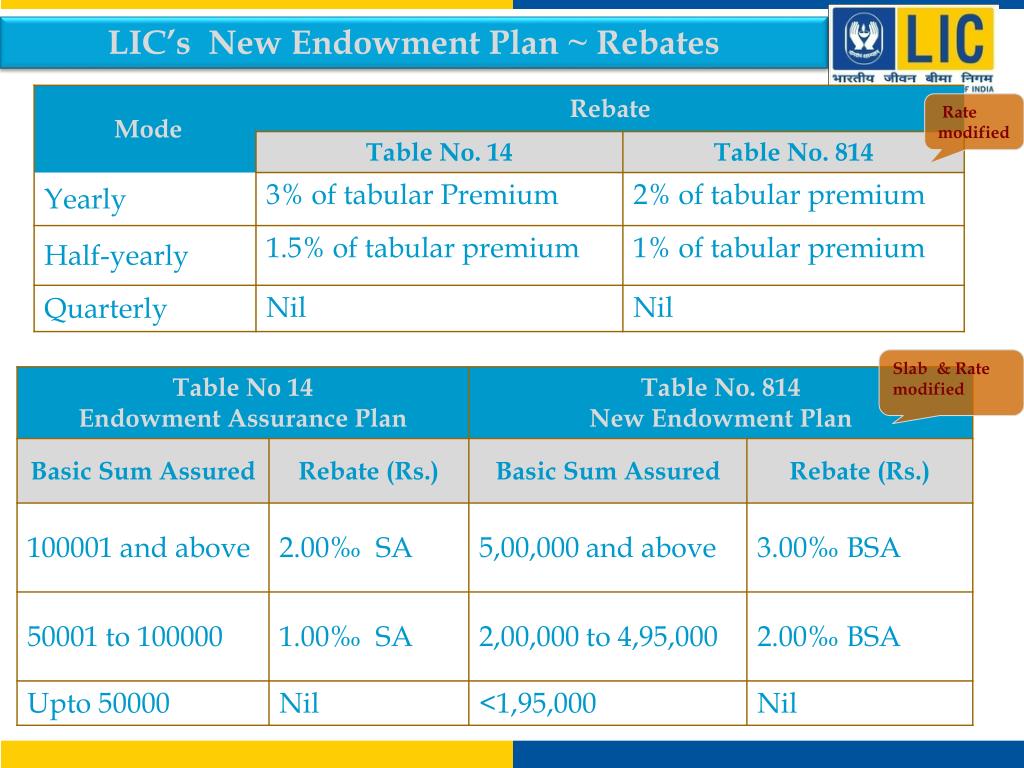

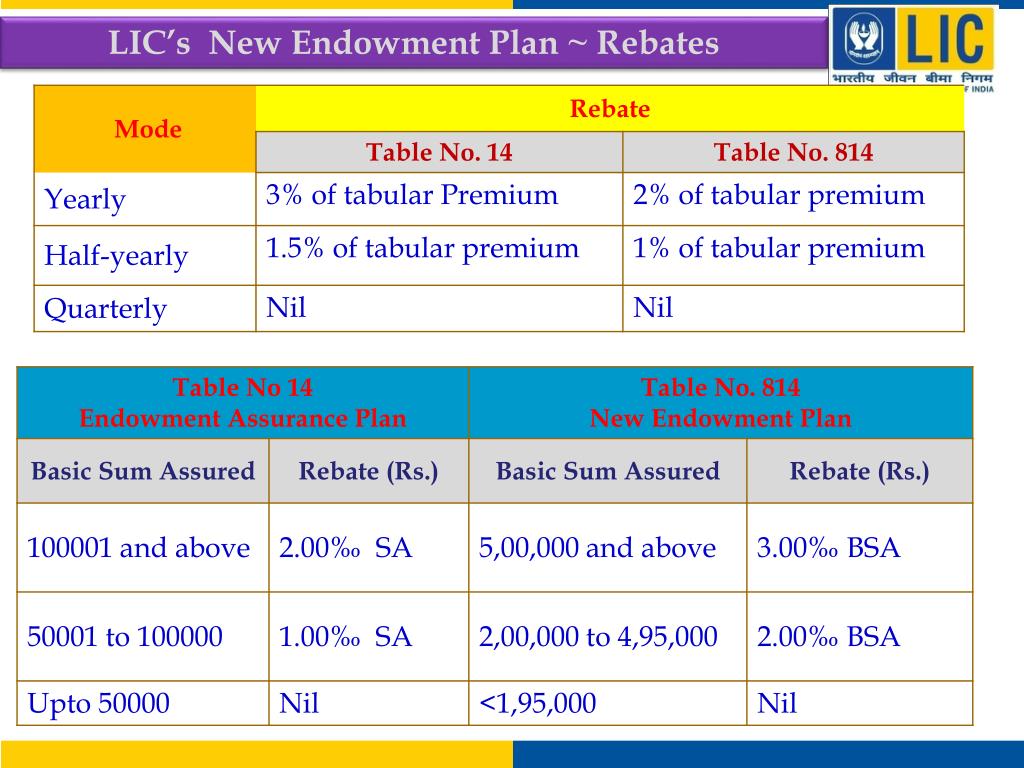

The new structure incorporates factors such as the policy term, premiums paid, guaranteed surrender value, and a "Special Surrender Value" (SSV) component, which is calculated based on the policy's accumulated bonus and the remaining term.

Key Details

Who: The Life Insurance Corporation of India (LIC). What: Revised surrender value calculation for new endowment plans. When: Effective from [Insert Effective Date].

Where: Applicable across India. Why: To offer a more transparent and potentially beneficial surrender value structure. How: Through a revised formula incorporating premiums, term, guaranteed surrender value, and Special Surrender Value (SSV).

According to an official statement released by LIC, the SSV component aims to provide a fairer return to policyholders who have maintained their policies for a considerable period. This component is designed to increase the surrender value, especially in later years.

Impact on Policyholders

The immediate impact is on new policies purchased after [Insert Effective Date]. Policyholders should carefully review the policy documents to understand the new surrender value calculation.

Financial advisors suggest that while the revised structure appears more favorable, it is crucial to compare the new policies with other investment options available in the market. Endowment plans are designed for long-term financial security and it's usually recommended to keep them until maturity for optimal benefits.

For existing policyholders, these changes do not directly impact their existing policies. Their surrender values will be calculated based on the terms and conditions of their initial policy agreement.

Expert Opinions and Market Response

Financial analysts at [Insert Reputable Financial News Source, e.g., Economic Times] note that the changes could potentially enhance the attractiveness of LIC's endowment plans. However, they also caution investors to carefully assess their individual financial goals and risk tolerance before investing.

"The revised surrender value structure is a step in the right direction, offering greater transparency and potential benefits to policyholders,"commented [Insert Name and Title of Financial Expert, e.g., Mr. Rajesh Kumar, a financial advisor at XYZ Investments].

LIC's share price has seen a minor fluctuation since the announcement, indicating a cautious but largely positive market response. Investors are closely monitoring the long-term implications of these changes.

Potential Challenges and Considerations

One potential challenge lies in effectively communicating the new surrender value calculation to policyholders. Clear and concise explanations are necessary to avoid confusion and ensure informed decision-making.

Another consideration is the long-term performance of the SSV component, which is dependent on various factors, including market conditions and LIC's investment returns. This component needs a closer look before making any final decision.

Furthermore, ensuring the new structure remains competitive with other investment options in the market is crucial for LIC to maintain its market share. LIC needs to ensure transparency while doing so.

Conclusion

The LIC's revised surrender value calculation for its new endowment plans represents a significant development in the insurance sector. This is due to its potential to improve transparency and offer more favorable surrender values to policyholders, especially in the long run.

While the changes are largely perceived as positive, policyholders and investors are advised to carefully evaluate their individual circumstances and seek professional financial advice before making any decisions. It is advised to compare the offer with those of other companies too.

The long-term impact of these changes will depend on various factors, including market dynamics and the effective communication of the new structure to the public. LIC needs to remain on the leading edge.