Liquidity Needs Vary Based Upon Which Of The Following Items

Understanding liquidity needs is crucial for businesses and individuals alike, impacting everything from day-to-day operations to long-term financial stability. But what exactly determines how much liquid assets are necessary? The answer is multifaceted, influenced by a variety of factors specific to each situation.

The level of liquidity required isn't a fixed number; instead, it's a dynamic target influenced by elements such as operational scale, market volatility, and access to credit. This article examines the key variables that shape liquidity needs, exploring how these elements collectively dictate the amount of readily available assets necessary to navigate financial challenges and capitalize on opportunities.

Operational Scale and Industry

A primary driver of liquidity needs is the operational scale of an entity. Larger organizations with extensive supply chains and substantial payroll obligations inherently require more liquid assets than smaller enterprises with simpler operations.

The industry in which a business operates also plays a significant role. Some industries, such as retail or manufacturing, are characterized by rapid inventory turnover and immediate payment obligations, demanding high levels of liquidity.

Conversely, industries with longer production cycles or payment terms, such as construction or aerospace, may have different liquidity profiles, though still substantial due to the magnitude of projects.

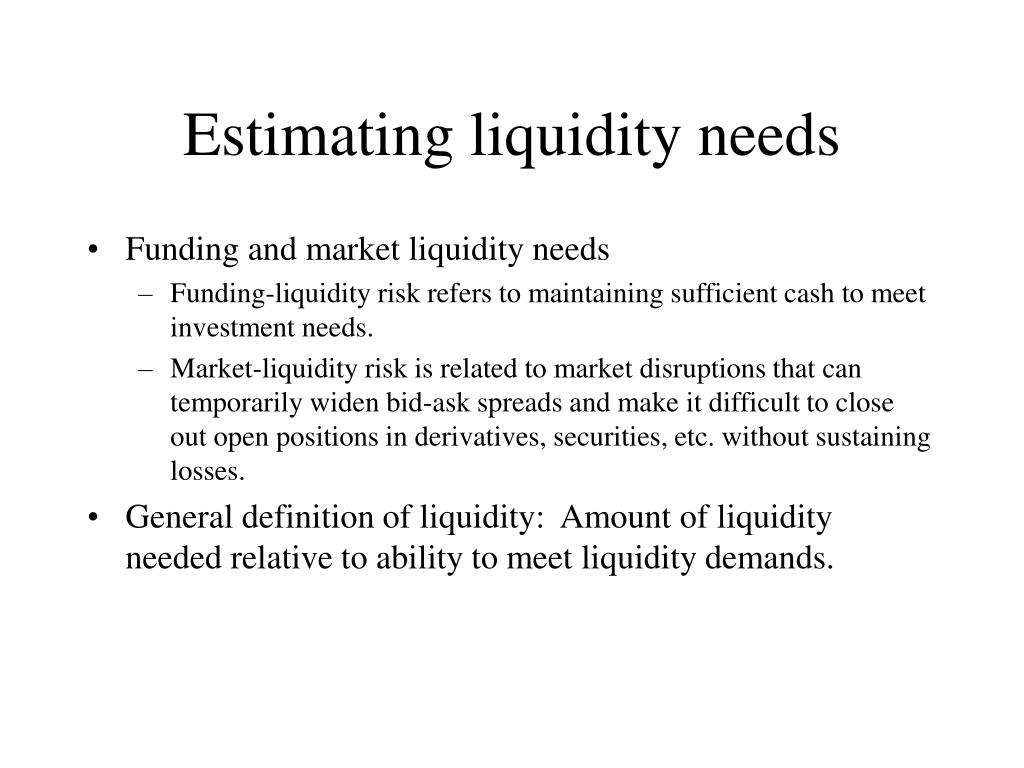

Market Volatility and Economic Conditions

External market conditions exert a powerful influence on liquidity requirements. Periods of economic uncertainty, characterized by market volatility and fluctuating demand, necessitate higher levels of liquid reserves.

Businesses need a buffer to withstand potential revenue declines or unexpected expenses during recessions or periods of economic contraction. Economic downturns can disrupt supply chains and reduce customer spending, creating challenges for businesses of all sizes.

The Federal Reserve and other central banks often adjust interest rates and monetary policy in response to economic conditions, which can directly impact the cost and availability of credit, further influencing liquidity management strategies.

Access to Credit and Financing Options

A company's ability to access credit lines and other financing options significantly impacts its immediate liquidity requirements. Businesses with readily available credit lines can often operate with lower levels of cash on hand, knowing they can quickly tap into external funding if needed.

Strong banking relationships and a solid credit rating are crucial for securing access to favorable financing terms. However, reliance on credit lines comes with associated costs, including interest payments and potential covenant restrictions.

Therefore, a balanced approach that considers both internal liquidity and external financing options is essential. Different businesses will have different risk tolerance and therefore will have different needs.

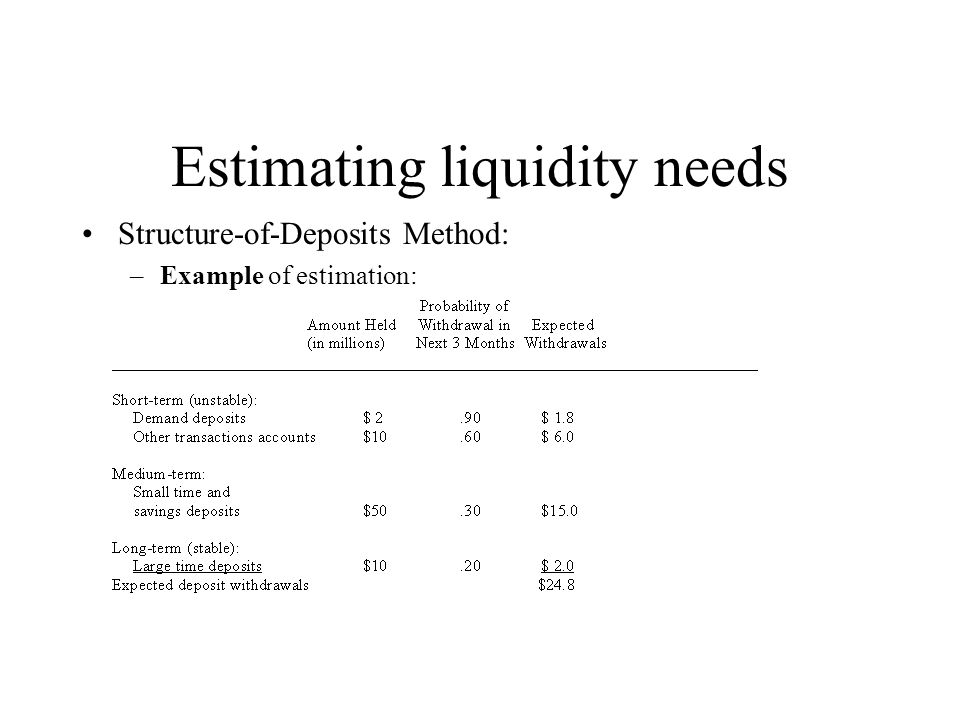

Short-Term Liabilities and Cash Flow Management

The extent of short-term liabilities, such as accounts payable, salaries, and loan repayments, directly influences the required level of liquidity. Effective cash flow management is paramount to ensure timely payment of these obligations.

Companies must carefully monitor their cash inflows and outflows, anticipating potential shortfalls and proactively addressing them. Accurately forecasting cash needs is vital for maintaining adequate liquidity levels.

Tools like cash flow statements and rolling forecasts can provide valuable insights into a company's liquidity position. Poor cash flow is a leading cause of business failure, highlighting the importance of disciplined liquidity management.

Strategic Objectives and Growth Plans

A company's strategic objectives and growth plans also play a key role in determining its liquidity needs. Businesses pursuing aggressive expansion strategies, such as acquisitions or new product launches, require significant upfront investments and must maintain adequate liquidity to support these initiatives.

Liquidity acts as a strategic resource, allowing companies to capitalize on opportunities and adapt to changing market conditions. A strong liquidity position provides flexibility to pursue strategic initiatives and respond to unexpected challenges.

However, holding excessive liquidity can also be detrimental, as it may represent missed investment opportunities. Optimal liquidity management involves striking a balance between maintaining adequate reserves and deploying capital for growth and profitability.

Human-Interest Angle: The Impact on Small Businesses

For small business owners, understanding liquidity needs is not just an academic exercise; it's a matter of survival. Many small businesses operate with limited financial resources and are particularly vulnerable to cash flow challenges.

A sudden unexpected expense, such as a broken piece of equipment or a delayed payment from a major customer, can quickly deplete a small business's cash reserves. Without adequate liquidity, these businesses may struggle to meet their obligations, potentially leading to closure.

This highlights the critical importance of financial planning and proactive liquidity management for small business owners. Simple steps like tracking cash flow, building an emergency fund, and establishing a relationship with a local bank can make a significant difference in their ability to navigate financial challenges and achieve long-term success.

Conclusion

In conclusion, liquidity needs are not static but are shaped by a complex interplay of factors including operational scale, market volatility, access to credit, short-term liabilities, and strategic objectives. By carefully considering these variables and implementing effective cash flow management practices, businesses and individuals can ensure they have the resources necessary to weather financial storms and seize opportunities.

Ultimately, a proactive and informed approach to liquidity management is essential for achieving financial stability and long-term success.

.jpg)

.jpg)

.jpg)

.jpg)