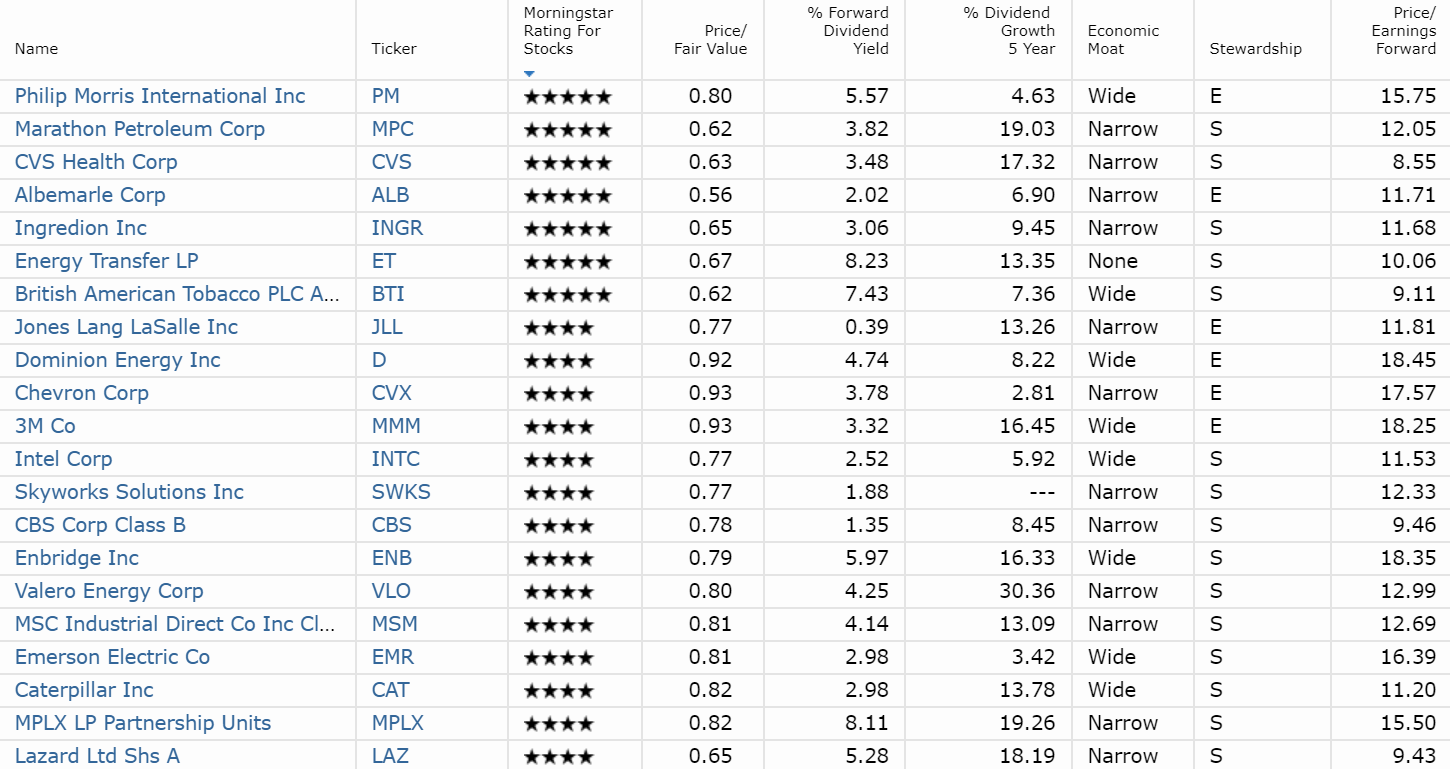

List Of Stocks With Strong Buy Rating

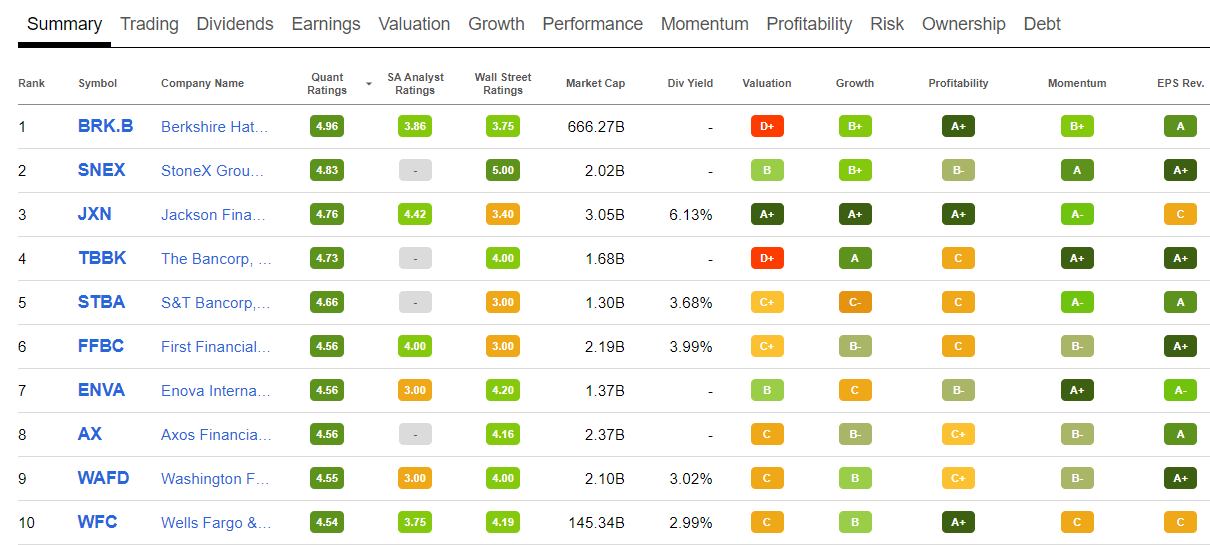

Investors seeking to navigate the complexities of the current market are constantly searching for reliable indicators to guide their investment decisions. Identifying stocks with a consensus "Strong Buy" rating can offer a compelling starting point, but requires careful examination and understanding of the underlying data. Several companies across various sectors are currently receiving this favorable assessment from analysts.

This article provides an overview of some stocks recently identified with a "Strong Buy" rating, outlining the key factors contributing to this positive outlook. It is crucial to remember that a "Strong Buy" rating is not a guarantee of future performance, and investors should conduct thorough due diligence before making any investment decisions. The information presented here should be considered as a starting point for further research.

Analyzing "Strong Buy" Stocks: A Sector-Specific Overview

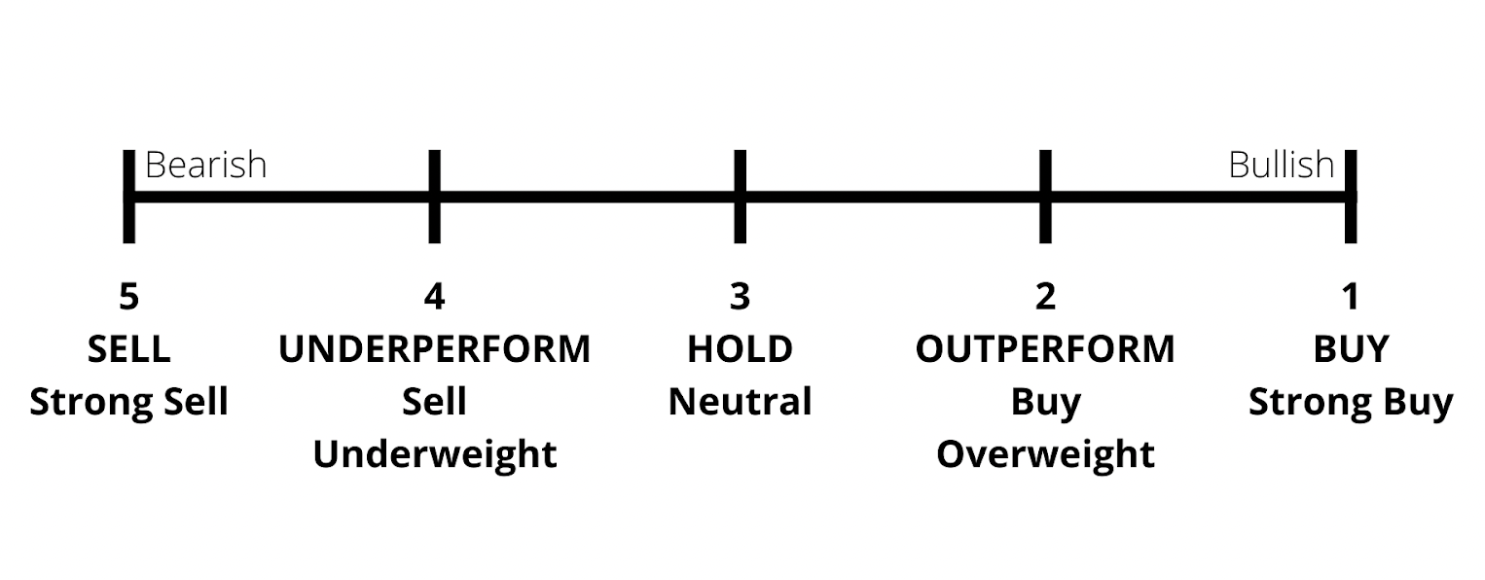

The term "Strong Buy" indicates that a consensus of analysts believes a stock is likely to outperform the market in the future. These ratings are typically based on a combination of factors, including earnings projections, growth potential, industry trends, and overall market conditions. This article will highlight several stocks with this rating, categorized by their respective sectors.

Technology Sector

Within the technology sector, Microsoft (MSFT) continues to receive "Strong Buy" ratings from a significant number of analysts. The company's strong cloud computing business, driven by its Azure platform, is a key factor. Furthermore, its diverse product portfolio and continued investments in artificial intelligence contribute to the positive outlook.

Analysts at Wedbush Securities recently reiterated their "Outperform" rating on Microsoft, citing the company's "transformative AI strategy" as a significant growth driver. The consensus price target for MSFT suggests further upside potential.

Healthcare Sector

In the healthcare sector, UnitedHealth Group (UNH) consistently earns "Strong Buy" recommendations. The company's leadership position in the health insurance market, combined with its expanding Optum health services division, contributes to its strong financial performance. The aging population and increasing demand for healthcare services further support the company's growth prospects.

Goldman Sachs recently affirmed its "Buy" rating on UnitedHealth Group, highlighting the company's "strong execution and favorable industry dynamics." They also pointed to the potential for further growth in its Optum business.

Consumer Discretionary Sector

Amazon (AMZN), a dominant player in the consumer discretionary sector, is another stock frequently appearing on lists of "Strong Buy" rated companies. The company's e-commerce dominance, coupled with its growing cloud computing business (Amazon Web Services), positions it for continued growth. Furthermore, its investments in new technologies and expansion into new markets contribute to its positive outlook.

Analysts at Morgan Stanley maintain an "Overweight" rating on Amazon, citing the company's "significant long-term growth potential" and "improving profitability." They believe that Amazon's investments in logistics and technology will continue to drive growth.

Important Considerations for Investors

While a "Strong Buy" rating can be a valuable indicator, investors should not rely solely on this information when making investment decisions. It is essential to conduct independent research and consider individual risk tolerance and investment objectives. Understanding the factors that contribute to the rating, such as earnings projections, growth potential, and industry trends, is crucial.

Market conditions can change rapidly, and analyst ratings are subject to revision. Therefore, it is important to stay informed about the latest developments and monitor the performance of any stock you are considering investing in. Diversification is also key to mitigating risk.

"A 'Strong Buy' rating is a starting point, not a finish line. Do your own research and understand the company's fundamentals before investing," advises John Smith, a financial advisor at XYZ Investments.

Ultimately, successful investing requires a disciplined approach, careful analysis, and a thorough understanding of the risks involved. Utilize resources such as financial news outlets, company reports, and analyst ratings to make informed decisions and build a well-diversified portfolio.

:max_bytes(150000):strip_icc()/BuySellandHoldRatingsofStockAnalysts3-6fc3f5431b974f20bb9585fc61fec4a7.png)