Managerial Accounting Provides All Of The Following Financial Information Except

Urgent concerns are mounting as a recent report reveals widespread confusion regarding the scope of managerial accounting. This misunderstanding could lead to flawed decision-making within organizations, impacting everything from resource allocation to strategic planning.

The core issue: many professionals incorrectly believe managerial accounting provides *all* financial information needed for business operations. It doesn't. This article clarifies the specific limitations of managerial accounting and highlights the critical information it *does not* provide.

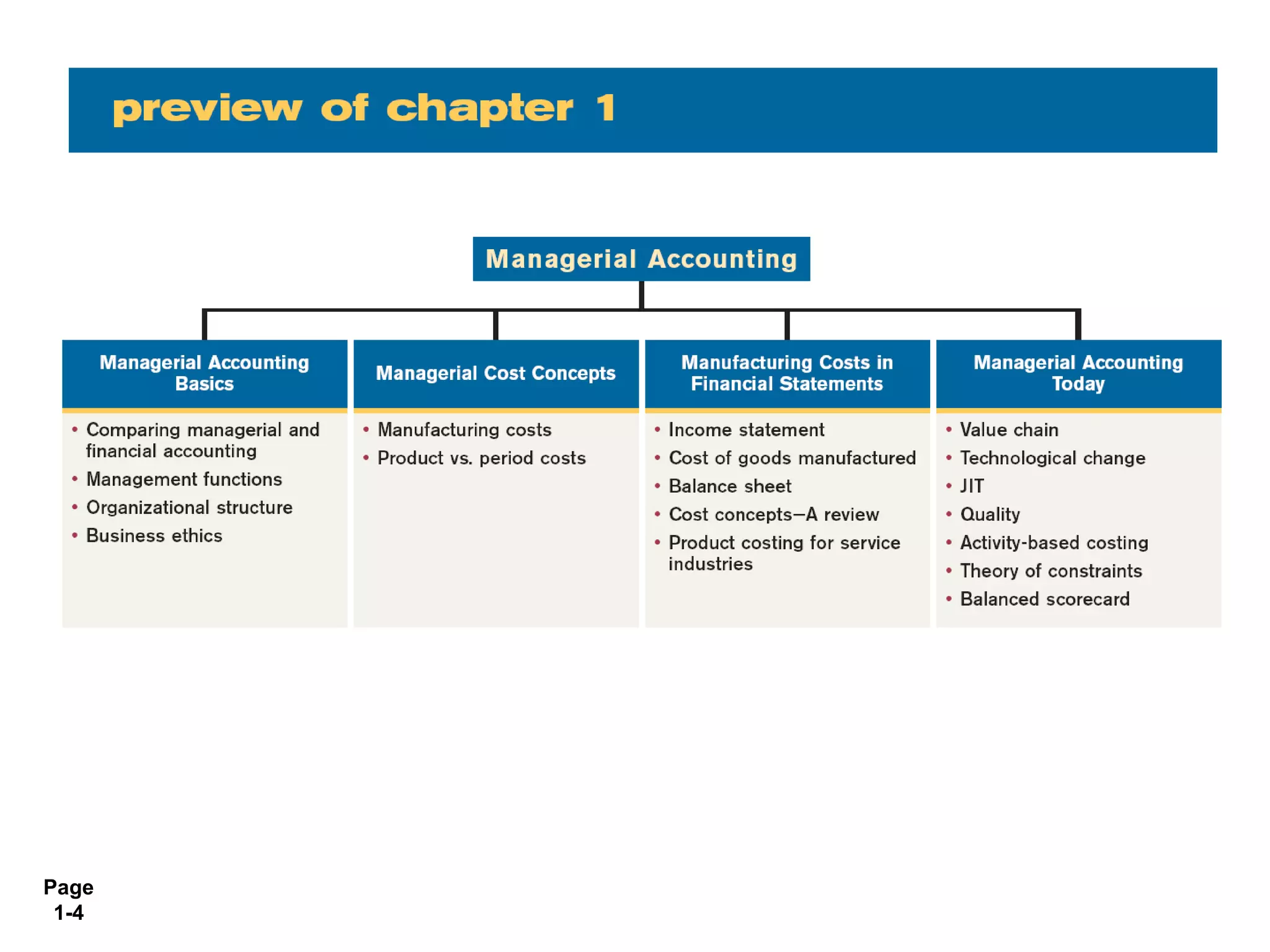

What Managerial Accounting Actually Offers

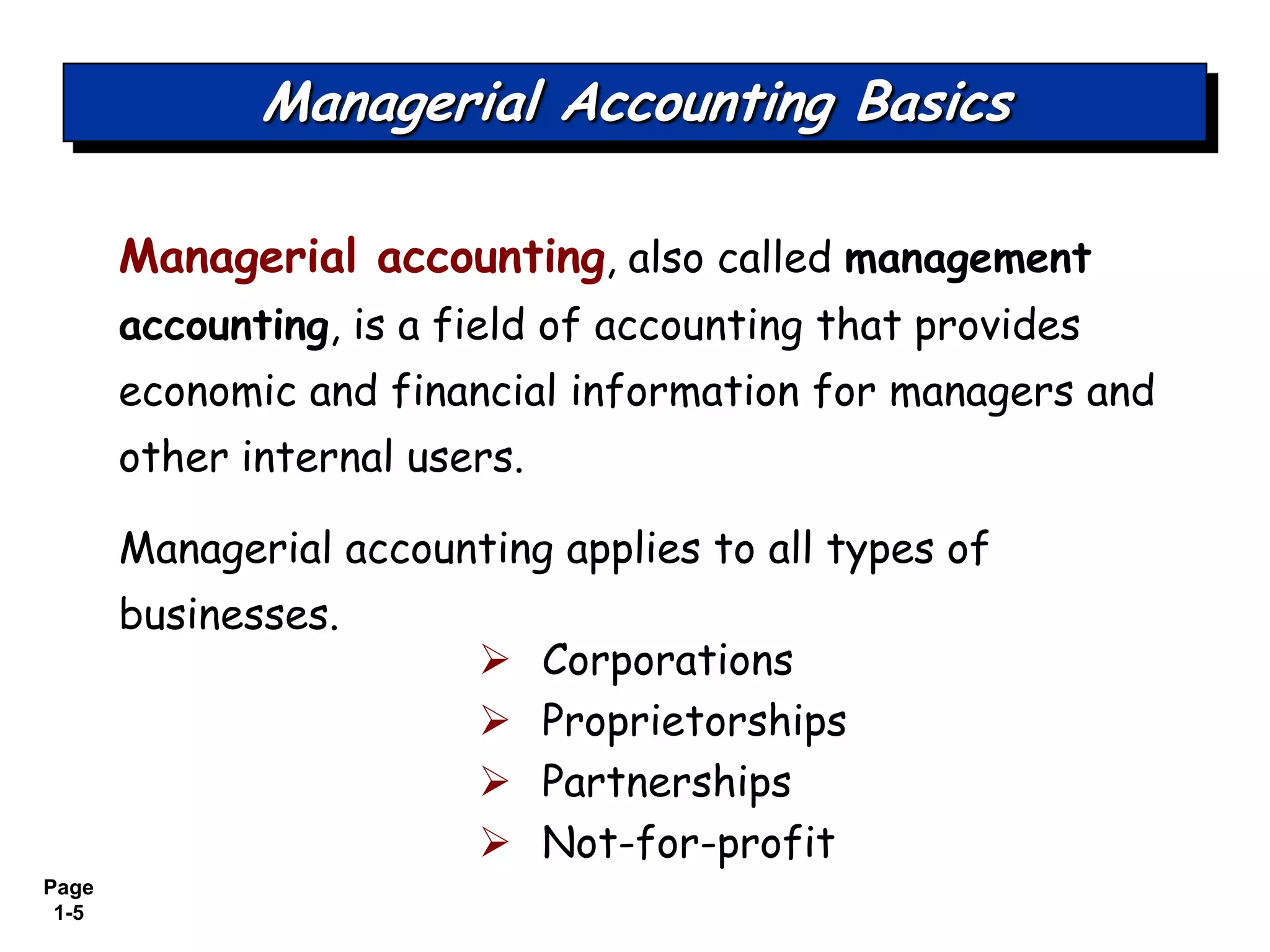

Managerial accounting, at its heart, is internally focused. It provides data and analysis to help managers make informed decisions within the organization.

It encompasses various aspects like cost accounting, budgeting, performance evaluation, and pricing strategies. The primary purpose is to improve operational efficiency and profitability.

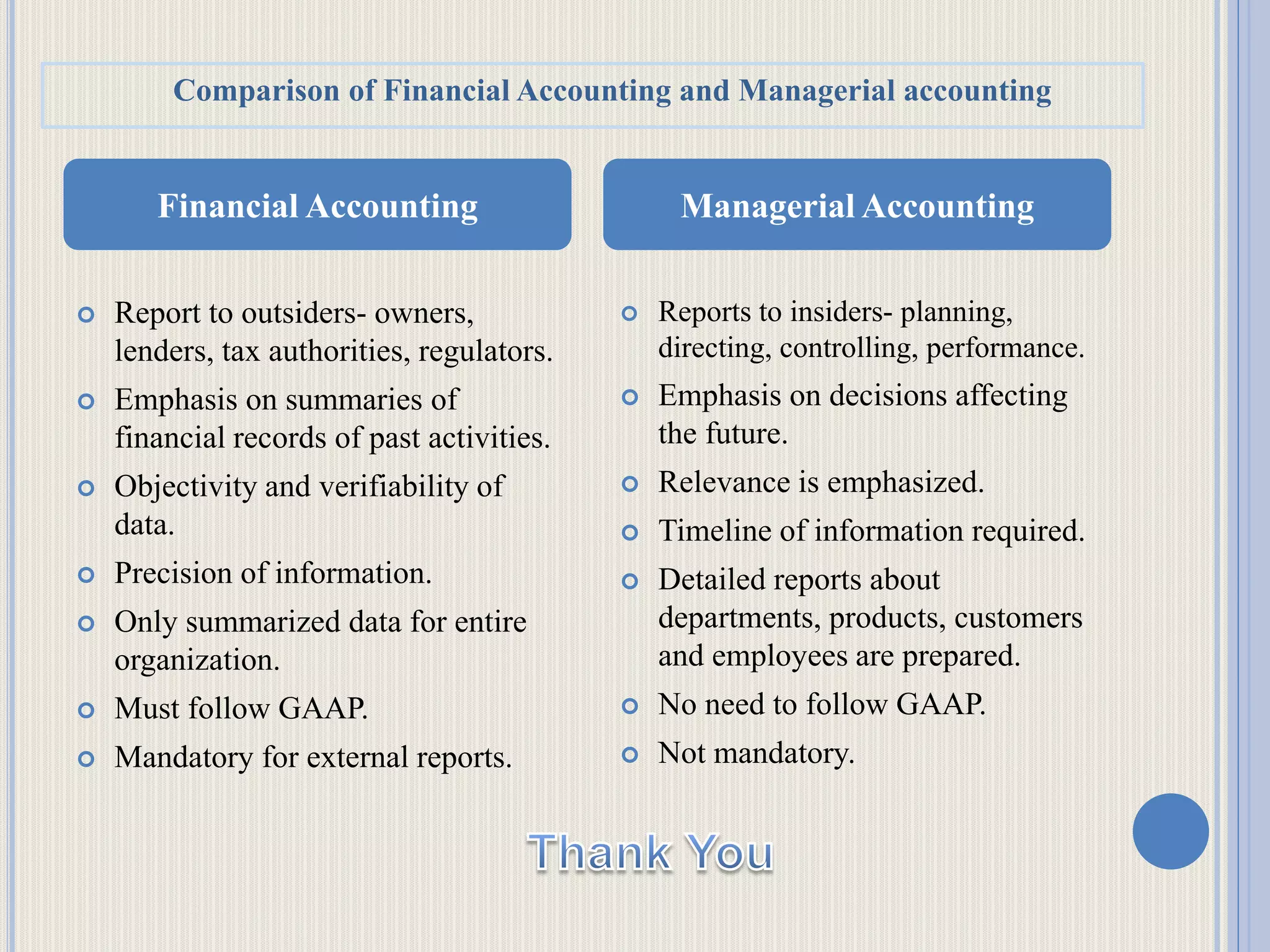

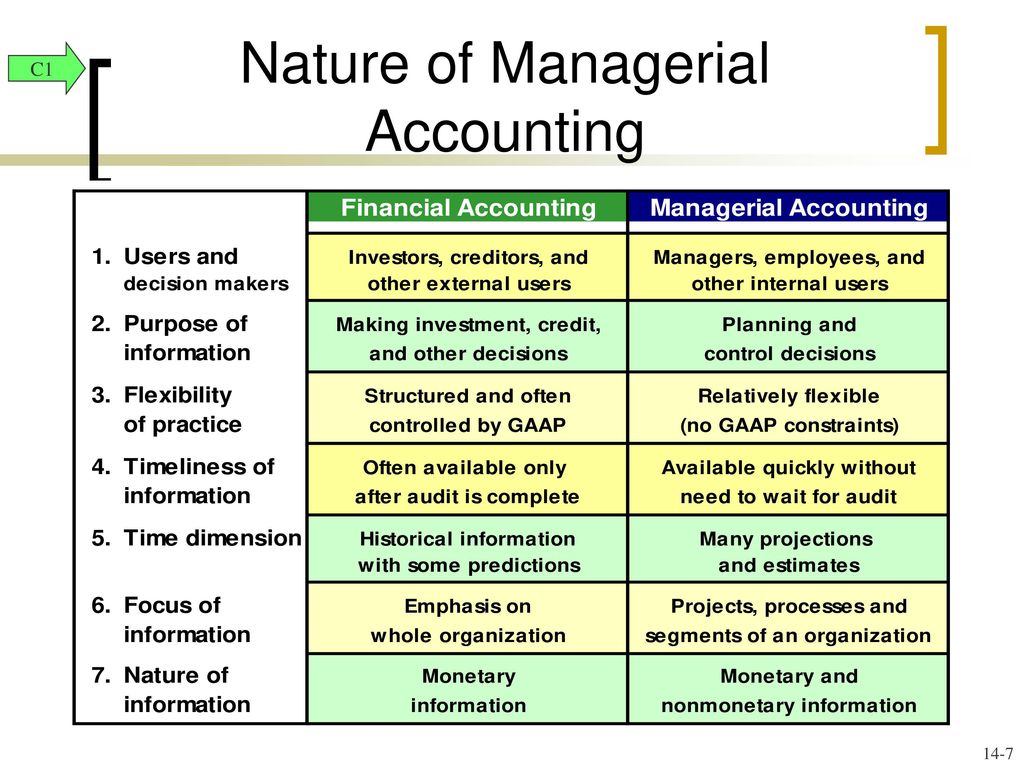

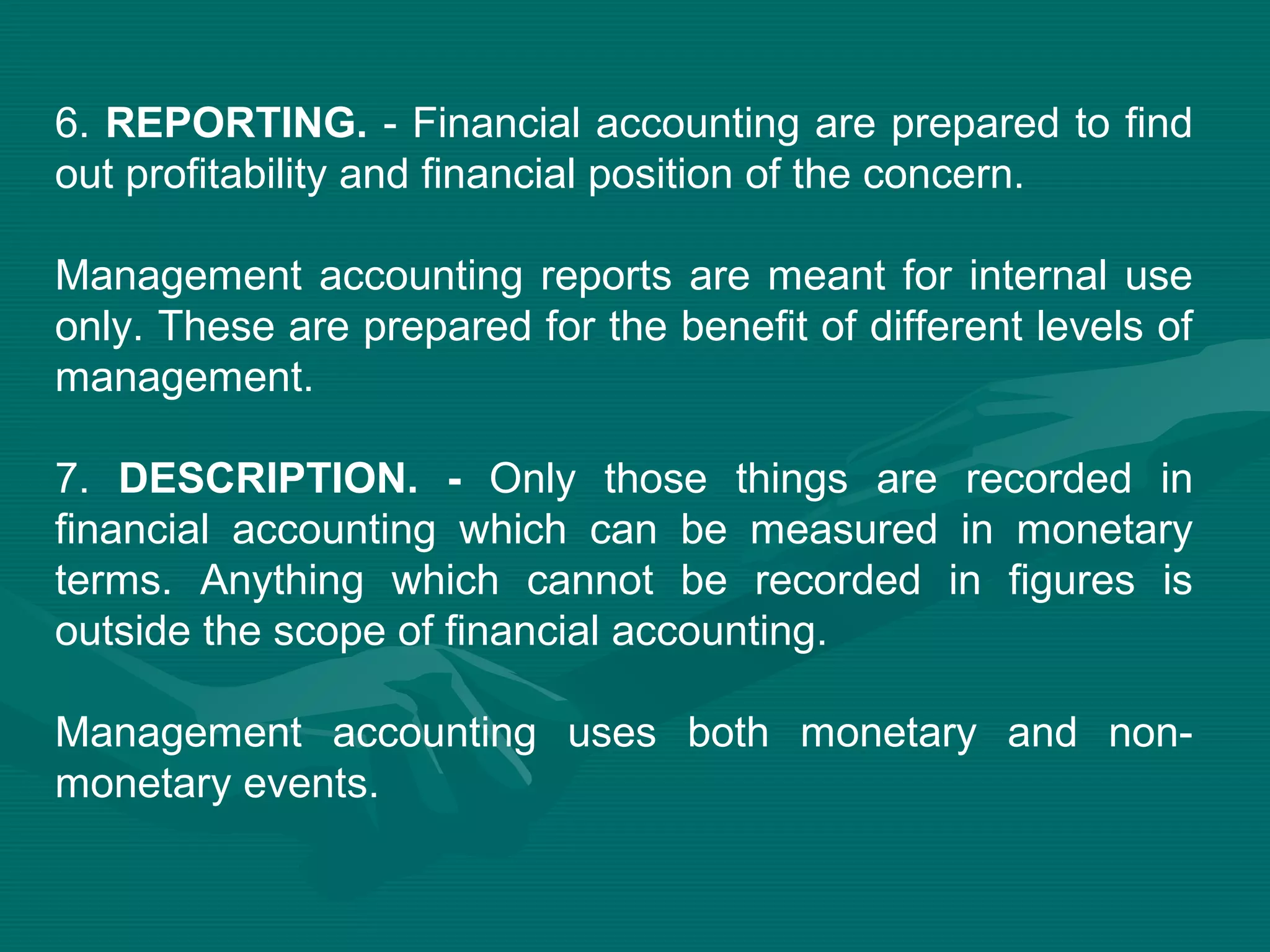

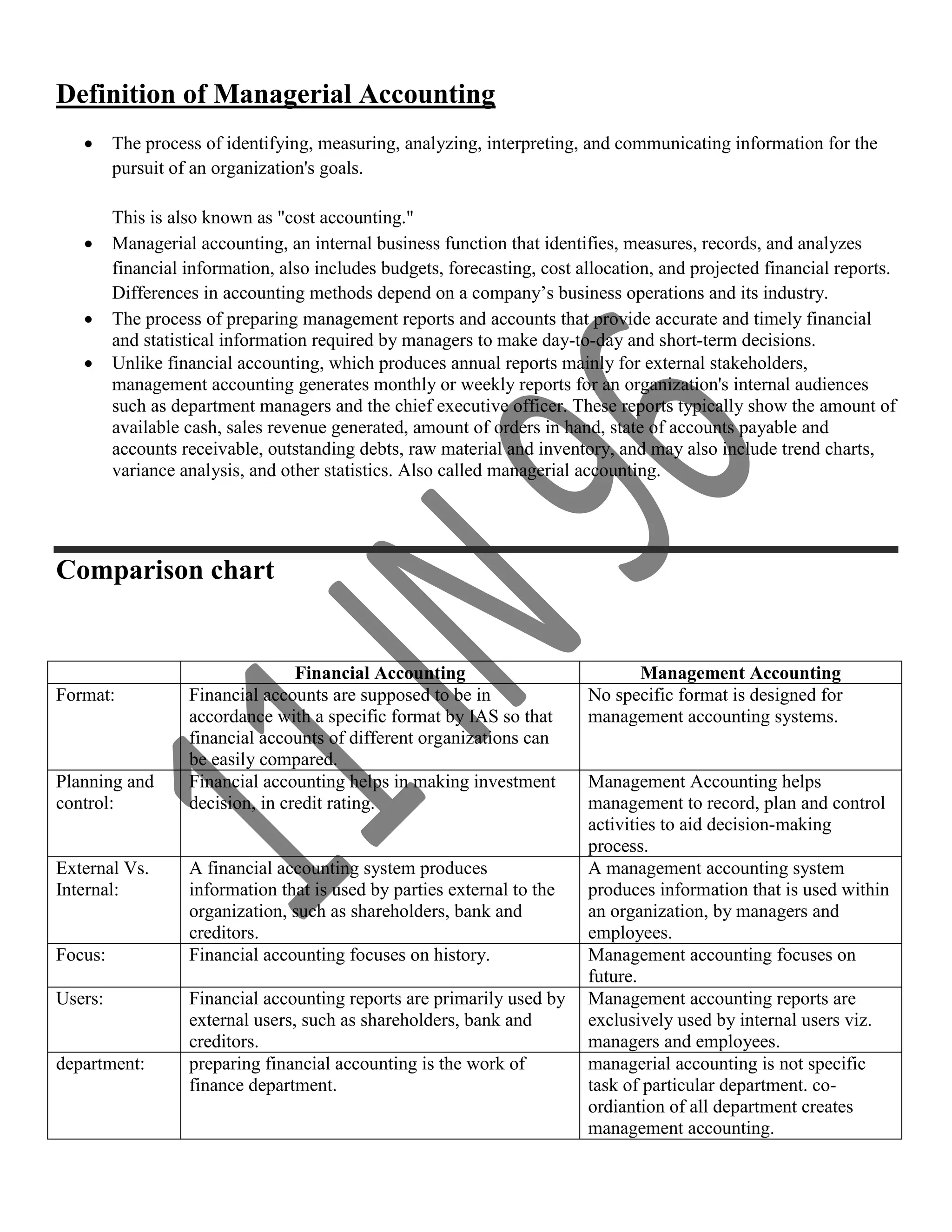

Managerial accounting reports are often tailored to specific needs and departments. These reports are not standardized and are not required to adhere to Generally Accepted Accounting Principles (GAAP).

The Critical Gap: External Financial Reporting

The major area where managerial accounting falls short is in providing financial information for external stakeholders. This includes investors, creditors, and regulatory agencies.

Financial reporting to external parties adheres to GAAP standards. Managerial accounting does not focus on these standards.

This external reporting provides a standardized view of the company's financial health and performance. External stakeholders rely on it for investment decisions and assessing creditworthiness.

Specifically: What Managerial Accounting Doesn't Offer

Managerial accounting does *not* produce the following:

Audited Financial Statements: These are prepared and reviewed by independent auditors to ensure accuracy and compliance with GAAP. Managerial accounting doesn't involve this independent verification.

Balance Sheet, Income Statement, and Statement of Cash Flows (for external reporting): While managerial accounting might use some of the data that goes into these statements, it doesn't generate the finalized, standardized versions required for external reporting.

SEC Filings: Publicly traded companies are required to file specific reports with the Securities and Exchange Commission (SEC). Managerial accounting does not handle these regulatory filings.

Tax Returns: Although managerial accounting can inform tax planning, it does not prepare or file tax returns. Specialized tax accounting expertise is required for this.

In essence, managerial accounting is about internal decision support. External reporting is a separate, crucial function handled through different processes and governed by strict regulations.

The Danger of Misunderstanding

Relying solely on managerial accounting data for external reporting is a grave error. It could lead to inaccurate financial representations and legal repercussions.

Investors might be misled, creditors could make unsound lending decisions, and the company could face penalties from regulatory bodies.

A clear separation between internal and external reporting is essential for responsible financial management.

Expert Opinion

"The failure to distinguish between managerial and financial accounting is a pervasive problem," states Dr. Anya Sharma, a leading accounting professor at the University of Wharton. "Companies need to ensure their teams understand the specific purpose and limitations of each."

Dr. Sharma emphasizes the need for robust training programs and clear lines of responsibility within accounting departments.

The Implications for Businesses

Businesses must prioritize accurate and compliant financial reporting. This involves maintaining a separate financial accounting function that adheres to GAAP and relevant regulations.

Audits, internal controls, and expert consultation are crucial for ensuring the integrity of external financial statements.

Investing in these areas is not merely a compliance issue, but a matter of safeguarding the company's reputation and financial stability.

Moving Forward: Addressing the Knowledge Gap

The focus now shifts to educating professionals and businesses about the distinct roles of managerial and financial accounting. Workshops, training programs, and clearer communication are needed.

The AICPA (American Institute of Certified Public Accountants) and other professional organizations are developing resources to address this knowledge gap. Stay informed about these resources.

Immediate action is needed to mitigate the risks associated with this widespread misunderstanding. Companies are urged to assess their current practices and implement necessary improvements without delay.