Marathon Petroleum Earnings Date April 2025

Imagine the warm glow of a spring evening, fireflies beginning their nightly dance, and the distant hum of industry – a backdrop to the quiet anticipation buzzing in financial circles. It's a scene far removed from the data streams and market analyses, yet it sets the stage for a significant moment on the calendar: Marathon Petroleum's April 2025 earnings announcement.

The upcoming earnings report holds considerable weight for investors, industry analysts, and even consumers, offering a crucial snapshot of the company's performance and a glimpse into the broader energy landscape. Understanding Marathon Petroleum's financial health and strategic direction provides invaluable insight into the stability and trajectory of a major player in the petroleum industry.

A Look Back: Marathon Petroleum's Foundation

Founded in 2011 as a spin-off from Marathon Oil, Marathon Petroleum Corporation (MPC) quickly established itself as a leading integrated downstream energy company. Its operations encompass refining, marketing, and transportation of petroleum products across the United States.

Over the years, MPC has grown through strategic acquisitions, including the landmark purchase of Andeavor in 2018. This expansion significantly broadened its footprint and diversified its portfolio, solidifying its position as a dominant force in the sector.

The company's commitment to operational efficiency and innovation has been a key driver of its success. Marathon Petroleum continues to invest in infrastructure and technology to enhance its refining capabilities and optimize its supply chain.

What to Expect: Anticipating the April 2025 Earnings

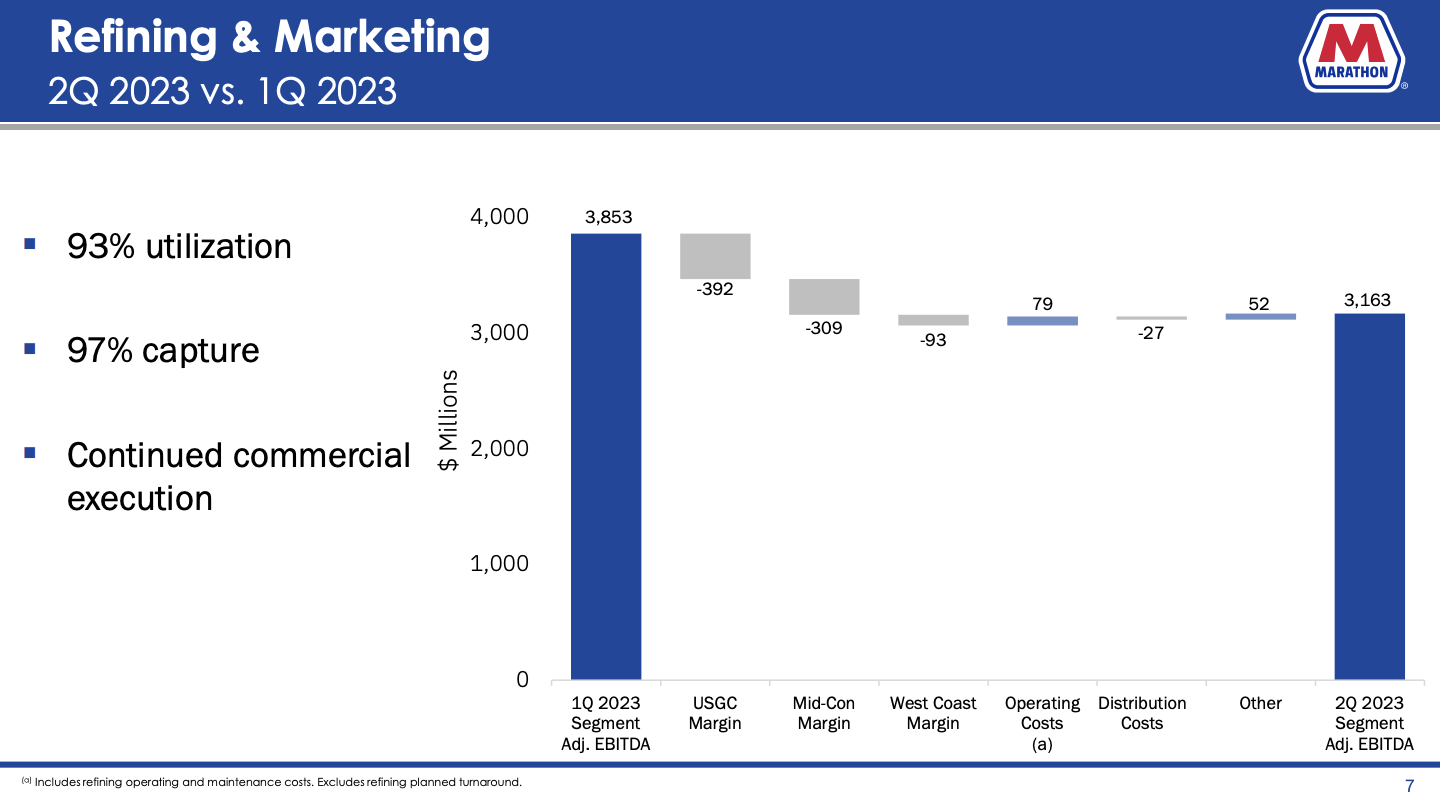

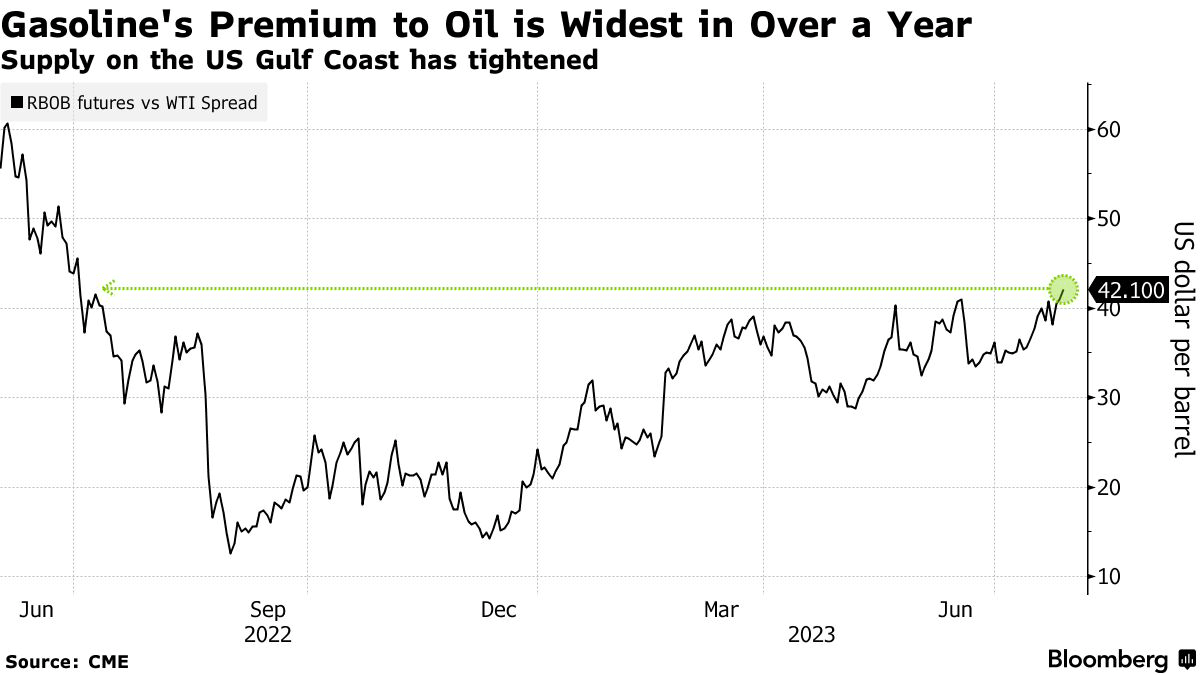

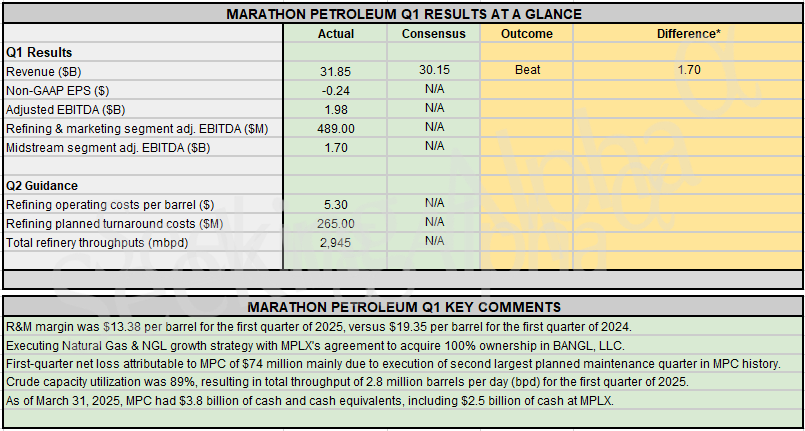

The April 2025 earnings announcement will be scrutinized for several key metrics. These include refining margins, sales volumes, operating expenses, and capital expenditures. These figures offer a comprehensive view of the company's profitability and financial management.

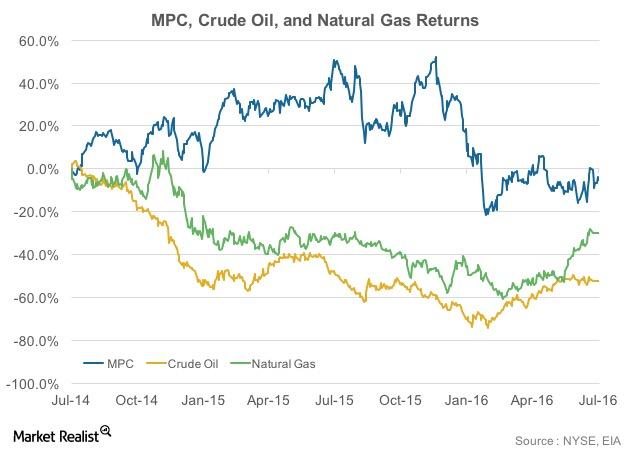

Analysts will be particularly interested in MPC's performance in the face of fluctuating crude oil prices and evolving consumer demand. The energy market is notoriously volatile, and the company's ability to navigate these challenges will be a crucial indicator of its long-term resilience.

Keep an eye on management's commentary regarding future investments and strategic initiatives. These insights provide valuable context for understanding the company's vision for the coming years.

External Factors: The Broader Economic Context

Marathon Petroleum's performance is intrinsically linked to the overall health of the global economy. Factors such as interest rates, inflation, and geopolitical events can significantly impact energy demand and pricing.

Government regulations and environmental policies also play a crucial role. Increased scrutiny on emissions and the transition to renewable energy sources present both challenges and opportunities for the company.

The ongoing developments in the electric vehicle (EV) market are another critical consideration. While the transition to EVs is gradual, it's a long-term trend that will undoubtedly shape the future of the petroleum industry.

The Significance of Marathon Petroleum's Performance

MPC's financial results offer more than just a snapshot of a single company; they reflect the broader state of the energy sector. Its performance provides valuable insights into trends impacting the entire industry.

For investors, the earnings report can influence decisions about resource allocation and portfolio diversification. A strong performance could attract new investment, while a weaker showing may prompt caution.

The company's actions and decisions also impact consumers. Changes in refining capacity or product pricing can ripple through the market, affecting gasoline prices and the cost of other petroleum-based products.

Beyond the Numbers: Marathon Petroleum's Community Impact

It's important to remember that Marathon Petroleum is more than just a balance sheet and a stock ticker. The company has a significant impact on the communities where it operates.

Through job creation, tax revenue, and philanthropic initiatives, MPC contributes to the economic and social well-being of these regions. Its commitment to safety and environmental stewardship is also a crucial aspect of its community engagement.

The earnings report offers an opportunity to reflect on the company's broader societal role and its efforts to balance profitability with responsible corporate citizenship.

Looking Ahead: Navigating the Future of Energy

As the energy landscape continues to evolve, Marathon Petroleum faces both challenges and opportunities. Its ability to adapt to changing market dynamics and embrace innovation will be critical to its long-term success.

The company's investments in renewable energy and alternative fuels will be closely watched. These initiatives signal a commitment to diversifying its portfolio and preparing for a future with a lower carbon footprint.

The April 2025 earnings announcement will provide valuable insights into MPC's progress on this journey and its vision for a sustainable energy future.

Conclusion: A Moment of Reflection

As we approach the April 2025 earnings date, it’s a moment to consider the complex interplay of factors that shape Marathon Petroleum's performance. It's a reminder that financial reports are more than just numbers; they tell a story about a company's past, present, and future.

Ultimately, the earnings announcement offers a valuable opportunity to assess the company's stewardship of resources, its commitment to innovation, and its impact on the broader world. The ripple effects will extend from the financial markets to the communities where Marathon Petroleum operates, reinforcing the importance of responsible and sustainable energy production.

Whether the news is positive or faces headwinds, the April 2025 earnings will contribute to a crucial narrative about the evolving future of energy and Marathon Petroleum’s role in shaping it.

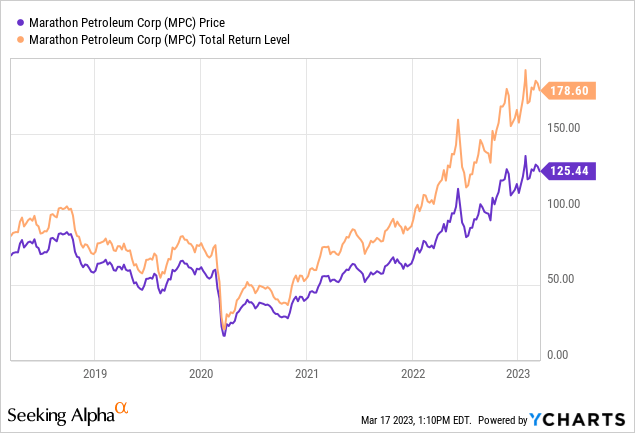

:max_bytes(150000):strip_icc()/MPC_SPXTR_chartcopy-66062d25b16543c287fe64ca7143c911.jpg)