Marc Chaikin Number One Ai Stock

The stock market is abuzz with speculation surrounding the next big player in the Artificial Intelligence (AI) sector. While established tech giants dominate headlines, a lesser-known company helmed by veteran market analyst Marc Chaikin is quietly gaining traction. Investors are keenly watching if it can disrupt the established order.

Is this the next hidden gem, or just another flash in the pan?

The anticipation is palpable, with projections suggesting substantial growth potential, but skepticism lingers among some industry experts.

Chaikin Analytics and the AI Advantage

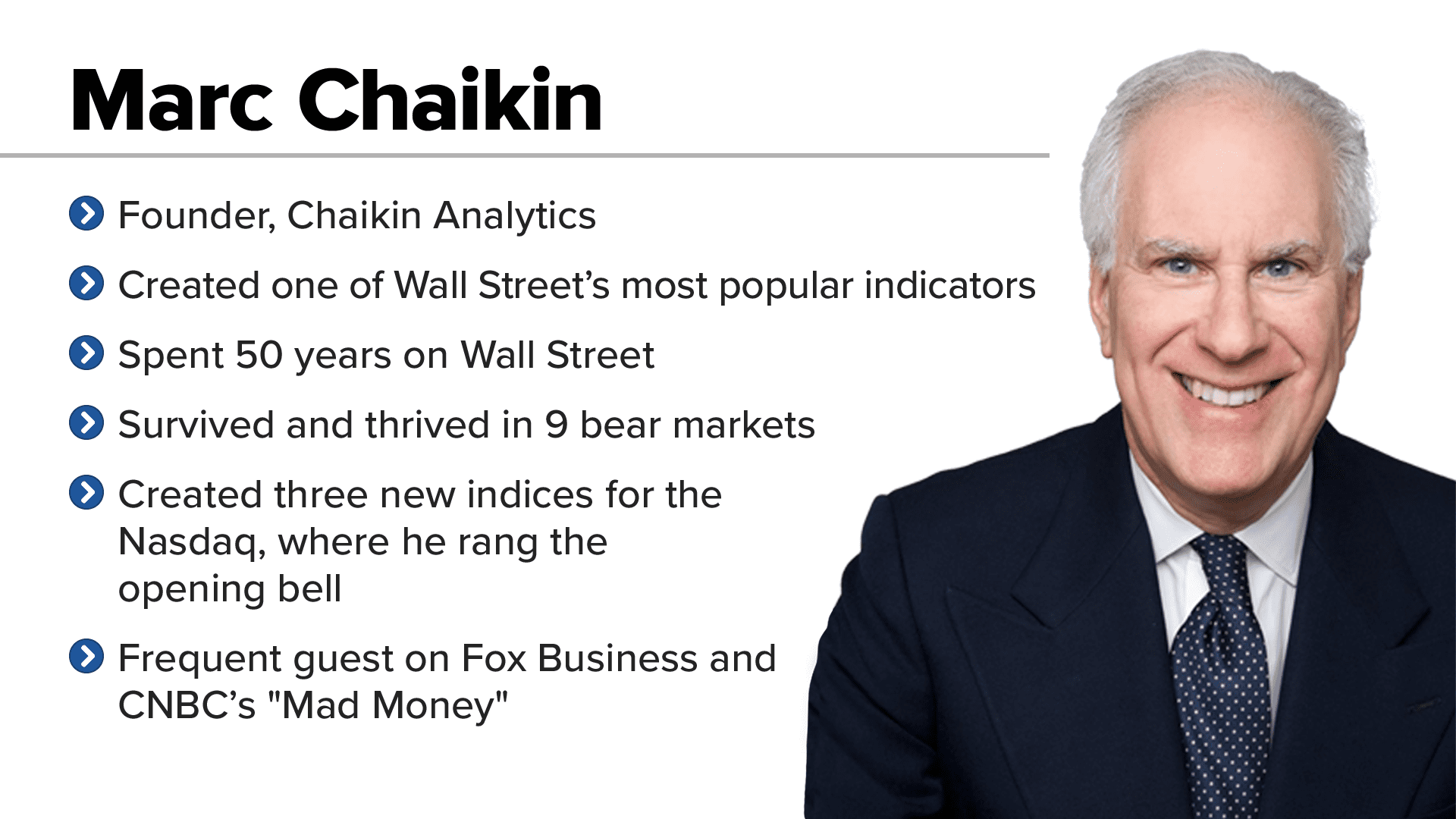

The core of the discussion revolves around Chaikin Analytics, founded by Marc Chaikin, a name synonymous with market timing and quantitative analysis. The company has developed a suite of tools leveraging AI and machine learning to provide investment insights. These tools aim to give users an edge in navigating increasingly complex financial markets.

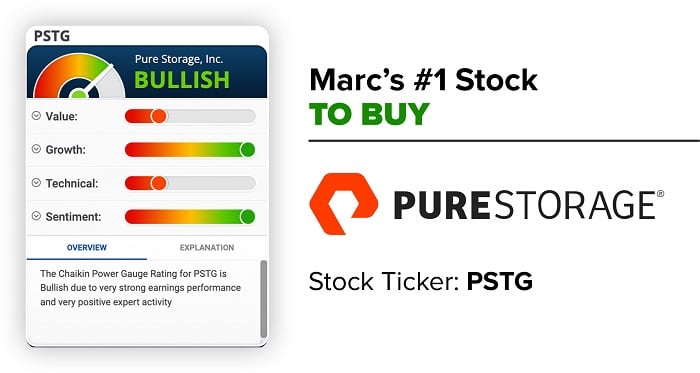

Specifically, the firm's AI-powered stock rating system, dubbed the Chaikin Power Gauge, analyzes various fundamental and technical factors to predict future stock performance. Chaikin and his team believe their system provides a more accurate and timely assessment of a stock's potential than traditional methods.

The question now is whether this translates to genuine market outperformance and investment success.

The 'Number One AI Stock' Claim

The heightened attention stems from Chaikin's bold claim of identifying a specific stock poised to benefit significantly from the AI boom. While the name of the company is only revealed to subscribers of Chaikin Analytics, the promise of exponential returns linked to AI advancements has sparked considerable interest.

This strategic marketing ploy generated both excitement and criticism. Some analysts lauded Chaikin's ability to capture market attention, while others questioned the validity of such a definitive prediction.

The identity of the so-called "Number One AI Stock" remains shrouded in secrecy, fueling further speculation and debate.

Analyzing the Potential

To assess the credibility of Chaikin's claim, it's essential to consider several factors. First, the accuracy of the Chaikin Power Gauge must be evaluated. Independent analysis and historical performance data are critical in determining the system's reliability.

Second, the unidentified company's actual involvement in the AI sector needs scrutiny. Is it genuinely innovating and disrupting, or is it merely capitalizing on the AI hype?

Finally, broader market trends and economic conditions play a significant role. Even the most promising AI stock can be vulnerable to external shocks and industry-wide downturns.

Historical Performance and Track Record

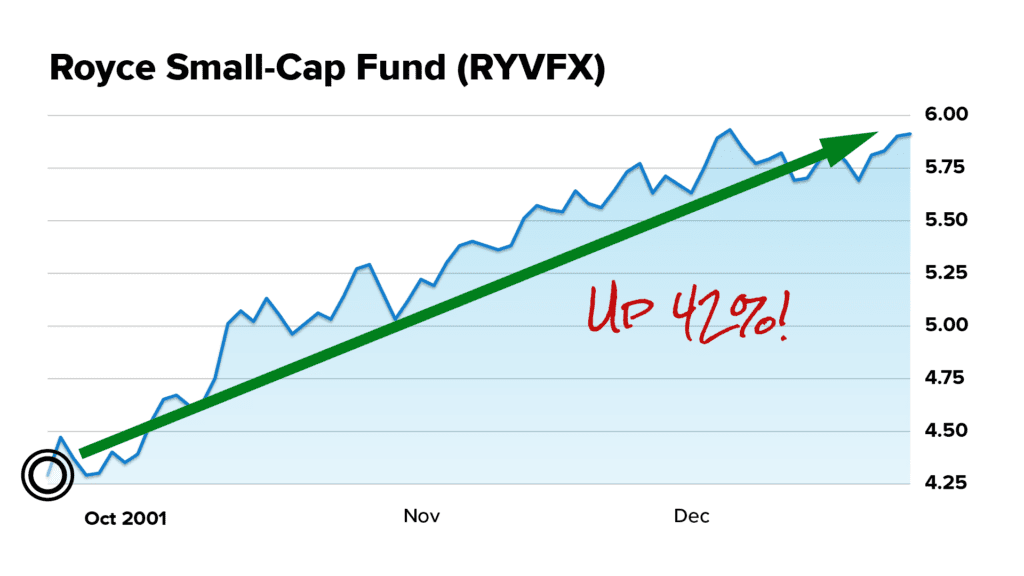

Marc Chaikin's reputation as a market analyst lends some weight to his claims. His decades of experience and development of widely-used indicators like the Chaikin Oscillator are well-documented.

However, past performance is not indicative of future results. The AI landscape is rapidly evolving, and what worked in the past may not be effective in the future.

Therefore, a critical evaluation of Chaikin Analytics' recent performance and methodology is crucial.

Skepticism and Alternative Perspectives

Not everyone is convinced by Chaikin's pronouncements. Some financial analysts argue that the AI hype is overblown, leading to inflated valuations and unsustainable growth.

Others express concerns about the "black box" nature of some AI-powered investment tools. The lack of transparency can make it difficult to understand the rationale behind investment decisions and assess the associated risks.

"Investors should always exercise caution and conduct thorough due diligence before investing in any stock based on a single analyst's recommendation," cautions a senior portfolio manager at a leading investment firm. "AI is a powerful tool, but it's not a magic bullet."

The Broader AI Investment Landscape

It's crucial to remember that the AI investment landscape extends far beyond a single stock. Major tech companies like Google (Alphabet), Microsoft, and Amazon are heavily invested in AI and are already generating substantial revenue from AI-related products and services.

Numerous smaller companies and startups are also developing innovative AI solutions. Investors have many options for exposure to the AI sector, each with its own risk-reward profile.

Diversification remains a key principle of sound investment strategy.

Looking Ahead: The Future of AI Investing

The AI revolution is still in its early stages, and the long-term potential is undeniable. AI is transforming industries ranging from healthcare to finance, creating new opportunities for growth and innovation.

However, the market is also prone to volatility and irrational exuberance. Investors should approach AI investments with a balanced perspective, focusing on companies with solid fundamentals, sustainable business models, and proven track records.

Whether Marc Chaikin's "Number One AI Stock" lives up to its billing remains to be seen, but the broader AI investment story is just beginning.

![Marc Chaikin Number One Ai Stock Marc Chaikin Number One Stock Exposed? [AI Prediction 2024] - YouTube](https://i.ytimg.com/vi/HM1c9dQQnJs/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGHIgRig1MA8=&rs=AOn4CLCbKXA6UfrYnTJhtstm6KrxiKS6bQ)