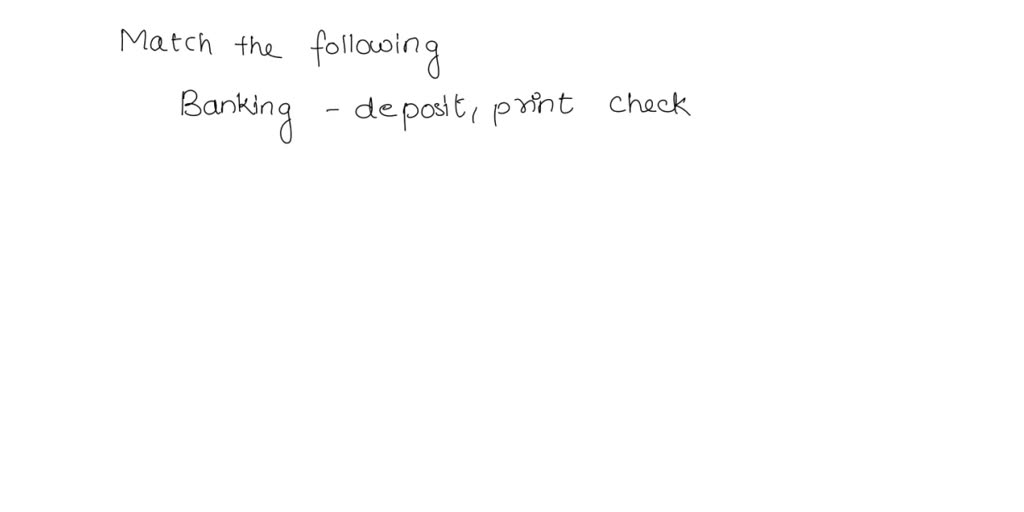

Match The Following Transactions With The Type Of Transaction

The seemingly simple task of categorizing financial transactions underpins the entire architecture of modern finance. From individual budgeting apps to complex international trade agreements, the correct classification of each transaction dictates how money flows, how taxes are levied, and ultimately, how economies function.

This deceptively complex process, often summarized as "matching transactions with their correct type," faces growing challenges in an increasingly digital and interconnected world. The rise of cryptocurrencies, decentralized finance (DeFi), and novel payment methods necessitates constant adaptation and refinement of existing classification systems.

The Nut Graf: Understanding the Importance

This article delves into the intricacies of transaction classification, exploring the different types of transactions, the challenges in accurately categorizing them, and the implications of misclassification. It will examine the role of technology, regulation, and human expertise in ensuring the integrity of financial data and the stability of the global financial system.

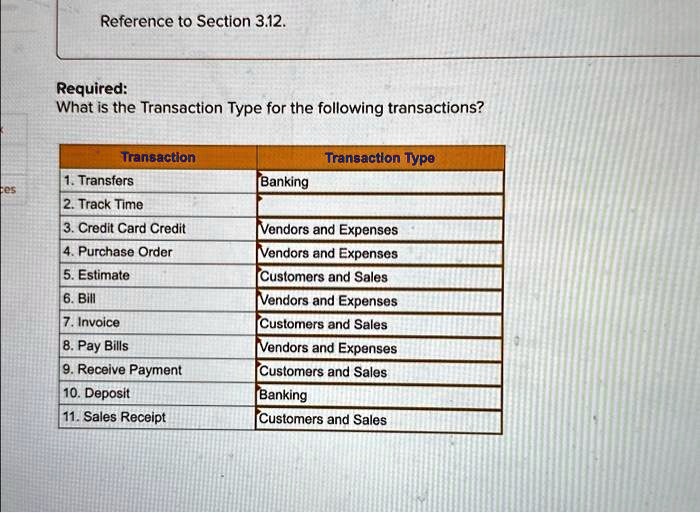

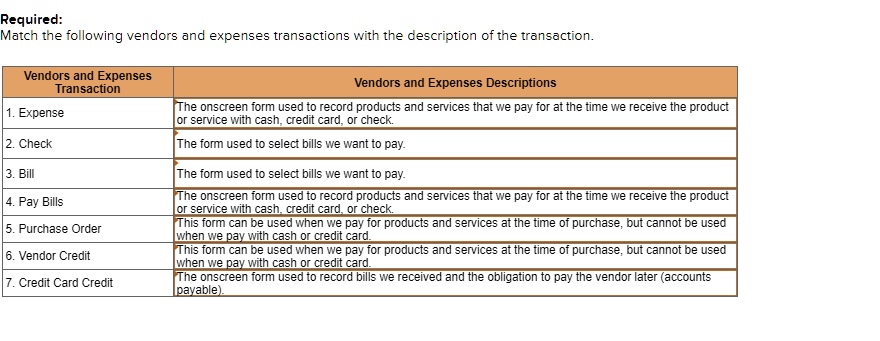

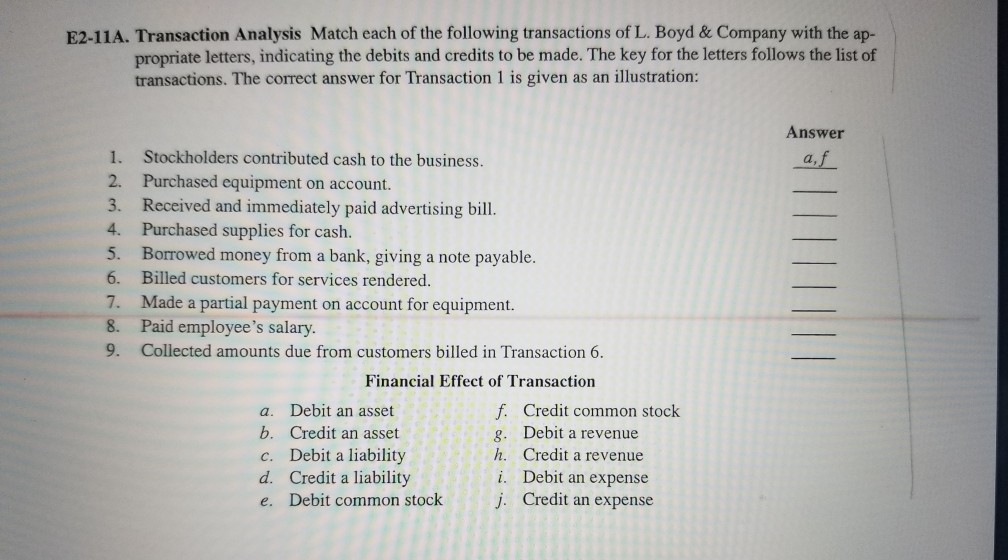

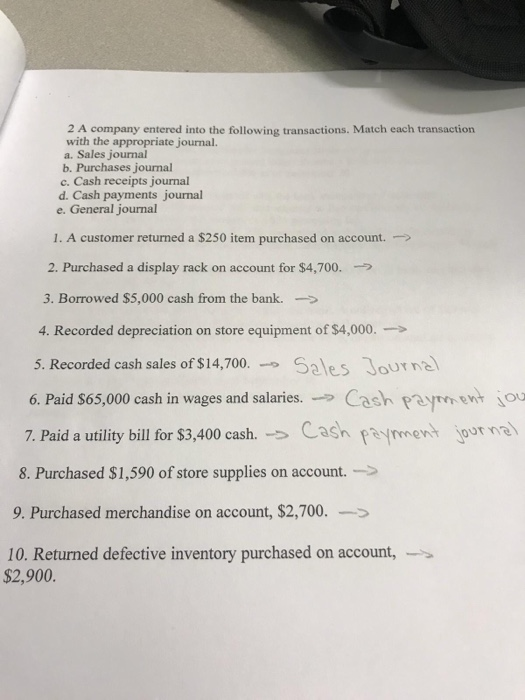

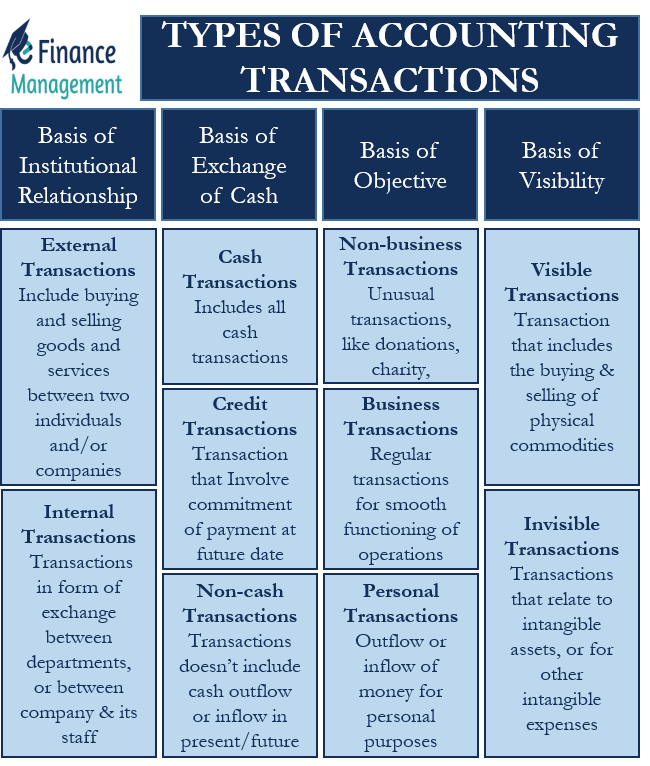

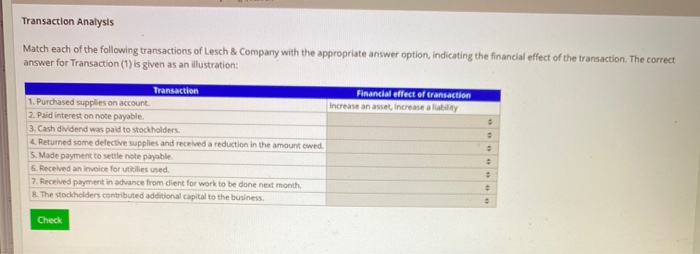

Types of Financial Transactions

Financial transactions can be broadly categorized based on several factors, including the nature of the exchange, the entities involved, and the purpose of the transaction.

One fundamental distinction lies between credit transactions and debit transactions. A credit transaction increases an account balance, while a debit transaction decreases it.

Another crucial distinction is between business-to-business (B2B), business-to-consumer (B2C), and consumer-to-consumer (C2C) transactions.

Investment transactions represent another distinct category, encompassing activities such as buying and selling stocks, bonds, and other assets. Securities and Exchange Commission (SEC) regulations closely govern these types of transactions.

Finally, international transactions involve the exchange of goods, services, or capital across national borders, often requiring currency conversions and adherence to international trade laws.

Challenges in Accurate Classification

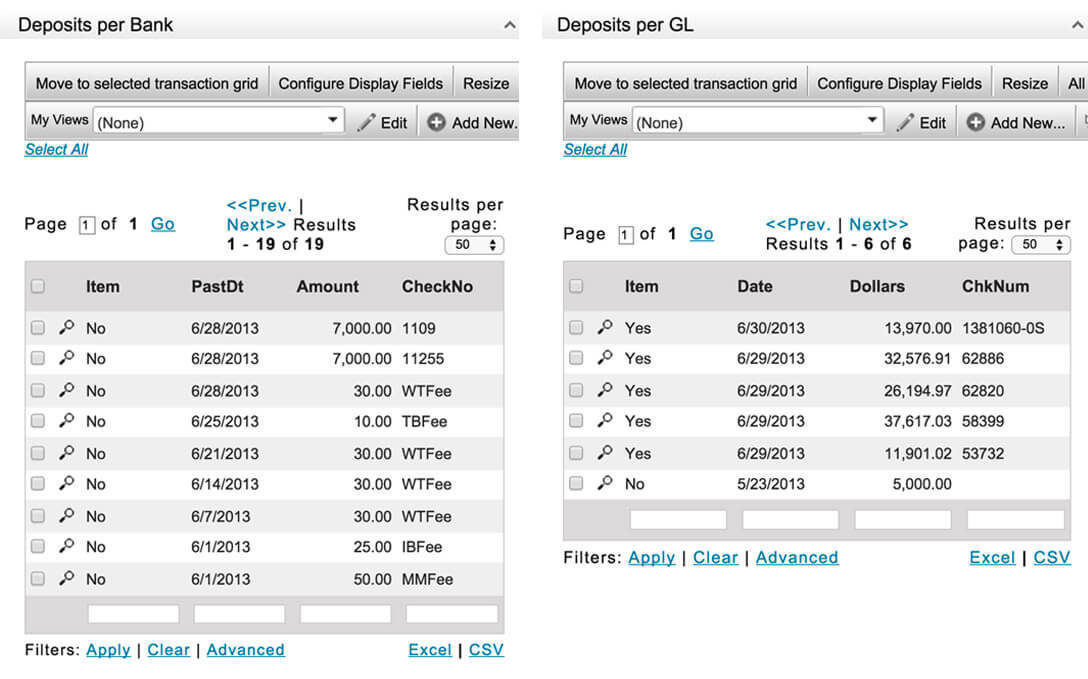

Despite the established frameworks, accurately classifying financial transactions presents numerous challenges. One key issue is the lack of standardization across different industries and geographical regions.

The rapid evolution of payment technologies, such as mobile wallets and cryptocurrencies, further complicates the classification process. These new methods often blur the lines between traditional transaction types.

Fraudulent activities also pose a significant challenge, as criminals often attempt to disguise illicit transactions to evade detection. This requires sophisticated data analysis and pattern recognition techniques.

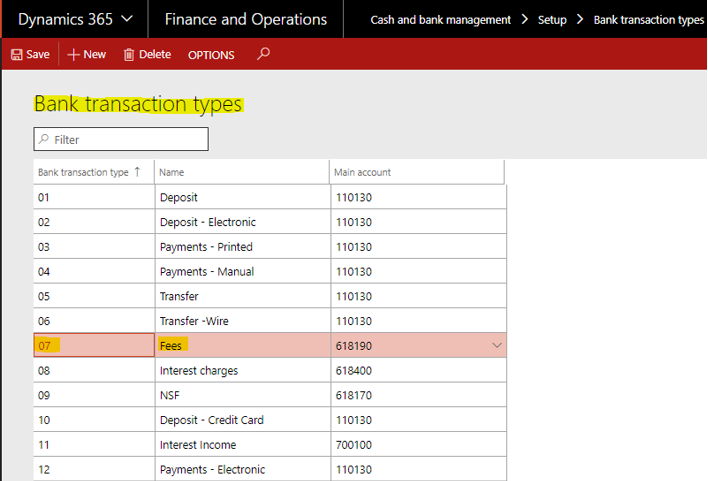

The Role of Technology

Technology plays an increasingly vital role in automating and improving the accuracy of transaction classification. Machine learning (ML) algorithms are being used to analyze vast datasets and identify patterns that would be impossible for humans to detect.

Artificial intelligence (AI)-powered systems can also learn from past classifications and adapt to new transaction types, enhancing their ability to categorize transactions correctly.

However, reliance on technology alone is not sufficient. Human oversight and expertise are still necessary to ensure the accuracy and integrity of the classification process.

Regulatory Landscape and Compliance

Regulatory bodies such as the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) set the standards and guidelines for financial reporting and transaction classification.

These regulations aim to ensure transparency and comparability of financial information across different companies and industries. Compliance with these regulations is crucial for maintaining investor confidence and the stability of financial markets.

Failure to accurately classify transactions can result in penalties, legal action, and reputational damage.

The Impact of Misclassification

Misclassifying financial transactions can have significant consequences. For businesses, it can lead to inaccurate financial reporting, incorrect tax payments, and flawed decision-making.

For individuals, it can result in incorrect credit scores, difficulty obtaining loans, and potential legal issues.

"Accurate transaction classification is the bedrock of a sound financial system,"says Dr. Anya Sharma, a leading economist at the International Monetary Fund (IMF).

On a macro level, widespread misclassification can distort economic indicators, undermine the effectiveness of monetary policy, and increase the risk of financial instability.

Looking Ahead: Future Trends and Challenges

The future of transaction classification will be shaped by several key trends. The continued growth of digital payments and cryptocurrencies will require new and innovative classification methods.

Increased focus on data privacy and security will necessitate the development of more secure and transparent transaction classification systems.

Collaboration between regulators, industry stakeholders, and technology providers will be essential to address the evolving challenges and ensure the integrity of financial data.

As the financial landscape continues to evolve, the ability to accurately match transactions with their correct type will become increasingly critical for maintaining a stable and efficient global economy. Continuous monitoring, adaptation and education are key.