Match The Funding Option To Its Description.

In an increasingly competitive landscape for funding, both for-profit ventures and non-profit organizations face a critical challenge: navigating the complex world of financing options. Misalignment between a project's needs and the chosen funding mechanism can lead to wasted resources, missed opportunities, and even organizational failure. Understanding the nuances of each funding source is paramount for ensuring long-term sustainability and achieving strategic goals.

This article provides an in-depth look at matching various funding options to their ideal use cases, offering a comprehensive guide for organizations seeking financial support. The goal is to equip decision-makers with the knowledge necessary to make informed choices, maximizing their chances of securing the right funding for their specific needs and ensuring efficient resource allocation.

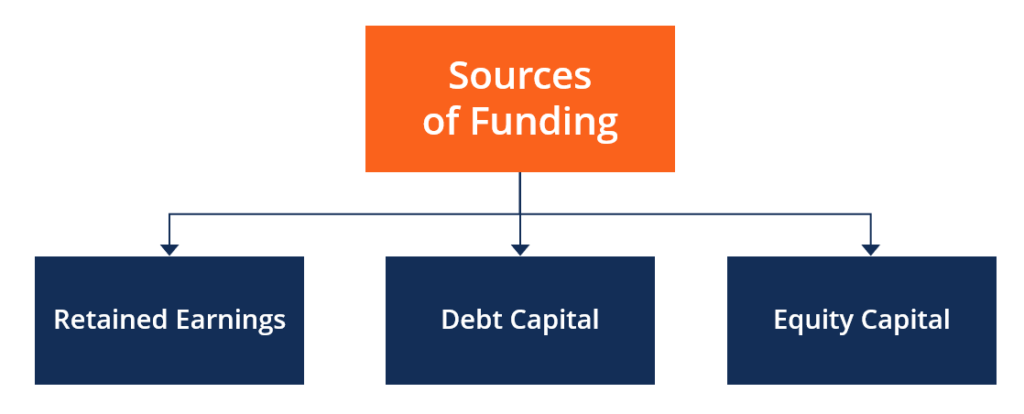

Understanding the Funding Landscape

Securing appropriate funding is a strategic imperative, not just a financial one. The right type of funding can accelerate growth, foster innovation, and enhance an organization's ability to achieve its mission.

However, the funding ecosystem is vast and diverse, encompassing everything from traditional bank loans to cutting-edge crowdfunding platforms. Each option comes with its own set of requirements, benefits, and potential drawbacks. Organizations must carefully evaluate these factors to determine the best fit for their circumstances.

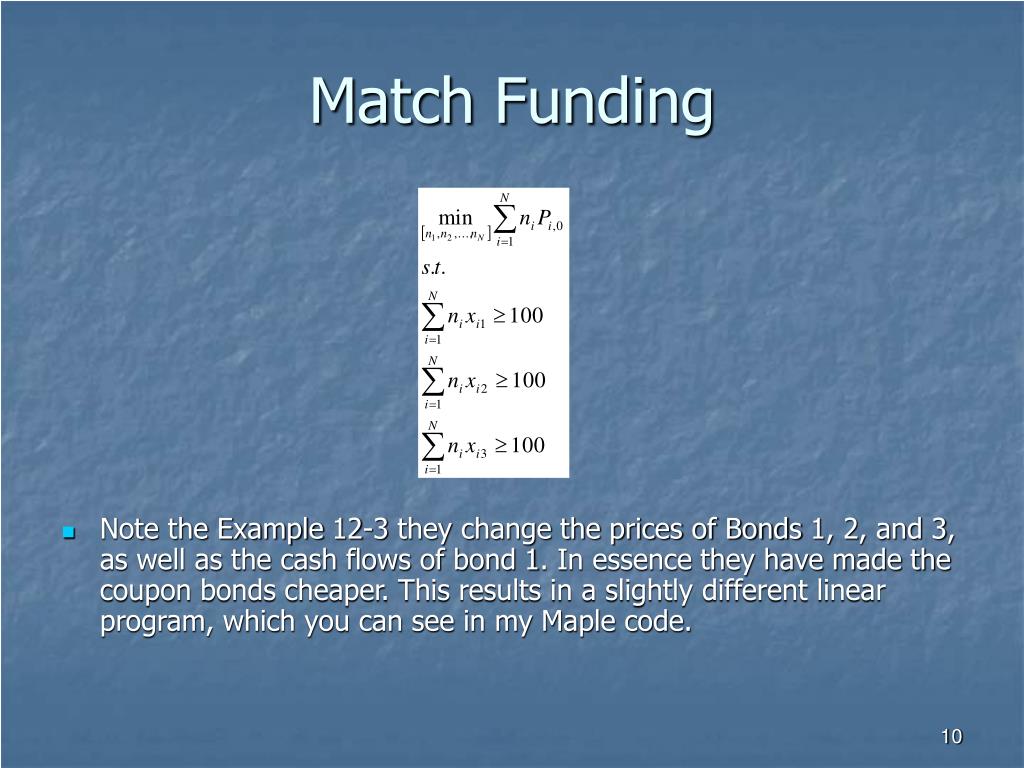

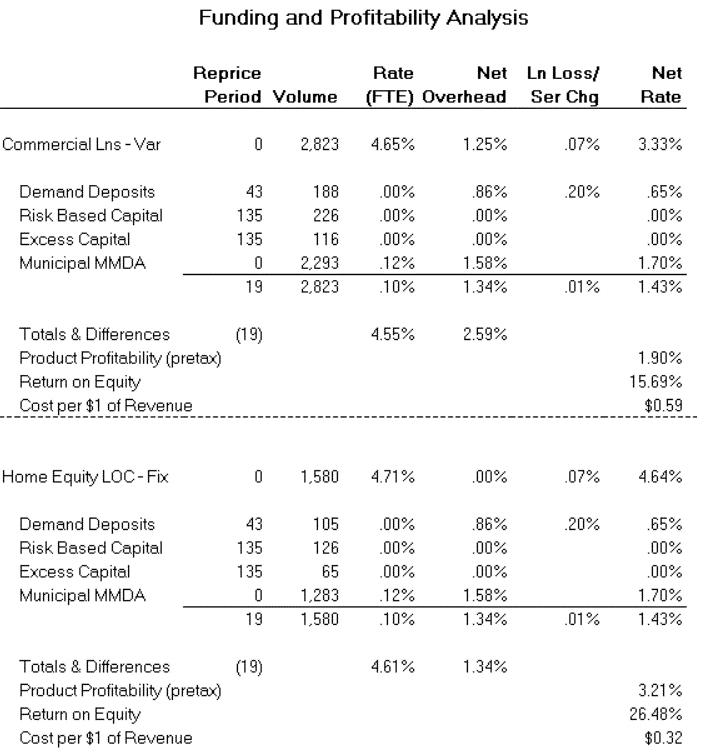

Debt Financing: Loans and Lines of Credit

Debt financing, primarily in the form of loans and lines of credit, is a common option for businesses requiring capital for specific projects or ongoing operations. Loans typically involve borrowing a fixed sum of money that must be repaid with interest over a predetermined period. Banks, credit unions, and other financial institutions are the traditional providers of these loans.

Lines of credit offer more flexibility, allowing businesses to draw funds as needed up to a specified limit. This is particularly useful for managing short-term cash flow challenges or funding cyclical inventory needs. Debt financing is typically best suited for projects with predictable cash flows and a clear return on investment, as the repayment obligations are legally binding.

Equity Financing: Venture Capital and Angel Investors

Equity financing involves exchanging a portion of ownership in the company for capital. This is often the preferred route for startups and high-growth ventures that may not have the collateral or financial history required for debt financing. Venture capital firms invest in companies with significant growth potential, typically providing substantial funding in exchange for a significant equity stake.

Angel investors are individuals who invest their personal funds in early-stage companies, often providing smaller amounts of capital but also valuable mentorship and industry expertise. Equity financing carries no repayment obligations, but it does dilute the ownership stake of the founders and existing shareholders. Furthermore, investors will expect a high return on their investment, influencing strategic decision-making.

Grants: Government and Private Foundations

Grants represent non-repayable funding awarded by government agencies, private foundations, and other organizations. These are typically earmarked for specific projects or programs that align with the grant-maker's mission and funding priorities. Government grants are often highly competitive, requiring detailed proposals and rigorous evaluation processes.

Private foundations offer a wide range of grant opportunities, supporting causes from scientific research to arts and culture. Grants are an excellent option for non-profit organizations and researchers, as they do not require repayment or equity dilution. However, securing grants can be time-consuming, and funding is often restricted to specific purposes and timeframes.

Crowdfunding: Online Platforms and Community Support

Crowdfunding has emerged as a popular alternative funding model, leveraging online platforms to solicit small contributions from a large number of individuals. This approach can be particularly effective for projects with a strong social impact or a compelling narrative. Reward-based crowdfunding offers contributors a reward or perk in exchange for their donation.

Equity crowdfunding allows individuals to invest in a company in exchange for equity, similar to angel investing but on a smaller scale. Crowdfunding can be a valuable source of seed capital and market validation, but it also requires significant marketing and community engagement efforts.

Success depends on the ability to effectively communicate the project's value proposition and build a strong online following.

Bootstrapping: Self-Funding and Internal Resources

Bootstrapping refers to self-funding a business or project using personal savings, revenue from existing operations, or internal resources. This approach allows entrepreneurs and organizations to maintain complete control over their ventures and avoid the complexities of external funding. Reinvesting profits is a key component of bootstrapping.

Careful management of cash flow and resource allocation are crucial for successful bootstrapping. While bootstrapping offers autonomy, it can also limit growth potential and require significant personal sacrifices. This option is best suited for businesses with low capital requirements or a strong commitment to self-reliance.

Matching Funding to Needs: A Strategic Approach

Choosing the right funding option requires a careful assessment of an organization's financial needs, risk tolerance, and long-term strategic goals. A startup with high growth potential and a disruptive technology may be a good candidate for venture capital, while a non-profit organization seeking to expand its programs may be better suited to grants.

A small business seeking to manage seasonal inventory fluctuations may benefit from a line of credit, while a research project may be best funded through a combination of government and private grants. Considering the terms and conditions of each funding option is crucial, including interest rates, repayment schedules, equity stakes, and reporting requirements.

Looking Ahead: The Future of Funding

The funding landscape continues to evolve, driven by technological innovation and changing investor preferences. Fintech companies are disrupting traditional lending practices, offering alternative financing solutions that are often more accessible and flexible.

Impact investing, which focuses on generating both financial returns and positive social or environmental impact, is gaining momentum, attracting capital to businesses and organizations that address pressing global challenges. Organizations that embrace innovation and adapt to these changing dynamics will be best positioned to secure the funding they need to thrive in the future.

In conclusion, matching the right funding option to the right project requires careful consideration, strategic planning, and a deep understanding of the funding ecosystem. By taking a thoughtful and informed approach, organizations can maximize their chances of securing the financial resources they need to achieve their goals and create lasting value.

![Match The Funding Option To Its Description. Startup Funding Stages Guide: From pre-seed to IPO [2024]](https://waveup.com/wp-content/uploads/2024/02/Later-funding-stages-Series-D-E-F-G-funding-table-1-1024x758.webp)

.jpg)