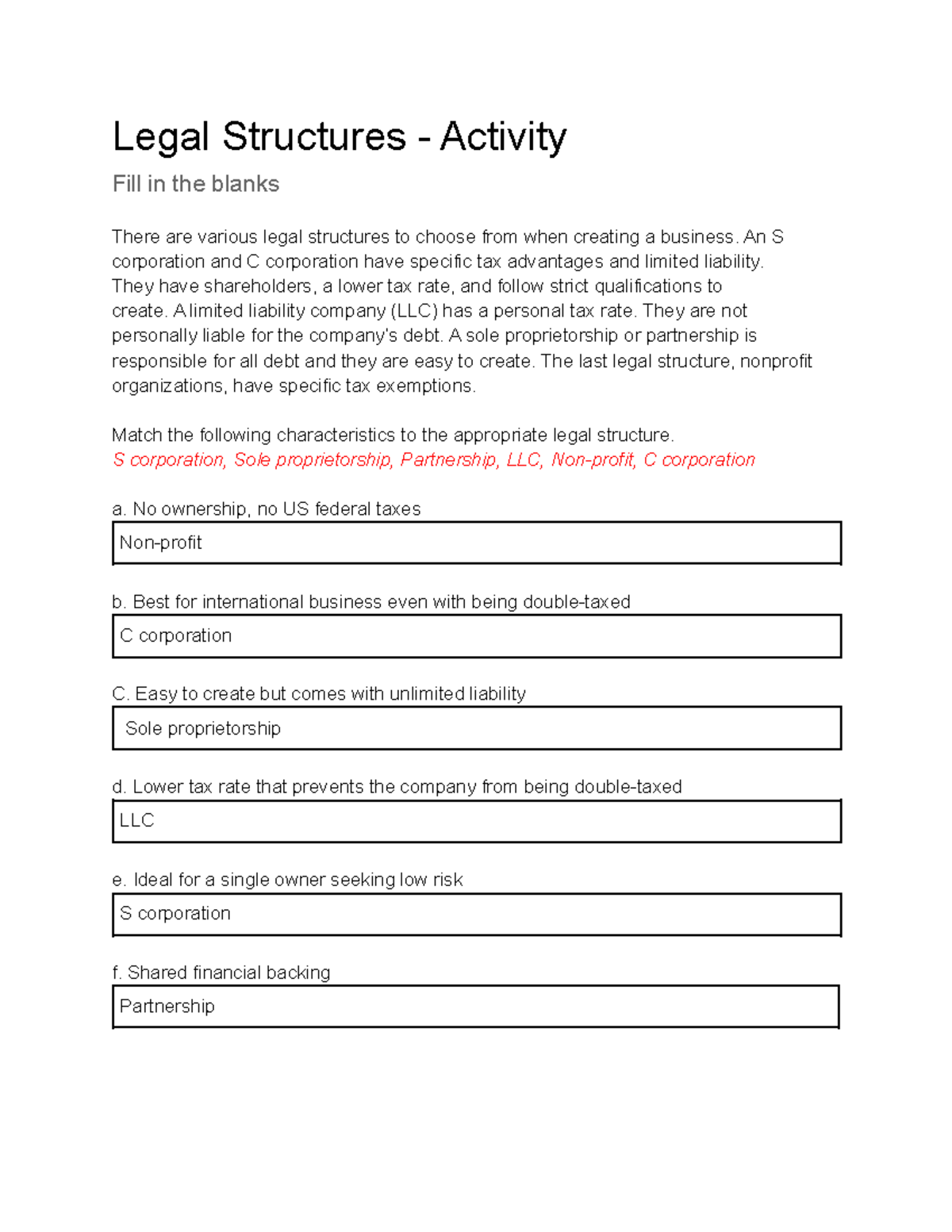

Match The Legal Structure To Its Description

The business world can be a complex landscape, particularly when navigating the legal structures that underpin various enterprises. Understanding the nuances of these structures is crucial for entrepreneurs, investors, and anyone involved in the commercial sphere. Misalignment between a business's operations and its legal framework can lead to significant legal and financial repercussions.

This article aims to provide a comprehensive overview of common business legal structures and their corresponding descriptions. It will cover sole proprietorships, partnerships, limited liability companies (LLCs), and corporations, outlining their key characteristics, advantages, and disadvantages. A clear understanding of these distinctions is essential for making informed decisions when starting or investing in a business.

Sole Proprietorship

A sole proprietorship is the simplest form of business organization, owned and run by one person. There is no legal distinction between the owner and the business entity. This means the owner is directly responsible for all business debts and obligations.

The primary advantage of a sole proprietorship is its ease of setup and minimal paperwork. Profits are taxed as personal income, which can be beneficial for smaller businesses. However, the owner faces unlimited liability, meaning personal assets are at risk if the business incurs debt or faces lawsuits.

"The simplicity of a sole proprietorship is appealing, but the unlimited liability is a significant drawback that entrepreneurs need to carefully consider," said Sarah Chen, a business law professor at the University of California, Berkeley.

Partnerships

A partnership involves two or more individuals who agree to share in the profits or losses of a business. Like sole proprietorships, partnerships are relatively easy to establish. They can be formed with a simple agreement, though a formal partnership agreement is highly recommended to outline each partner's responsibilities and profit-sharing arrangements.

There are several types of partnerships, including general partnerships and limited partnerships. In a general partnership, all partners share in the business's operational management and liability. Limited partnerships have general partners who manage the business and have unlimited liability, and limited partners whose liability is limited to their investment.

Partnerships benefit from pooled resources and expertise. However, general partners also face unlimited liability for the partnership's debts, and disagreements between partners can disrupt business operations.

Limited Liability Companies (LLCs)

A Limited Liability Company (LLC) is a popular business structure that offers a blend of the simplicity of a partnership and the liability protection of a corporation. LLCs are separate legal entities from their owners, known as members. This separation shields members from personal liability for business debts and lawsuits.

LLCs can be structured with single or multiple members. They offer flexibility in terms of taxation, allowing members to choose to be taxed as a sole proprietorship, partnership, or corporation. This flexibility makes LLCs attractive to a wide range of businesses.

While LLCs offer significant liability protection, they may be subject to more complex regulatory requirements than sole proprietorships or partnerships. State laws governing LLCs can vary, so it's essential to consult with legal professionals to ensure compliance.

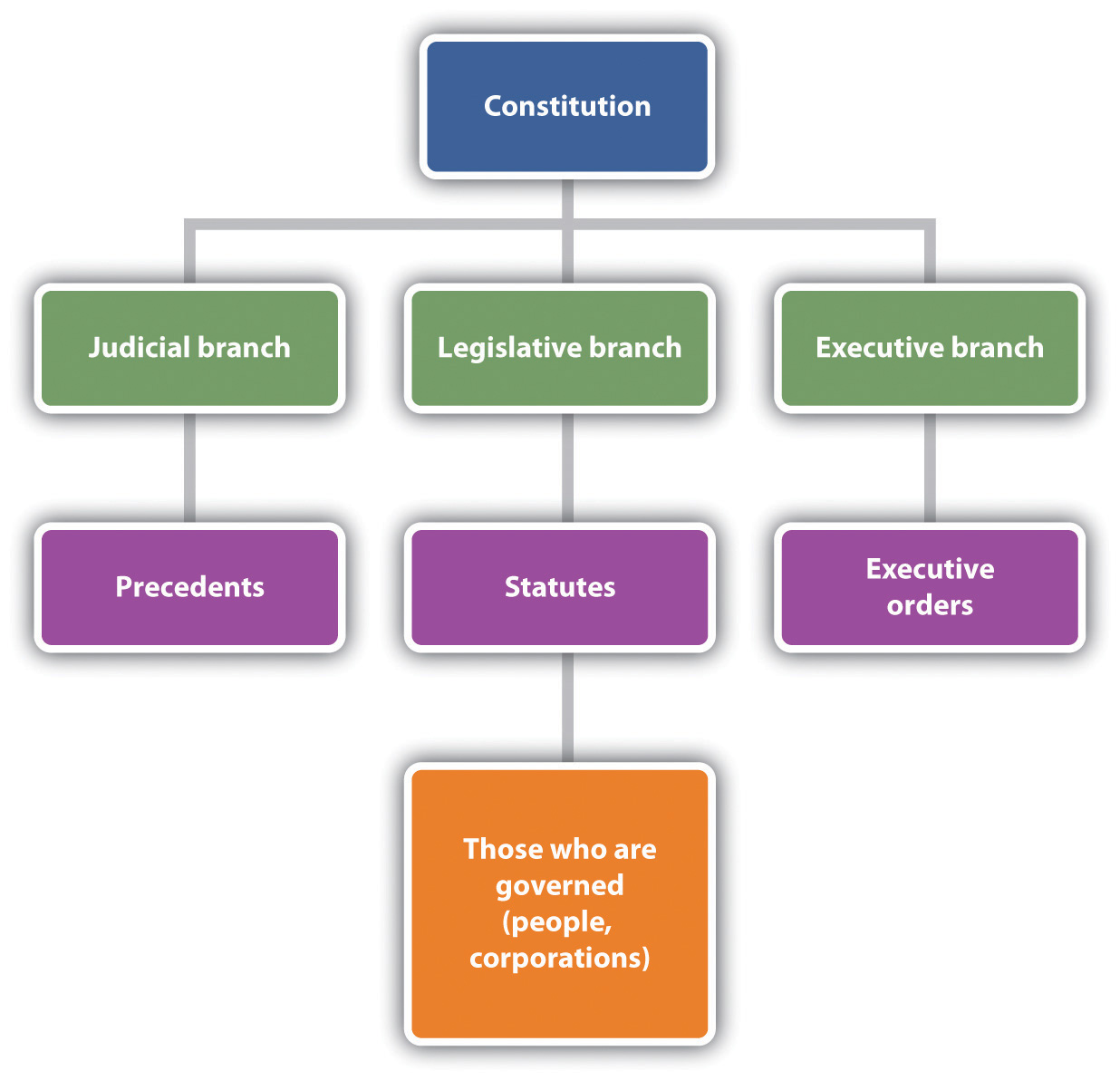

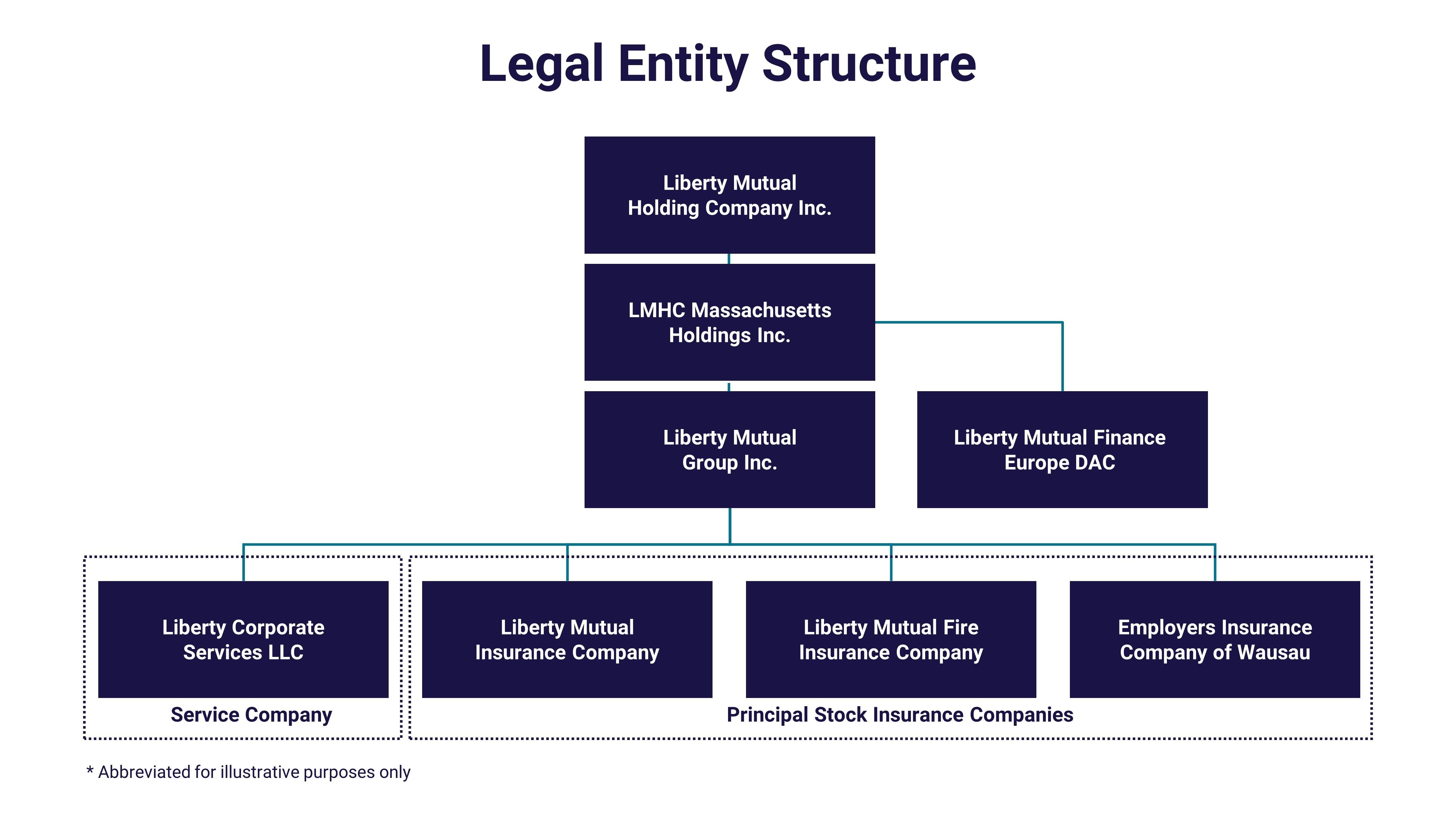

Corporations

A corporation is a complex business structure that is legally separate and distinct from its owners, known as shareholders. Corporations can enter into contracts, own property, and sue or be sued in their own name. This separation provides shareholders with the strongest protection from personal liability.

There are several types of corporations, including S corporations and C corporations. C corporations are subject to double taxation, meaning the corporation's profits are taxed, and then shareholders are taxed again on dividends. S corporations avoid double taxation because profits and losses are passed through directly to the shareholders' personal income.

Corporations are typically more complex and expensive to set up and maintain than other business structures. They require more extensive regulatory compliance and reporting. However, they are often favored by larger businesses due to their ability to raise capital through the sale of stock and their strong liability protection.

"Choosing the right legal structure is a foundational decision for any business. It impacts liability, taxation, and operational flexibility," explained Michael Davis, a certified public accountant.

Matching the Structure to the Description

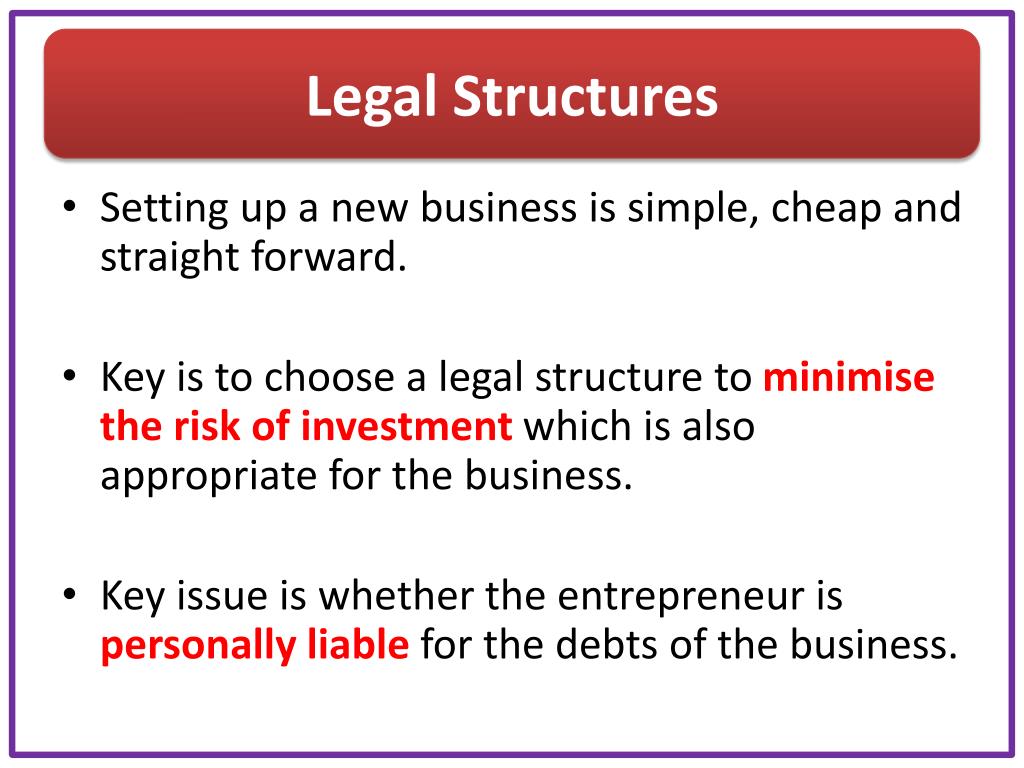

Matching the legal structure to its description requires careful consideration of factors such as liability, taxation, and administrative burden. A sole proprietorship is ideal for a single individual seeking simplicity and direct control. A partnership suits multiple individuals sharing resources and expertise, but with a willingness to accept joint liability.

An LLC provides a balance between liability protection and flexibility, making it suitable for a wide range of businesses. A corporation offers the strongest liability protection and access to capital markets, but at the cost of complexity and regulatory compliance. Selecting the right structure involves aligning the business's needs with the features and requirements of each legal form.

For example, a freelance writer might choose a sole proprietorship for its simplicity, while a tech startup seeking venture capital would likely incorporate as a C corporation. An established family business might opt for an S corporation to avoid double taxation while still benefiting from liability protection.

In conclusion, understanding the different legal structures available is vital for businesses of all sizes. By carefully evaluating the advantages and disadvantages of each structure, entrepreneurs can make informed decisions that align with their business goals and protect their personal assets. Consulting with legal and financial professionals is highly recommended to navigate the complexities of business formation and ensure compliance with all applicable regulations.

![Match The Legal Structure To Its Description [FREE] Match the voting law to its description - brainly.com](https://media.brainly.com/image/rs:fill/w:750/q:75/plain/https://us-static.z-dn.net/files/dc5/176c0c070f4f85278968a3cac4353f7b.png)

![Match The Legal Structure To Its Description [FREE] Drag the tiles to the correct boxes to complete the pairs. Match](https://media.brainly.com/image/rs:fill/w:1080/q:75/plain/https://us-static.z-dn.net/files/db3/74abbb540bb303540791e9d3e2e0f0dd.png)