Mercury Bank Rejected My Application

The crisp scent of new beginnings hung in the air, mingling with the aroma of freshly brewed coffee at "The Daily Grind," my favorite local cafe. Sunlight streamed through the large windows, illuminating dust motes dancing in the air. I sat anxiously awaiting my laptop to connect to the cafe's Wi-Fi, a digital portal to what I hoped would be a significant step towards financial independence: a new business account.

My application to Mercury Bank, touted as the ideal financial partner for startups, had been rejected. While disappointing, this setback has sparked a wider conversation about the challenges faced by entrepreneurs, particularly those from underrepresented backgrounds, in accessing crucial financial services.

For years, I nurtured a dream of launching a sustainable, eco-friendly line of children's clothing. The idea sprung from a frustration shared by many parents: finding durable, ethically made garments that wouldn’t break the bank or harm the planet.

Hours were spent researching materials, sketching designs, and building relationships with local artisans committed to fair labor practices. This was more than just a business; it was a passion project, a chance to create something meaningful and contribute positively to the world.

Securing funding proved more challenging than anticipated. Traditional loans required extensive collateral and a proven track record, both luxuries I didn’t possess as a nascent entrepreneur.

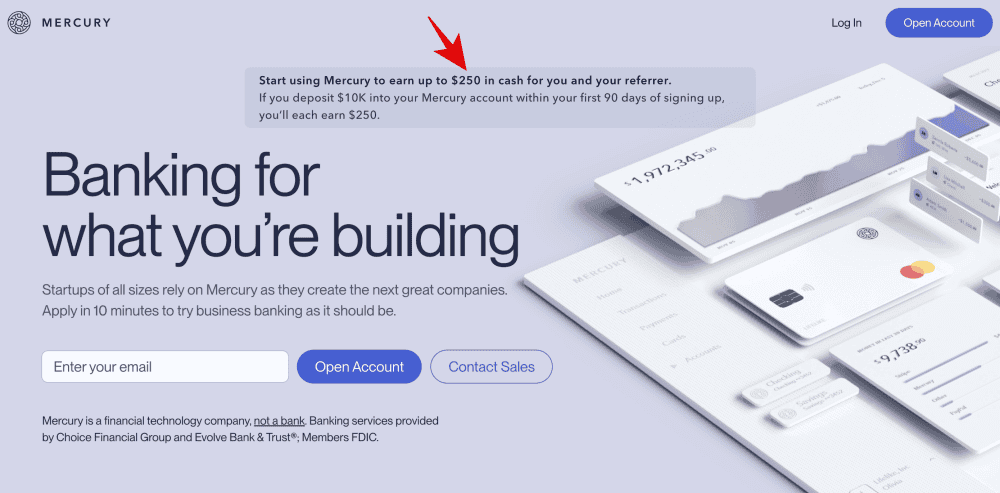

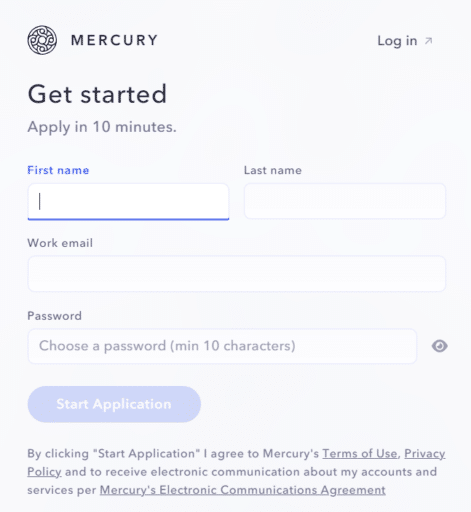

Mercury Bank, with its promise of simplified banking for startups and a focus on technology-driven businesses, felt like a perfect fit. I meticulously prepared my application, highlighting my business plan, market research, and commitment to sustainable practices.

The rejection email felt like a punch to the gut. No specific reason was given, just a generic message stating that my application didn't meet their criteria.

Initially, I felt defeated, questioning my business idea and my ability to succeed. But after a few moments of self-doubt, I decided to view this setback as a learning opportunity.

The experience highlighted a persistent issue: the hurdles faced by many small business owners in accessing capital and financial services. According to data from the Small Business Administration (SBA), minority-owned businesses are disproportionately likely to be denied loans compared to their counterparts.

These challenges aren't just financial; they're systemic, reflecting biases in lending practices and a lack of understanding of the unique needs of diverse entrepreneurs. The SBA is doing its best to support small businesses, offering resources and loan programs to bridge this gap.

I started researching alternative funding options, connecting with other entrepreneurs, and seeking mentorship from experienced business owners. This includes exploring grant opportunities and crowdfunding campaigns.

The rejection from Mercury Bank, though initially discouraging, has ultimately fueled my determination to succeed. It served as a stark reminder that the path to entrepreneurship is rarely linear, but filled with unexpected twists and turns.

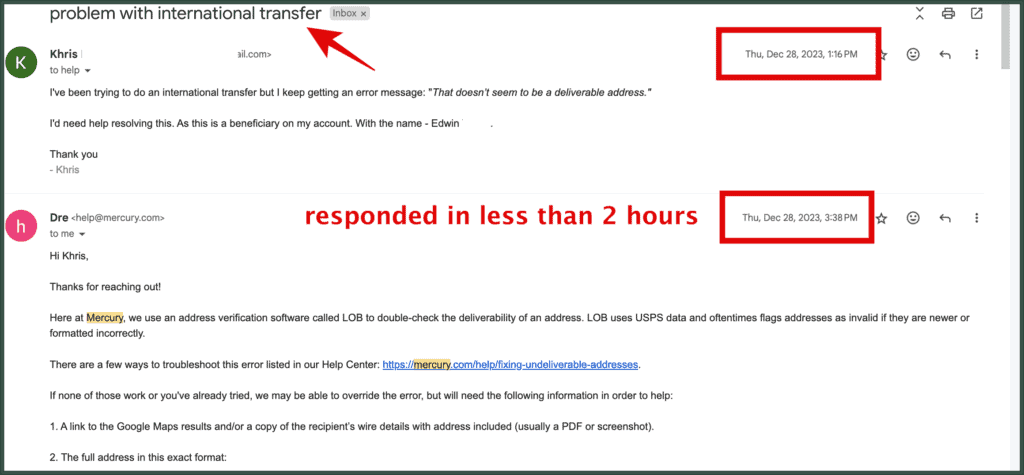

This experience reinforced the importance of resilience, resourcefulness, and a strong network of support. It also underscored the need for financial institutions to be more transparent and inclusive in their lending practices, ensuring that promising businesses, regardless of their background, have a fair chance to thrive.

My journey continues, armed with newfound knowledge and a renewed sense of purpose. The dream of creating a sustainable children's clothing line remains alive, fueled by a deeper understanding of the challenges and a stronger commitment to overcoming them. I'm confident that with persistence and the support of my community, I will find the right financial partner to help me realize my vision.