Minimum Credit Score To Rent A Car From Budget

Renting a car offers freedom and flexibility, but for many, a low credit score can feel like a roadblock. Budget Rent a Car, a prominent player in the rental industry, maintains specific credit requirements that potential renters should be aware of, a factor that can significantly impact travel plans. Understanding these requirements is crucial for ensuring a smooth rental experience.

This article delves into Budget's minimum credit score policy, outlining who is affected, what the requirements are, where these policies apply, when they are enforced, why Budget has these requirements, and how individuals can navigate the process. It aims to provide clear and concise information, empowering readers to make informed decisions when renting a vehicle.

Budget's Credit Score Policy: The Basics

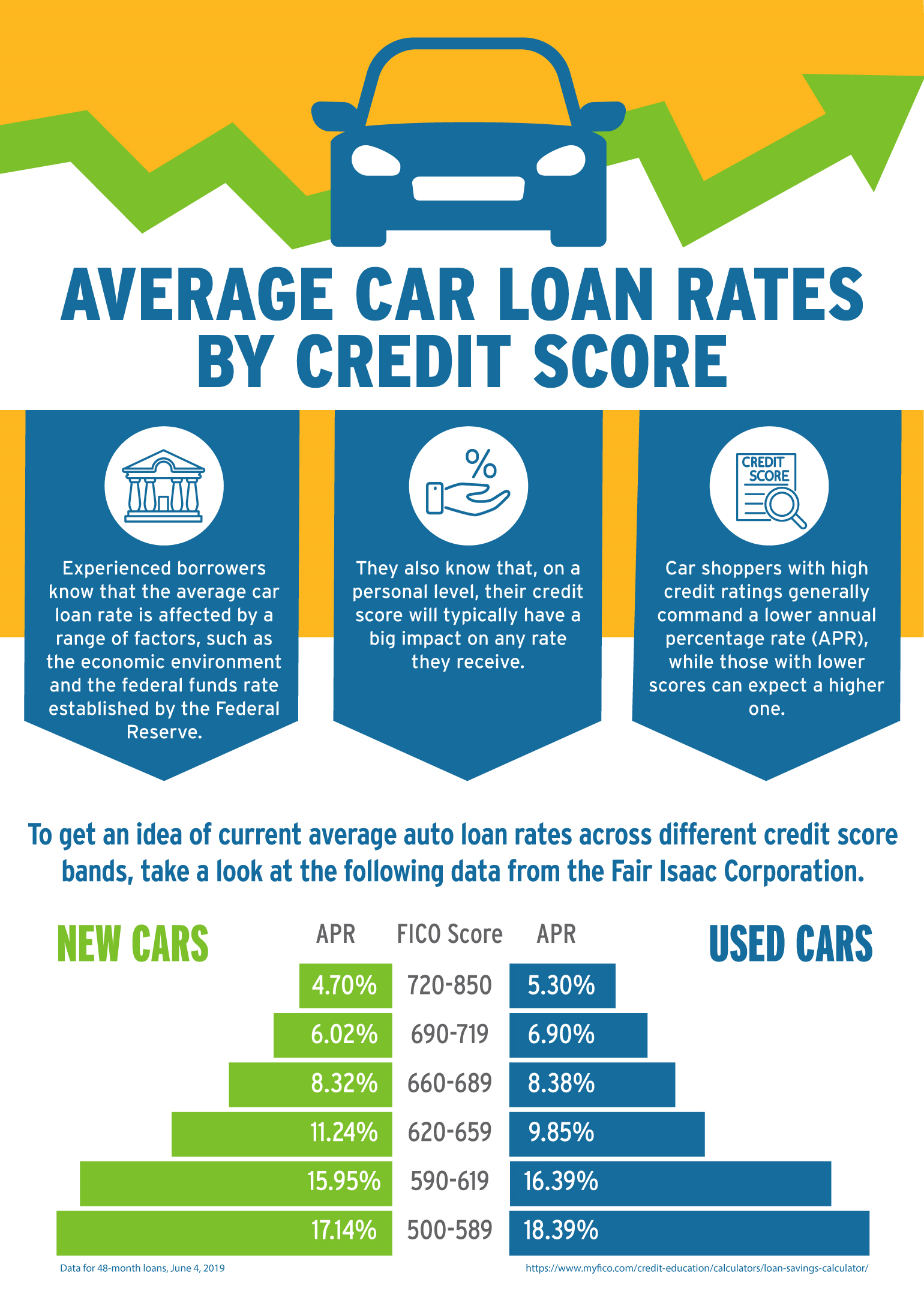

Budget Rent a Car, like many other major rental companies, uses credit checks to assess the risk associated with each rental. A good credit score indicates a history of responsible financial behavior, suggesting a lower likelihood of defaulting on the rental agreement or damaging the vehicle.

The specific minimum credit score required by Budget is not publicly advertised as a fixed number. Instead, Budget often utilizes a creditworthiness assessment that considers various factors beyond just a single score. This includes payment history, outstanding debt, and overall credit utilization.

Credit Checks and Alternatives

When a customer attempts to rent a car from Budget, a credit check is often performed. This check is typically a 'soft inquiry,' which doesn't negatively impact the individual's credit score.

However, if a customer's creditworthiness doesn't meet Budget's standards, alternatives may be available. These can include providing a larger deposit or presenting additional forms of identification and proof of address.

Navigating the Rental Process with Limited Credit

For individuals with limited or poor credit, renting a car from Budget isn't necessarily impossible. Several strategies can improve the chances of a successful rental.

One option is to prepay for the rental using a debit card, although this may require additional documentation and scrutiny. Another alternative is to have a cosigner with a strong credit score act as a guarantor for the rental agreement.

"We understand that not everyone has perfect credit," stated a Budget representative in a past interview. "We strive to offer flexible solutions to accommodate a wider range of customers, while still protecting our assets."

Debit Card Policies and Restrictions

While Budget may accept debit cards, certain restrictions often apply. These can include a requirement for a credit check, a larger security deposit, and proof of a return airline ticket if renting at an airport location.

Additionally, the name on the debit card must match the name on the driver's license. The funds must be available on the card at the time of rental.

The Significance of Credit Policies in the Rental Industry

Credit checks have become a standard practice in the car rental industry. They are designed to protect rental companies from financial losses due to unpaid rentals, damage to vehicles, or theft.

However, these policies can disproportionately affect individuals with low incomes or those who are rebuilding their credit. This creates a barrier to transportation for those who may need it most.

The Impact on Travelers

The credit requirements of car rental companies can significantly impact travel plans. Individuals relying on rental cars for business trips, family vacations, or emergency situations may find themselves stranded if they don't meet the minimum credit requirements.

Planning ahead and understanding the specific policies of each rental company is crucial. It's advisable to check the fine print and contact Budget directly to clarify any uncertainties regarding credit requirements.

A Human Perspective: The Struggle to Rent

Sarah, a single mother working two part-time jobs, needed to rent a car to visit her ailing mother who lived several states away. However, due to past financial difficulties, her credit score was below the acceptable range for most major rental companies, including Budget.

After several frustrating attempts, she managed to secure a rental by prepaying with a debit card and providing additional documentation. While she was eventually able to make the trip, the experience highlighted the challenges faced by individuals with low credit when accessing essential services.

This personal story underscores the real-world impact of credit policies and the need for greater understanding and flexibility within the rental car industry.

Conclusion: Staying Informed and Planning Ahead

Understanding Budget Rent a Car's credit score policies is essential for ensuring a hassle-free rental experience. While a specific minimum score isn't published, creditworthiness is carefully assessed, and alternatives may be available for those with limited credit.

By planning ahead, exploring alternative payment options, and understanding the requirements, individuals can navigate the rental process with confidence, regardless of their credit score. Staying informed is the best way to avoid unpleasant surprises and ensure a smooth and successful rental.

Always verify the most up-to-date policies directly with Budget before your rental to ensure accurate information and avoid any unforeseen complications.

:max_bytes(150000):strip_icc()/Heres-how-get-car-no-down-payment_final-1c94e62ad4644532a18289cf826f6cce.png)

:max_bytes(150000):strip_icc()/credit-score-needed-to-buy-a-car-4771942_color-a6adfc67f45c47108ac8b17204da6d43.png)