Monolithic Power Systems Earnings April 2025

Monolithic Power Systems (MPS) reported its Q1 2025 earnings this morning, exceeding analyst expectations but triggering a mixed market reaction. Revenue growth remained strong, although concerns about future guidance persist.

This earnings report provides a critical snapshot of MPS's performance in a dynamic semiconductor market, highlighting both opportunities and challenges for the power solutions provider.

Q1 2025 Financial Highlights

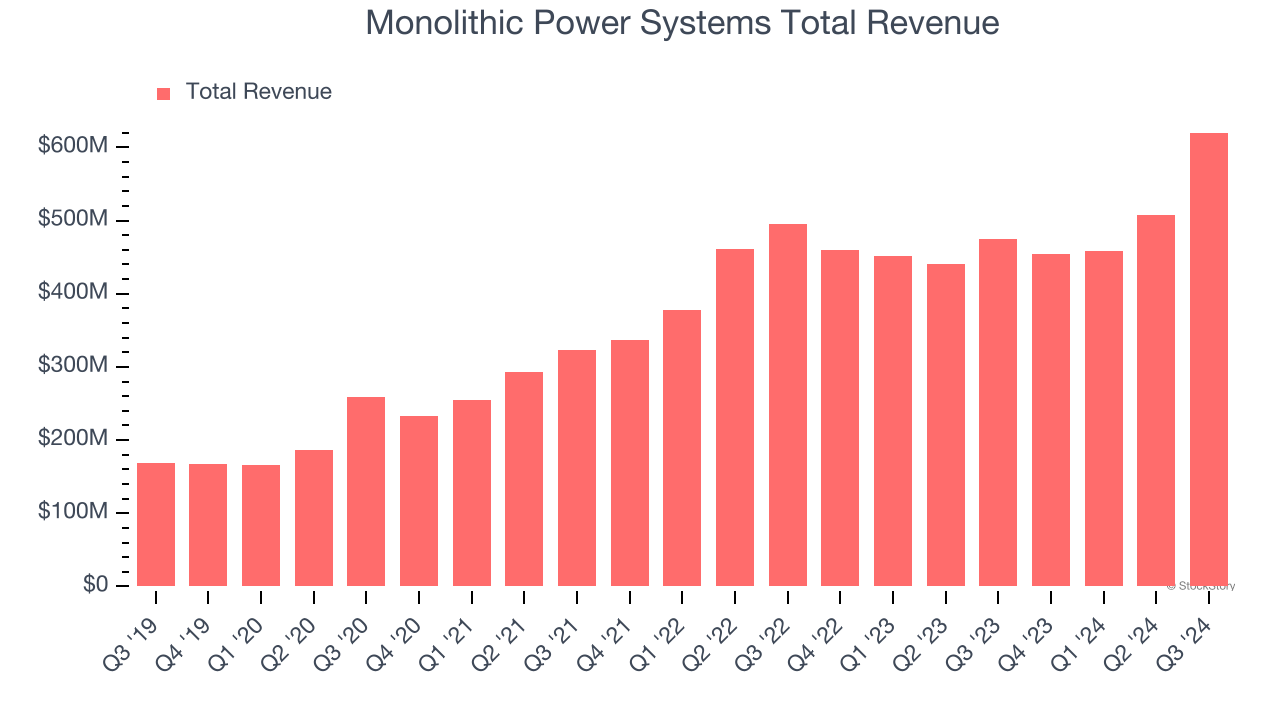

MPS announced revenue of $501.2 million for Q1 2025. This reflects a 23.7% increase compared to $405.2 million in Q1 2024. The figure surpassed the consensus estimate of $485 million.

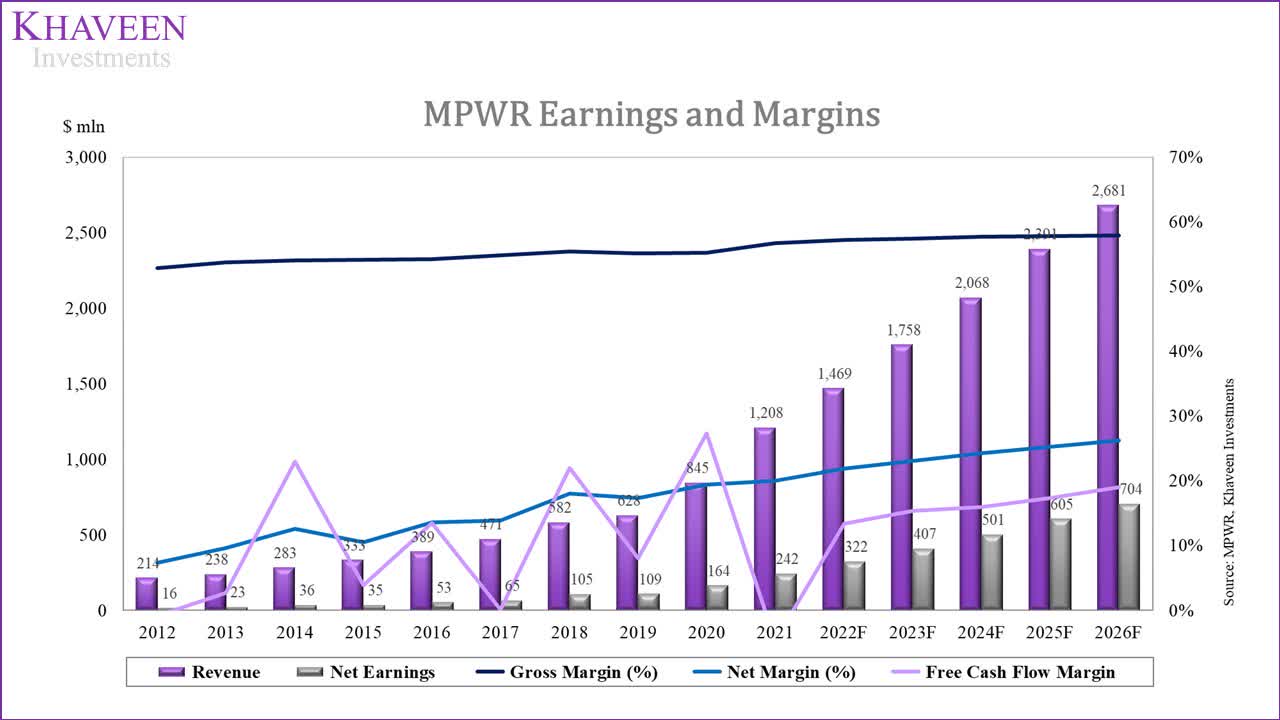

Gross margin came in at 56.0%, slightly above the previous quarter's 55.8%. Non-GAAP earnings per share (EPS) were reported at $1.25. This is compared to $0.95 in the same quarter last year, again exceeding estimates.

Operating income reached $150.4 million, up from $115.7 million year-over-year. The company’s strong financial performance showcases continued demand for its power management solutions.

Segment Performance

Computing and Data Center

Revenue from the computing and data center segment reached $180.4 million. This indicates substantial growth driven by demand for high-performance power solutions. These are critical for AI and cloud infrastructure.

Industrial

The industrial segment contributed $160.4 million in revenue. Growth was driven by strength in factory automation and renewable energy sectors. Monolithic Power Systems continues to expand its presence in these markets.

Automotive

The automotive segment reported $100.2 million in revenue. The increase was fueled by demand for advanced driver-assistance systems (ADAS) and electric vehicle (EV) power solutions. MPS is benefiting from the electrification of vehicles.

Consumer

Consumer segment revenue totaled $60.2 million. This segment experienced moderate growth due to stabilization in consumer electronics markets. Despite fluctuations, the segment remains a significant contributor.

Management Commentary

“Our Q1 results reflect strong execution and continued demand for our innovative power solutions across key markets,” said Michael Hsing, CEO of Monolithic Power Systems. The CEO highlighted the company’s focus on expanding its product portfolio. He also focused on penetrating high-growth markets.

Hsing added, "We remain committed to delivering superior performance and creating long-term value for our shareholders." The management team expressed confidence in the company’s strategic direction.

Guidance for Q2 2025

MPS provided revenue guidance for Q2 2025, expecting revenue in the range of $505 million to $520 million. This forecast, while still indicating growth, fell slightly below analyst expectations of $525 million.

Gross margin is projected to be between 55.7% and 56.2%. Operating expenses are expected to remain relatively stable.

Market Reaction

Following the earnings release, Monolithic Power Systems' stock initially rose in pre-market trading. However, the stock price saw a correction during the trading session. This was largely due to the slightly conservative Q2 revenue guidance.

Investors are closely monitoring the company's ability to maintain its growth trajectory. They are especially keen to learn about how it will continue to navigate supply chain constraints.

Key Takeaways

Monolithic Power Systems delivered a strong Q1 2025, surpassing revenue and EPS expectations. Growth was broad-based across its key segments, including computing, industrial, and automotive. Future revenue projections remain somewhat cautious.

The company's ability to capitalize on opportunities in the AI, EV, and renewable energy sectors is crucial. This is critical for its long-term success.

Next Steps

Analysts will be closely scrutinizing MPS's performance in the coming quarters. Focus will be on its ability to meet the evolving demands of its key markets. An important point will be monitoring the impact of global economic conditions on its operations.

MPS plans to continue investing in research and development. This is intended to expand its product offerings and maintain its competitive edge. An upcoming investor conference will likely provide further insights into the company's strategy.

/Monolithic Power System Inc logo magnified-by Casimiro PT via Shutterstock.jpg)