Mortgage Borrower To Do List Checklist Template

The path to homeownership is paved with excitement, but often overshadowed by a daunting avalanche of paperwork, financial assessments, and legal requirements. Many aspiring homeowners find themselves lost in a labyrinth of tasks, increasing the risk of delays, missed opportunities, and even loan denials. The stakes are undeniably high, as a misstep can jeopardize what is likely the largest investment of their lives.

This article explores the critical importance of a comprehensive mortgage borrower to-do list checklist template. It serves as a roadmap, breaking down the complex mortgage process into manageable steps. By outlining key tasks, gathering necessary documentation, and adhering to deadlines, borrowers can navigate the process with greater confidence and efficiency.

Understanding the Mortgage Process

The mortgage process is a multi-stage journey that typically begins with pre-approval and culminates in closing. Each stage requires specific actions and documentation from the borrower.

Pre-Approval: Laying the Foundation

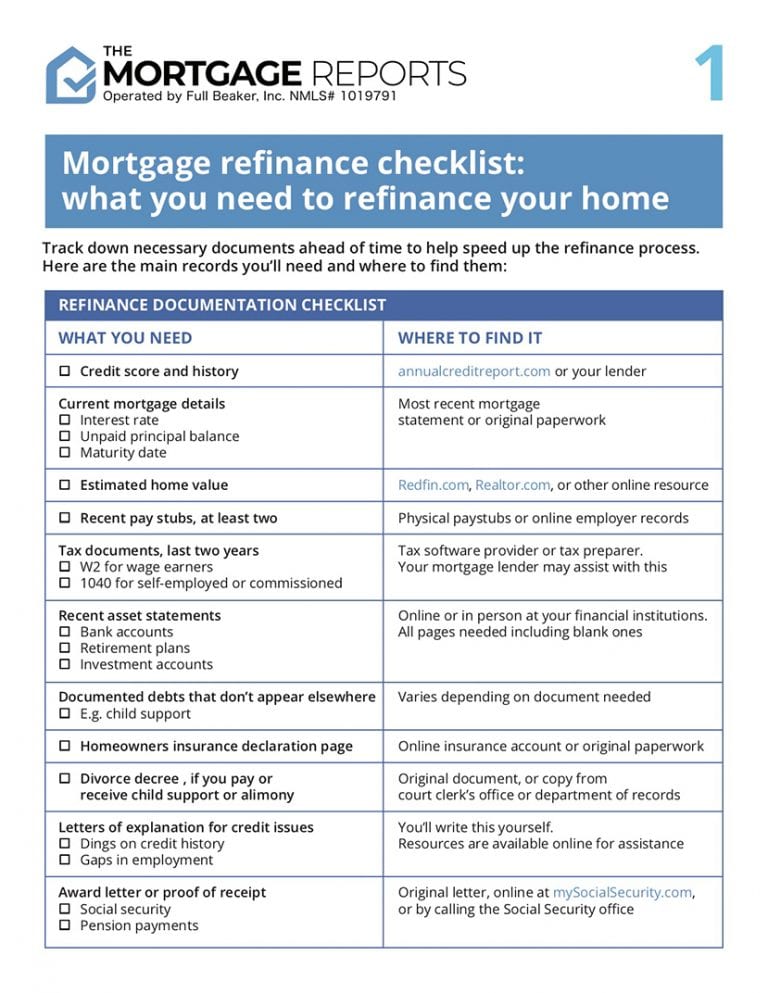

Obtaining pre-approval is a crucial first step. It provides an estimate of how much a lender is willing to loan, empowering borrowers to shop for homes within their budget.

Lenders will assess credit history, income, assets, and debts to determine creditworthiness during pre-approval. Having these documents readily available streamlines the process and provides a realistic view of affordability.

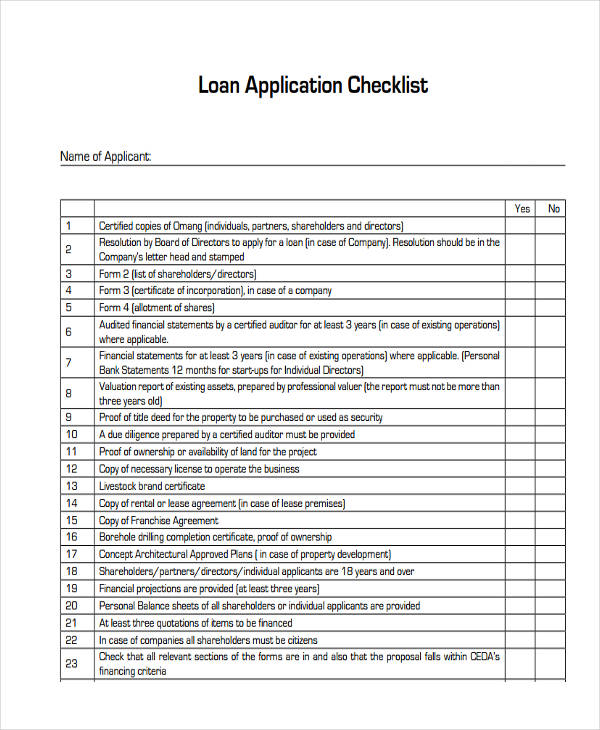

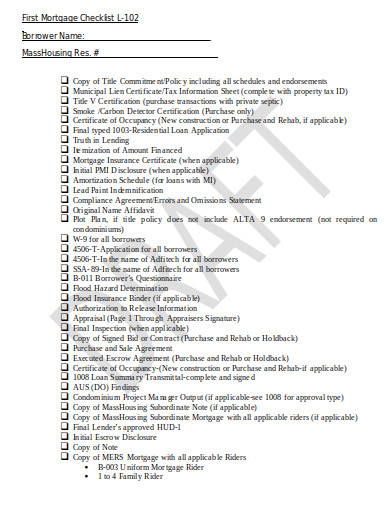

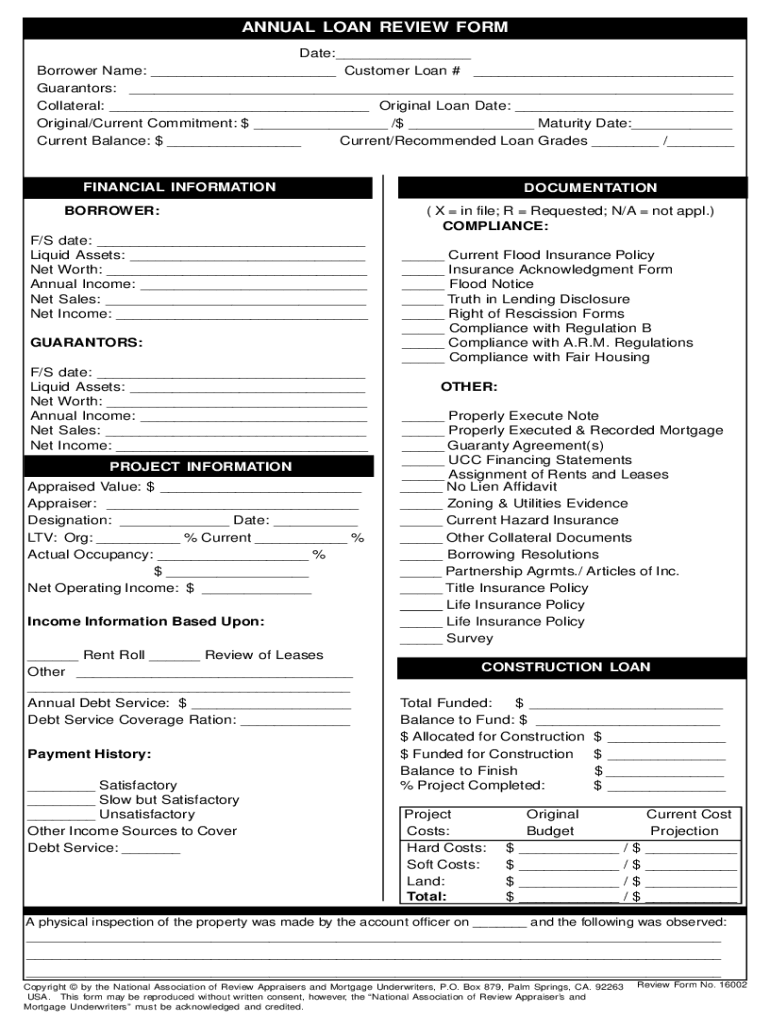

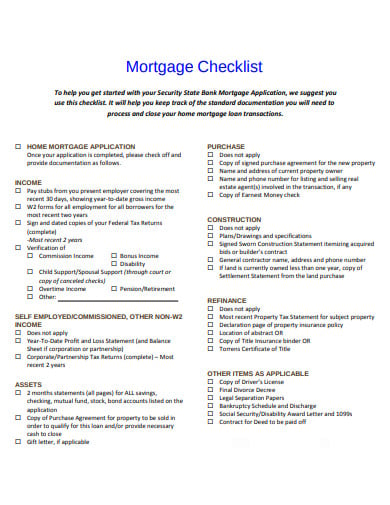

The Loan Application: Gathering Documentation

Once a property is identified, the formal loan application process begins. This involves submitting a comprehensive package of documents to the lender.

Typical documentation includes: proof of income (W-2s, pay stubs, tax returns), bank statements, asset verification, credit reports, and purchase agreement. A detailed checklist ensures no crucial document is overlooked, minimizing potential delays.

Underwriting and Appraisal: Due Diligence

The lender's underwriting team meticulously reviews the borrower's financial profile and the property's value. They will evaluate the loan application to assess risk.

An appraisal ensures the property's market value aligns with the loan amount. Address any concerns raised by the underwriter or appraiser promptly.

Closing: The Final Steps

The closing stage involves finalizing the loan terms and transferring ownership of the property. This includes signing loan documents, paying closing costs, and receiving the keys to the new home.

A checklist helps borrowers stay organized by outlining all required actions and deadlines, ensuring a smooth and timely closing.

Key Components of a Mortgage Borrower Checklist Template

A well-designed checklist template should cover all phases of the mortgage process. It should be comprehensive yet easy to understand.

Essential Checklist Items

The checklist should include tasks such as: Gathering financial documents, obtaining pre-approval, selecting a lender, submitting a loan application, coordinating with a real estate agent, scheduling a home inspection, obtaining homeowners insurance, and attending the closing.

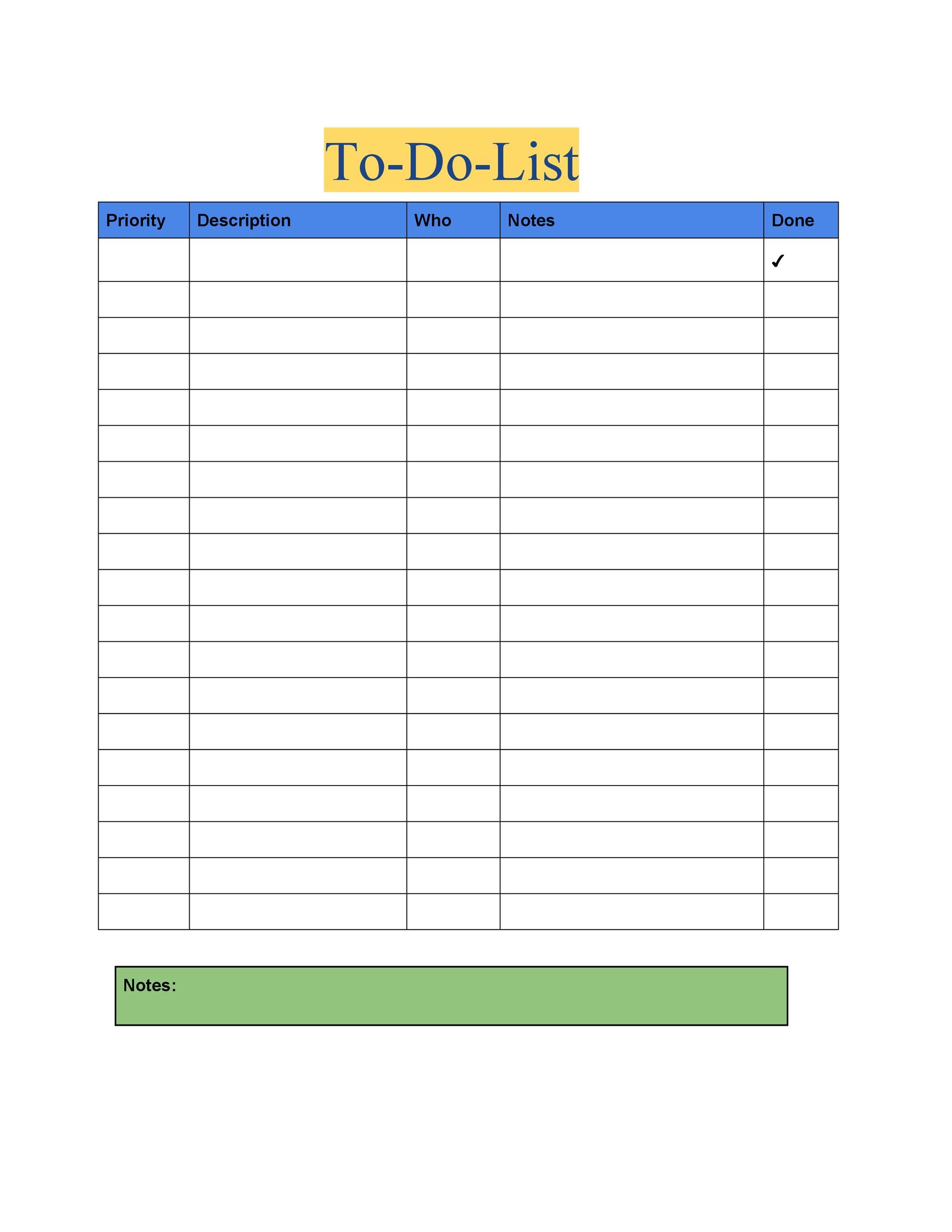

Each task should have a designated space for notes, deadlines, and completion status. This enables borrowers to track their progress and identify any potential roadblocks.

Organizing the Checklist

Categorizing the checklist by stage (pre-approval, application, underwriting, closing) makes it easier to navigate. Using a digital format allows for easy editing, updating, and sharing with relevant parties.

Consider including links to helpful resources, such as lender websites or government agencies. Consumer Financial Protection Bureau (CFPB) and HUD (Department of Housing and Urban Development) are good resources.

Benefits of Using a Checklist

Employing a mortgage borrower checklist offers several significant advantages. It improves organization, minimizes errors, and reduces stress.

Improved Organization and Efficiency

A checklist provides a structured framework for managing the mortgage process. This ensures that all tasks are completed in a timely and efficient manner.

By tracking progress and deadlines, borrowers can stay on top of their responsibilities and avoid costly delays.

Reduced Stress and Anxiety

The mortgage process can be overwhelming. A checklist provides a sense of control and reduces the anxiety associated with uncertainty.

Knowing what to expect and having a clear plan can alleviate stress and boost confidence.

Minimizing Errors and Delays

Omitting a required document or missing a deadline can jeopardize the loan application. A comprehensive checklist minimizes the risk of errors and delays.

By ensuring all tasks are completed correctly and on time, borrowers can streamline the process and increase their chances of a successful outcome.

Potential Challenges and Solutions

Despite the benefits, using a checklist is not without its challenges. Overcoming these challenges is critical to maximizing its effectiveness.

Overwhelm and Information Overload

The sheer volume of tasks and information can still feel overwhelming. Breaking down tasks into smaller, more manageable steps can help.

Seek guidance from a mortgage professional or real estate agent for clarification and support.

Difficulty Gathering Documentation

Obtaining certain documents, such as tax returns or asset statements, can be time-consuming. Start gathering these documents early in the process to avoid last-minute scrambles.

Utilize online resources and tools to streamline the document collection process. Also, lenders often provide secure portals for uploading documents.

Changing Requirements

Lender requirements and regulations can change during the mortgage process. Stay in close communication with the lender to stay informed of any updates or modifications.

Be prepared to adapt to changing requirements and provide any additional information or documentation requested.

The Role of Technology

Technology has transformed the mortgage process, offering various tools and resources to simplify tasks. Digital checklists, online portals, and mobile apps can enhance efficiency and collaboration.

Digital Checklists and Project Management Tools

Digital checklists offer several advantages over traditional paper-based lists. They are easily editable, searchable, and shareable.

Project management tools like Trello or Asana can be used to track progress and assign tasks to different parties. This can also offer integration with cloud storage solutions.

Online Portals and Mobile Apps

Many lenders offer online portals where borrowers can track the status of their loan application, upload documents, and communicate with their loan officer. Mobile apps provide convenient access to loan information and updates on the go.

Staying Informed with Online Resources

Online resources, such as mortgage calculators and educational articles, can help borrowers make informed decisions. Utilize reputable websites and tools to research mortgage options and understand the process.

Looking Ahead

The mortgage landscape is constantly evolving, with new technologies and regulations emerging regularly. Borrowers who embrace technology, stay informed, and utilize tools such as a comprehensive checklist will be best positioned for success.

The mortgage borrower to-do list checklist template will remain an essential tool for navigating the complexities of homeownership. It provides a structured approach, promotes organization, and reduces the stress associated with this significant financial undertaking. By proactively managing the process and staying informed, aspiring homeowners can confidently navigate the path to their dream home.

![Mortgage Borrower To Do List Checklist Template Mortgage Document Checklist [PDF] - Pulte Mortgage Education Corner](https://blog.pultemortgage.com/wp-content/uploads/2022/05/PFS-Document-Checklist-V2.png)

![Mortgage Borrower To Do List Checklist Template Free Printable To-Do List & Checklist Templates [Word, PDF, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/04/To-Do-List.jpg)