National Debt Relief Class Action Lawsuit

Imagine a collective sigh of relief echoing across the nation. For many, the crushing weight of debt feels like an endless winter. But what if there was a glimmer of spring on the horizon? A chance to reclaim financial stability and breathe freely again?

This is the promise held within the recently certified class action lawsuit against National Debt Relief. At its core, this legal action seeks to hold the company accountable for alleged deceptive practices and secure restitution for individuals who believe they were misled or unfairly treated during their enrollment in the company’s debt relief program.

Understanding the Lawsuit

The class action lawsuit, filed in [Insert Court Name and Location], alleges that National Debt Relief engaged in deceptive marketing practices.

It further claims that the company made misrepresentations about the potential outcomes of their debt relief program. The plaintiffs contend that these practices led consumers to enroll in a program that ultimately harmed their credit and financial standing, rather than providing the relief they were promised.

Who is Involved?

The lawsuit is spearheaded by [Lead Plaintiff Name(s)] and represents a class of individuals who enrolled in National Debt Relief’s program between [Start Date] and [End Date]. These individuals share a common grievance: they believe they were harmed by the company's alleged misrepresentations and deceptive practices.

The legal team representing the plaintiffs is led by [Law Firm Name(s)], a firm with extensive experience in consumer protection litigation. National Debt Relief is being defended by [Defense Law Firm Name(s)].

What are the Specific Allegations?

Several key allegations form the basis of the lawsuit. Plaintiffs claim that National Debt Relief misrepresented the success rates of its program.

They also allege that the company failed to adequately disclose the potential negative consequences of debt settlement, such as damage to credit scores and potential lawsuits from creditors. Additionally, the lawsuit claims that National Debt Relief charged excessive fees and failed to provide adequate customer support.

The Backstory: A Nation Struggling with Debt

To understand the significance of this lawsuit, it’s crucial to acknowledge the pervasive issue of debt in America. Millions of individuals are burdened by credit card debt, medical bills, student loans, and other financial obligations.

According to data from the Federal Reserve, household debt in the United States stands at [Insert Current Debt Figure], a staggering number that underscores the vulnerability of many families. This environment of financial stress creates a fertile ground for debt relief companies, promising a path to financial freedom.

"We believe that National Debt Relief preyed on vulnerable consumers who were desperate for help," says [Attorney Name], lead counsel for the plaintiffs. "This lawsuit seeks to hold them accountable and provide restitution to those who were harmed."

The Role of Debt Relief Companies

Debt relief companies offer various services aimed at helping individuals manage and reduce their debt. These services can include debt consolidation, credit counseling, and debt settlement.

Debt settlement, the service offered by National Debt Relief, involves negotiating with creditors to reduce the amount owed. While this can be an effective strategy for some, it also carries significant risks. These risks include damaged credit scores, potential lawsuits from creditors, and the possibility that the debt settlement efforts will be unsuccessful.

The Consumer Financial Protection Bureau (CFPB) has issued warnings about the potential risks associated with debt settlement companies. They caution consumers to carefully research any company before enrolling in their services and to understand the potential consequences.

The Potential Impact of the Lawsuit

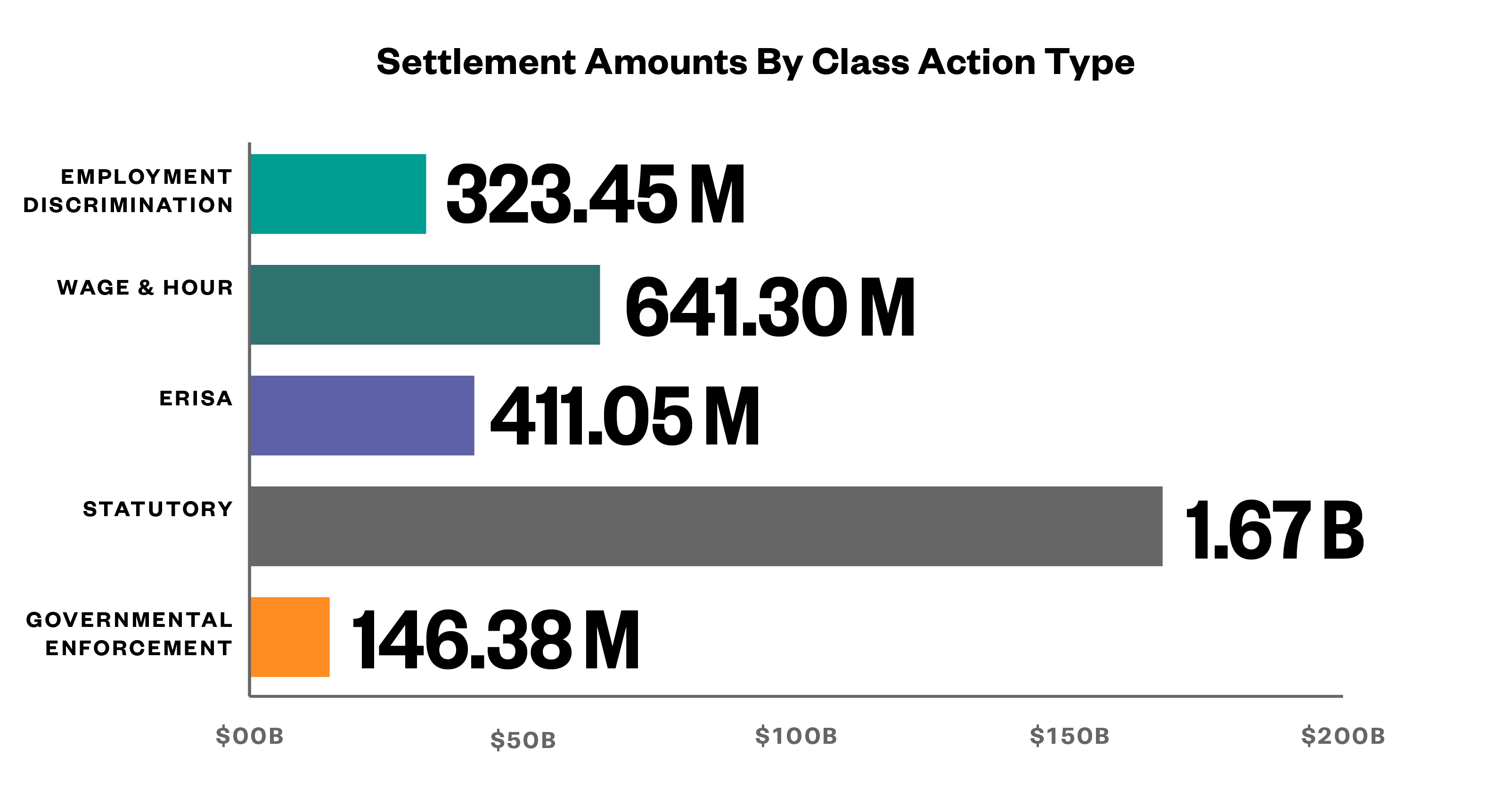

The outcome of this class action lawsuit could have far-reaching implications. If the plaintiffs are successful, National Debt Relief could be required to pay significant damages to the class members, potentially in the millions of dollars.

A favorable verdict for the plaintiffs could also set a precedent for future lawsuits against other debt relief companies. It could also lead to increased regulatory scrutiny of the debt relief industry, prompting stricter rules and oversight to protect consumers from deceptive practices.

What Happens Next?

The lawsuit is currently in the discovery phase, during which both sides are gathering evidence and preparing their cases. A trial date has not yet been set.

Class members will be notified of the lawsuit and given the opportunity to opt-in or opt-out of the class. Those who opt-in will be eligible to receive a share of any settlement or judgment obtained in the case.

Finding Hope Amidst Financial Hardship

This lawsuit represents more than just a legal battle. It’s a symbol of hope for individuals struggling with the burden of debt. It’s a chance for them to seek justice and hold accountable those who they believe have taken advantage of their vulnerability.

While the outcome remains uncertain, the lawsuit serves as a reminder that consumers have rights and that they can take action to protect themselves from deceptive and unfair business practices. It’s a testament to the power of collective action and the importance of holding companies accountable for their actions.

Even if you are not directly involved in this specific lawsuit, its progress may serve as a learning experience.

A Word of Caution and Empowerment

If you are struggling with debt, it’s essential to explore all available options and to seek advice from reputable and unbiased sources. Consider consulting with a non-profit credit counseling agency, a financial advisor, or an attorney.

Remember, there is hope. While the road to financial recovery may be challenging, it is possible to regain control of your finances and build a brighter future. Be informed. Be proactive. And never give up on your financial well-being.

The information provided in this article is for informational purposes only and does not constitute legal advice. Consult with a qualified professional for personalized guidance.