Navy Federal Credit Score For Personal Loan

For members of the military and their families seeking personal loans, Navy Federal Credit Union (NFCU) remains a popular option. A key factor in loan approval is the applicant’s credit score, but exactly what score is needed can be a complex question.

This article explores the credit score requirements for NFCU personal loans, examining the factors that influence approval and offering insights for potential borrowers. Understanding these requirements is crucial for anyone considering an NFCU personal loan.

Understanding NFCU's Lending Criteria

Navy Federal Credit Union, known for its member-focused approach, doesn't publish a specific minimum credit score for personal loans. Instead, they consider a range of factors including credit history, income, debt-to-income ratio (DTI), and employment stability.

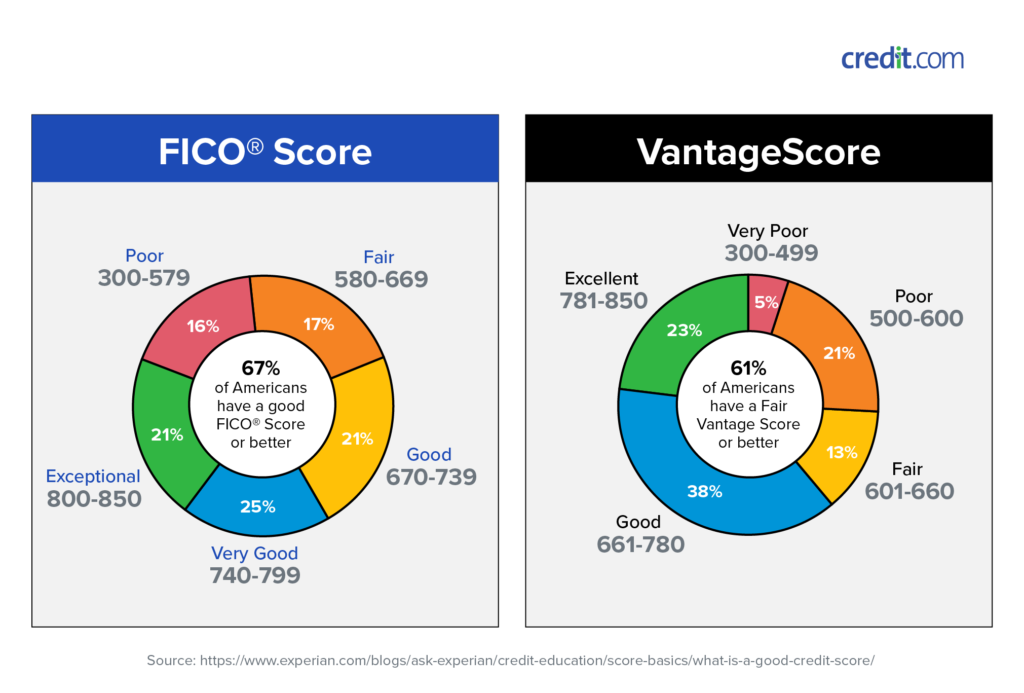

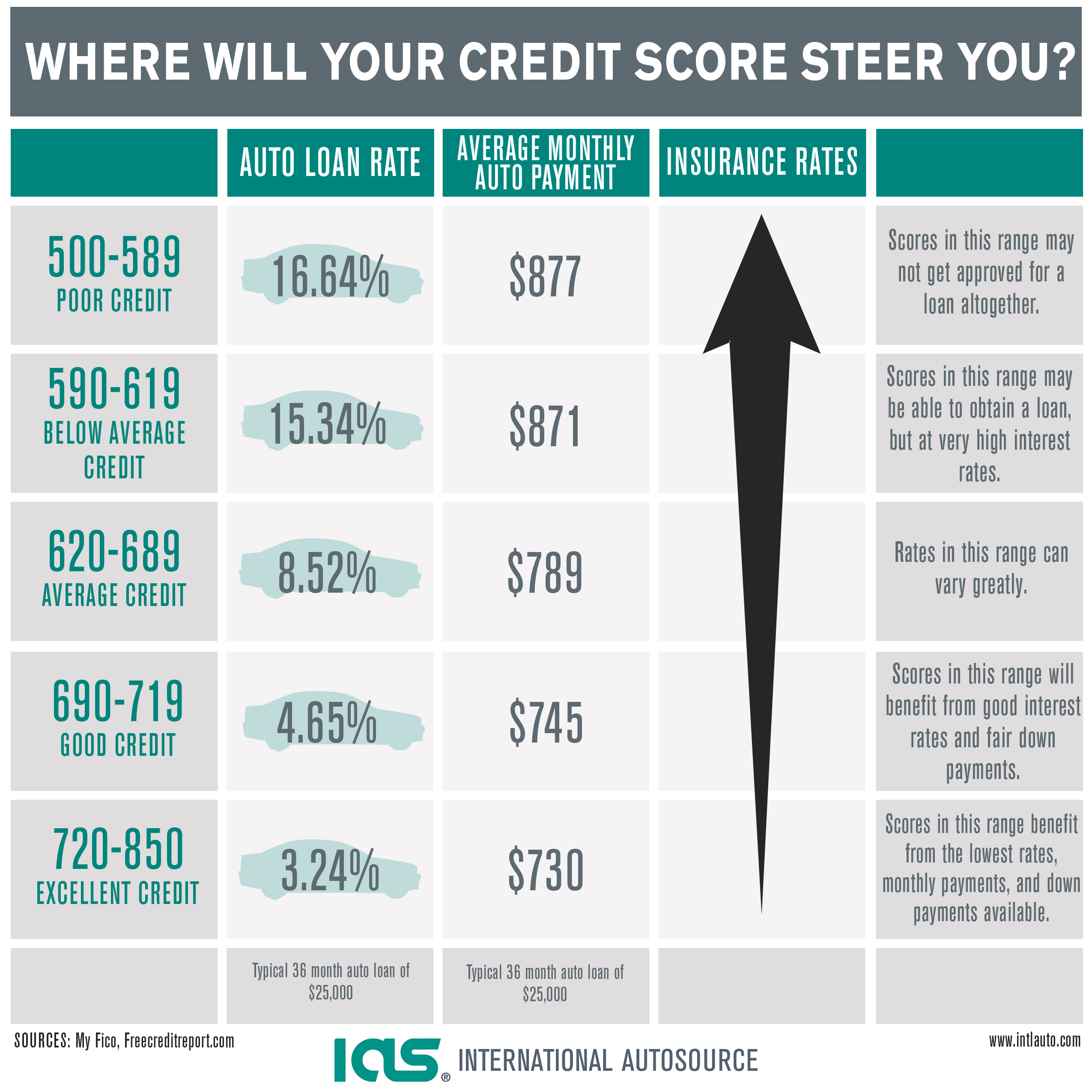

However, analysis of approved loans and borrower reports suggest that a credit score of 660 or higher increases the likelihood of approval. Scores in the "good" range (670-739) generally receive more favorable interest rates and loan terms.

Factors Beyond Credit Score

While your credit score is important, it's not the only factor. NFCU assesses your overall financial profile.

A low debt-to-income ratio, demonstrating the ability to manage existing debt, can offset a slightly lower credit score. A stable employment history also reassures NFCU of your ability to repay the loan.

Positive aspects of your credit history, such as consistent on-time payments and a mix of credit accounts, can also boost your application.

Navigating the Application Process

Before applying for a personal loan with Navy Federal, review your credit report from all three major credit bureaus: Equifax, Experian, and TransUnion. Dispute any errors or inaccuracies to improve your credit score.

Calculate your debt-to-income ratio by dividing your monthly debt payments by your gross monthly income. A DTI below 43% is generally considered favorable.

Gather documentation such as pay stubs, W-2 forms, and bank statements to verify your income and employment. Prepare to explain any negative marks on your credit report, such as late payments or collections.

"We look at the total picture of the applicant," states a representative from NFCU's lending department, "not just the credit score."

Tips for Improving Your Chances

If your credit score is below 660, take steps to improve it before applying. Pay down existing debt, especially credit card balances, to reduce your credit utilization ratio.

Avoid opening new credit accounts shortly before applying for a loan, as this can lower your score. Consider becoming an authorized user on a responsible credit cardholder's account to build credit history.

Explore options like a secured personal loan or a co-signer if you are having difficulty getting approved on your own. These options can mitigate risk for the lender.

Impact on Military Community

NFCU's personal loans can be a valuable resource for military members and their families, helping them cover unexpected expenses, consolidate debt, or finance important life events.

Understanding the lending criteria and taking steps to improve your financial profile can increase your chances of accessing these loans. Responsible borrowing can build a strong financial foundation.

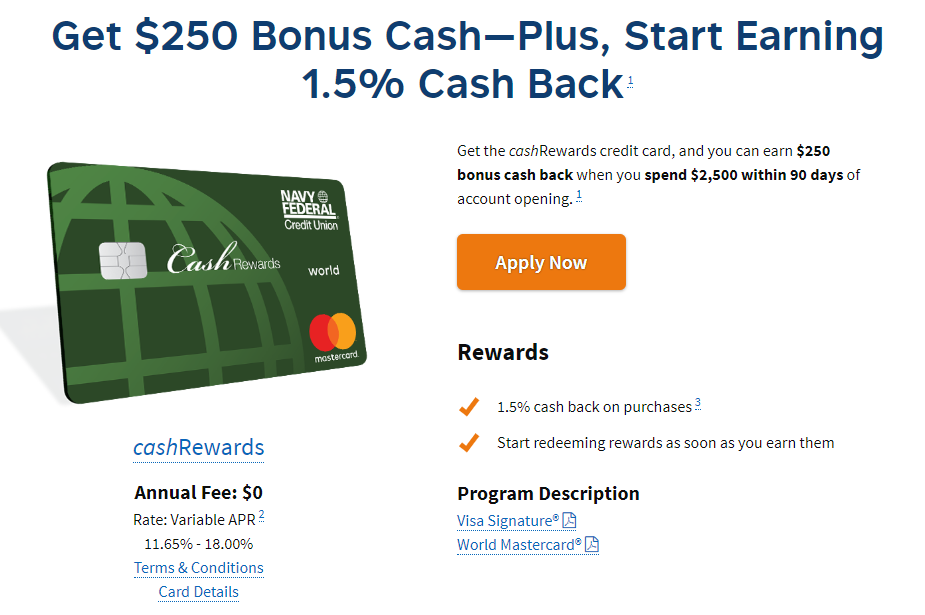

By offering competitive rates and a range of financial products, Navy Federal aims to support the financial well-being of its members within the military community.

Prospective borrowers should visit the Navy Federal Credit Union website or speak with a loan officer to learn more about specific requirements and loan options. Preparation and understanding are key to a successful loan application.