Nbt Bank Na Norwich Ny Fdic

Norwich, New York – NBT Bank, a fixture in the Central New York community, recently reaffirmed its commitment to serving its customers and maintaining financial stability in light of ongoing concerns about the broader banking sector.

This follows a period of increased scrutiny of banks nationwide, particularly after several high-profile bank failures earlier in the year. NBT Bank's continued strong performance in Norwich provides a sense of security for local depositors.

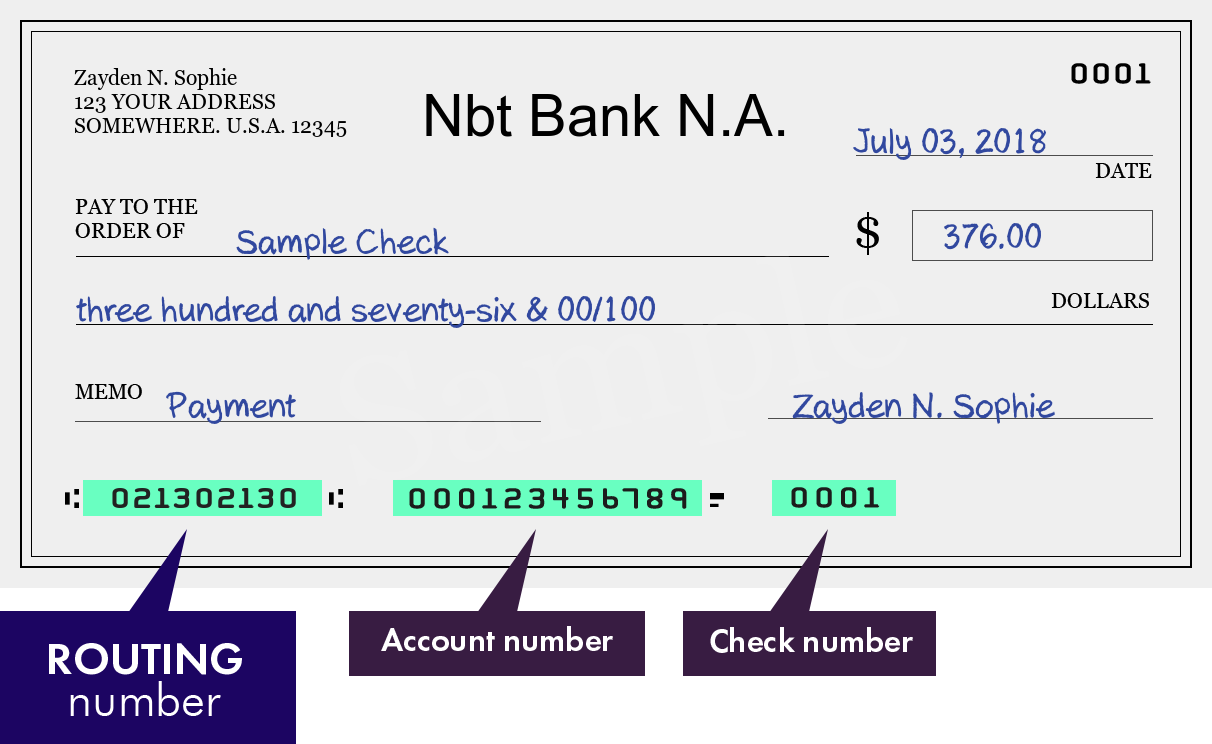

NBT Bank operates under the supervision of the Federal Deposit Insurance Corporation (FDIC), which ensures the safety of deposits up to $250,000 per depositor, per insured bank.

The FDIC's role is to maintain stability and public confidence in the nation's financial system. This insurance coverage provides a critical safety net for individuals and businesses banking with NBT Bank.

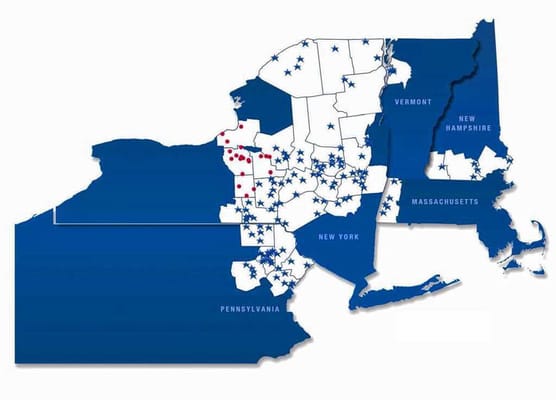

NBT Bank's Presence in Norwich

NBT Bank's presence in Norwich dates back many years. The bank has played a vital role in the economic development of the city and surrounding areas.

NBT Bank provides a range of financial services, including personal and business banking, loans, and wealth management. These services cater to the diverse needs of the Norwich community.

The bank is actively involved in local initiatives and supports various community organizations. This underlines NBT Bank's dedication to improving the quality of life for Norwich residents.

FDIC Insurance: Protecting Depositors

The FDIC insurance program is a cornerstone of the American banking system. It was established during the Great Depression to prevent bank runs and restore public trust.

When a bank is FDIC-insured, depositors are automatically protected up to the insured limit. This protection applies to a wide range of deposit accounts, including checking, savings, and money market accounts.

The FDIC is funded by premiums paid by banks and savings associations. This ensures that the agency has the resources to cover insured deposits in the event of a bank failure.

Recent Banking Sector Volatility

The banking sector has experienced increased volatility in recent months. This was triggered by concerns about rising interest rates and the financial health of some institutions.

The collapse of Silicon Valley Bank and Signature Bank sent shockwaves through the financial industry. These events prompted regulators to take swift action to stabilize the system.

The FDIC played a key role in resolving these bank failures and protecting depositors. The agency's actions helped to prevent a wider crisis.

NBT Bank's Financial Stability

Despite the recent turmoil in the banking sector, NBT Bank remains financially sound. The bank has a strong capital base and a diversified loan portfolio.

NBT Bank's conservative lending practices and prudent risk management have contributed to its stability. The bank is committed to maintaining a strong financial position.

NBT Bank consistently meets or exceeds regulatory capital requirements. This provides assurance to depositors and investors.

Community Impact and Response

The presence of a stable and reliable bank like NBT Bank is crucial for the Norwich community. It ensures access to essential financial services and supports local businesses.

Local residents have expressed confidence in NBT Bank's ability to weather economic challenges. The bank has a long track record of serving the community.

The continued assurance from NBT Bank and the FDIC can mitigate any uncertainty during volatile financial climates, solidifying community trust.

Looking Ahead

NBT Bank is well-positioned to continue serving the Norwich community in the years to come. The bank remains focused on providing excellent customer service and supporting local economic growth.

The FDIC will continue to play a vital role in maintaining the stability of the banking system. The agency's oversight and insurance coverage provide a critical safety net for depositors.

As the financial landscape evolves, NBT Bank will adapt and innovate to meet the changing needs of its customers. The bank is committed to remaining a trusted partner for the Norwich community.

/cloudfront-us-east-1.images.arcpublishing.com/gray/YLAKIZ3OPNGS5KK2ZDZUIJEJAA.PNG)