Net Income Available To Common Stockholders

Understanding a company's profitability is crucial for investors and stakeholders alike. A key metric in this assessment is net income available to common stockholders. It reflects the portion of a company's profit that's attributable to common shareholders after all other obligations have been met.

This figure provides a clearer picture of the earnings available to common shareholders than simply looking at net income. It's essential for calculating earnings per share (EPS), a widely used metric for valuing a company's stock.

Defining Net Income Available to Common Stockholders

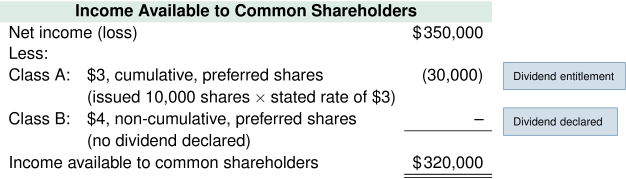

Net income available to common stockholders is a financial metric that reveals the profit a company has earned and is available to distribute to its common shareholders. This calculation starts with the company's net income, which is the profit after all operating expenses, interest, and taxes have been subtracted from revenue.

From net income, any dividends paid to preferred stockholders must be deducted. Preferred stock dividends have a higher priority than common stock dividends, and must be paid out first.

The resulting figure represents the earnings attributable to common stockholders. It is a fundamental measure of profitability from the perspective of the common shareholder.

Significance for Investors

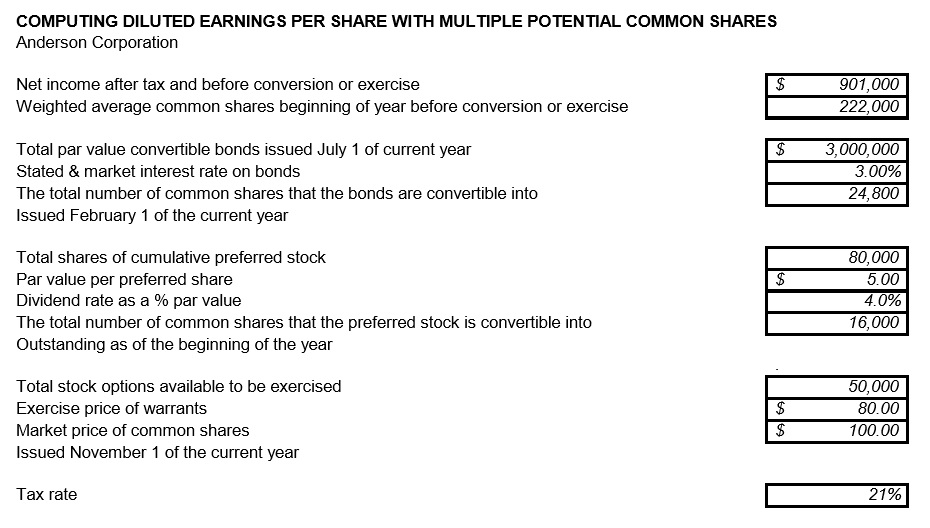

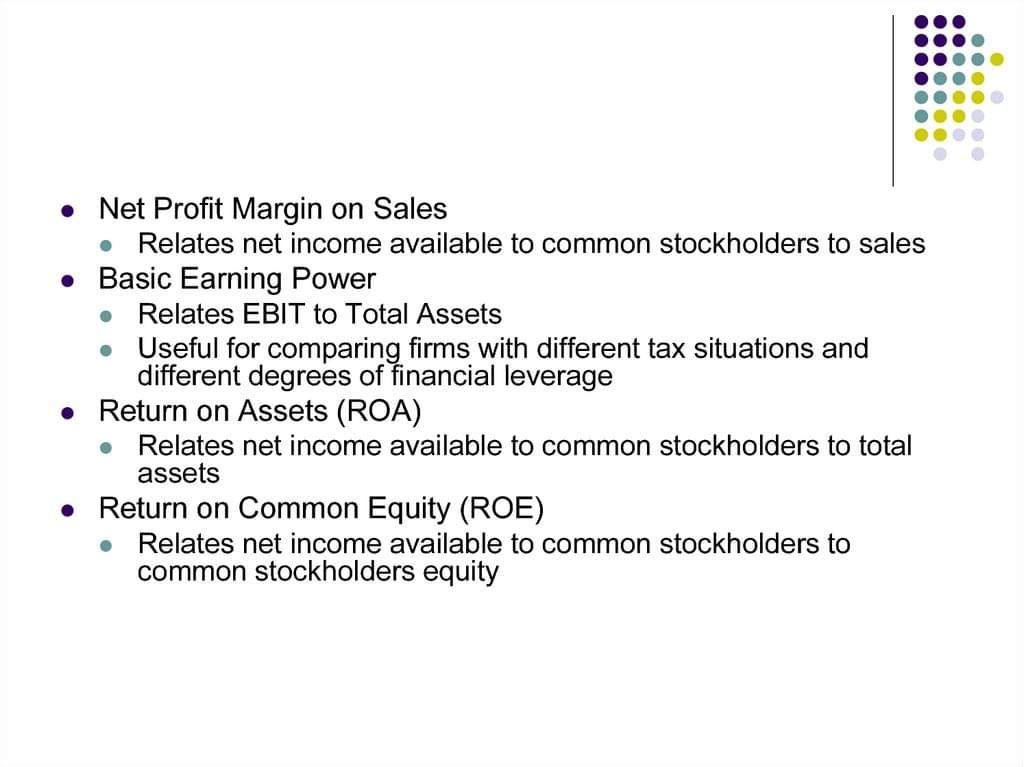

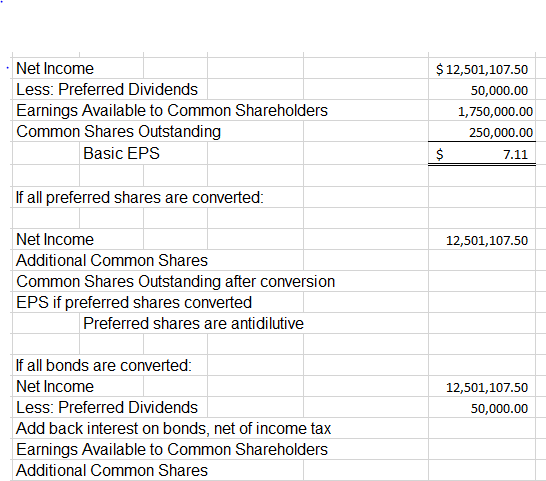

Investors closely monitor this figure because it directly impacts key valuation metrics. It is a critical component in calculating a company's earnings per share (EPS).

EPS is one of the most widely used financial ratios to evaluate a company's profitability on a per-share basis. A higher EPS generally signals stronger profitability and can make a stock more attractive to investors.

Furthermore, consistent growth in net income available to common stockholders over time suggests that a company is effectively generating value for its shareholders. This trend can indicate a strong and sustainable business model.

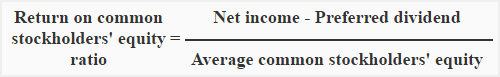

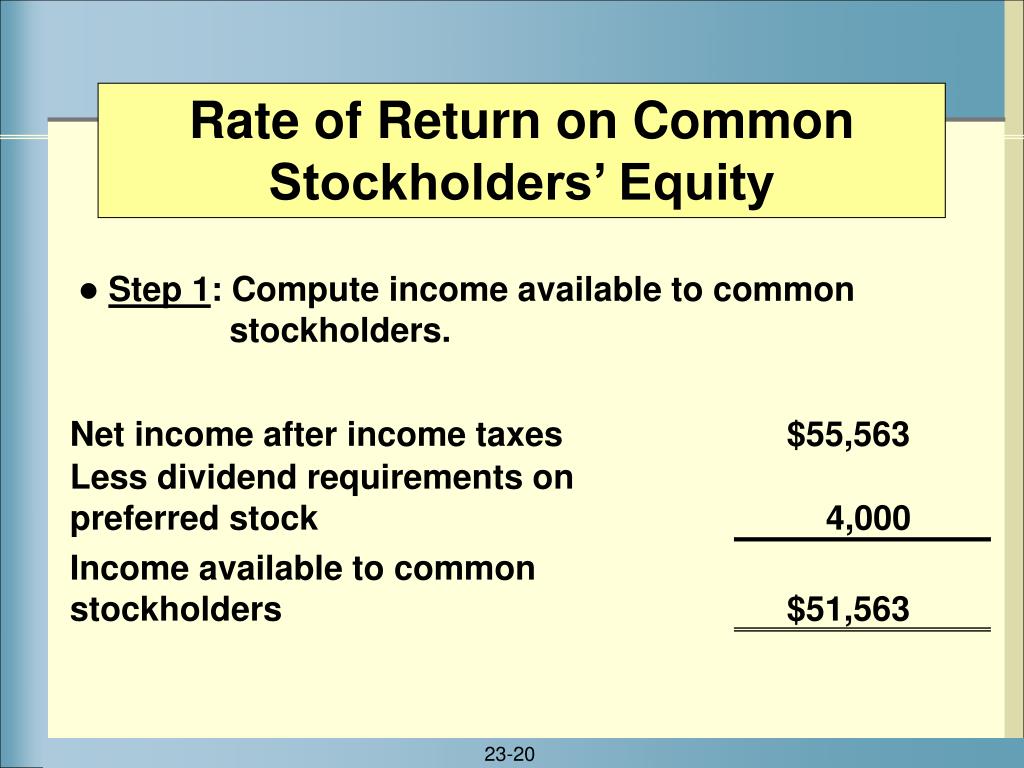

Calculation and Components

The formula for net income available to common stockholders is relatively straightforward. The formula is: Net Income – Preferred Dividends = Net Income Available to Common Stockholders.

Net Income is found at the bottom of the income statement. Preferred Dividends represent the dividends paid to preferred stockholders, and must be subtracted before calculating the income available to common stockholders.

For example, if a company has a net income of $1 million and pays $100,000 in preferred dividends, the net income available to common stockholders would be $900,000.

Real-World Examples and Implications

Consider Apple Inc. Apple's financial statements clearly outline the net income and the allocation of dividends. Analyzing these figures helps investors understand the true profitability available to common shareholders.

Companies in different sectors, like Amazon in e-commerce or ExxonMobil in energy, also report this metric. Comparing these figures allows investors to assess the relative profitability of companies within and across different industries.

Changes in accounting standards or company policies can impact the reported net income available to common stockholders. Therefore, it is important for investors to stay informed of potential changes.

Potential Impact and Challenges

A decline in net income available to common stockholders can negatively impact a company's stock price. Investors may interpret this as a sign of weakening profitability.

Companies with consistently low or negative net income available to common stockholders may struggle to attract investment. This can limit their growth potential.

Manipulating or misreporting these figures is a serious form of financial fraud. Such actions can lead to legal consequences and a loss of investor trust.

Conclusion

Net income available to common stockholders is a crucial metric for assessing a company's financial performance. It provides a clear picture of the earnings available to common shareholders.

By understanding this metric, investors can make more informed decisions about their investments. The number is a fundamental tool for evaluating the true profitability of a company.

Ultimately, it is essential for both seasoned investors and newcomers to grasp the significance of net income available to common stockholders. This will help them navigate the complexities of the stock market with greater confidence and insight.

:EBIT/total+assets..jpg)