Net Working Capital Represents Current Assets Plus Current Liabilities.

Breaking: Businesses face immediate scrutiny as Net Working Capital calculations are under review following widespread misinterpretations. Initial reports suggest significant discrepancies impacting financial stability assessments.

This miscalculation, defining Net Working Capital (NWC) as current assets plus current liabilities instead of current assets minus current liabilities, poses critical challenges for accurate financial reporting and decision-making.

The Core Issue: A Fundamental Error

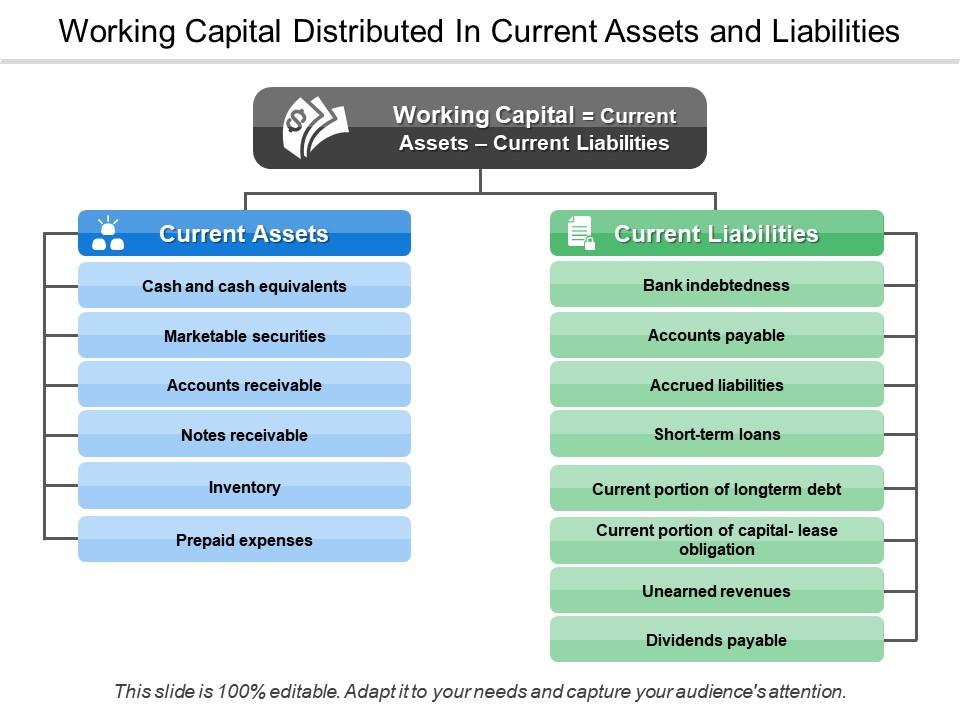

The central problem revolves around a widespread misunderstanding of the NWC formula. NWC, a crucial metric for assessing a company's short-term liquidity, is calculated by subtracting current liabilities from current assets, not adding them.

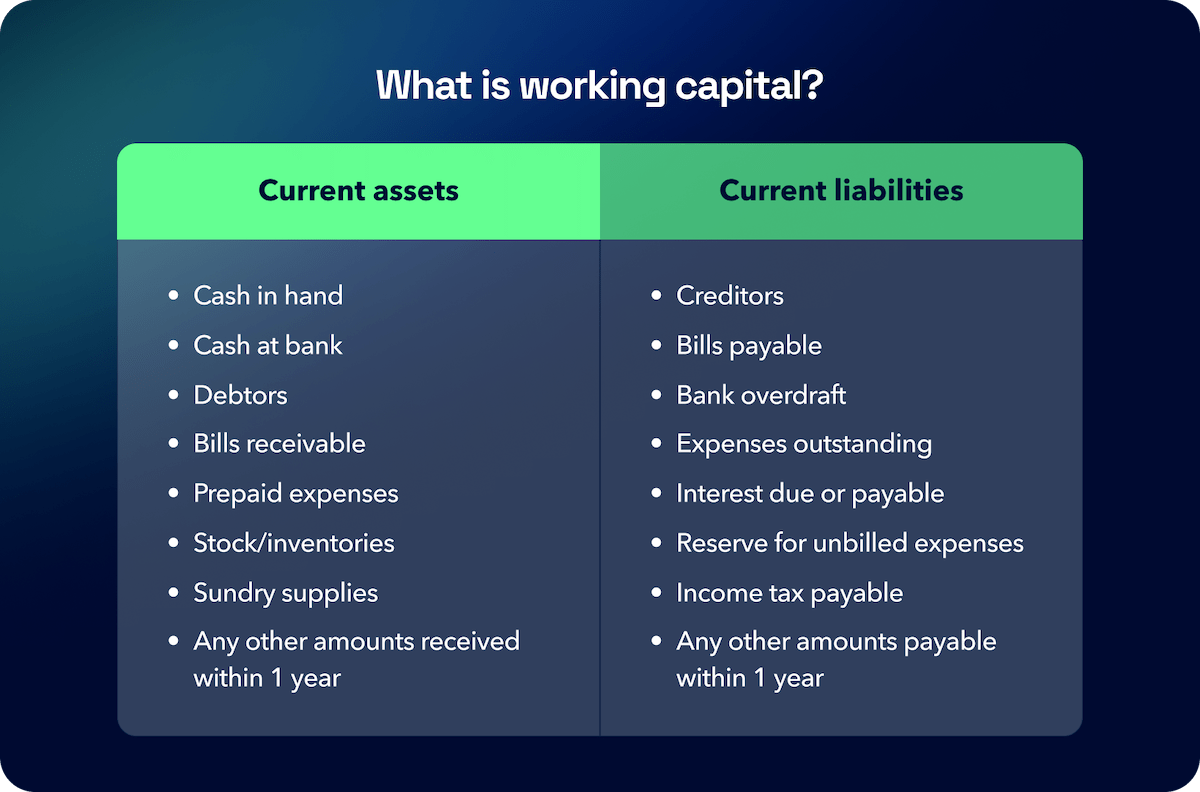

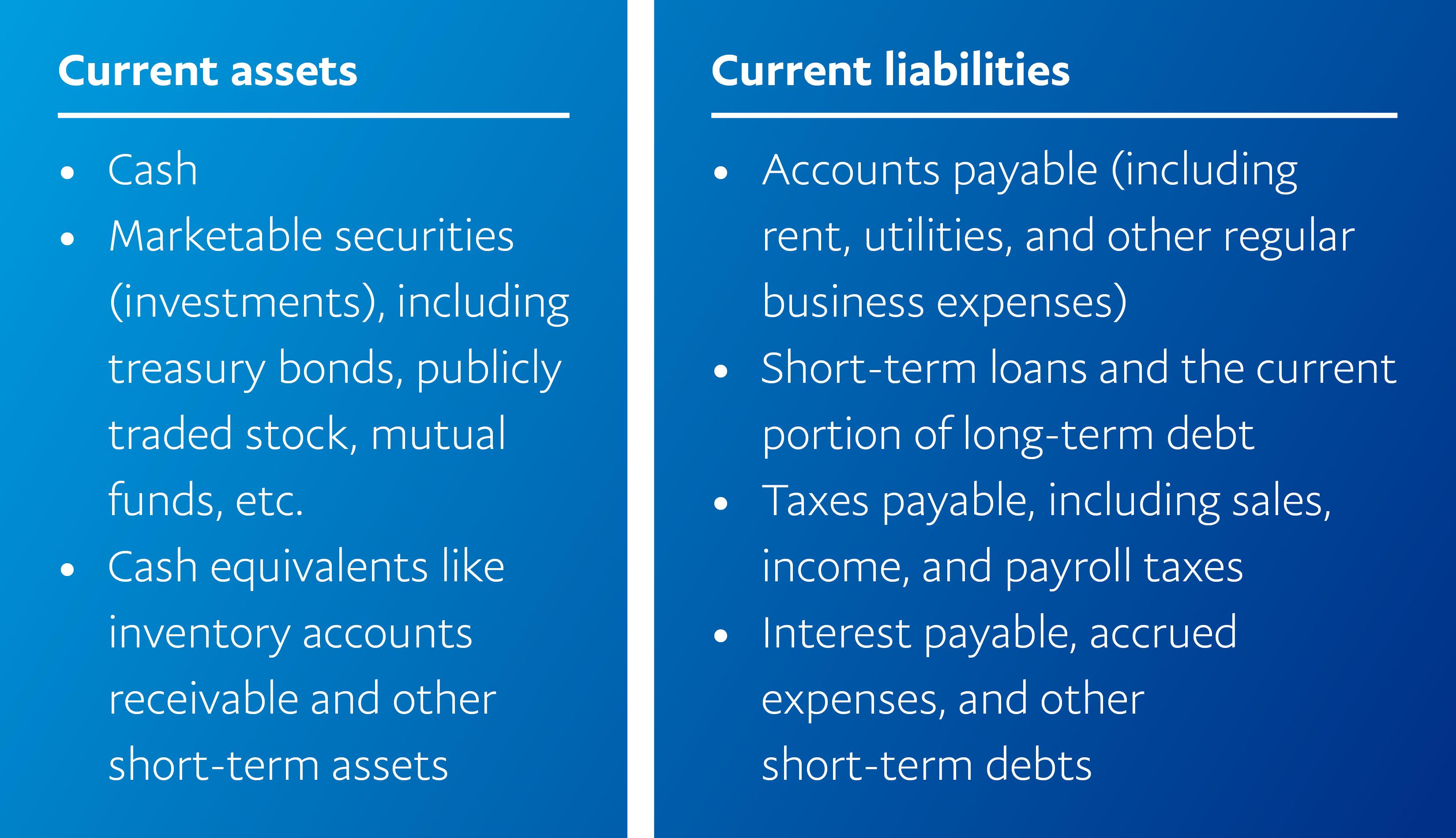

Current assets include resources like cash, accounts receivable, and inventory. Current liabilities are short-term obligations such as accounts payable, salaries payable, and short-term debt.

The erroneous addition inflates the perceived financial health, masking potential liquidity issues and leading to flawed investment decisions. This misstatement directly impacts companies' ability to meet short-term obligations.

Who is Affected?

The implications of this error span across various sectors. From small businesses to multinational corporations, any entity relying on NWC for financial analysis is potentially affected.

Initial data suggests a disproportionate impact on companies with high levels of short-term debt. Auditing firms, investment analysts, and lending institutions are actively reassessing their evaluations in light of this revelation.

Furthermore, regulatory bodies are under pressure to provide clear guidelines and ensure standardized financial reporting practices to prevent future occurrences.

Where and When Did This Occur?

The miscalculation appears to be pervasive across multiple regions and industries. No single geographical location is solely responsible; instead, the issue stems from a broader misunderstanding of basic accounting principles.

While the exact timeframe remains under investigation, preliminary evidence suggests that the error has been present in various reports over the past several years. Increased scrutiny is likely for financial statements released since 2020.

This timeframe aligns with a period of increased economic volatility and rapid shifts in market conditions, exacerbating the potential consequences of inaccurate NWC calculations.

The Immediate Impact: Recalculations and Reassessments

Companies are now scrambling to recalculate their NWC using the correct formula. This involves a thorough review of their balance sheets and financial records to identify and rectify any inaccuracies.

Lenders are reevaluating creditworthiness based on the revised NWC figures. This could lead to revised loan terms, increased interest rates, or even the denial of credit for companies previously considered low-risk.

Investment analysts are adjusting their ratings and recommendations, potentially triggering market volatility as investors react to the updated financial picture. Some companies may experience a sharp decline in their stock prices.

How Did This Happen?

Several factors contributed to this widespread error. A lack of standardized training, inadequate oversight, and reliance on automated systems with flawed programming are all potential culprits.

In some cases, the error originated from simple data entry mistakes that were not caught during the review process. Others resulted from a misinterpretation of accounting terminology and formulas.

Furthermore, the increasing complexity of financial reporting standards may have overwhelmed some professionals, leading to unintentional errors. More robust internal controls are needed to prevent such problems.

What Are The Next Steps?

Regulatory agencies, including the Securities and Exchange Commission (SEC), are expected to release updated guidelines on NWC calculations. This is intended to provide clarity and ensure compliance across all sectors.

Accounting firms are implementing enhanced training programs to educate their staff on the correct application of NWC and other key financial metrics. This is meant to prevent similar errors from occurring in the future.

Companies must prioritize the implementation of robust internal controls to detect and correct any financial misstatements. Independent audits are recommended to ensure accuracy and transparency.

Ongoing Developments

The investigation into the extent and impact of this miscalculation is ongoing. Further updates will be provided as new information becomes available.

Stakeholders are urged to exercise caution and seek professional advice when interpreting financial statements. A thorough understanding of NWC and other key metrics is essential for making informed decisions.

The financial community must collectively strive for greater accuracy and transparency in financial reporting to maintain investor confidence and promote economic stability.