New Jersey Sales Tax Rate 2024

Imagine strolling down the vibrant streets of Hoboken, the aroma of freshly brewed coffee wafting from a cozy café. You're eyeing a stylish new jacket in a boutique window, a perfect addition to your wardrobe as the autumn chill sets in. As you mentally calculate the cost, a familiar question pops up: What's the sales tax rate in New Jersey this year?

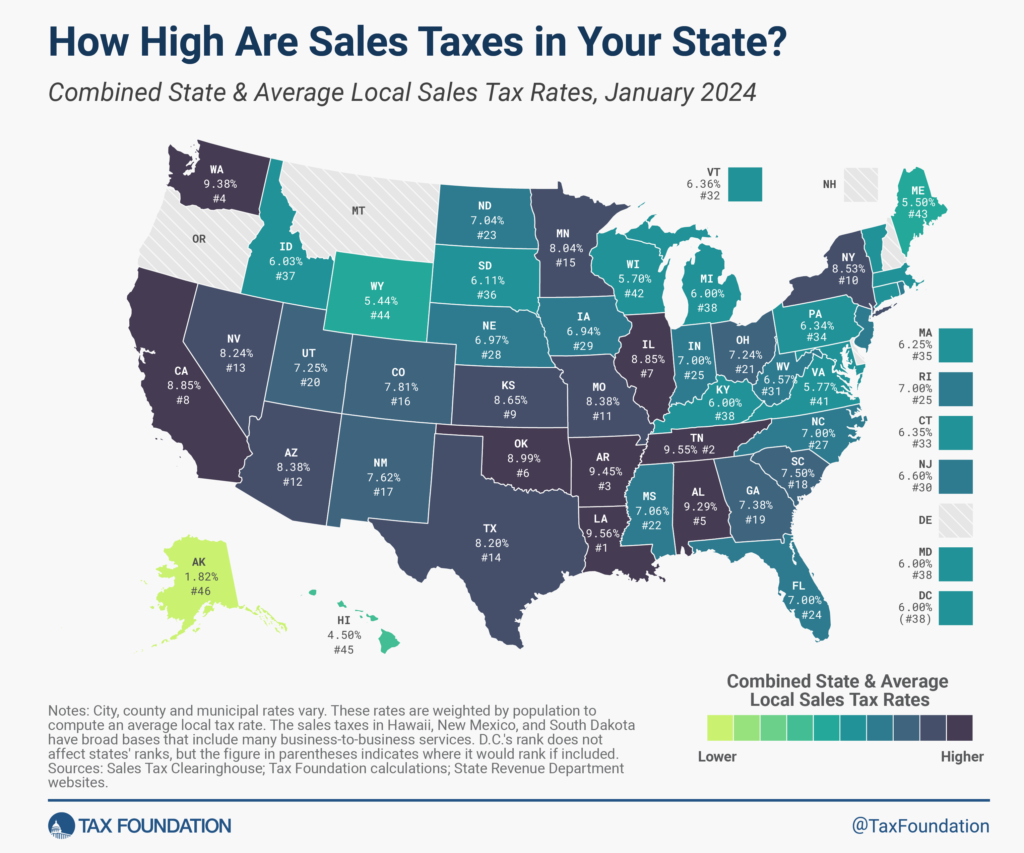

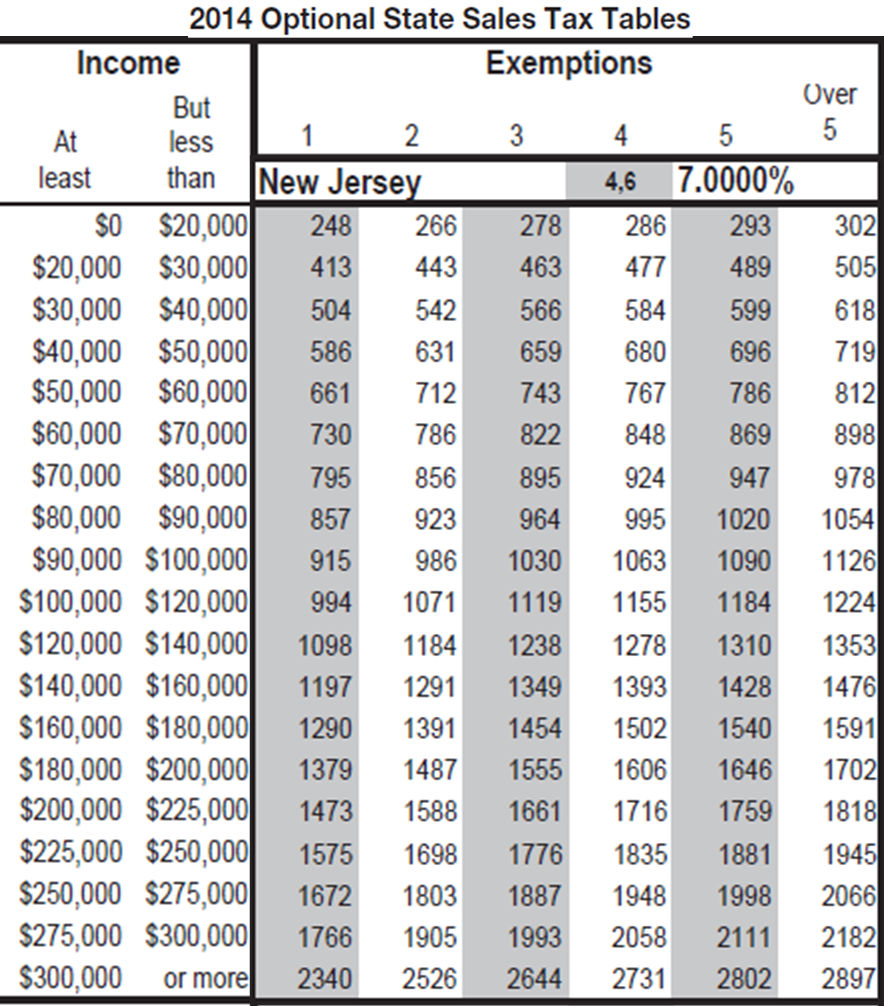

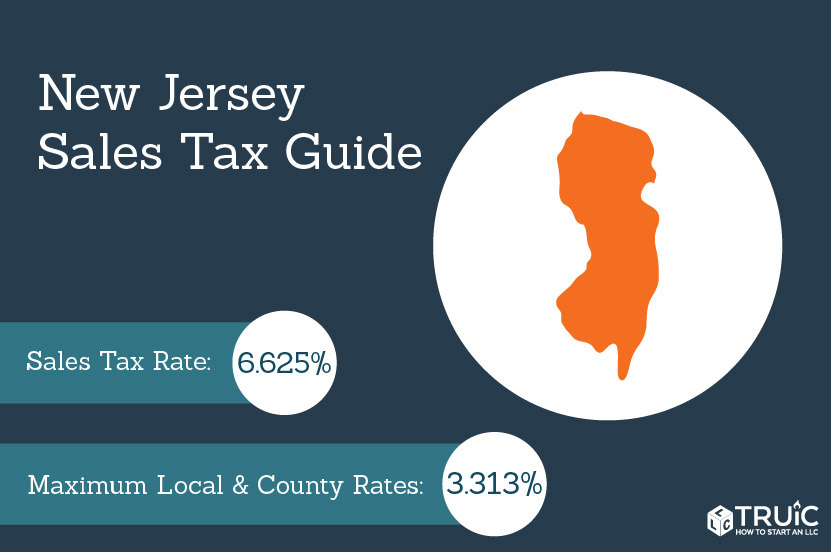

The sales tax rate in New Jersey remains a consistent 6.625% for the majority of purchases in 2024. This rate applies statewide, providing a degree of predictability for shoppers and businesses alike. Understanding how this tax impacts your spending and financial planning is crucial for navigating the Garden State's economy.

A Deep Dive into New Jersey's Sales Tax

New Jersey's sales tax has a history as varied as the state itself. Originally introduced in 1966 at a modest 3%, it has evolved over the decades to meet the changing needs of the state's budget. This evolution reflects the ongoing balancing act between funding public services and ensuring affordability for residents.

The 6.625% rate has been in place for several years, offering a sense of stability. This allows consumers to plan their purchases with a clear understanding of the final cost. Businesses, too, benefit from this consistency in forecasting their revenue and managing their pricing strategies.

What's Taxable and What's Not?

Not all goods and services are subject to New Jersey's sales tax. Understanding these exemptions can lead to significant savings and better budgeting.

Essential items like most food products purchased at grocery stores are exempt from sales tax. Clothing is also generally exempt, offering a welcome break for families shopping for necessities. Utility services such as water and gas are also typically exempt, helping to keep household costs manageable.

However, prepared food from restaurants, alcoholic beverages, and tangible personal property are generally taxable. Certain services, such as haircuts and dry cleaning, are also subject to sales tax. Being aware of these taxable items allows you to make informed purchasing decisions.

The Impact of Sales Tax on Consumers

Sales tax plays a significant role in the everyday lives of New Jersey residents. It directly influences the affordability of goods and services, affecting household budgets and spending habits.

For families on a tight budget, the 6.625% sales tax can add up quickly. Careful planning and awareness of tax-exempt items can help mitigate this impact. Taking advantage of sales and promotions can also further reduce the overall cost of purchases.

"Understanding the sales tax rate is an essential part of financial literacy," says Maria Rodriguez, a financial advisor based in Newark. "It empowers consumers to make informed decisions and manage their money effectively."

Sales Tax and the State's Revenue

Beyond its impact on consumers, sales tax is a crucial component of New Jersey's state revenue. It helps fund essential public services, including education, infrastructure, and healthcare.

The revenue generated from sales tax supports schools, roads, and social programs throughout the state. This ensures that New Jersey can continue to provide vital services to its residents. The sales tax revenue also contributes to the overall economic stability of the state.

According to the New Jersey Department of Treasury, sales tax collections contribute a significant portion to the state's general fund. These collections are essential for maintaining the quality of life that New Jersey residents enjoy.

Navigating Sales Tax as a Business Owner

For business owners in New Jersey, understanding and complying with sales tax regulations is paramount. Accurate collection, reporting, and remittance of sales tax are essential for maintaining a healthy business and avoiding penalties.

Businesses are required to register with the state to obtain a sales tax permit. This permit allows them to collect sales tax from customers and remit it to the state on a regular basis. The frequency of reporting and remittance depends on the volume of sales.

Keeping accurate records of all sales transactions is crucial for ensuring compliance with sales tax laws. Businesses should also stay informed about any changes to sales tax regulations to avoid errors and penalties. The New Jersey Division of Taxation provides resources and guidance to help businesses navigate these requirements.

Online Sales and the Sales Tax Landscape

The rise of online shopping has transformed the sales tax landscape. New Jersey, like many other states, has adapted its regulations to address the complexities of e-commerce.

Out-of-state retailers that have a significant economic presence in New Jersey are required to collect sales tax on purchases made by New Jersey residents. This ensures that online retailers contribute to the state's revenue in the same way as brick-and-mortar stores. This levels the playing field and prevents unfair advantages for online businesses.

Consumers shopping online should be aware that sales tax will likely be added to their purchases, even if the retailer is located outside of New Jersey. Understanding this can help avoid surprises at checkout and ensure accurate budgeting.

Looking Ahead: Potential Changes and Future Trends

While the 6.625% sales tax rate has remained consistent in recent years, it's important to stay informed about potential changes and future trends. Economic conditions, legislative decisions, and evolving consumer behavior can all influence the sales tax landscape.

Discussions about potential adjustments to the sales tax rate or the list of taxable items occasionally arise in the state legislature. These discussions often center on the need to balance state revenue with the affordability of goods and services for residents. Monitoring these discussions can provide insights into potential future changes.

"It's always wise to stay informed about potential changes to tax laws," advises David Lee, a tax attorney based in Trenton. "This allows individuals and businesses to adapt their financial plans and strategies accordingly."

As New Jersey continues to evolve, so too will its approach to sales tax. Keeping abreast of these changes ensures that you're well-prepared to navigate the financial landscape of the Garden State.

Conclusion

So, as you consider that stylish jacket in the Hoboken boutique, remember that 6.625% sales tax. It’s a constant presence in New Jersey's economic rhythm. Understanding this rate, its exemptions, and its impact empowers you to make informed decisions, whether you're a consumer carefully managing your budget or a business owner striving for compliance and success.

Ultimately, the sales tax is more than just a number. It's a reflection of the state's commitment to funding essential services and shaping a vibrant community for all its residents. By staying informed and engaged, we can all play a part in ensuring a prosperous future for the Garden State.