No Credit Check Loans Guaranteed Approval Direct

Desperate for cash? Offers promising "No Credit Check Loans Guaranteed Approval Direct" are surging, but beware: financial experts warn these loans often mask predatory lending practices.

This article cuts through the noise to deliver crucial information about these enticing but risky financial products, helping you understand the potential pitfalls before you commit.

The Allure and the Danger

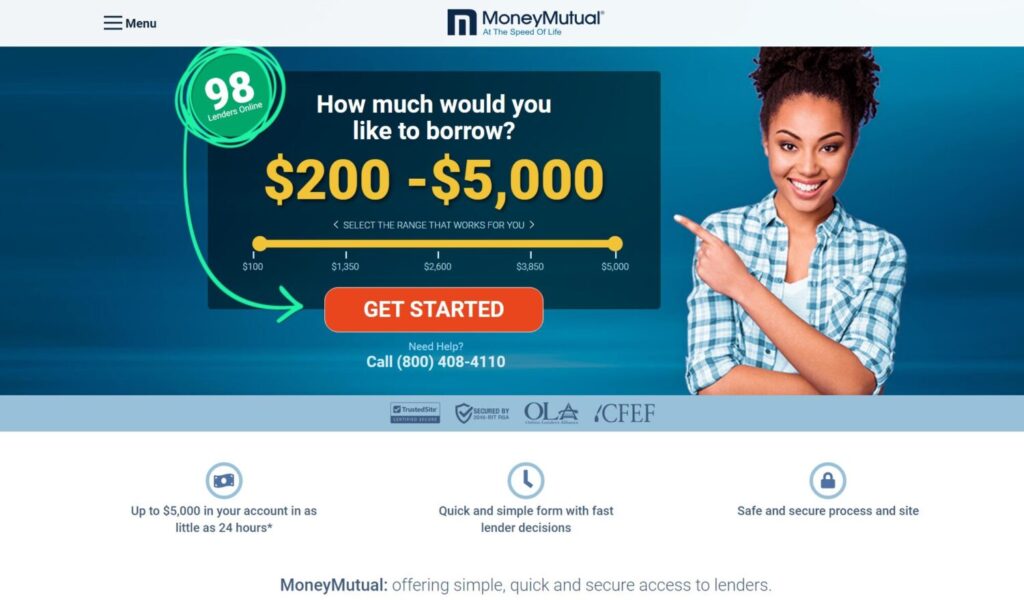

The promise of quick cash without a credit check is tempting, especially for those with low credit scores or limited credit history.

These lenders often advertise online, boasting "guaranteed approval" and "instant funding." But the reality is far more complex and potentially dangerous.

What Are "No Credit Check Loans"?

"No credit check loans" are a type of loan where the lender does not review your credit report from major credit bureaus (Experian, Equifax, and TransUnion) before approving the loan.

Instead, they may rely on other factors like proof of income, bank statements, or even collateral like a vehicle title.

This seemingly easier access to funds comes at a steep price: exorbitantly high interest rates and fees.

The Reality of "Guaranteed Approval"

The phrase "guaranteed approval" should be a red flag.

No legitimate lender can *guarantee* approval to everyone, as they still need to assess some level of risk to protect their investment.

These "guaranteed" approvals are often a marketing tactic to attract vulnerable borrowers, setting them up for a cycle of debt.

The Dark Side: Predatory Lending

These loans often fall into the category of predatory lending.

Predatory lending involves unfair or abusive loan terms designed to trap borrowers in debt, profiting from their financial vulnerability.

Think incredibly high APRs (Annual Percentage Rates), hidden fees, and short repayment periods that are difficult to meet.

Example: Payday Loans

Payday loans, often marketed as no credit check loans, are a prime example.

According to the Consumer Financial Protection Bureau (CFPB), the average payday loan carries an APR of almost 400%.

Borrowers often find themselves needing to renew or "rollover" the loan, incurring more fees and digging themselves deeper into debt. A report by the Pew Charitable Trusts found that the average payday loan borrower is in debt for five months of the year.

Example: Title Loans

Title loans are another risky option.

These loans require you to offer your vehicle as collateral, meaning the lender can seize your car if you fail to repay the loan.

The Federal Trade Commission (FTC) warns that title loans often have high interest rates and fees, putting borrowers at risk of losing their vehicle.

Alternatives to Consider

Before resorting to no credit check loans, explore safer alternatives.

Consider options like:

- Credit Counseling: Non-profit credit counseling agencies can help you manage your debt and improve your financial situation.

- Personal Loans from Credit Unions: Credit unions often offer lower interest rates and more flexible repayment terms compared to payday or title lenders.

- Borrowing from Friends or Family: If possible, ask for help from trusted friends or family members.

- Negotiating with Creditors: Try to negotiate payment plans or hardship programs with your existing creditors.

Protect Yourself: Red Flags to Watch For

Be wary of lenders who:

- Guarantee approval regardless of your credit history.

- Charge extremely high interest rates and fees.

- Are not licensed to operate in your state.

- Pressure you to borrow more than you need.

- Are vague about loan terms and conditions.

Report Suspicious Activity

If you believe you have been targeted by a predatory lender, report it to the relevant authorities.

Contact the Federal Trade Commission (FTC) and your state's Attorney General's office.

You can also file a complaint with the Consumer Financial Protection Bureau (CFPB).

The Bottom Line

While the promise of "No Credit Check Loans Guaranteed Approval Direct" may seem appealing, proceed with extreme caution.

These loans often come with significant risks and can lead to a cycle of debt.

Explore safer alternatives and protect yourself from predatory lending practices.