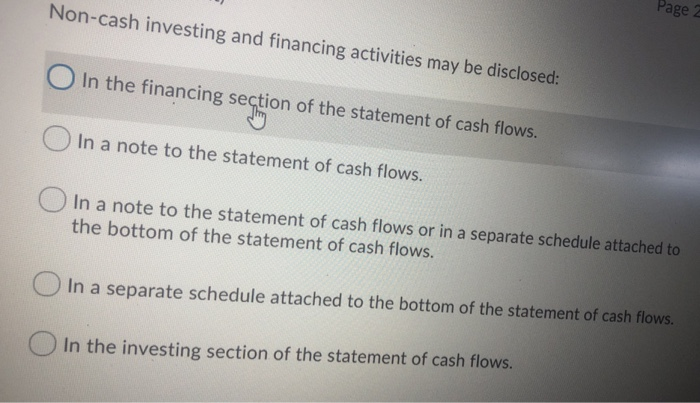

Noncash Investing And Financing Activities May Be Disclosed In

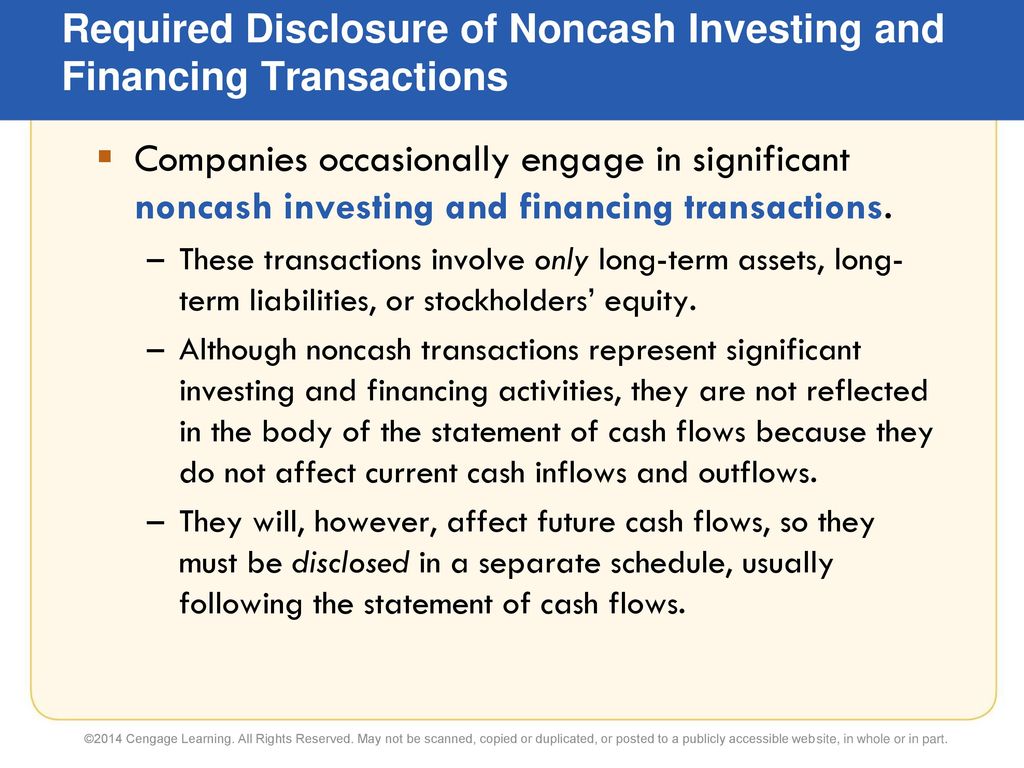

The accounting world has been abuzz with discussions regarding the disclosure of noncash investing and financing activities. These activities, while not directly impacting a company's cash flow statement, can significantly alter its financial structure and future prospects. Understanding where and how these disclosures are presented is crucial for investors and stakeholders alike.

The Securities and Exchange Commission (SEC), the primary regulatory body overseeing financial reporting in the United States, requires that companies disclose all significant noncash investing and financing activities. This requirement, detailed under Generally Accepted Accounting Principles (GAAP), aims to provide a more complete picture of a company's financial activities beyond just cash transactions.

So, where exactly does one find these disclosures? The answer lies within the financial statements themselves, typically in the accompanying notes.

Where to Find Noncash Activity Disclosures

The primary location for disclosing noncash investing and financing activities is within the notes to the financial statements. These notes serve as supplementary information to the main financial statements – the balance sheet, income statement, and statement of cash flows – offering deeper insights and explanations of various accounting items.

Specifically, look for a section titled something along the lines of "Noncash Investing and Financing Activities" or "Supplemental Disclosures." The exact title can vary slightly, but the intent remains the same: to outline significant transactions that didn't involve the immediate exchange of cash.

Examples of Noncash Activities

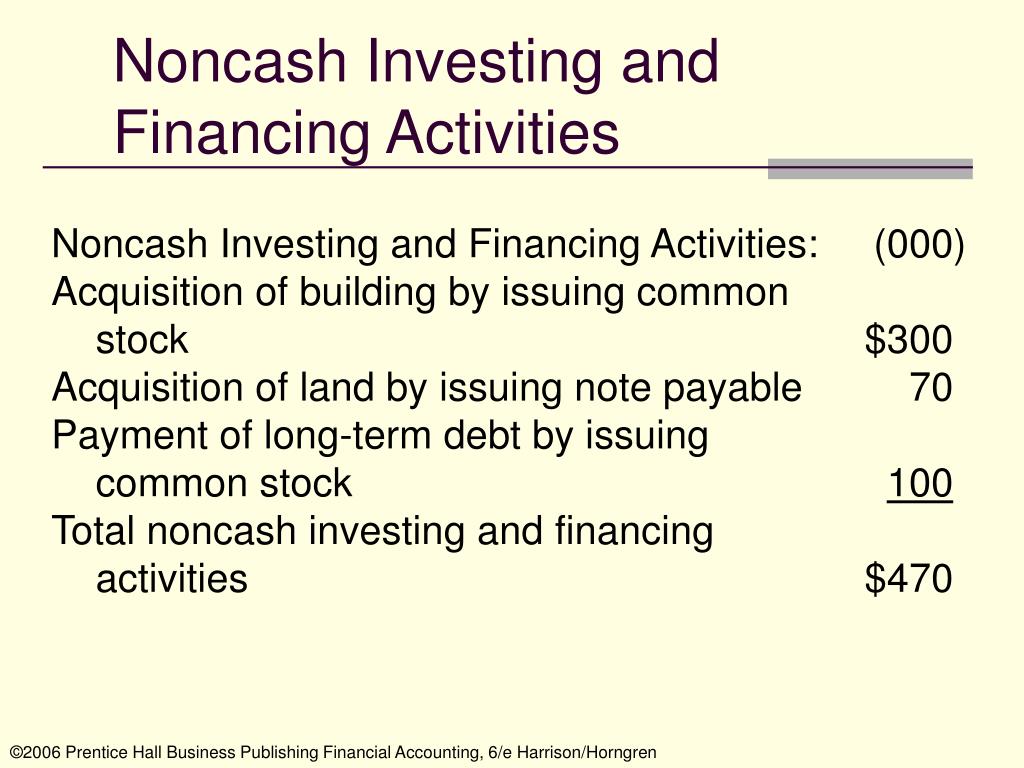

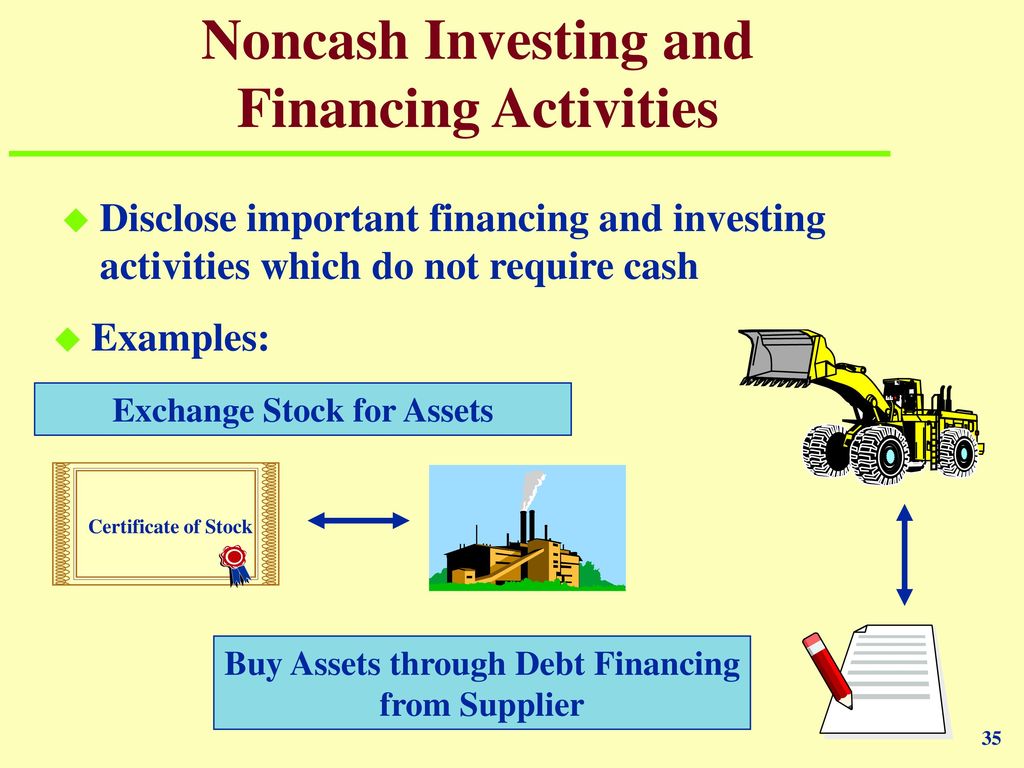

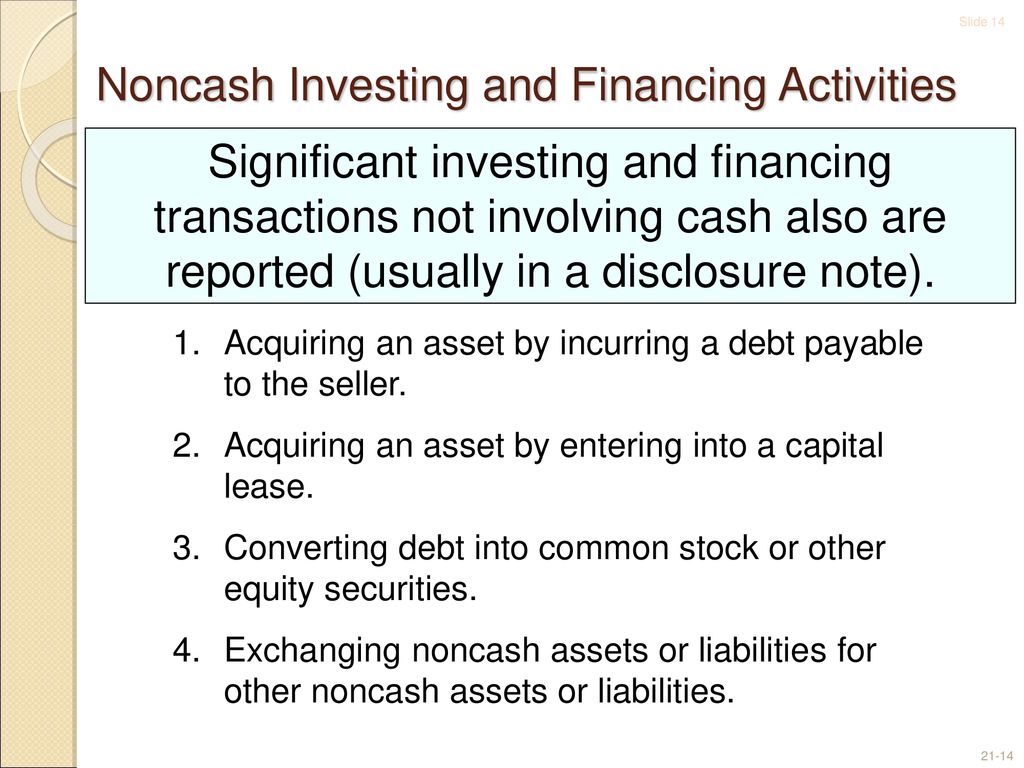

Understanding what constitutes a noncash investing and financing activity is key to identifying relevant disclosures. Consider these common examples:

Issuance of stock for assets: A company might acquire land or equipment by issuing shares of its own stock instead of paying cash. This transaction increases both the company's assets and its equity, but it doesn't involve a cash outflow.

Debt converted to equity: A company might convert outstanding debt into shares of stock. This reduces the company's liabilities and increases its equity without affecting cash.

Exchanges of noncash assets: Companies can exchange assets directly, such as trading one piece of equipment for another. No cash changes hands, but the company’s asset composition changes.

Lease transactions: Under modern accounting standards, many leases are now recognized on the balance sheet, impacting both assets and liabilities, even though no immediate cash outlay may occur.

The notes to the financial statements will describe the nature of these transactions, the assets and liabilities involved, and the impact on the company's financial position. They might include details on the fair value of the assets exchanged or the number of shares issued.

Why are These Disclosures Important?

The importance of disclosing noncash investing and financing activities lies in providing a more complete and nuanced understanding of a company's financial health. Relying solely on the statement of cash flows can be misleading.

For example, a company might appear to have weak cash flow, but a significant acquisition of assets through a stock issuance could indicate a positive long-term strategic move. Investors need to understand the full picture to make informed decisions.

These disclosures also enhance transparency and accountability. By revealing these noncash transactions, companies provide stakeholders with a better understanding of management's decisions and their impact on the company’s financial future.

Impact on Investors and Stakeholders

The enhanced transparency resulting from these disclosures empowers investors to make more informed decisions. They can better assess a company's growth strategy, capital structure, and overall financial risk.

Lenders also benefit from this increased transparency. Understanding the composition of a company's assets and liabilities, including those acquired or created through noncash transactions, helps lenders evaluate the creditworthiness of the company.

Moreover, regulators and analysts rely on these disclosures to monitor company performance and identify potential financial risks or irregularities. Consistent and clear disclosures contribute to the overall integrity of the financial markets.

The Future of Noncash Activity Disclosures

Accounting standards are constantly evolving, and the disclosure of noncash investing and financing activities is no exception. Regulatory bodies like the Financial Accounting Standards Board (FASB) continuously review and update guidelines to ensure relevance and clarity.

Future changes might focus on providing even more granular details about the nature and impact of these transactions, potentially including quantitative disclosures or more standardized reporting formats.

Staying informed about these evolving standards is crucial for accountants, auditors, and financial professionals to ensure compliance and accurate financial reporting. Investors should also remain aware of these changes to better interpret financial statements.

In conclusion, the disclosure of noncash investing and financing activities within the notes to the financial statements is a vital component of comprehensive financial reporting. It provides critical insights into a company's financial health, empowering stakeholders to make informed decisions and contributing to the overall transparency and integrity of the financial markets.

+If+noncash+investing+and+financing+transactions+do+not+produce+cash+flows%2C+why+must+they+be+disclosed.jpg)