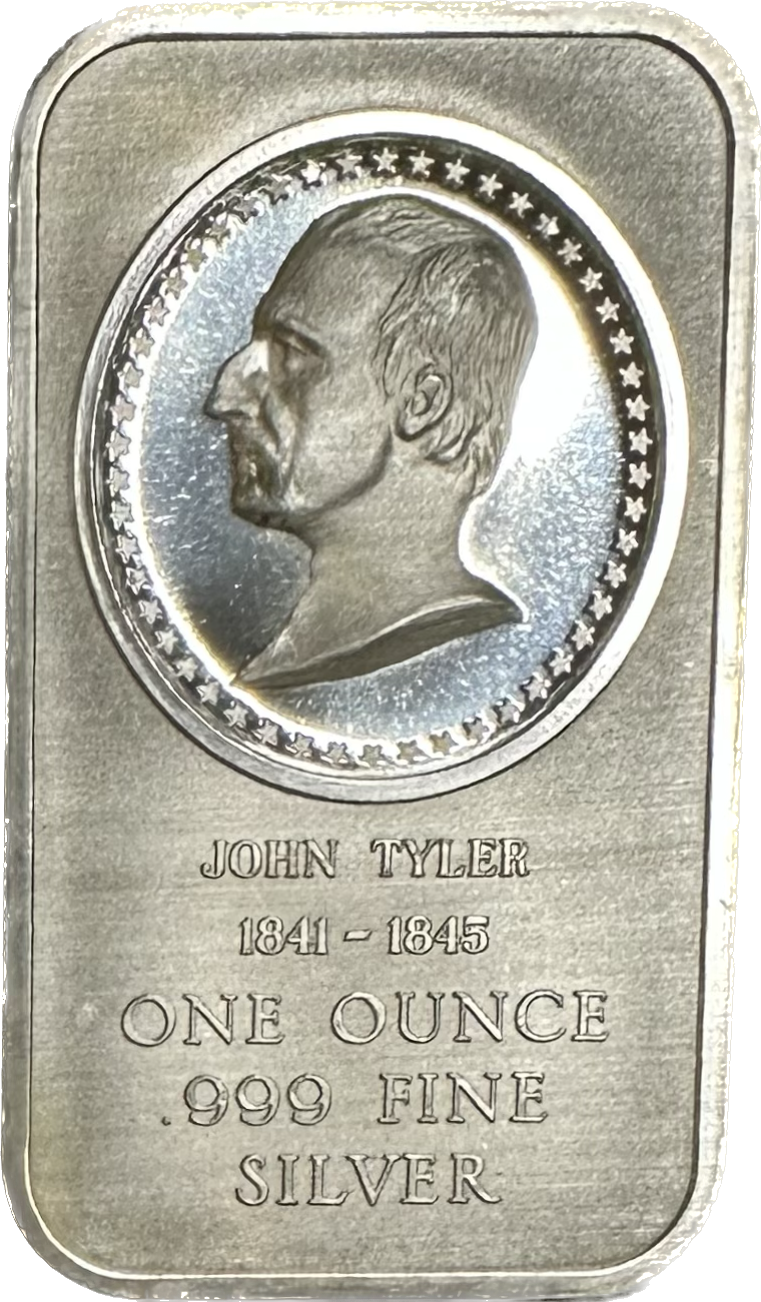

One Troy Ounce 999 Silver Value

Silver prices are surging, prompting both investors and everyday consumers to closely monitor market fluctuations. The value of one troy ounce of .999 fine silver has experienced notable volatility, demanding immediate attention.

The current market instability presents both opportunities and risks for those involved in buying, selling, or holding silver assets. Understanding the factors driving these changes is crucial for informed decision-making.

Silver Prices Soar Amidst Economic Uncertainty

As of today, October 26, 2023, the spot price for one troy ounce of .999 fine silver hovers around $23.00. This figure reflects recent market activity influenced by a confluence of economic indicators and geopolitical events.

The price is being quoted across major precious metal exchanges, including the London Bullion Market Association (LBMA) and the COMEX in New York.

Key Factors Influencing Silver Value

Several factors contribute to the current price volatility. These include inflation concerns, interest rate hikes by the Federal Reserve, and overall global economic uncertainty.

Heightened demand for silver in industrial applications, particularly in electronics and solar panels, also plays a significant role. Supply chain disruptions further compound the price pressures.

Investor sentiment, often driven by fear of economic downturn, is a key driver of price fluctuations, with many turning to silver as a safe haven asset.

Impact on Investors and Consumers

The rising silver prices impact both investors and everyday consumers. Investors holding physical silver or silver-backed securities are seeing gains, while those looking to buy face higher entry costs.

Consumers may notice increased prices in products that utilize silver, such as electronics, medical equipment, and jewelry. Silverware and other decorative items are also impacted.

Mike Maloney, author of "Guide to Investing in Gold & Silver", states, "Silver's dual role as both a precious metal and an industrial commodity makes it a unique asset class."

Expert Analysis and Market Predictions

Market analysts are offering varying predictions about the future of silver prices. Some anticipate continued upward momentum driven by persistent inflation, while others foresee a potential correction.

John Williams of Shadow Government Statistics cautions, "Expect continued volatility in precious metals markets as the Federal Reserve navigates inflationary pressures and potential recession."

Forecasts range from $25 to $30 per ounce by the end of the year, contingent upon macroeconomic developments.

Where to Track Silver Prices

Real-time silver prices can be tracked on reputable financial websites and precious metal exchanges. These include Bloomberg, Reuters, Kitco, and APMEX.

Monitoring these sources provides up-to-date information on market trends and price fluctuations. Investors and consumers can make more informed decisions when they track market fluctuations.

The Who, What, Where, When, Why, and How

Who: Investors, consumers, industrial users, and financial analysts are all closely watching the silver market.

What: The price of one troy ounce of .999 fine silver is experiencing significant volatility.

Where: The price is being tracked across major precious metal exchanges globally.

When: The current price surge is occurring in late October 2023.

Why: Inflation, interest rates, industrial demand, and geopolitical instability are all factors driving the price.

How: Silver prices are determined by supply and demand dynamics on global commodity markets.

Next Steps and Ongoing Developments

Investors should carefully consider their risk tolerance and investment objectives before making any decisions. Consumers should factor potential price increases into their purchasing plans.

The Federal Reserve's upcoming monetary policy decisions will significantly impact the silver market. Geopolitical events and supply chain developments warrant close monitoring.

Further updates on silver price movements and market analysis will be provided as events unfold.