Payday Loan That Accepts Cash App

The intersection of instant money access and digital payment platforms has birthed a controversial trend: payday loans that accept Cash App. This blend promises speed and convenience, particularly appealing to those in urgent need of funds. However, it also raises concerns about predatory lending practices and the potential for trapping vulnerable individuals in cycles of debt.

This article delves into the rise of Cash App-compatible payday loans, examining their mechanics, benefits, risks, and the broader implications for consumers and the financial landscape. We will explore how these loans operate, who is most likely to use them, and the regulatory challenges they present, using data from reputable financial organizations and insights from consumer advocacy groups.

What are Payday Loans That Accept Cash App?

Traditional payday loans are short-term, high-interest loans typically due on the borrower's next payday. The emergence of payday loans accepting Cash App marks an evolution, leveraging the app's instant transfer capabilities.

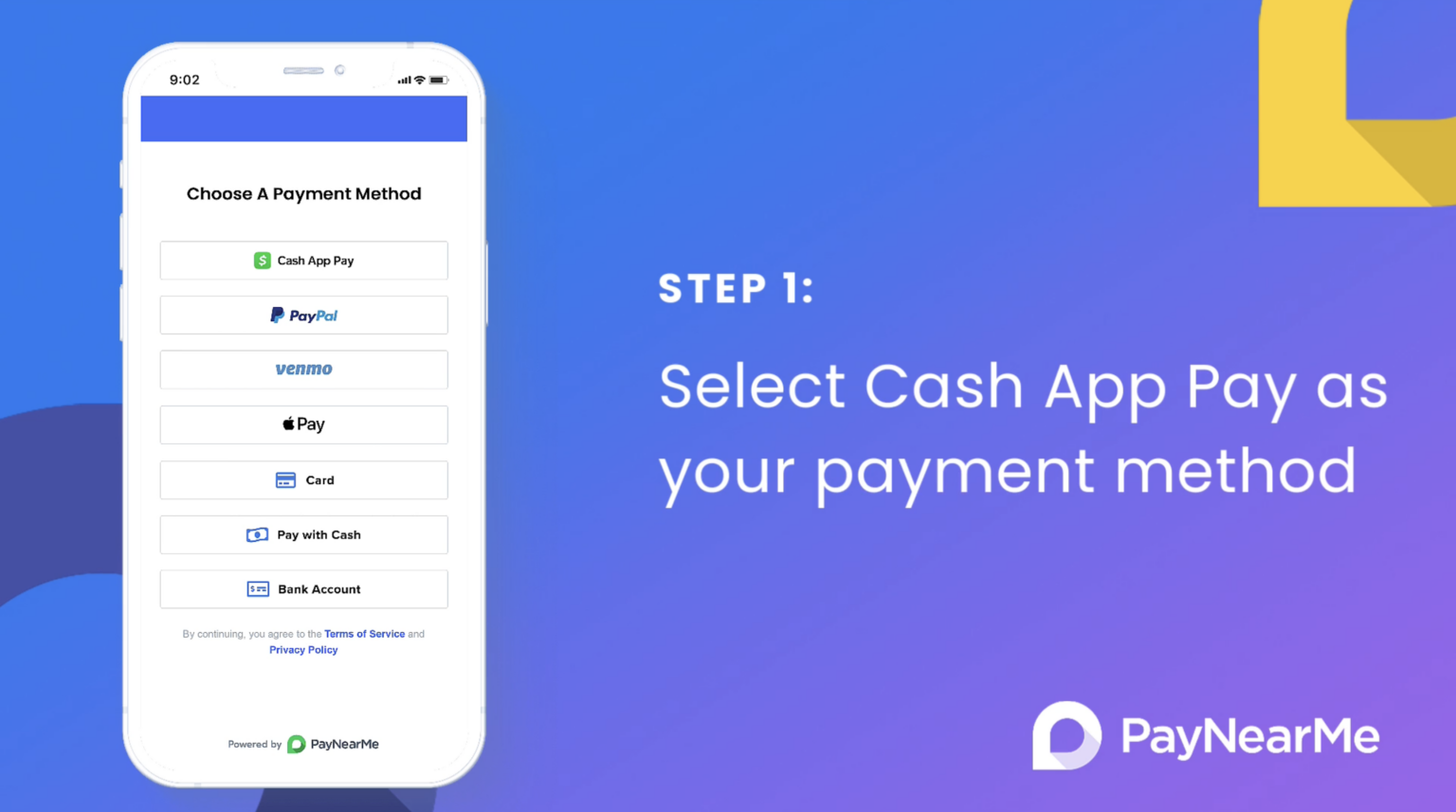

These loans are often advertised online, promising quick access to funds directly through Cash App. Borrowers typically complete an online application, and if approved, the loan amount is deposited into their Cash App account, often within minutes.

Repayment is usually automated, with the lender withdrawing the principal and fees from the borrower's Cash App account on the due date. This ease of access and repayment can be both a blessing and a curse.

The Allure of Instant Access

The primary draw of Cash App payday loans is their speed and accessibility. In emergency situations, where traditional lenders might take days to approve a loan, these platforms offer immediate relief.

This is particularly appealing to individuals with limited access to traditional banking services or those with poor credit scores. Cash App lowers the barrier to entry, providing a seemingly simple solution to immediate financial needs.

Furthermore, the digital nature of these loans often appeals to a younger demographic comfortable with mobile banking and online transactions. The convenience factor is undeniably strong.

The Dark Side: High Costs and Potential for Debt Traps

Despite the allure of quick cash, Cash App payday loans come with significant risks. The interest rates associated with these loans are often exorbitant, exceeding APRs of several hundred percent in some cases.

These high costs can quickly turn a small financial shortfall into a major debt burden. Borrowers who are unable to repay the loan on time often find themselves taking out new loans to cover the existing debt, creating a cycle of dependence.

Consumer advocacy groups warn that this pattern of rollover loans can lead to long-term financial instability. The Center for Responsible Lending, for instance, has consistently highlighted the predatory nature of high-cost, short-term loans.

Regulatory Scrutiny and Legal Concerns

The legality of payday loans that accept Cash App is often murky, varying significantly by state. Many states have laws regulating or prohibiting payday lending due to concerns about predatory practices.

However, the online nature of these loans makes it difficult to enforce these regulations. Lenders may operate from states or jurisdictions with more lenient laws, making it challenging for regulators to protect consumers.

Furthermore, the use of Cash App as a payment platform adds another layer of complexity. While Cash App itself is not a lender, its platform facilitates the transactions, potentially raising questions about its role in enabling these loans.

"The ease of access offered by Cash App payday loans can mask the true cost of borrowing, leading to unsustainable debt burdens for vulnerable consumers," cautions a recent report from the National Consumer Law Center.

Who Uses These Loans and Why?

Cash App payday loans tend to attract individuals facing immediate financial challenges, such as unexpected medical bills, car repairs, or rent payments. These borrowers often lack other viable options for accessing credit.

Research indicates that lower-income individuals and those with limited financial literacy are disproportionately likely to use these loans. The promise of quick cash can be particularly appealing to those who are struggling to make ends meet.

Furthermore, individuals with poor credit histories may see Cash App payday loans as their only option, as traditional lenders are less likely to approve their applications. This creates a cycle of vulnerability, where those who are already struggling financially are most at risk of falling into debt traps.

Alternatives to Payday Loans

For individuals facing financial emergencies, there are often more responsible alternatives to Cash App payday loans. These include credit counseling, borrowing from friends or family, and seeking assistance from local charities or non-profit organizations.

Credit unions and community banks may offer small-dollar loans with more reasonable interest rates and repayment terms. Exploring these options can help avoid the high costs and risks associated with payday lending.

Building an emergency fund, even a small one, can also provide a financial cushion for unexpected expenses. This can reduce the reliance on high-cost loans in the future.

The Future of Digital Lending and Consumer Protection

The rise of Cash App payday loans highlights the need for stronger consumer protection measures in the digital lending space. Regulators must adapt to the evolving landscape and develop strategies to address the unique challenges posed by online lenders.

This includes increased enforcement of existing laws, as well as the development of new regulations that specifically target online lending practices. Transparency and disclosure requirements are also crucial to ensure that borrowers fully understand the terms and risks of these loans.

Ultimately, protecting consumers from predatory lending requires a multi-faceted approach that includes education, regulation, and access to affordable financial services. The intersection of technology and finance presents both opportunities and challenges, and it is essential to strike a balance between innovation and consumer protection to ensure a fair and equitable financial system. The increased use of Cash App for financial transactions necessitates a closer look at the potential for exploitation and the need for safeguards.