Payday Loans That Accept Netspend Accounts No Credit Check

Financial desperation is driving individuals to seek out payday loans that accept Netspend accounts, often without requiring a credit check. This trend highlights a growing reliance on high-interest, short-term loans among those with limited financial options.

This article explores the availability of these loans, the risks involved, and the alternatives borrowers should consider before committing to such arrangements. The focus remains on providing factual information to help individuals make informed decisions.

The Allure of No Credit Check Payday Loans

Payday loans that bypass traditional credit checks are increasingly popular, particularly among those with poor or nonexistent credit histories. These loans offer a quick infusion of cash, often deposited directly onto a Netspend prepaid debit card.

The appeal lies in the speed and accessibility; however, this convenience comes at a steep price. Interest rates and fees associated with these loans can be exorbitant, trapping borrowers in a cycle of debt.

What is a Netspend Account?

Netspend provides prepaid debit cards that function similarly to bank accounts. Users can load funds onto the card via direct deposit, cash, or other methods.

This makes it an attractive option for individuals who may not have access to traditional banking services. Netspend cards are widely accepted, allowing users to make purchases online and in stores.

Finding Payday Loans Accepting Netspend

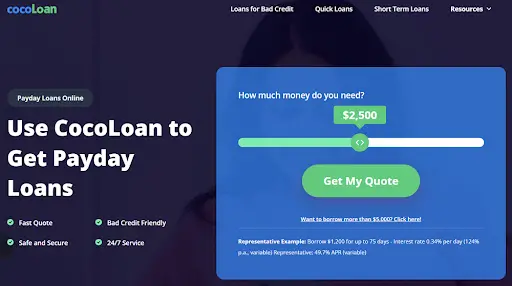

Numerous online lenders advertise payday loans that accept Netspend accounts. These lenders often market themselves as providing "fast cash" and "guaranteed approval," even without a credit check.

However, potential borrowers should exercise extreme caution. Not all lenders are reputable, and some may engage in predatory lending practices.

The Risks of Payday Loans

The primary risk associated with payday loans is the high cost of borrowing. Annual Percentage Rates (APRs) can often exceed 300% or even 400%.

This means that a borrower taking out a $200 loan could end up owing significantly more within a short period. Failure to repay the loan on time can result in additional fees and penalties, further escalating the debt.

Another risk is the potential for debt cycles. Many borrowers find themselves unable to repay the loan on the due date and are forced to roll it over, incurring even more charges.

Alternatives to Payday Loans

Before resorting to payday loans, borrowers should explore alternative options. These may include seeking assistance from local charities or social service organizations.

Credit counseling agencies can provide guidance on managing debt and developing a budget. Personal loans from credit unions or banks, even with less-than-perfect credit, may offer more favorable terms.

Consider asking family or friends for assistance, even though it might be a difficult discussion to have. Sometimes, a short-term fix is better than a long-term debt.

The Regulatory Landscape

The regulation of payday loans varies by state. Some states have strict laws that cap interest rates and limit loan amounts, while others have more lenient regulations.

The Consumer Financial Protection Bureau (CFPB) has taken steps to regulate the payday loan industry, but the effectiveness of these regulations remains a subject of debate.

Real-World Examples and Borrower Experiences

Numerous stories illustrate the dangers of payday loans. Borrowers often report feeling trapped by high interest rates and aggressive collection tactics.

Some have even faced legal action due to their inability to repay the loans. It's imperative to learn from their struggles before taking out these types of loans.

Example: John Doe, a construction worker, took out a $300 payday loan with Netspend when his car broke down. Within weeks, the loan had ballooned to over $600, and he struggled to make ends meet.

The Future of Payday Lending with Netspend

The demand for quick access to cash is likely to persist, ensuring the continued availability of payday loans accepting Netspend. Technological advancements may further streamline the loan application process.

The emphasis must be on consumer education and responsible lending practices. Borrowers need access to clear and concise information about the risks involved, and lenders must be held accountable for their actions.

Conclusion: Proceed with Extreme Caution

Payday loans that accept Netspend accounts without credit checks offer a tempting solution for short-term financial needs, but they carry significant risks. Before considering such a loan, explore all available alternatives and carefully weigh the costs involved.

Stay informed about changes in regulations and be wary of lenders promising "guaranteed approval." Take steps to improve your credit score and build a savings cushion to avoid relying on high-interest loans in the future.

![Payday Loans That Accept Netspend Accounts No Credit Check 1 Hour Payday Loans No Credit Check | [year] Guide](https://avocadoughtoast.com/wp-content/uploads/2022/02/1-Hour-Payday-Loans-No-Credit-Check.png)