Period Costs For A Manufacturing Company Flow Directly To

The seemingly mundane world of manufacturing accounting has recently become the focus of increased scrutiny, with a renewed emphasis on the treatment of period costs. A growing debate centers around the implications of directly allocating these costs, which are not directly tied to the production process, to the income statement.

This accounting practice, while standard, is drawing attention due to its impact on a company's reported profitability and potential long-term investment decisions.

Understanding Period Costs: A Refresher

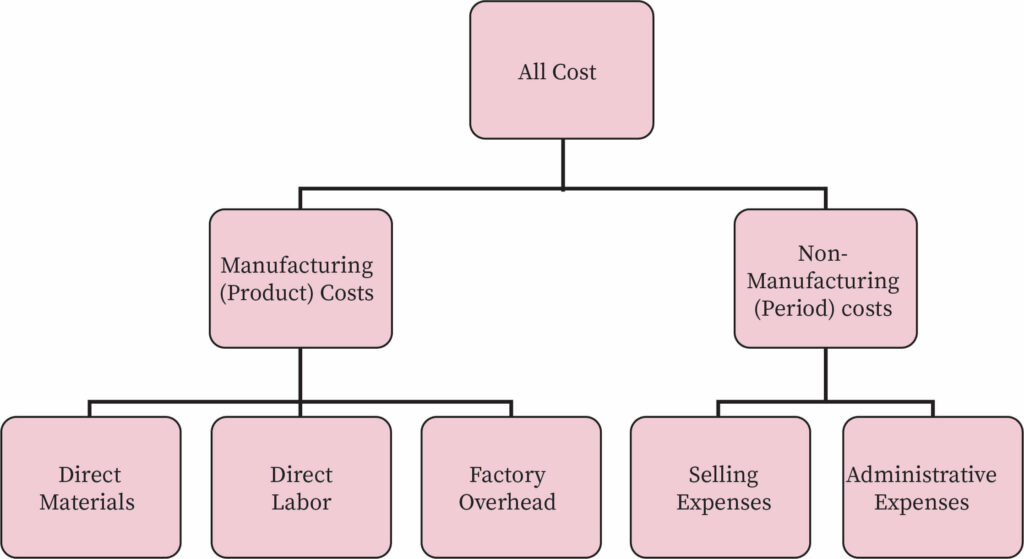

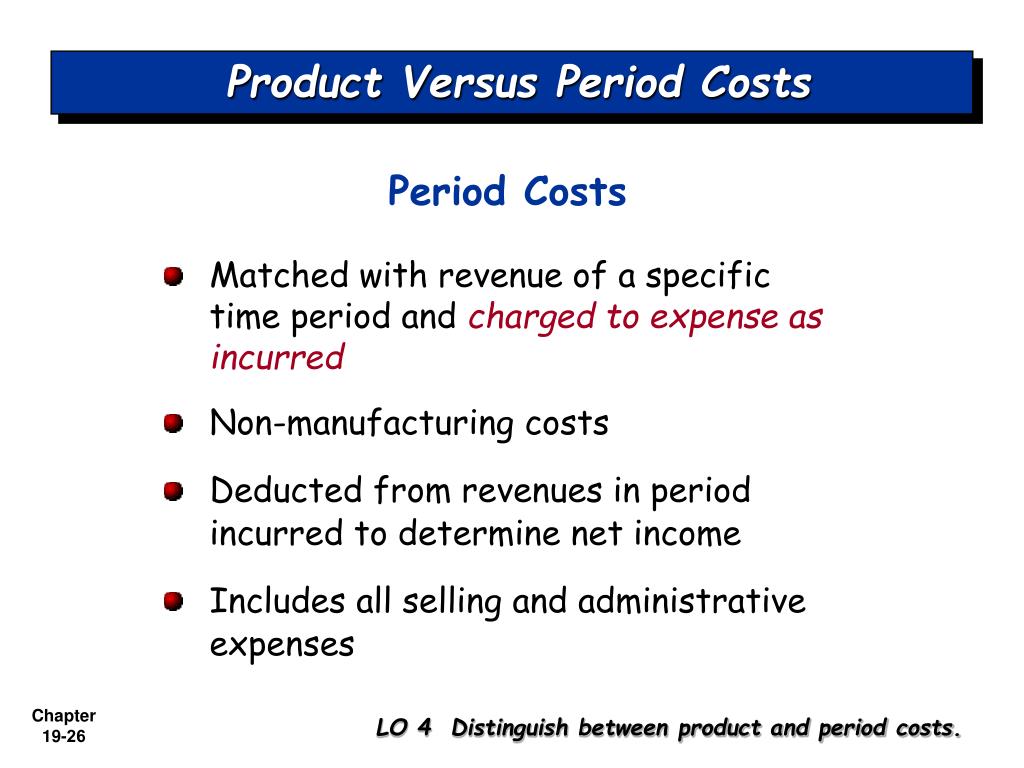

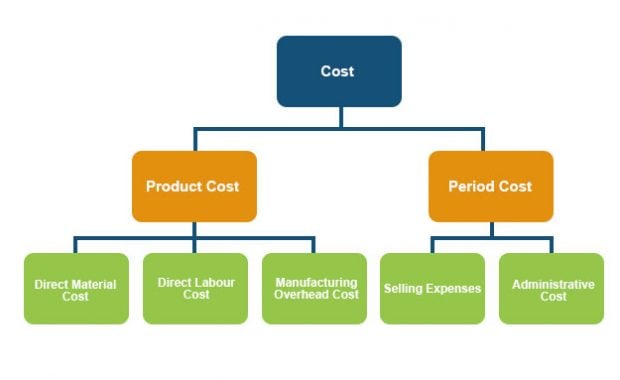

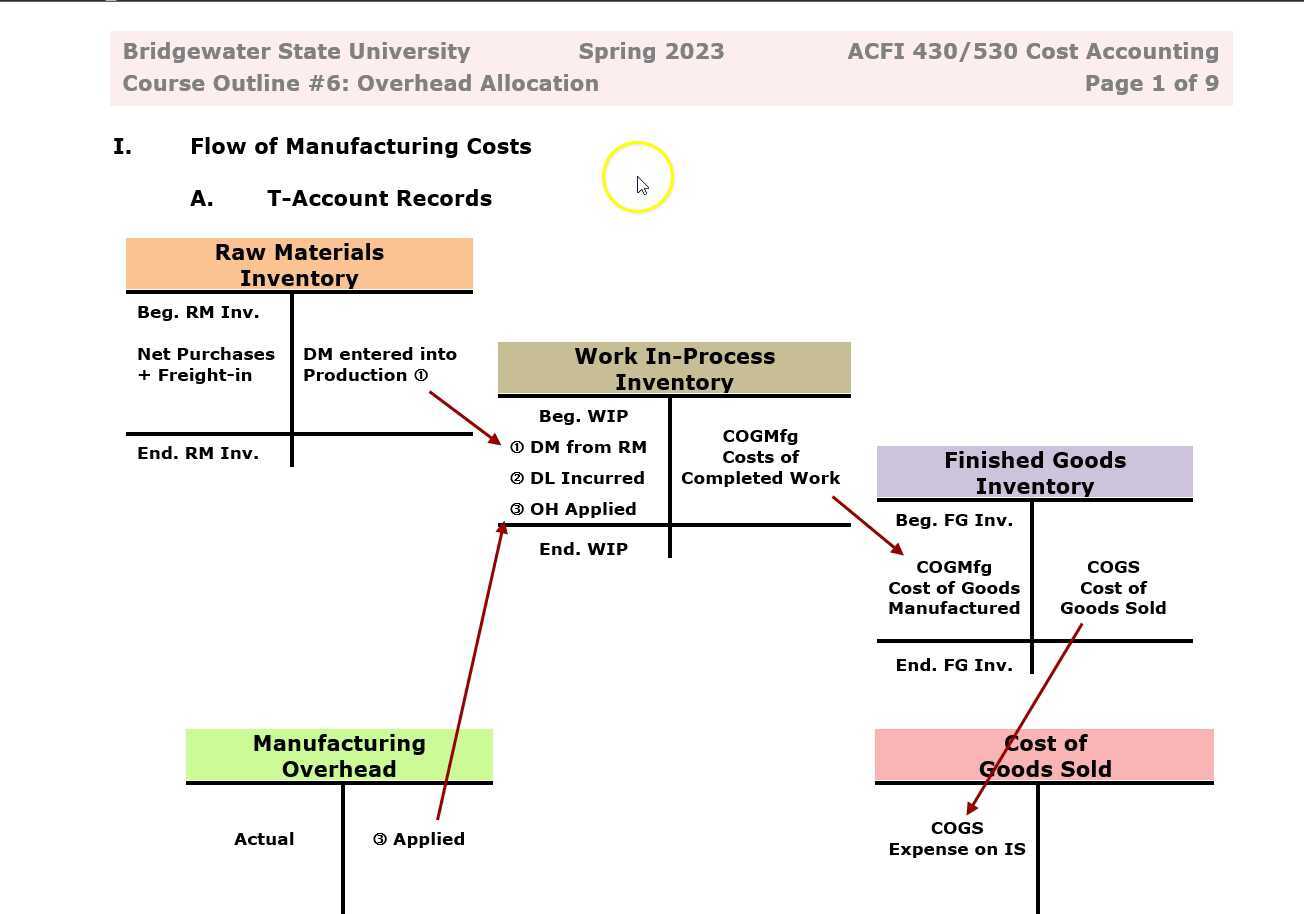

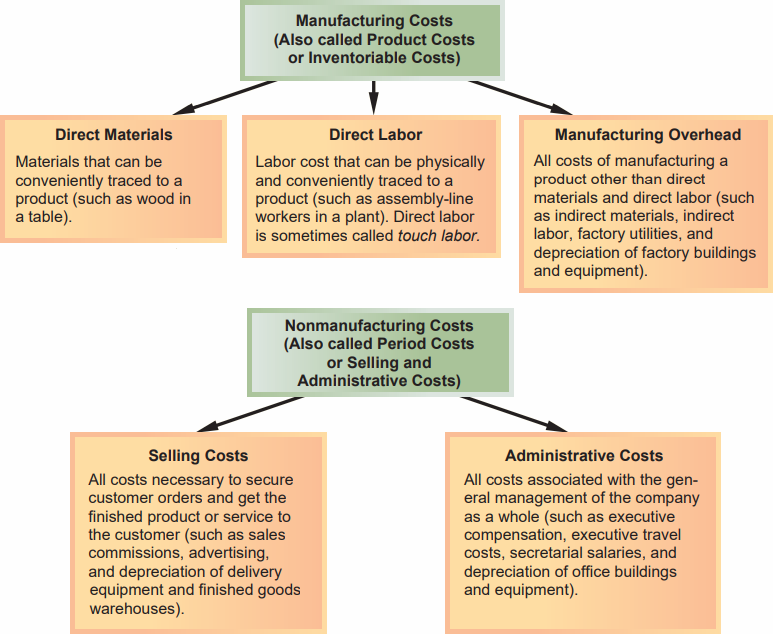

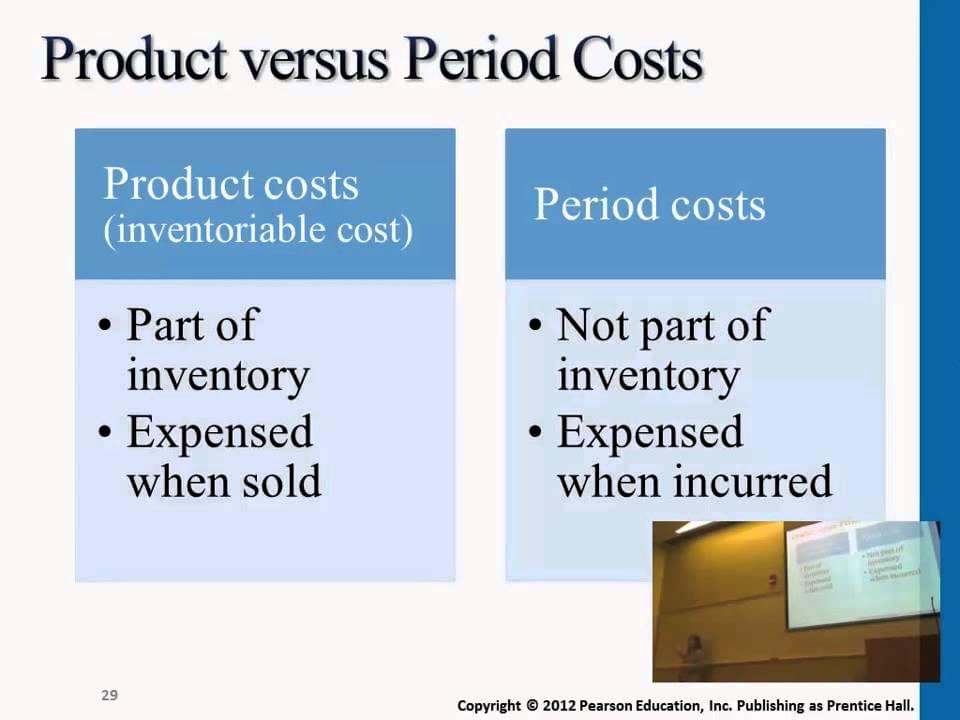

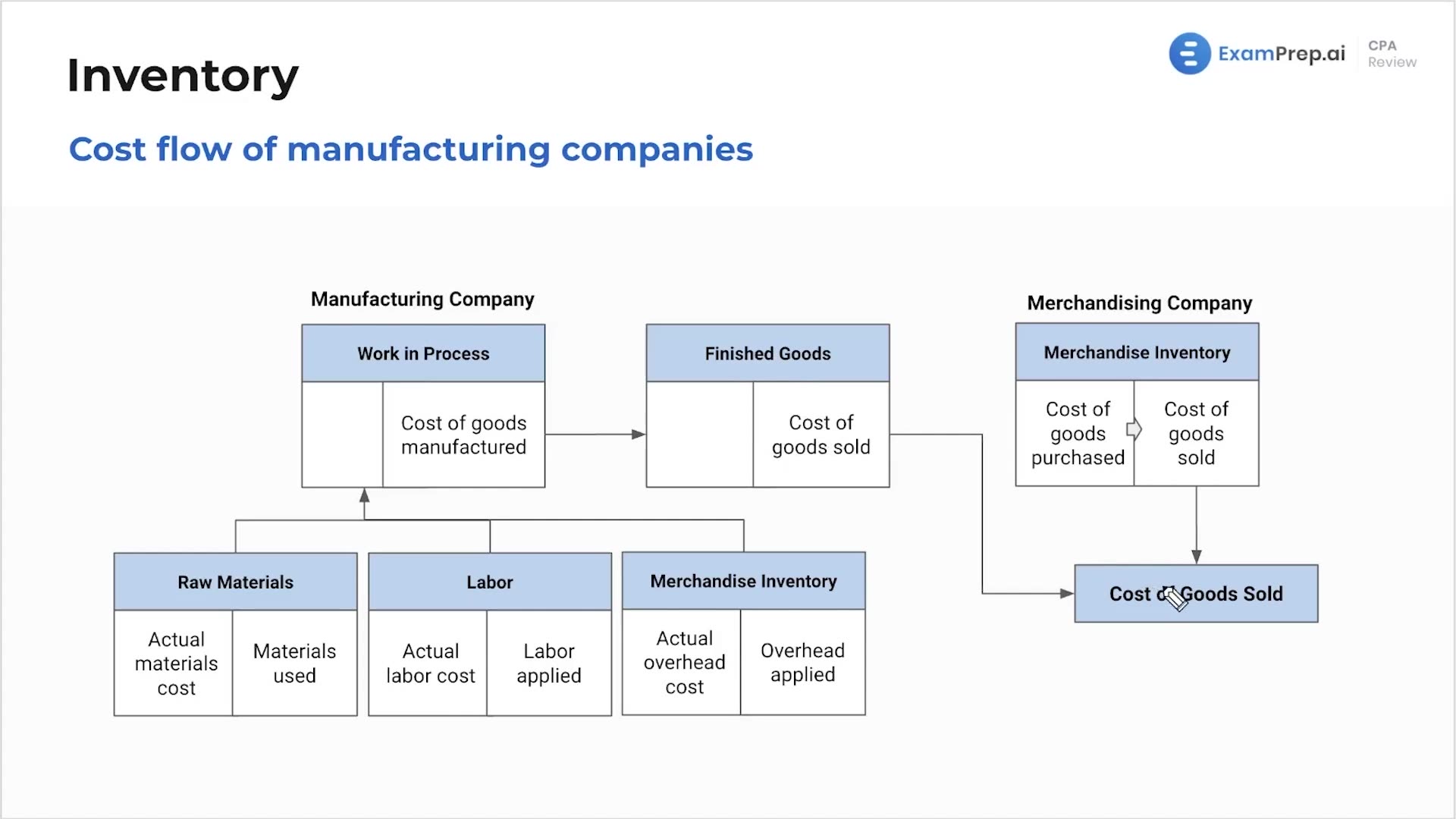

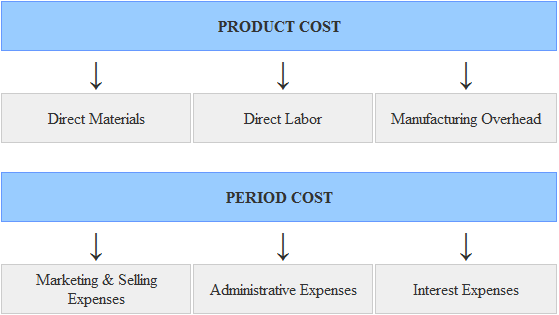

Period costs, in manufacturing, encompass expenses that are not directly linked to the creation of a product. They are generally administrative or selling expenses.

Examples include rent for administrative offices, salaries of sales personnel, marketing expenses, and research and development costs. Unlike product costs, which are capitalized into inventory until the goods are sold, period costs are expensed in the period they are incurred.

The Direct Allocation Controversy

The established accounting principle dictates that period costs flow directly to the income statement as expenses. This means they immediately reduce a company's reported profit for that period.

Some industry analysts and financial professionals are questioning the long-term consequences of this approach, particularly in industries reliant on innovation and long-term growth.

The central argument revolves around whether expensing these costs immediately accurately reflects the potential future benefits they might generate. For instance, a significant investment in research and development might not yield immediate profits, but it could lead to breakthrough products and substantial revenue growth in the future.

"The current system can sometimes discourage companies from making necessary long-term investments because it negatively impacts their short-term profitability metrics," says Dr. Emily Carter, a professor of accounting at the University of California, Berkeley. "This can create a short-sighted approach to business management."

Impact on Investment Decisions

Critics argue that the direct expensing of period costs can create a disincentive for companies to invest in activities that are vital for long-term competitiveness. A manufacturer might hesitate to invest heavily in marketing or research if it means a significant decrease in reported profits for the current quarter.

This is particularly relevant in industries characterized by rapid technological advancements and intense competition, where innovation is crucial for survival.

For example, a pharmaceutical company might delay or reduce funding for a promising drug development program if it fears the immediate negative impact on its earnings per share.

Alternative Perspectives and Justifications

Despite the concerns, proponents of the current accounting treatment emphasize its simplicity and objectivity. They argue that allocating period costs to future periods would introduce subjectivity and complexity into financial reporting.

The generally accepted accounting principles (GAAP) prioritize conservatism, meaning that companies should avoid overstating their assets and profits. Expensing period costs immediately aligns with this principle.

Furthermore, supporters of the current system argue that investors are sophisticated enough to understand the nature of period costs and their potential long-term benefits. They can analyze a company's financial statements and make informed investment decisions accordingly.

The Role of Financial Regulations

Accounting standards are set by regulatory bodies such as the Financial Accounting Standards Board (FASB) in the United States and the International Accounting Standards Board (IASB) globally. These boards constantly review and update accounting principles to ensure they remain relevant and accurate.

Any significant change to the treatment of period costs would require a thorough evaluation of its potential impact on financial reporting and investment decisions. It would also require broad consensus among stakeholders, including accountants, auditors, and investors.

The debate surrounding period costs highlights the ongoing tension between providing accurate and timely financial information and encouraging long-term investment and innovation.

A Case Study: The Automotive Industry

The automotive industry provides a compelling example of the challenges associated with expensing period costs. Automakers invest heavily in research and development to create new models and technologies.

These investments, which are typically treated as period costs, might not generate revenue for several years. This can make it difficult for investors to assess the true value of a company's investments in innovation.

However, altering the accounting treatment could open the door to companies manipulating earnings by inappropriately capitalizing expenses.

Looking Ahead

The discussion on period costs is likely to continue as the business landscape evolves and companies face increasing pressure to innovate and compete globally. While no immediate changes to accounting standards are anticipated, the ongoing debate underscores the importance of carefully considering the impact of accounting practices on investment decisions.

Ultimately, a balance must be struck between providing transparent financial reporting and fostering an environment that encourages long-term growth and innovation. This requires a collaborative effort among regulators, accountants, and business leaders.