Personal Finance For Small Business Owners

The lifeblood of the American economy, small businesses, are facing an increasingly complex financial landscape. Navigating the intricacies of personal and business finance is no longer a luxury, but a necessity for survival and sustainable growth.

Mismanagement in this area can quickly lead to business failure, loss of personal assets, and significant financial stress for the owner. Understanding and implementing sound financial strategies is paramount to building a thriving and resilient enterprise.

This article delves into the critical aspects of personal finance for small business owners. It will explore strategies for separating personal and business finances, managing cash flow, securing funding, and planning for the future. We'll provide actionable insights, leveraging expert advice and data-driven insights to empower small business owners to take control of their financial destiny.

Separating Personal and Business Finances

One of the most crucial steps a small business owner can take is establishing a clear separation between personal and business finances. This includes opening a separate business bank account and obtaining a business credit card.

According to the Small Business Administration (SBA), commingling funds can lead to significant accounting challenges and potential legal liabilities. Furthermore, it complicates tax filings and makes it difficult to track business performance accurately.

A separate business entity, such as an LLC or S-corp, provides an additional layer of protection for personal assets from business debts and lawsuits. The IRS provides detailed guidelines on establishing and maintaining these business structures.

Mastering Cash Flow Management

Cash flow is the lifeblood of any small business. Consistent monitoring and proactive management are essential to ensure sufficient liquidity for day-to-day operations and future investments.

Develop a comprehensive cash flow projection that forecasts income and expenses over a specific period. Regularly review and update this projection to identify potential shortfalls and take corrective action, such as negotiating payment terms with suppliers or increasing sales efforts.

Consider using accounting software like QuickBooks or Xero to automate financial tracking and generate real-time cash flow reports. Efficient invoice management and timely collection of receivables are also crucial for maintaining healthy cash flow.

Securing Funding and Managing Debt

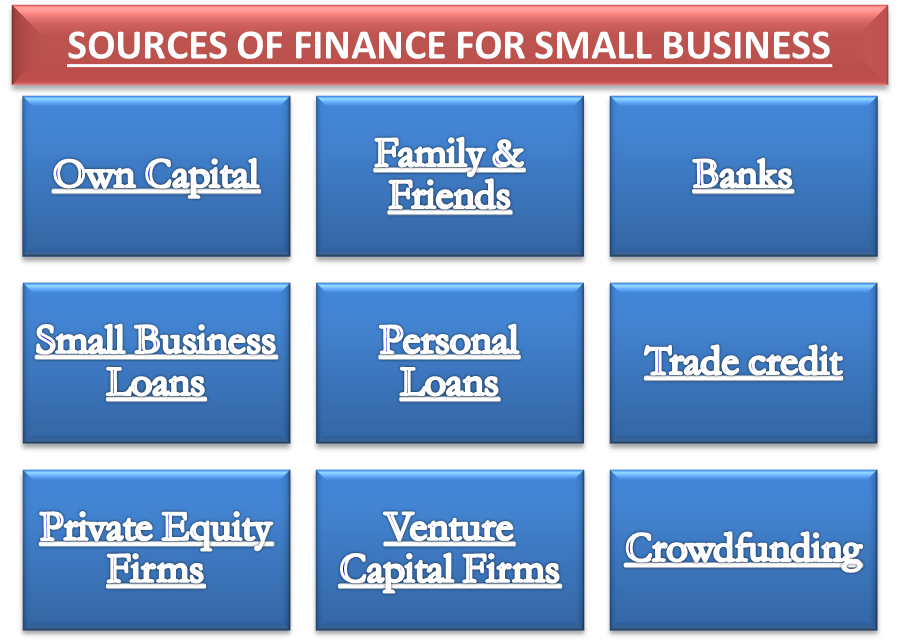

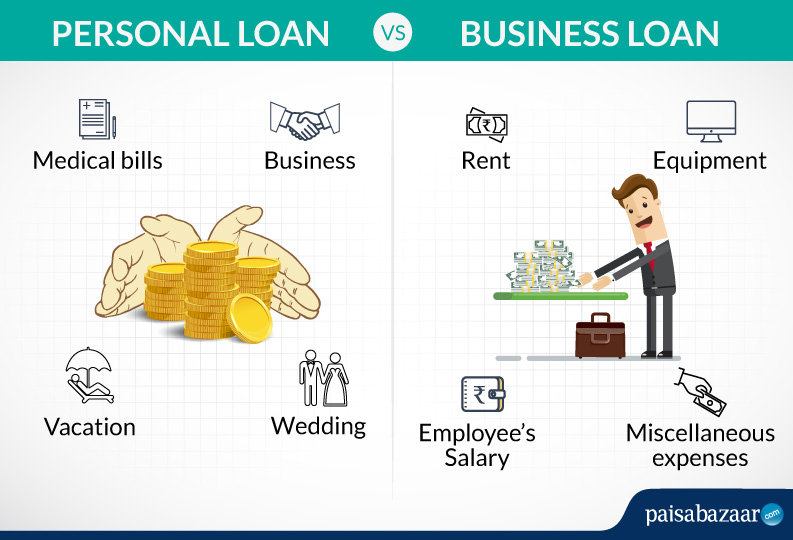

Access to capital is often a significant hurdle for small business owners. Understanding various funding options and managing debt responsibly are vital for growth and sustainability.

Explore traditional bank loans, SBA loans, and alternative funding sources such as crowdfunding and venture capital. According to a Federal Reserve report, small businesses often face challenges in securing traditional financing due to limited credit history or collateral.

Carefully evaluate the terms and conditions of any loan agreement, including interest rates, repayment schedules, and potential penalties. Avoid over-leveraging the business and maintain a healthy debt-to-equity ratio.

"Debt is a tool, not a burden, when used strategically to fuel growth and generate a return on investment," emphasizes Maria Contreras-Sweet, former Administrator of the SBA.

Planning for the Future: Retirement and Succession

Small business owners often prioritize their business over their personal financial planning. However, planning for retirement and succession is crucial for long-term financial security and business continuity.

Consider establishing a retirement plan, such as a SEP IRA or Solo 401(k), to save for retirement while also potentially reducing taxable income. Consult with a financial advisor to determine the most appropriate retirement plan based on individual circumstances and business needs.

Develop a succession plan that outlines how the business will be transferred to new ownership or management. This ensures a smooth transition and protects the value of the business for future generations. A well-defined succession plan also ensures personal financial security for the owner post-retirement.

The Human Element: Stress and Well-being

The financial pressures of running a small business can take a toll on the owner's personal well-being. Managing stress and maintaining a healthy work-life balance are essential for long-term success.

Seek support from mentors, peers, and professional advisors. Prioritize self-care activities, such as exercise, meditation, and spending time with loved ones. Remember that taking care of yourself is not a luxury, but a necessity for effective leadership and sound decision-making.

Mental health is crucial. Do not hesitate to seek professional help if you find yourself struggling with the stress and anxiety associated with running a small business.

In conclusion, mastering personal finance is an ongoing process for small business owners. By prioritizing financial literacy, implementing sound financial strategies, and seeking professional guidance, entrepreneurs can navigate the challenges and build a thriving and sustainable enterprise, ensuring both business success and personal financial security.