Personal Financial Statement Business Owners

:max_bytes(150000):strip_icc()/Screenshot3-869320d427024c9aadf078b3bb224174.png)

Business owners, time is running out. Secure your financial future by mastering the Personal Financial Statement (PFS) before year-end.

This document is vital for securing loans, attracting investors, and making informed business decisions. Ignoring it puts your business at risk.

What is a Personal Financial Statement?

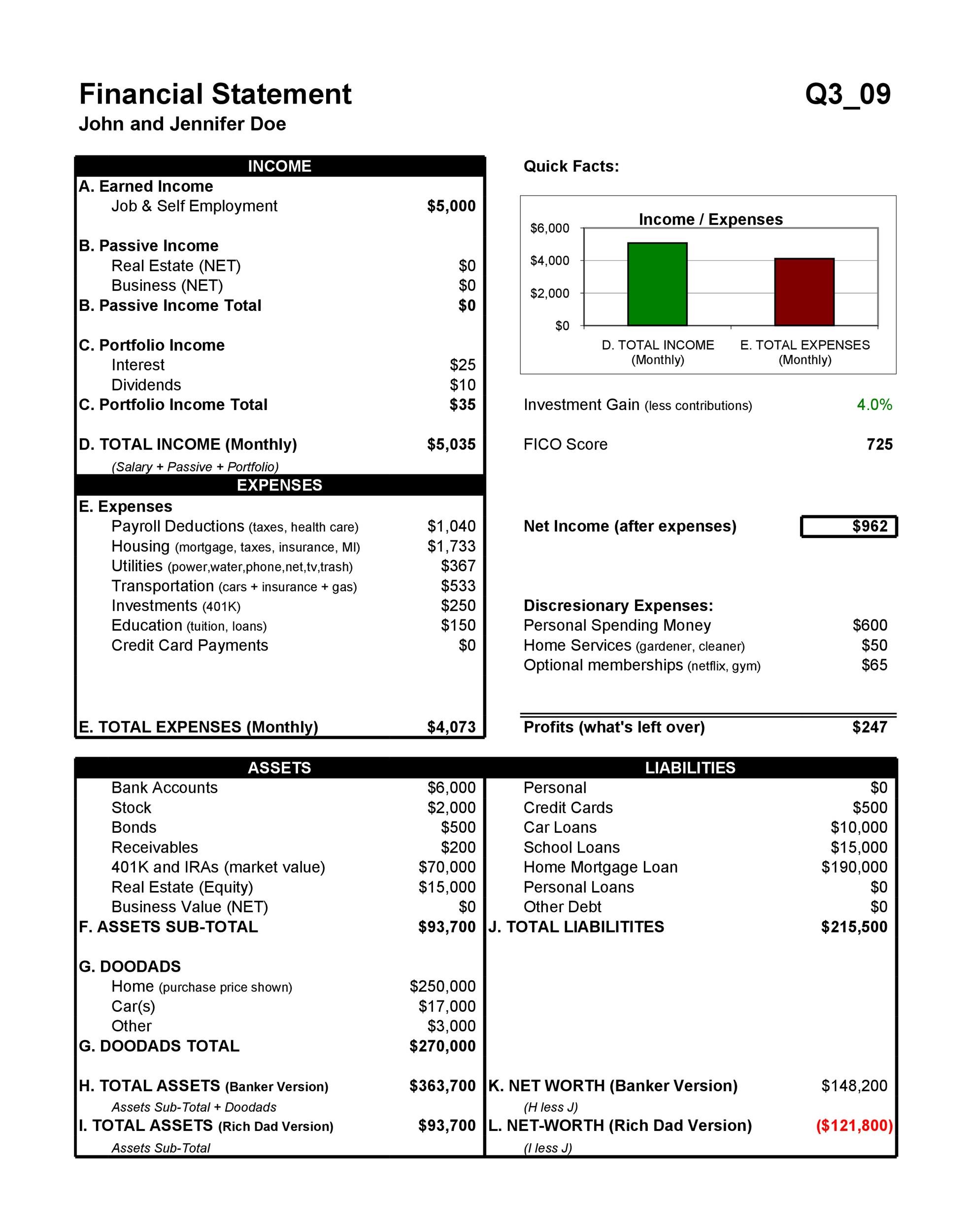

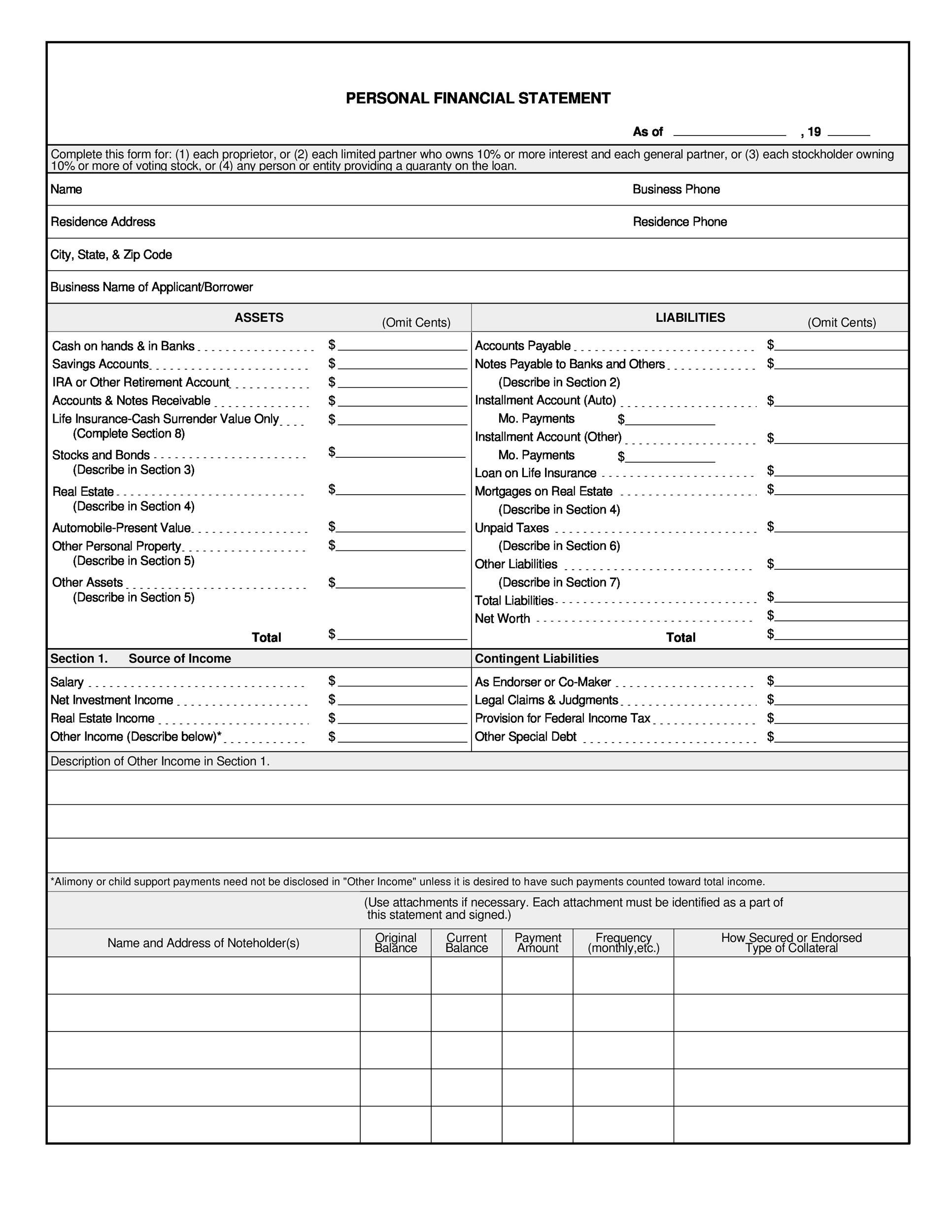

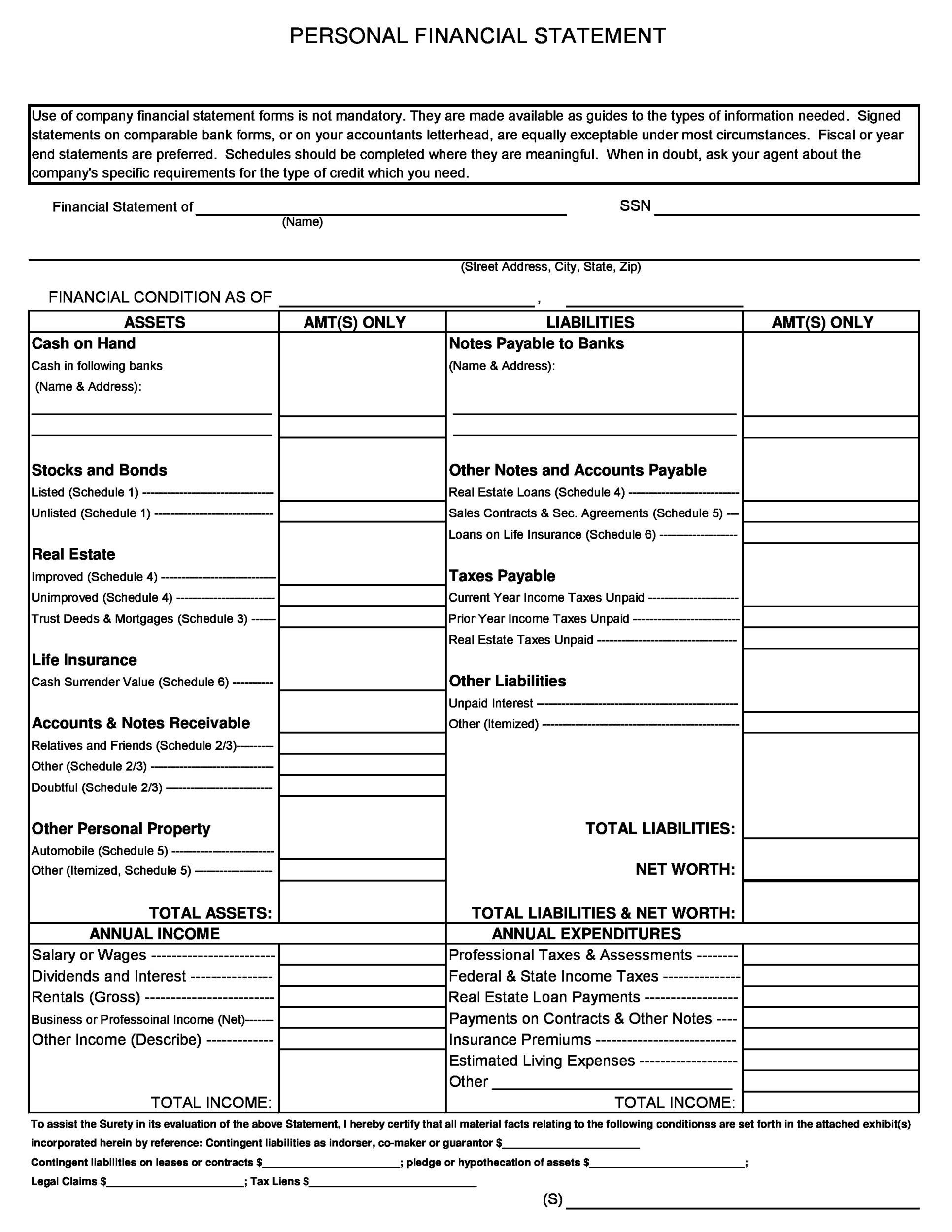

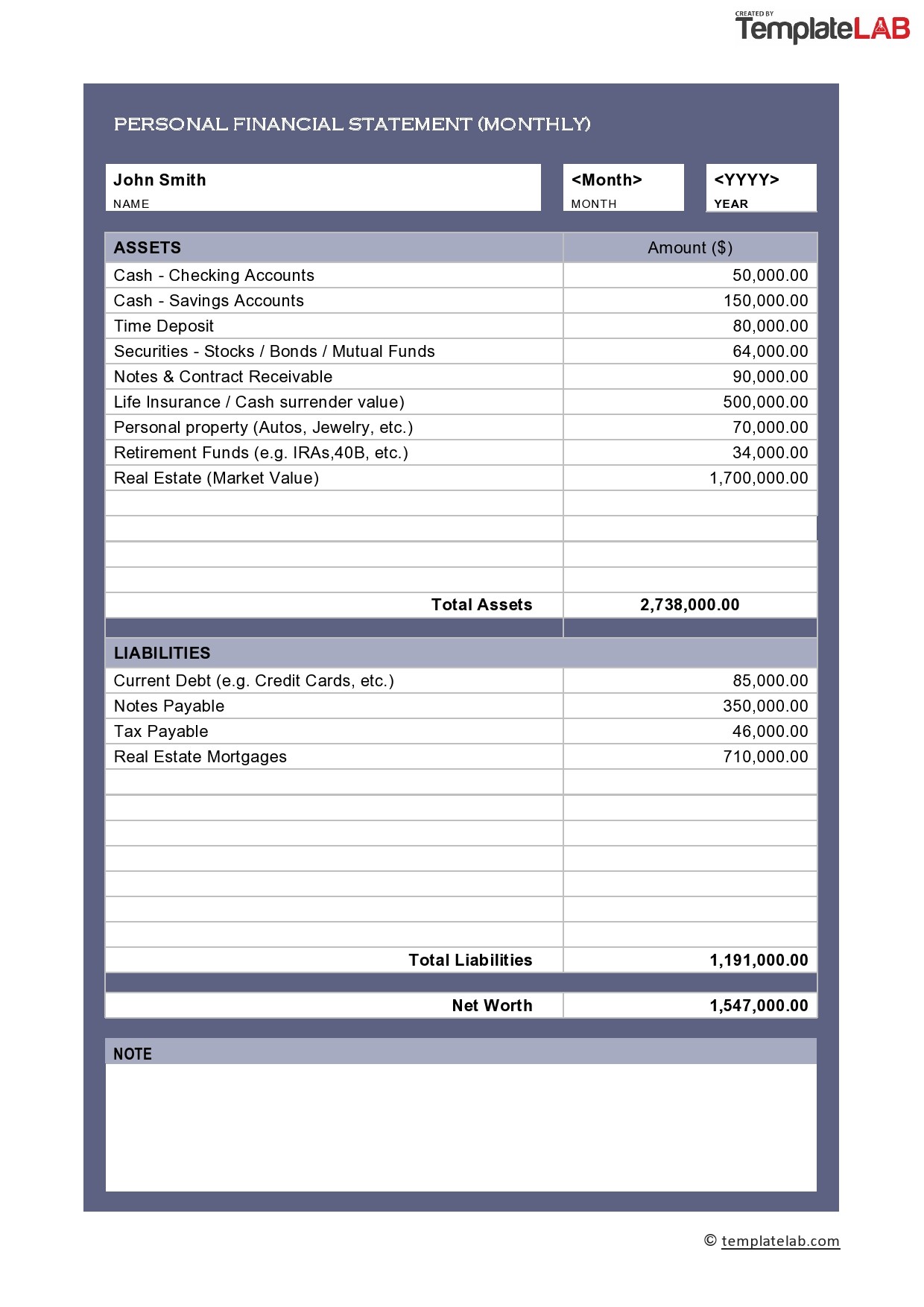

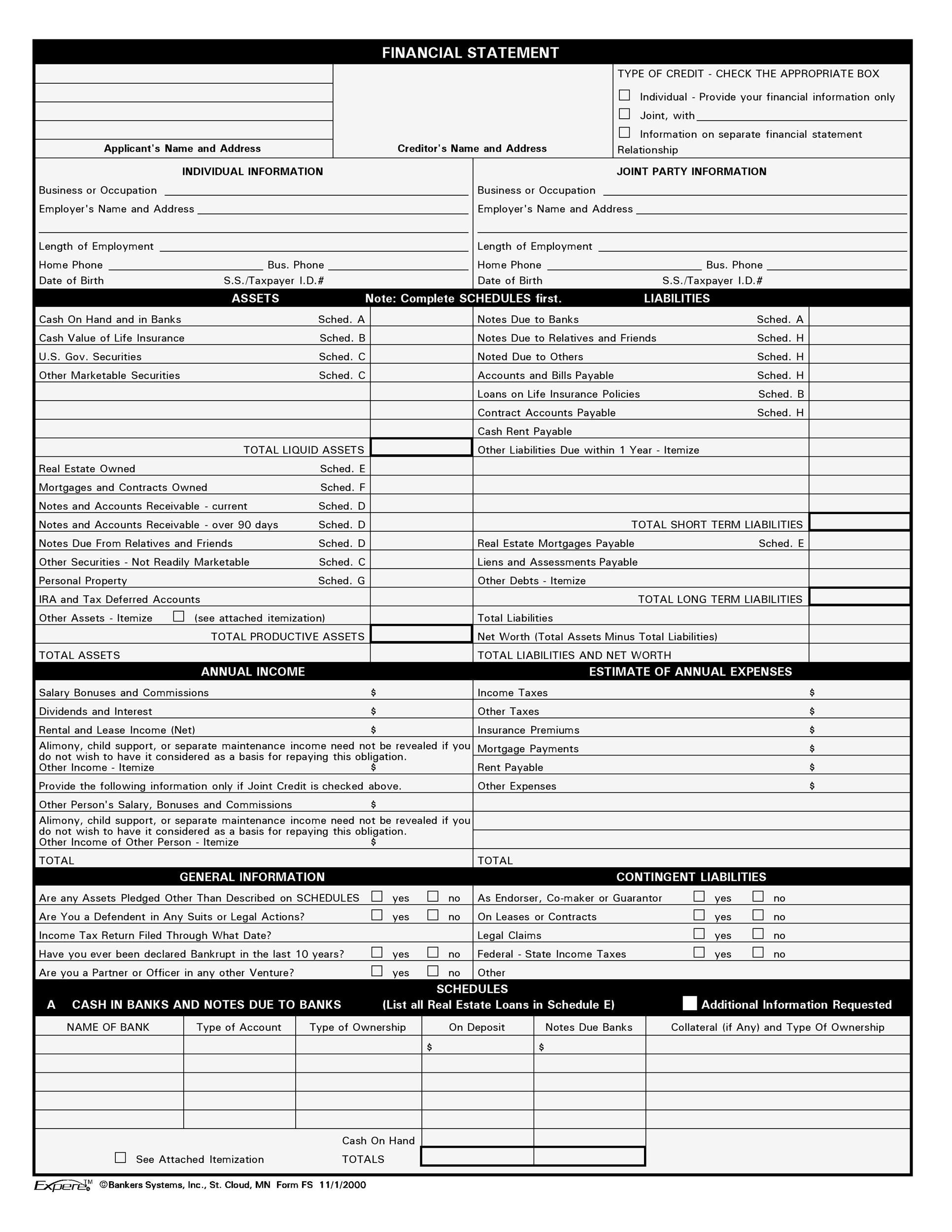

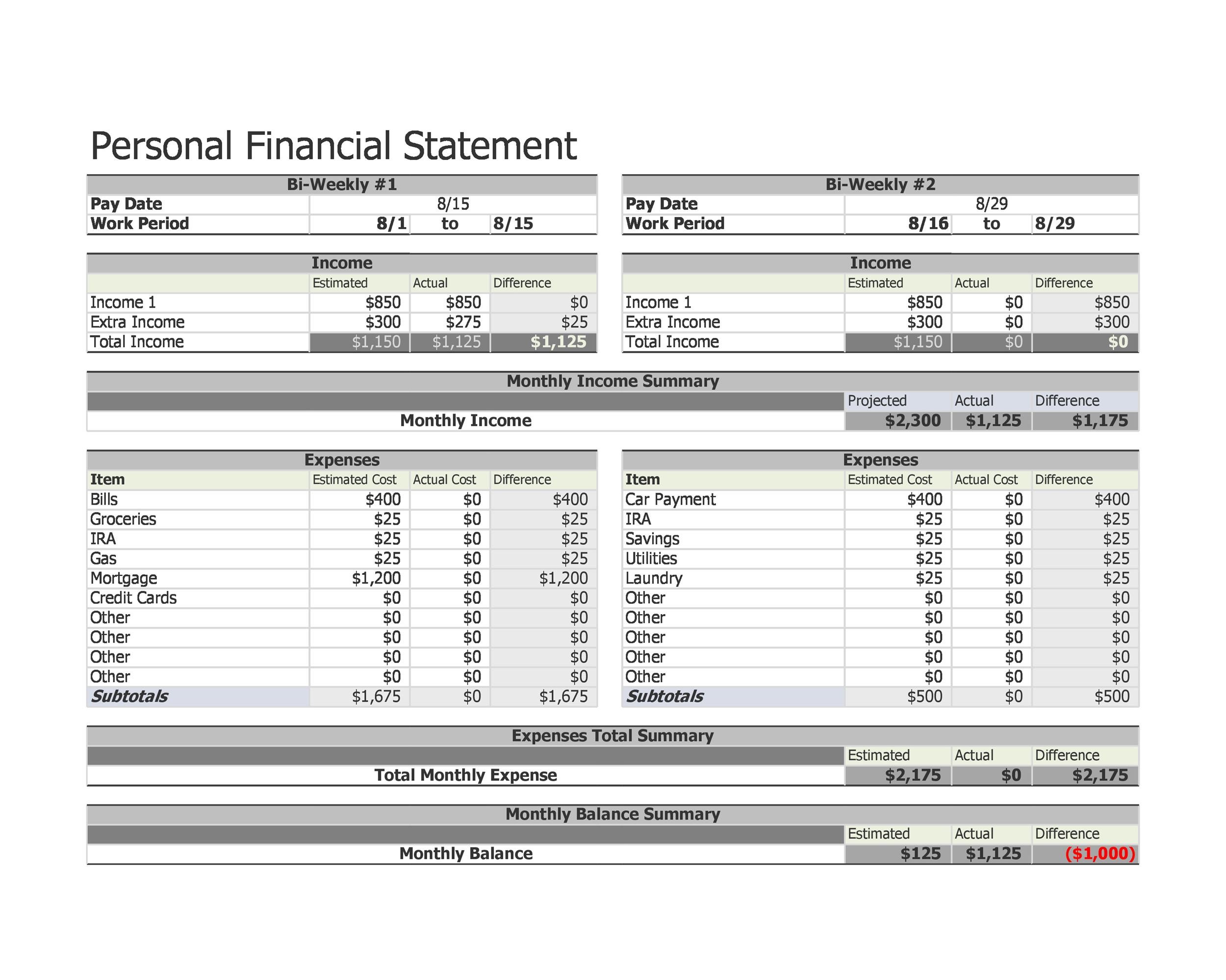

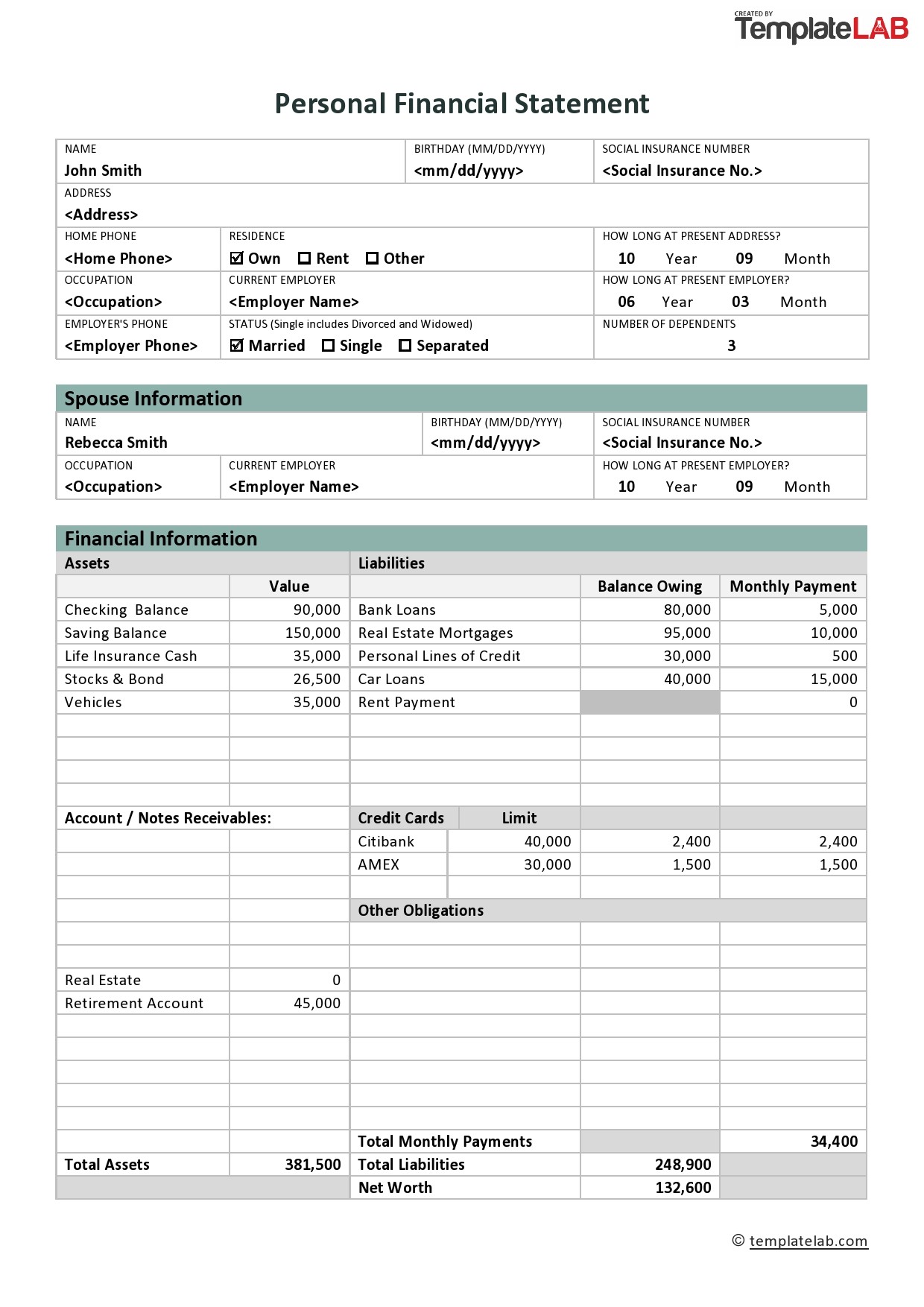

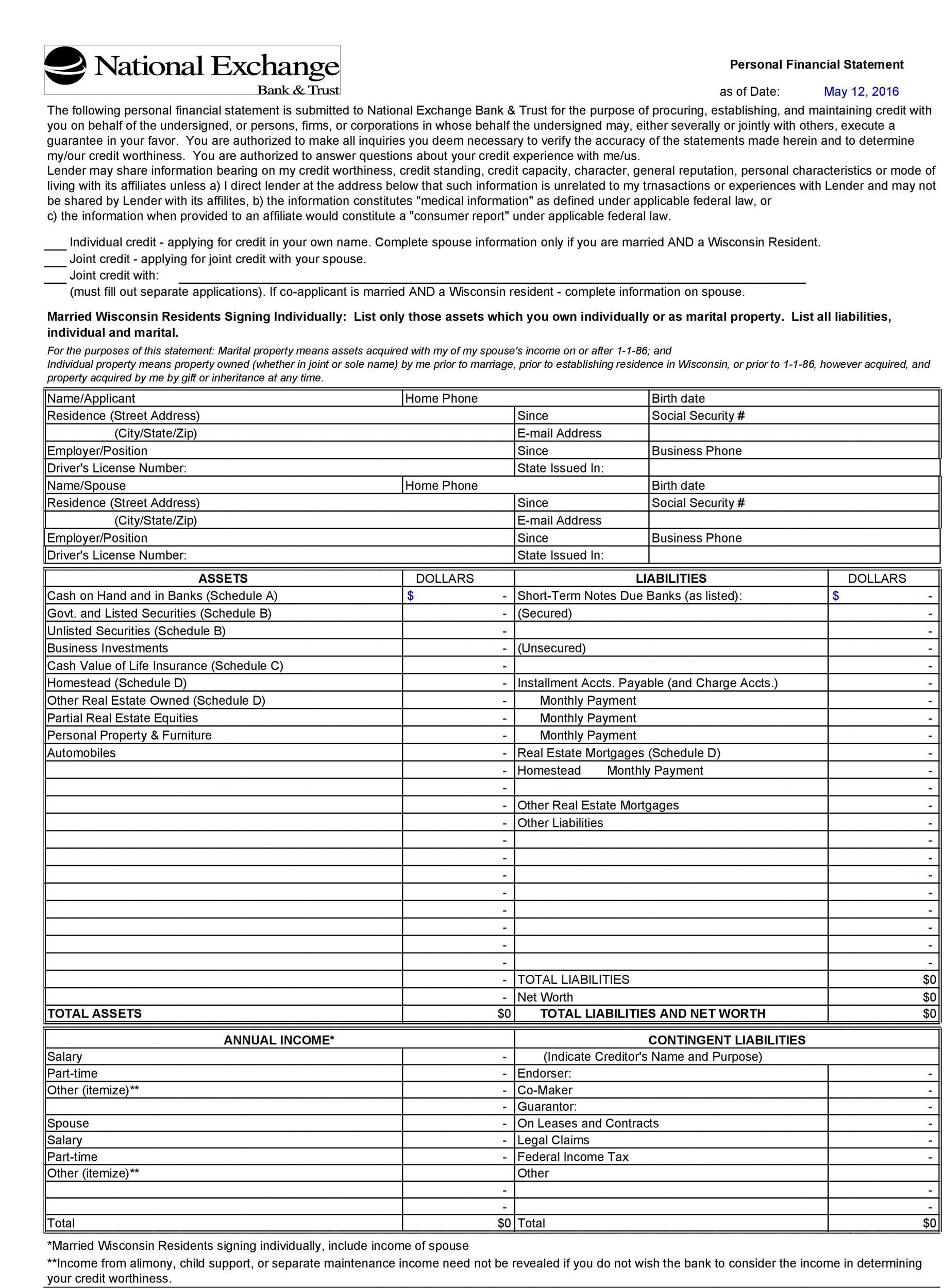

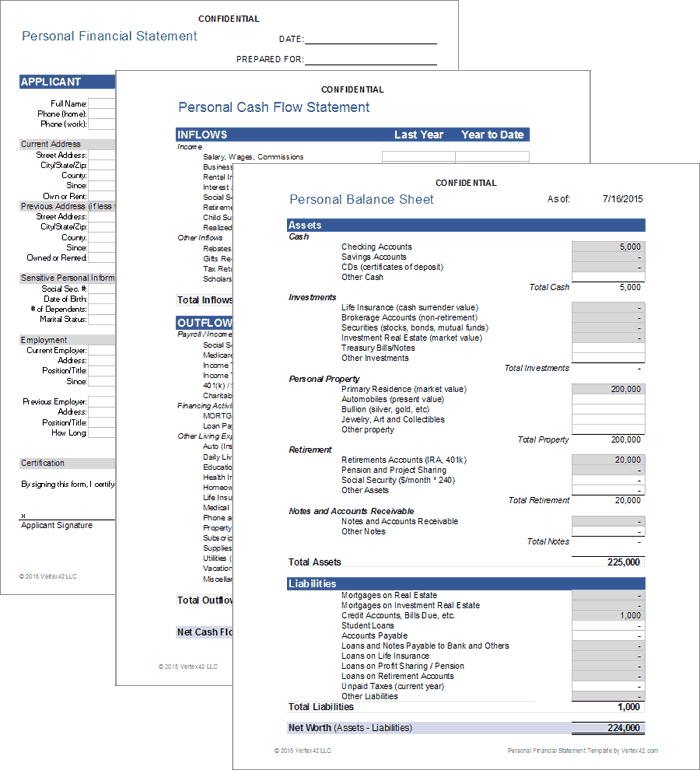

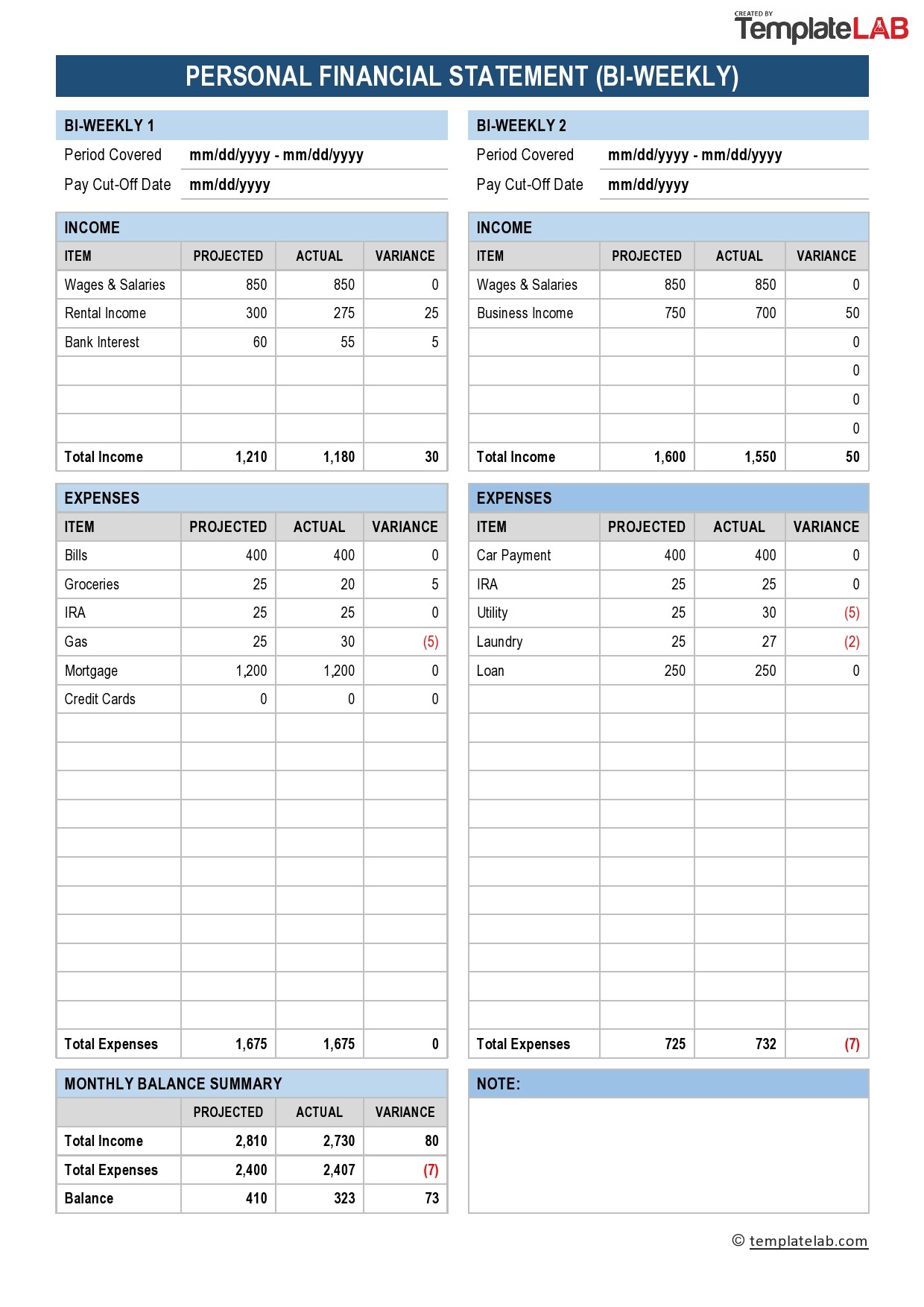

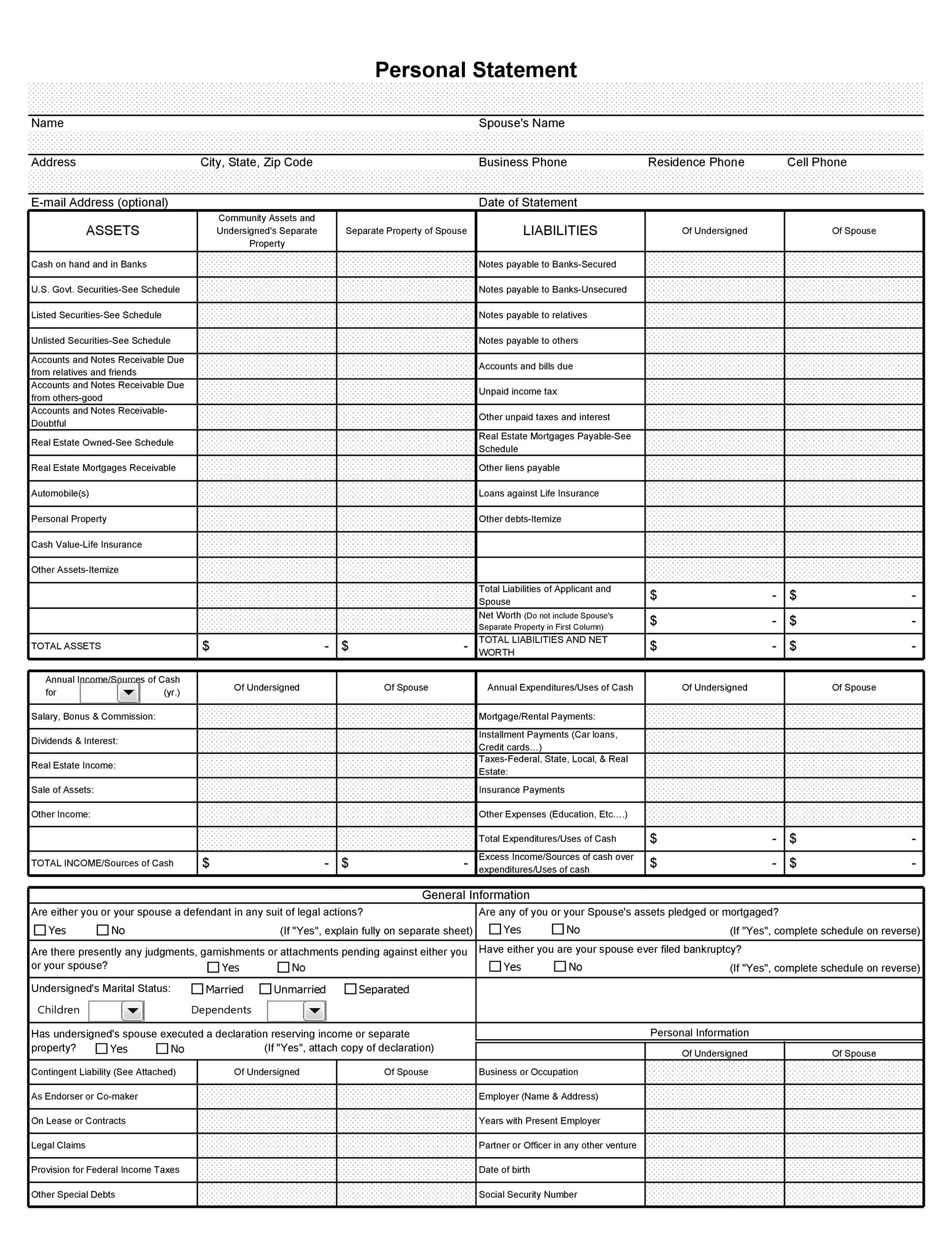

A PFS is a snapshot of your personal financial health. It outlines your assets, liabilities, and net worth.

Banks and investors scrutinize it to assess your creditworthiness and ability to repay debts or contribute capital.

It's your financial resume – demonstrating your financial stability and trustworthiness.

Essential Components of Your PFS

Your PFS must include a comprehensive list of assets. Think cash, investments, real estate, and ownership stakes in your business.

Don't forget to list all liabilities such as loans, mortgages, and credit card debt.

Calculate your net worth by subtracting total liabilities from total assets. A positive net worth signifies financial stability.

Why Business Owners Need a Strong PFS

Many lenders require a PFS to evaluate your personal financial backing for business loans. This is especially true for startups and small businesses.

A weak PFS can lead to loan denial or unfavorable terms. This could hinder your business growth or even survival.

A strong PFS can also attract potential investors who want assurance of your financial commitment to the business.

Common Mistakes to Avoid

Overvaluing assets is a frequent mistake. Be realistic and use fair market values.

Underreporting liabilities can also backfire. Disclose all debts honestly.

Neglecting to update your PFS regularly renders it useless. Keep it current with any significant financial changes.

Expert Advice for a Winning PFS

Seek guidance from a qualified financial advisor. They can help you prepare an accurate and compelling statement.

Document everything thoroughly. Back up your asset values with appraisals or statements.

Be proactive in addressing any financial weaknesses. Develop a plan to improve your credit score or reduce debt.

Where to Find Resources and Templates

Numerous online resources offer PFS templates and guidance. Look to reputable financial institutions and business organizations.

Consider using financial software to streamline the process. These tools can help you track your assets, liabilities, and net worth.

The Small Business Administration (SBA) offers valuable resources and workshops for business owners.

Urgent Action Needed: Secure Your Business Future Now

Don't wait until the last minute to prepare your PFS. Lenders are seeing a rise in incomplete or inaccurate personal statements.

Start gathering your financial documents and seeking professional advice today. Your business depends on it.

Improve your financial documentation to ensure the future of your business in a turbulent economy.

Next Steps and Ongoing Developments

Schedule a meeting with your accountant or financial advisor to review your PFS. Make any necessary adjustments.

Monitor your credit report regularly for accuracy. Dispute any errors immediately.

Stay informed about changes in lending requirements. These can impact your ability to secure financing.

Taking control of your personal finances is the best investment you can make in your business.

![Personal Financial Statement Business Owners Free Printable Personal Financial Statement Templates [PDF, Word, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/05/Personal-Financial-Statement-1024x576.jpg)