Personal Loan With 578 Credit Score

Urgent action is needed for individuals with a 578 credit score seeking personal loans. Options exist, but borrowers must act swiftly and strategically to secure favorable terms amidst tightening lending conditions.

This article details strategies for obtaining personal loans with a 578 credit score, a crucial piece of information for those currently navigating financial challenges and in need of immediate funding.

Understanding the Landscape

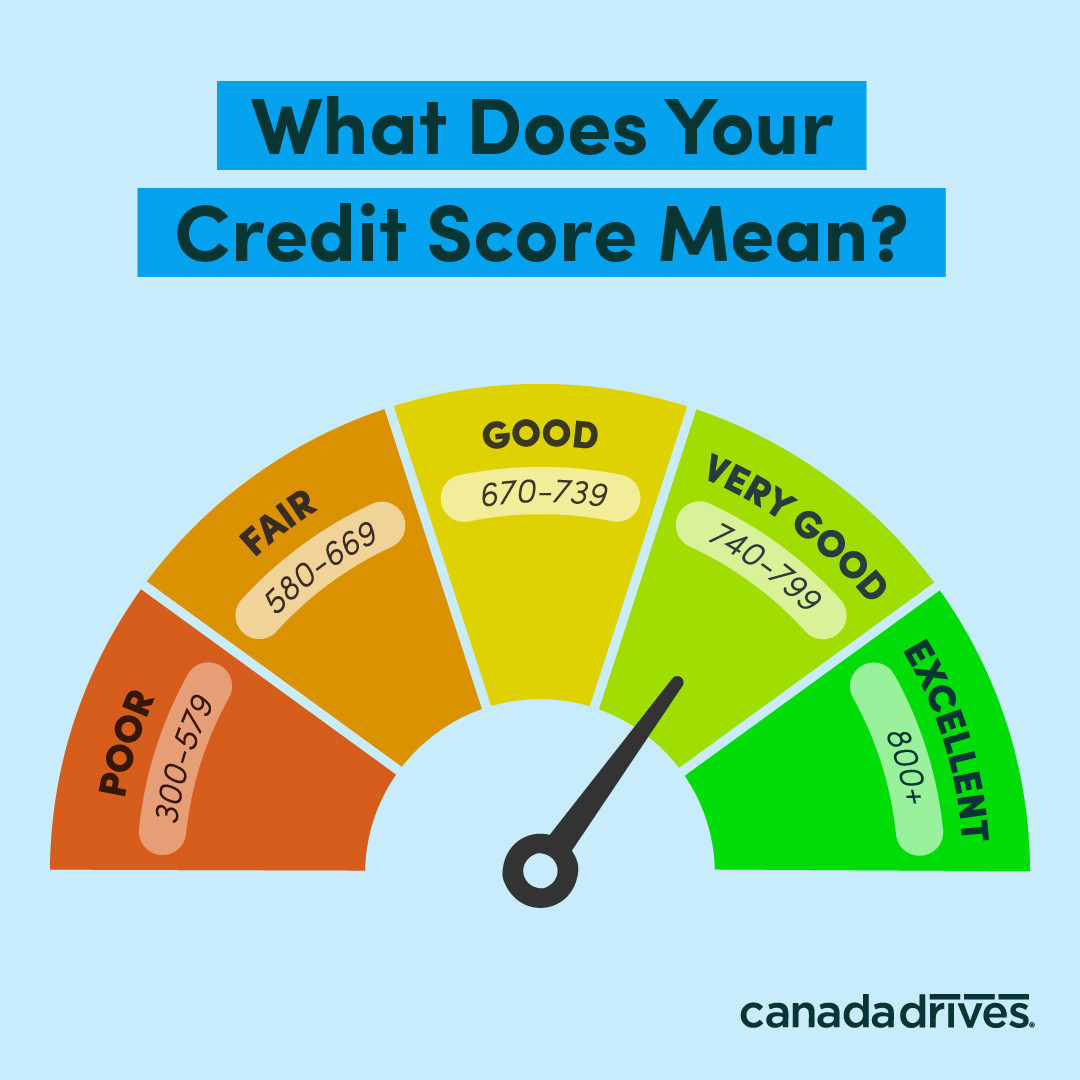

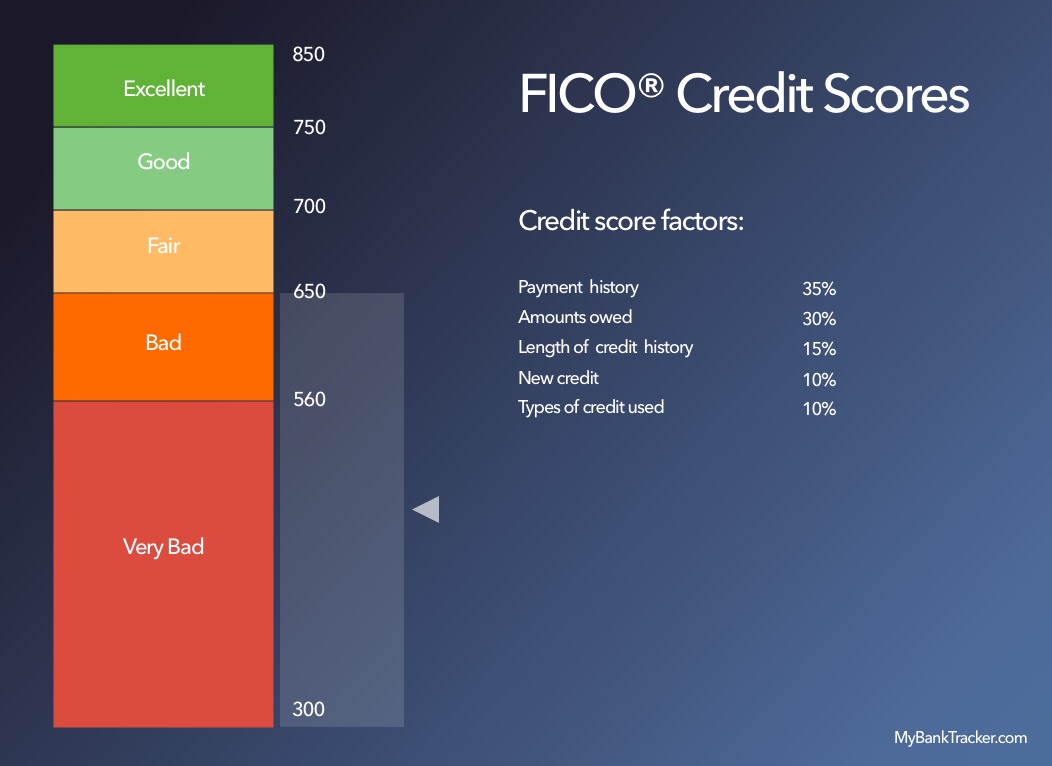

A 578 credit score falls within the "poor" to "fair" range. This significantly limits access to traditional lenders like banks and credit unions.

According to Experian, the average FICO score in the United States is 718, highlighting the challenges faced by those with lower scores.

Interest rates will inevitably be higher, and loan amounts may be smaller.

Where to Look for Loans

Online lenders specializing in subprime lending are a primary option.

These lenders often have more flexible eligibility requirements than traditional institutions.

Credit unions may also offer some possibilities, particularly if you're already a member.

Key Lenders to Consider

While specific recommendations change frequently, research lenders like OppLoans and OneMain Financial.

These companies are known to work with borrowers who have less-than-perfect credit histories. Always compare interest rates and fees.

Read reviews and understand all loan terms before committing.

How to Improve Your Chances

Securing a loan with a 578 credit score requires a proactive approach. Begin by checking your credit report for errors.

Dispute any inaccuracies immediately to potentially improve your score before applying. A small improvement can make a difference.

Demonstrate a stable income and employment history.

The Importance of a Cosigner

Consider applying with a cosigner who has good credit.

A cosigner guarantees the loan, reducing the lender's risk and increasing your approval odds.

Be mindful of the responsibility placed on the cosigner.

Beware of Predatory Lending

Be cautious of lenders offering guaranteed approvals or unusually low rates with little to no credit check.

These may be predatory lenders who charge exorbitant fees and trap borrowers in cycles of debt. According to the Consumer Financial Protection Bureau, understanding all loan terms is critical.

Always research lenders thoroughly and read all fine print.

The Cost of Borrowing

Understand the total cost of the loan, including interest rates, fees, and repayment terms. Use online loan calculators to compare different offers.

Focus on paying down the loan as quickly as possible to minimize the total interest paid. Explore debt consolidation options if applicable.

Prioritize improving your credit score for future borrowing needs.

Next Steps

Act now to assess your credit report and explore available loan options. Compare offers carefully and consider all potential risks.

Consult with a financial advisor to create a personalized debt management plan. Monitor your credit score regularly to track progress.

Ongoing developments in the lending market may present new opportunities. Stay informed to make the best financial decisions.