Pimco Tax Exempt By State 2024

Imagine a sun-drenched California beach, the rhythmic crash of waves a constant lullaby. Now picture a New York City skyscraper piercing the clouds, a symbol of ambition and financial might. These seemingly disparate scenes share a common thread: municipal bonds, quietly working behind the scenes to fund the schools, hospitals, and infrastructure that underpin these vibrant communities. For investors, particularly those focused on tax-advantaged income, understanding the nuances of state-specific municipal bond funds is crucial, especially as we navigate the landscape of 2024.

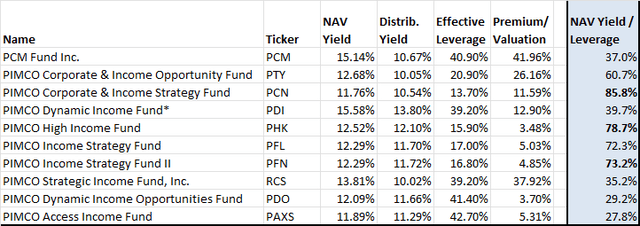

The PIMCO Tax Exempt By State series, a collection of mutual funds, aims to provide investors with income exempt from federal and, in some cases, state and local income taxes. These funds invest primarily in municipal bonds issued by states and municipalities, offering a potentially attractive option for high-net-worth individuals seeking to minimize their tax liabilities. Understanding the performance, strategies, and outlook for these funds in 2024 requires a deep dive into the municipal bond market and PIMCO's approach.

The Allure of Municipal Bonds

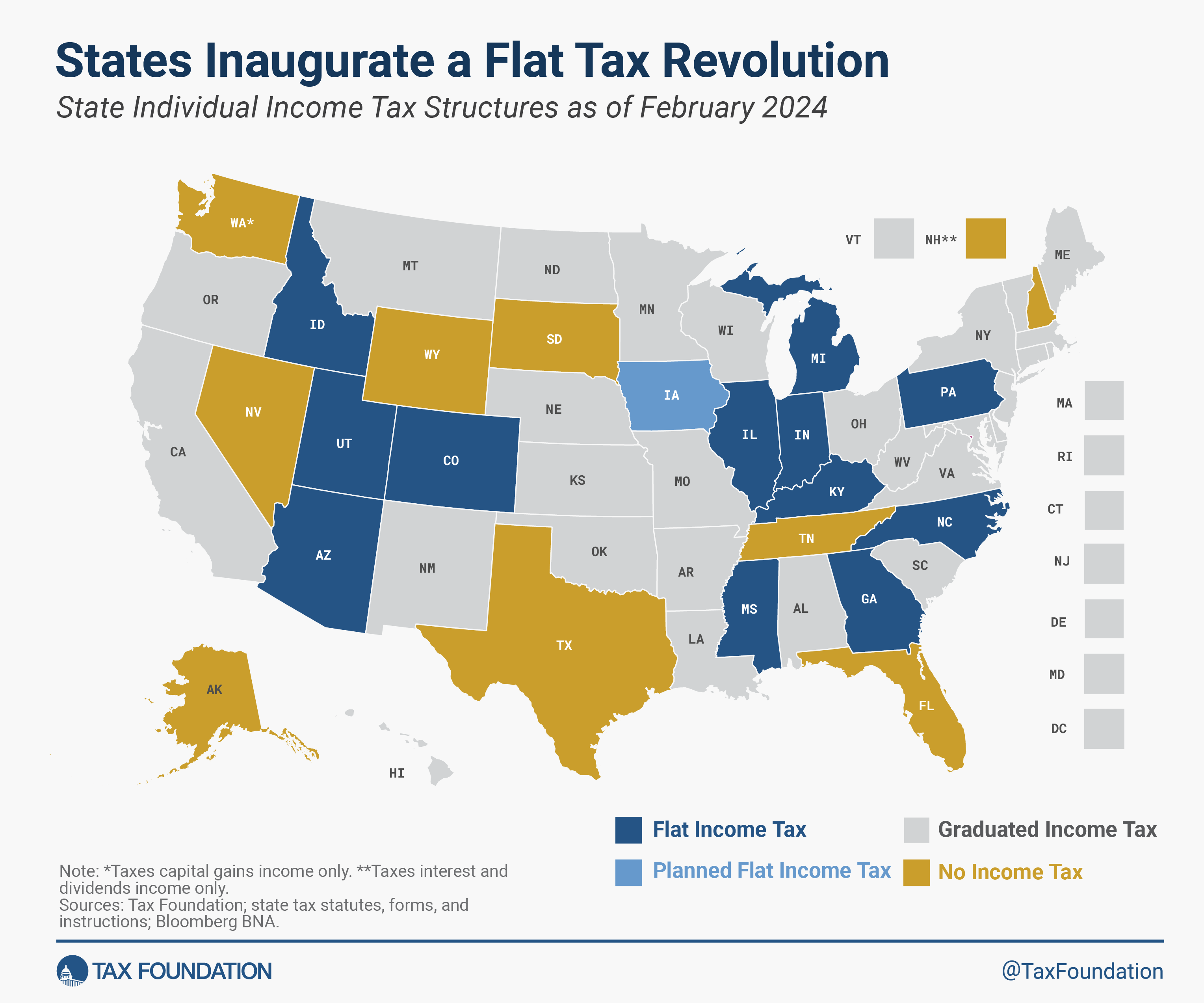

Municipal bonds, often called "munis," are debt securities issued by state and local governments to finance public projects. These projects range from building schools and hospitals to improving roads and bridges. The key attraction of municipal bonds lies in their tax-exempt status. Interest earned on these bonds is generally exempt from federal income taxes, and if you purchase bonds issued in your state of residence, the interest may also be exempt from state and local income taxes.

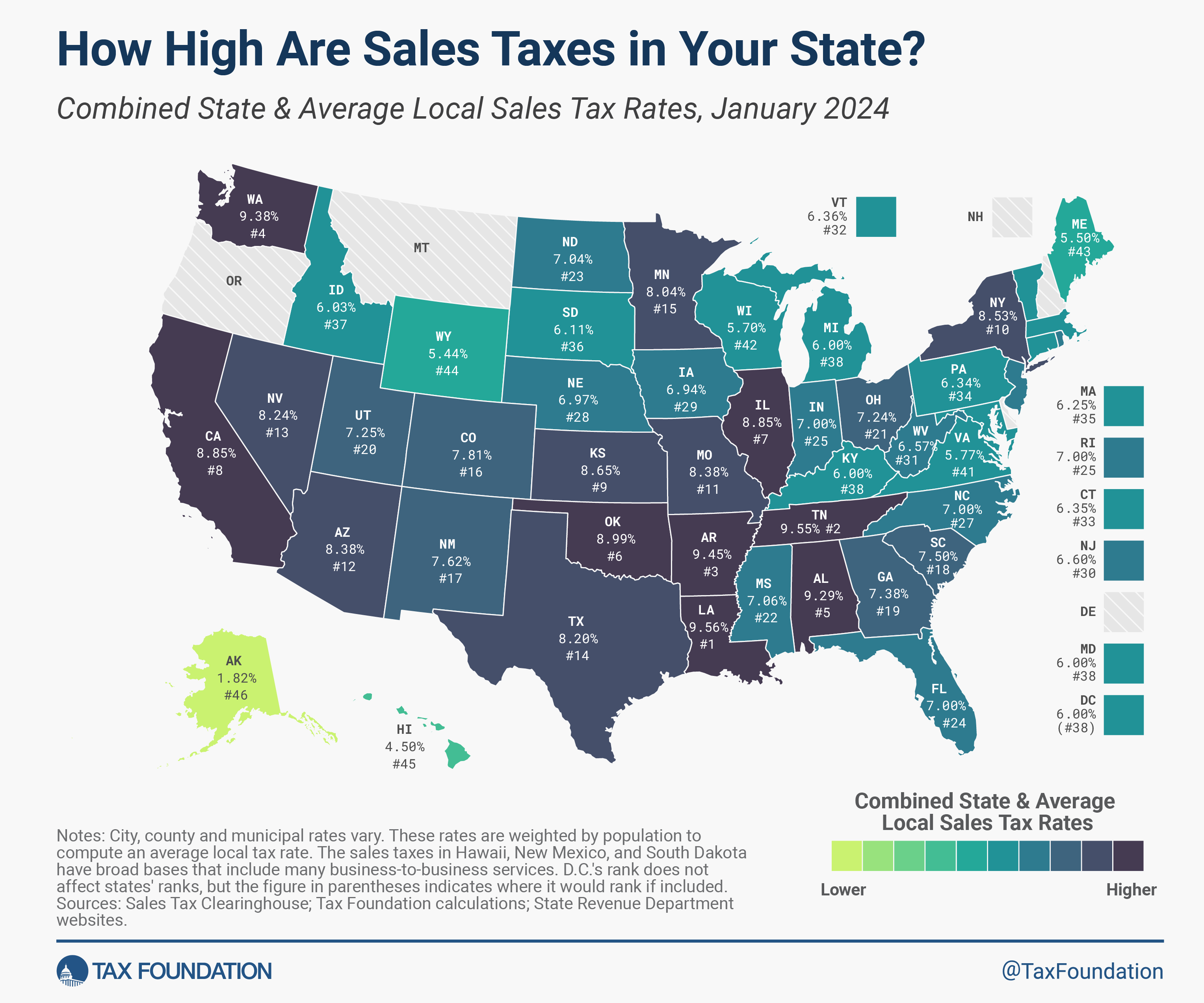

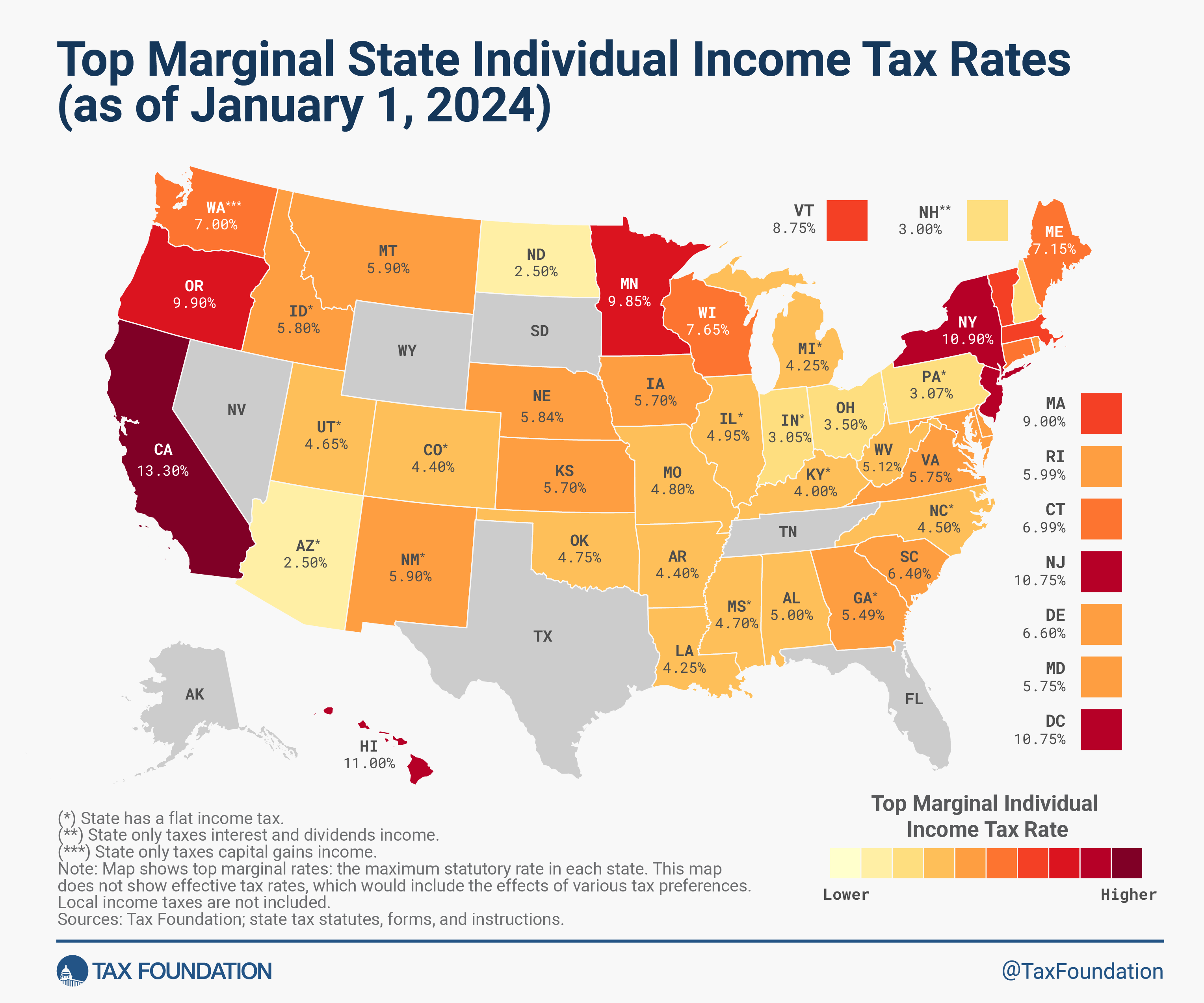

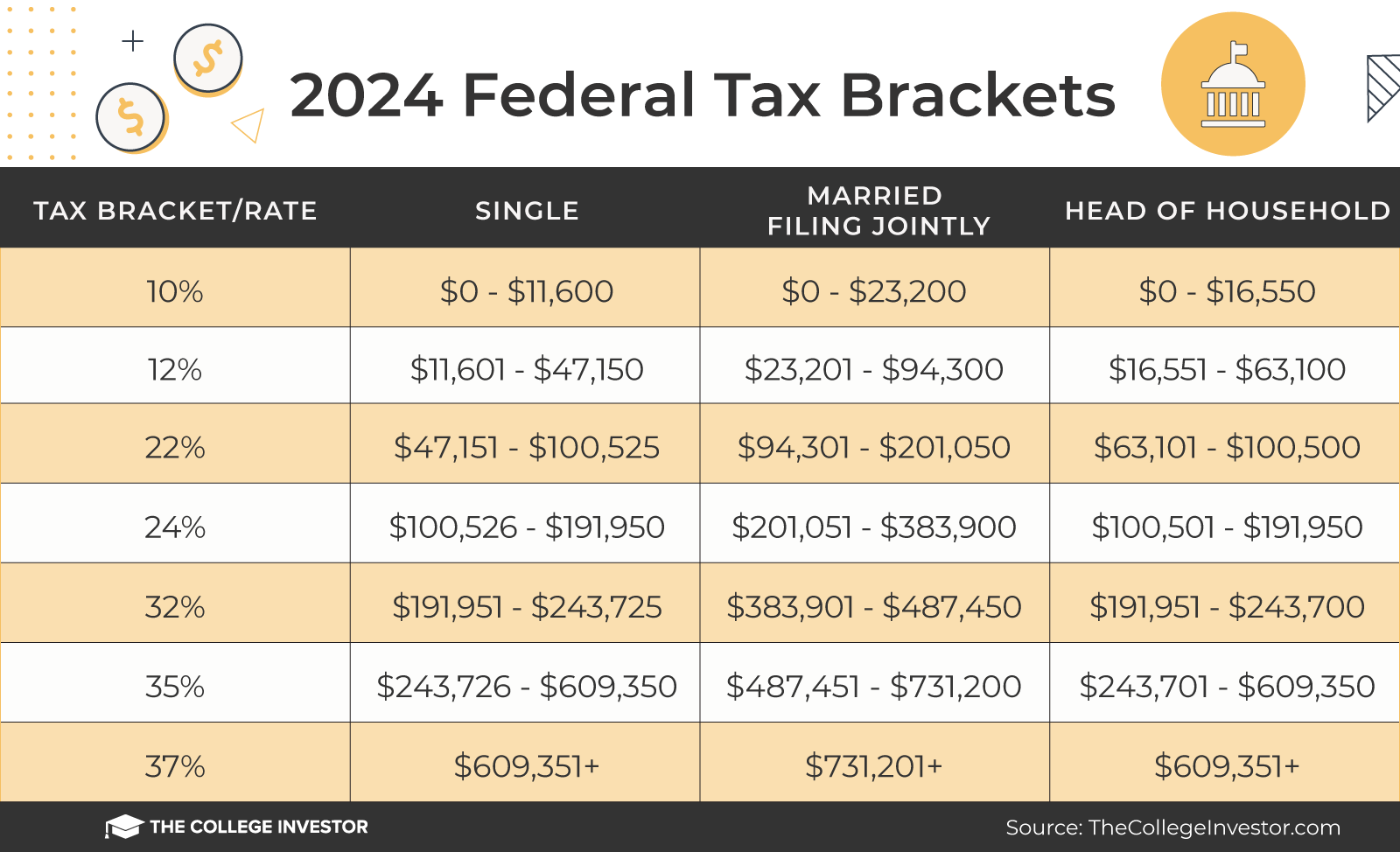

This tax advantage makes munis particularly appealing to investors in high tax brackets. The higher your tax bracket, the more valuable the tax exemption becomes. Consider an investor in the 37% federal tax bracket. A taxable bond yielding 4% would only provide an after-tax yield of 2.52%. A municipal bond yielding 3% would provide a higher after-tax yield, making it a more attractive investment.

PIMCO's Tax-Exempt By State Funds: A Closer Look

PIMCO, a globally recognized investment management firm, offers a suite of tax-exempt funds tailored to specific states. These funds, known as the PIMCO Tax Exempt By State series, allow investors to focus on their home state's municipal bond market, potentially maximizing their tax benefits. By concentrating on a single state, these funds aim to provide income that is exempt from federal, state, and local income taxes for residents of that state.

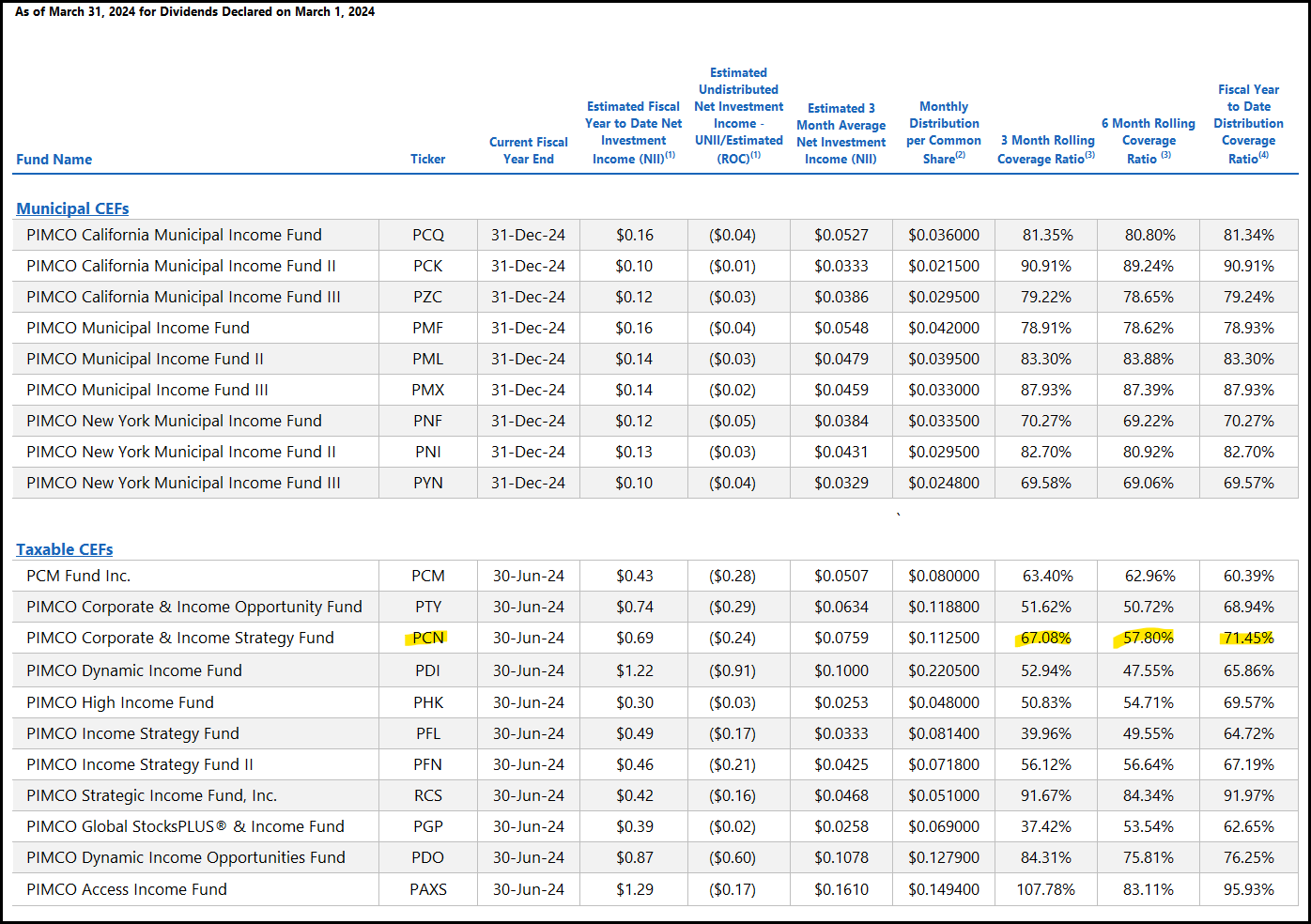

Each fund within the series focuses on municipal bonds issued within a particular state. Examples include the PIMCO California Municipal Income Fund and the PIMCO New York Municipal Income Fund. The specific investment strategies and holdings will vary depending on the individual fund and the characteristics of the state's municipal bond market.

Investment Strategy: PIMCO's investment approach typically involves a combination of top-down macroeconomic analysis and bottom-up security selection. This means they consider the overall economic environment and specific creditworthiness of the issuers. Their experienced portfolio managers actively manage the funds, seeking to identify undervalued opportunities and manage risk.

Key Considerations: When evaluating a PIMCO Tax Exempt By State fund, it's important to consider factors such as the fund's expense ratio, historical performance, credit quality of the underlying bonds, and duration. The expense ratio represents the annual cost of owning the fund, while past performance is not indicative of future results, it can provide insight into how the fund has performed relative to its peers. Credit quality reflects the creditworthiness of the issuers of the bonds held by the fund. Duration measures the fund's sensitivity to changes in interest rates.

Navigating the 2024 Landscape

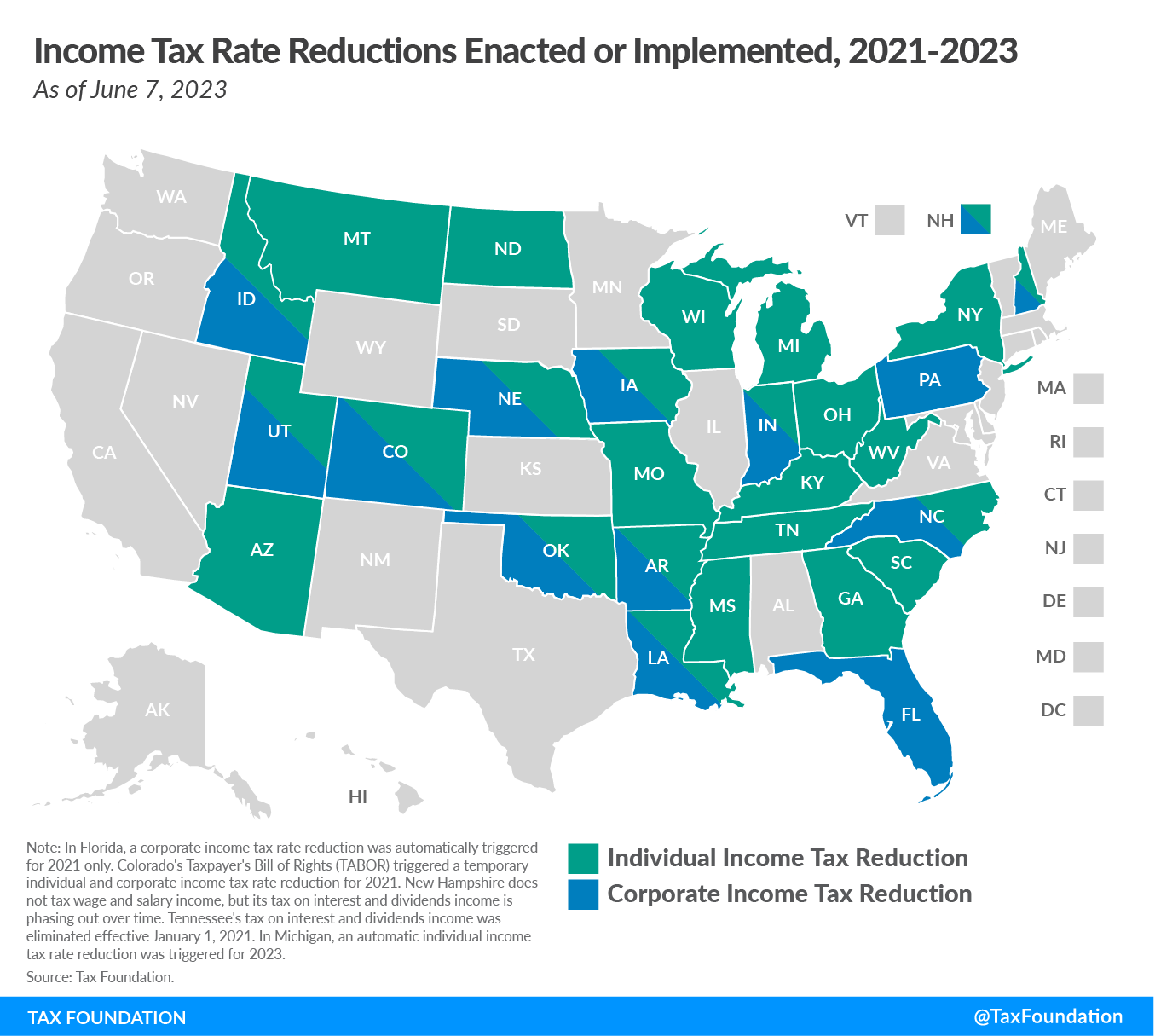

The municipal bond market in 2024 is shaped by several key factors. These include interest rate movements, inflation, and the financial health of state and local governments. Changes in interest rates can significantly impact the value of municipal bonds. When interest rates rise, bond prices typically fall, and vice versa.

Interest Rate Sensitivity: With the Federal Reserve's monetary policy impacting interest rates, understanding the duration of a fund is crucial. A fund with a longer duration will be more sensitive to interest rate changes. Investors concerned about rising interest rates might consider funds with shorter durations.

Credit Quality: The financial health of state and local governments directly impacts the creditworthiness of their municipal bonds. States with strong economies and sound fiscal management are generally considered to have lower credit risk. Investors should carefully evaluate the credit quality of the bonds held by a fund before investing.

Inflation's Impact: Inflation can erode the real value of fixed income investments like municipal bonds. While municipal bonds offer tax advantages, it's important to consider whether the after-tax yield can outpace inflation. Consulting with a financial advisor can help determine if these funds align with overall financial goals.

Opportunities and Risks

The municipal bond market presents both opportunities and risks for investors. Opportunities can arise from market inefficiencies and periods of heightened volatility. Skilled portfolio managers can capitalize on these opportunities to generate attractive returns. Risks include credit risk, interest rate risk, and liquidity risk. Credit risk refers to the risk that a bond issuer will default on its debt obligations. Interest rate risk is the risk that bond prices will decline as interest rates rise. Liquidity risk is the risk that a bond cannot be easily sold at a fair price.

PIMCO's expertise in navigating the municipal bond market can help mitigate some of these risks. Their rigorous credit analysis and active management strategies aim to identify and avoid potentially problematic bonds. Diversification across different issuers and sectors can also help reduce risk.

Important Note: Potential investors should consult the fund's prospectus for detailed information about its investment objectives, strategies, risks, and fees. The prospectus contains important information that can help you make an informed investment decision.

Tax Advantages: The Core Benefit

The primary benefit of investing in PIMCO Tax Exempt By State funds lies in their tax advantages. As mentioned earlier, interest income from municipal bonds is generally exempt from federal income taxes. For residents of the state in which the bonds are issued, the interest may also be exempt from state and local income taxes.

This tax-exempt status can significantly enhance the after-tax return of municipal bonds, particularly for investors in high tax brackets. For example, a taxpayer in California, a state with relatively high income taxes, would benefit greatly from the tax-exempt status of the PIMCO California Municipal Income Fund.

However, it's important to consult with a tax advisor to determine the specific tax implications of investing in municipal bonds. Tax laws can be complex and may vary depending on your individual circumstances.

Conclusion: A Place in a Diversified Portfolio

The PIMCO Tax Exempt By State series of funds offers a compelling option for investors seeking tax-advantaged income. By focusing on municipal bonds issued within a specific state, these funds can provide income that is exempt from federal, state, and local income taxes for residents of that state. These funds could potentially play a role within a well-diversified investment portfolio.

However, it's important to carefully evaluate the risks and rewards of investing in municipal bonds before making any investment decisions. Consider factors such as interest rate sensitivity, credit quality, and inflation. In the complex world of finance, sound advice and careful planning are very important. Thorough research, potentially guided by a professional, can help you find the option best suited to your unique financial landscape.