Predatory Lenders Get Their Negative Reputation From . . .

Emergency rooms of finance: that's the reputation predatory lenders have cultivated, offering quick cash to those in desperate need. But their rapid growth and ubiquitous presence mask a darker side, one built on trapping vulnerable borrowers in cycles of debt.

This article dives into the core practices that earned predatory lenders their infamous reputation: exorbitant interest rates, hidden fees, and aggressive collection tactics. We'll explore how these practices exploit vulnerable individuals and communities, leaving a trail of financial devastation.

The Anatomy of Predatory Lending

Predatory lending isn't a new phenomenon, but its modern form has exploded with the rise of payday loans, auto title loans, and online lenders. The core issue boils down to exploiting financial desperation for profit.

Sky-High Interest Rates: A Trap Door

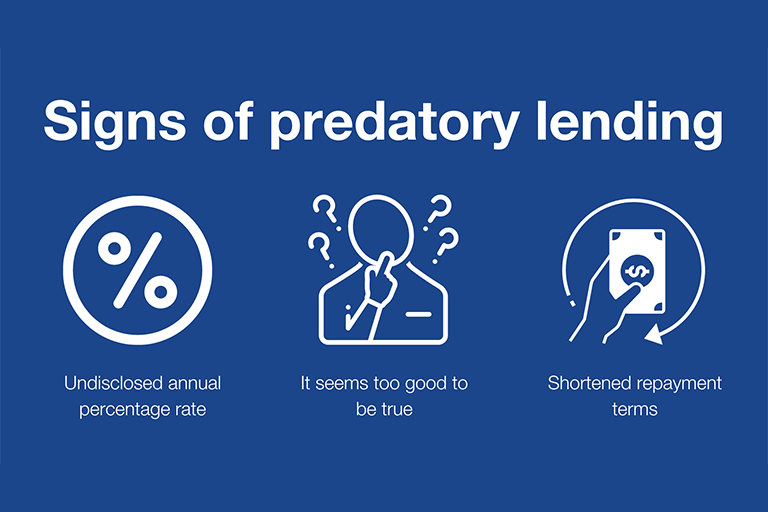

Payday loans are the poster child for exorbitant interest. According to the Consumer Financial Protection Bureau (CFPB), the typical two-week payday loan comes with a fee of $10-$30 for every $100 borrowed.

This translates to an Annual Percentage Rate (APR) of 391% to over 521%, far exceeding standard credit card rates. Borrowers often can't repay the loan on time, leading to rollovers and accruing even more fees.

Auto title loans, where borrowers use their vehicle as collateral, also carry extremely high APRs, often in the triple digits. Failure to repay can result in the borrower losing their car, a critical asset for many.

Hidden Fees and Deceptive Practices

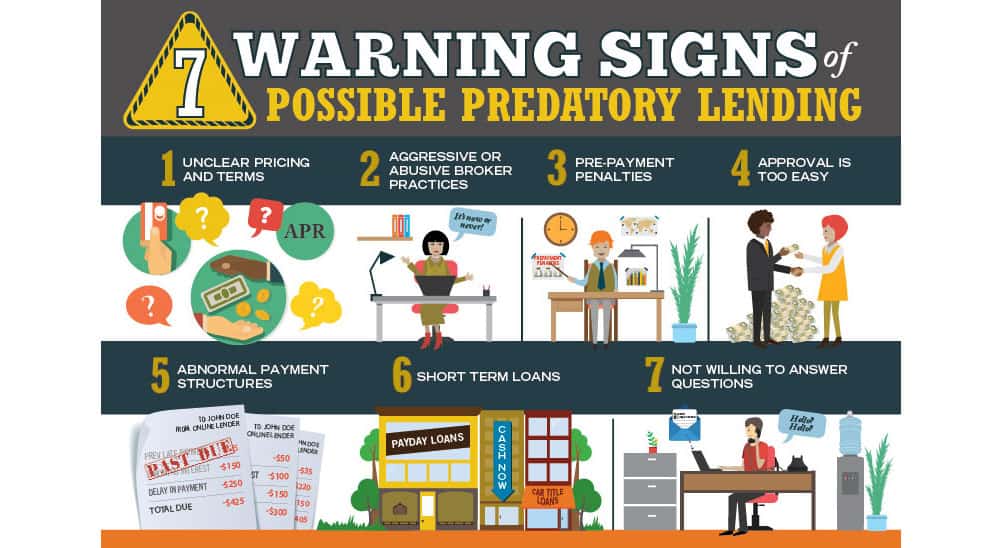

Predatory lenders often obscure the true cost of borrowing with hidden fees and complex loan agreements. Origination fees, processing fees, and prepayment penalties can significantly increase the total amount owed.

Some lenders use aggressive marketing tactics that target vulnerable populations, such as low-income communities and minority groups. These tactics often downplay the risks and emphasize the speed and ease of obtaining a loan.

The lack of transparency makes it difficult for borrowers to understand the full terms of the loan and to compare options. This opaqueness is a key tactic of predatory lenders.

Aggressive Collection Tactics and Debt Traps

When borrowers struggle to repay, predatory lenders often resort to aggressive collection tactics. This can include harassing phone calls, threats of legal action, and wage garnishment.

The structure of many payday and auto title loans makes it difficult for borrowers to escape the cycle of debt. Often, borrowers end up taking out new loans to repay existing ones, digging themselves deeper into a financial hole.

These practices disproportionately affect vulnerable populations, exacerbating existing financial inequalities. The CFPB has documented numerous cases of borrowers losing their homes, cars, and life savings due to predatory lending practices.

Who is Affected?

Predatory lending disproportionately impacts specific demographic groups. Low-income communities, communities of color, and military families are particularly vulnerable.

These groups often lack access to traditional financial services and are more likely to be targeted by predatory lenders. The consequences can be devastating, leading to increased debt, bankruptcy, and housing instability.

The impact extends beyond individual borrowers, affecting entire communities. High rates of predatory lending can drain local economies and perpetuate cycles of poverty.

The Regulatory Landscape

Efforts to combat predatory lending vary across states and at the federal level. Some states have enacted strong usury laws that cap interest rates and restrict loan terms.

The Dodd-Frank Wall Street Reform and Consumer Protection Act created the CFPB, giving it the authority to regulate payday lenders and other financial institutions. The CFPB has taken action against numerous predatory lenders, recovering millions of dollars for consumers.

However, lobbying efforts by the payday lending industry have weakened some regulations. There is ongoing debate about the appropriate level of regulation and the role of the federal government in protecting consumers.

The Road Ahead: What's Next?

Combating predatory lending requires a multi-pronged approach. This includes stronger regulations, increased financial literacy, and greater access to affordable financial services.

The CFPB is continuing to monitor the payday lending industry and to enforce existing regulations. State lawmakers are considering new legislation to protect consumers from predatory lending practices.

Ultimately, breaking the cycle of debt requires empowering individuals with the knowledge and resources to make informed financial decisions. That includes ensuring access to safe and affordable alternatives to predatory loans.

.jpg?width=1170&name=iStock-1263686977 (1).jpg)