Preparing For An Economic Depression

Whispers of economic downturn are growing louder, casting a shadow over global markets and prompting individuals and institutions alike to consider a scenario once relegated to the history books: a potential economic depression. The convergence of high inflation, rising interest rates, geopolitical instability, and supply chain vulnerabilities has created a precarious environment, forcing many to ask: Are we prepared for the worst?

This article will explore the growing concerns surrounding a potential economic depression, drawing upon expert analysis and economic data to provide a realistic assessment of the current climate. It will delve into practical strategies individuals, businesses, and governments can implement to mitigate risk and navigate a severe economic contraction. The aim is to equip readers with the knowledge necessary to make informed decisions in the face of uncertainty.

Understanding the Risks

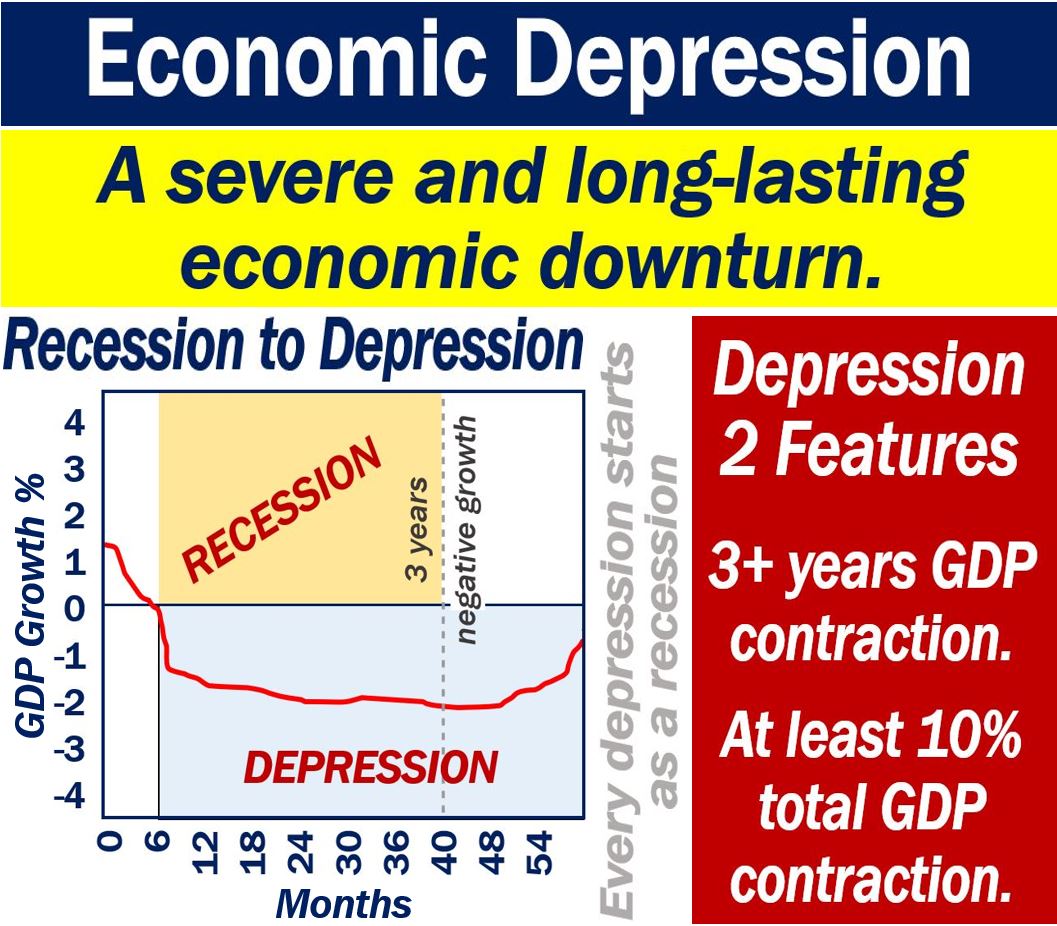

The term "depression" isn't thrown around lightly. It signifies a sustained, severe downturn in economic activity characterized by prolonged periods of high unemployment, deflation, and a significant contraction in industrial production and consumer spending, according to the National Bureau of Economic Research (NBER).

Several factors contribute to the current apprehension. Inflation, stubbornly persistent despite central bank efforts, erodes purchasing power and fuels social unrest. Rising interest rates, intended to curb inflation, simultaneously increase borrowing costs for businesses and consumers, potentially stifling economic growth.

Furthermore, geopolitical tensions, such as the war in Ukraine, disrupt global supply chains and exacerbate energy price volatility. The International Monetary Fund (IMF) has repeatedly revised its global growth forecasts downward, citing these interconnected challenges.

Individual Preparedness: Protecting Your Finances

For individuals, financial preparedness is paramount. Building an emergency fund that can cover 3-6 months of living expenses provides a crucial safety net in case of job loss or unexpected expenses.

Diversifying income streams, through freelance work or side hustles, can reduce reliance on a single employer. Reducing debt, especially high-interest debt like credit cards, frees up cash flow and minimizes financial vulnerability.

Consider investing in assets that tend to hold their value during economic downturns, such as precious metals or real estate in stable markets. However, it is critical to consult with a qualified financial advisor before making any investment decisions.

Business Strategies: Navigating the Storm

Businesses need to adopt a proactive and conservative approach to survive a depression. Cutting operational costs, streamlining processes, and improving efficiency are essential steps.

Maintaining a healthy cash flow is crucial. Negotiating favorable payment terms with suppliers and customers can help manage liquidity effectively. Diversifying customer base and exploring new markets can reduce reliance on vulnerable sectors.

Investing in employee training and development can improve productivity and boost morale. Companies should also consider developing contingency plans for various scenarios, including significant revenue declines and supply chain disruptions.

Government Actions: Mitigating the Impact

Governments play a critical role in mitigating the impact of an economic depression. Fiscal stimulus, such as infrastructure projects and unemployment benefits, can help support demand and prevent a downward spiral.

Monetary policy, including interest rate adjustments and quantitative easing, can influence borrowing costs and liquidity. However, these tools are not always effective, particularly when facing supply-side shocks.

Strengthening social safety nets, such as unemployment insurance and food assistance programs, provides crucial support to vulnerable populations. International cooperation, through organizations like the World Bank and the IMF, can help stabilize global markets and coordinate responses to economic crises.

Expert Opinions and Divergent Views

Economists hold varying views on the likelihood and severity of a potential economic depression. Some, like Nouriel Roubini, have warned of a "stagflationary debt crisis" and a potentially long and painful recession, if not a depression. Others, while acknowledging the risks, believe that central banks and governments have learned from past mistakes and can effectively manage the situation.

The Congressional Budget Office (CBO) provides economic forecasts and analysis, but their predictions are not always accurate. It is essential to consider a range of perspectives and rely on diverse sources of information when assessing economic risks.

Looking Ahead: Adapting to a New Reality

While predicting the future is impossible, preparing for a potential economic depression is a prudent course of action. By understanding the risks, implementing sound financial strategies, and advocating for responsible government policies, individuals, businesses, and communities can increase their resilience and navigate uncertain times.

The key is adaptability and a willingness to embrace change. A potential depression may necessitate a fundamental shift in how we work, consume, and invest. Staying informed and proactive will be critical to surviving and thriving in a challenging economic environment.

![Preparing For An Economic Depression [Economics] What is Economic Depression? - Class 12 Teachoo](https://d1avenlh0i1xmr.cloudfront.net/b627c738-a0db-444d-acf8-0db6aeb5e54c/slide12.jpg)