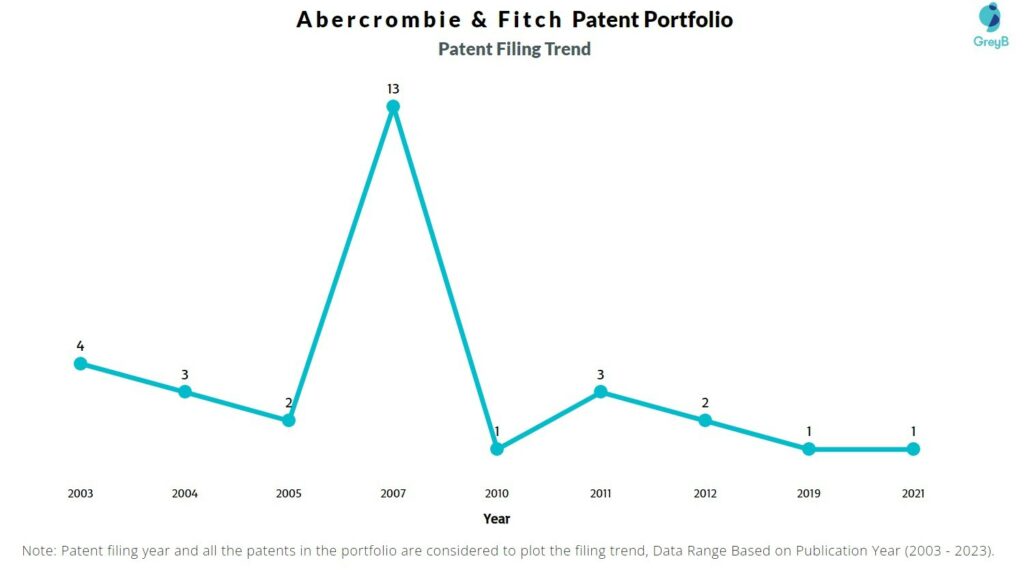

Price Earning Ratio Trend Abercrombie And Fitch

Imagine strolling through a sun-drenched mall, the scent of familiar cologne wafting through the air. Abercrombie & Fitch, once synonymous with preppy cool, stands ahead, its logo a beacon of nostalgia for some, a relic of the past for others. But behind the storefront and the carefully curated playlists, a fascinating financial narrative is unfolding, one that hinges on a critical metric: the Price-to-Earnings (P/E) ratio.

This article dives deep into the P/E ratio trend of Abercrombie & Fitch (ANF), exploring how this vital financial indicator reflects the company's resurgence and investor sentiment in an ever-evolving retail landscape. We will examine the factors driving these changes and what they suggest about the future of this iconic American brand.

Abercrombie & Fitch: A Brand Reborn

Abercrombie & Fitch's journey has been one of dramatic transformation. Once defined by its exclusivity and controversial marketing, the company faced declining sales and a damaged reputation in the early 2010s. A new leadership team, led by CEO Fran Horowitz, recognized the need for a fundamental shift in strategy.

The brand embarked on a journey of reinvention. This included embracing inclusivity, expanding its size range, and focusing on a more mature, customer-centric approach.

The Significance of the P/E Ratio

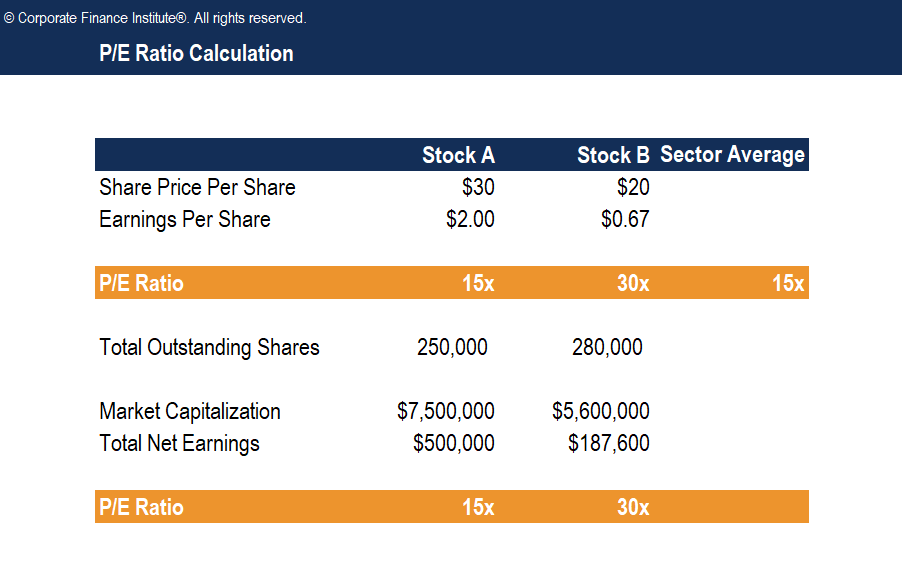

The Price-to-Earnings (P/E) ratio is a fundamental metric used by investors to assess the valuation of a company. It essentially tells you how much investors are willing to pay for each dollar of a company's earnings.

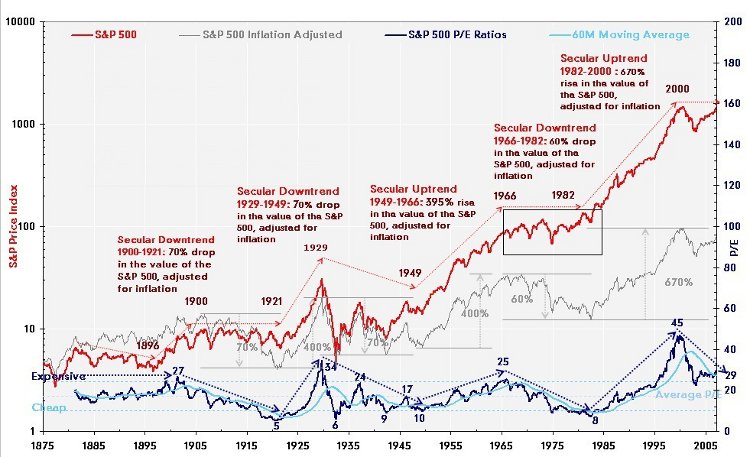

A high P/E ratio might suggest that investors have high expectations for future growth, or that the stock is overvalued. Conversely, a low P/E ratio could indicate that the stock is undervalued, or that investors have concerns about the company's future prospects.

Analyzing the trend of a company's P/E ratio over time provides valuable insights into market sentiment and the company's performance relative to its peers.

Analyzing Abercrombie & Fitch's P/E Ratio Trend

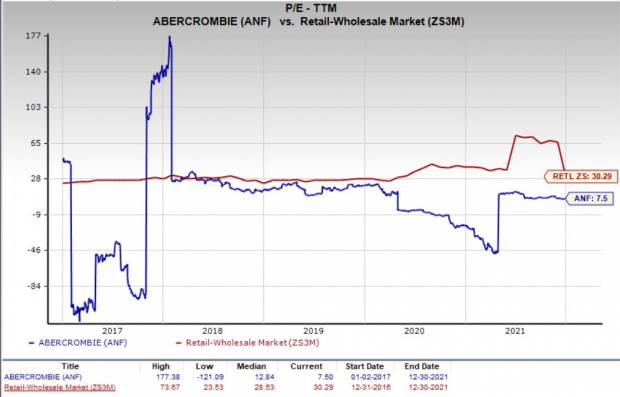

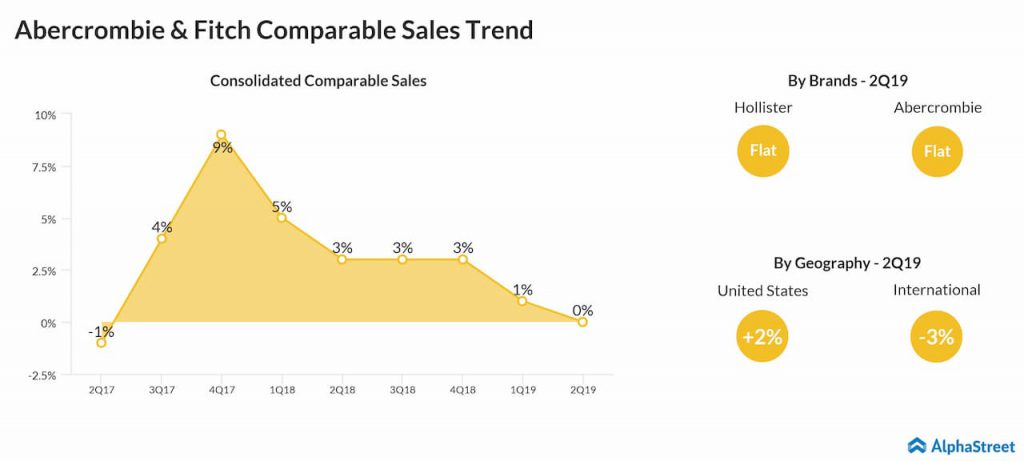

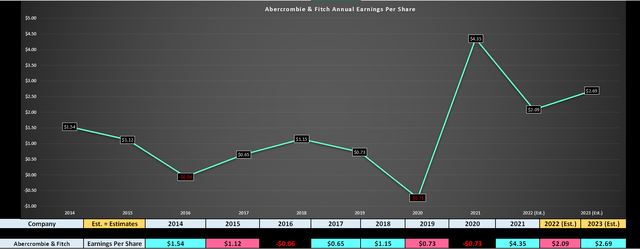

Over the past few years, ANF's P/E ratio has experienced significant fluctuations, mirroring the company's operational turnaround. Data from financial news outlets like Yahoo Finance and Bloomberg, reveals a dynamic picture. In the early years of its transformation, the company experienced periods of low or even negative P/E ratios reflecting investor uncertainty.

However, more recently, as the company's financial performance has improved, its P/E ratio has shown a clear upward trend. This suggests increased investor confidence in the company's ability to sustain its growth trajectory.

Several factors have contributed to this positive shift.

Factors Influencing the P/E Ratio

Numerous factors influence a company’s P/E ratio. These are internal factors like earnings growth, profitability, and debt levels, as well as external factors such as industry trends, macroeconomic conditions, and overall market sentiment.

ANF's successful turnaround has played a crucial role in boosting its P/E ratio. By improving its financial performance and attracting a broader customer base, the company has demonstrated its ability to generate sustainable earnings growth.

Furthermore, the positive macroeconomic environment, particularly strong consumer spending, has provided a tailwind for the retail sector as a whole. This has generally increased investor appetite for retail stocks, including Abercrombie & Fitch.

Competitive Landscape

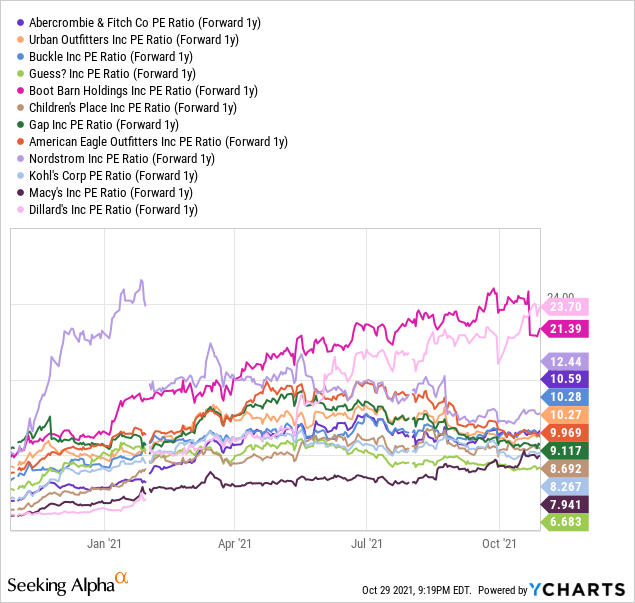

It's important to consider ANF's P/E ratio in the context of its competitors. Companies like American Eagle Outfitters (AEO) and Urban Outfitters (URBN) operate in similar market segments and provide valuable benchmarks.

Comparing ANF's P/E ratio to these peers can reveal whether the market is valuing Abercrombie & Fitch at a premium or discount relative to its competitors. This comparative analysis can provide insights into the market's perception of ANF's relative strengths and weaknesses.

A higher P/E ratio compared to its peers may indicate that investors believe ANF has stronger growth potential. Conversely, a lower P/E ratio could suggest that investors are more cautious about ANF's prospects compared to its competitors.

The Future Outlook

Looking ahead, the future of ANF's P/E ratio will depend on its ability to sustain its current momentum. Continued innovation, effective marketing, and a strong focus on customer satisfaction will be crucial for driving future growth.

The company's expansion into new markets, particularly in Asia, represents a significant growth opportunity. Success in these regions could further boost investor confidence and drive the P/E ratio higher.

However, challenges remain. The retail industry is constantly evolving, and ANF must adapt to changing consumer preferences and competitive pressures to maintain its edge.

"Our commitment to delivering relevant, high-quality products and experiences to our customers remains unwavering," said a recent statement from ANF’s Investor Relations team.

Potential Risks and Opportunities

Several risks could potentially impact ANF's P/E ratio in the future. Economic downturns, increased competition, and supply chain disruptions could all negatively affect the company's earnings and investor sentiment.

On the other hand, there are also opportunities for further growth and value creation. Successful product launches, strategic acquisitions, and effective cost management could all drive the P/E ratio higher.

The company's ability to navigate these risks and capitalize on these opportunities will ultimately determine the long-term trajectory of its P/E ratio.

Conclusion: A Story Told in Numbers

The P/E ratio trend of Abercrombie & Fitch tells a compelling story of resilience and reinvention. From facing near extinction to staging a remarkable comeback, the company has demonstrated its ability to adapt and thrive in a challenging environment.

While the P/E ratio is just one piece of the puzzle, it provides a valuable window into investor sentiment and the company's overall financial health. It reflects both the achievements and the remaining challenges in the journey of an iconic brand.

As we watch ANF continue to evolve, its P/E ratio will remain a key indicator of its ongoing success and its ability to capture the hearts and wallets of a new generation of consumers. It serves as a reminder that even the most iconic brands must constantly adapt and innovate to stay relevant in the ever-changing world of retail.