Questions To Ask Before Buying A Business

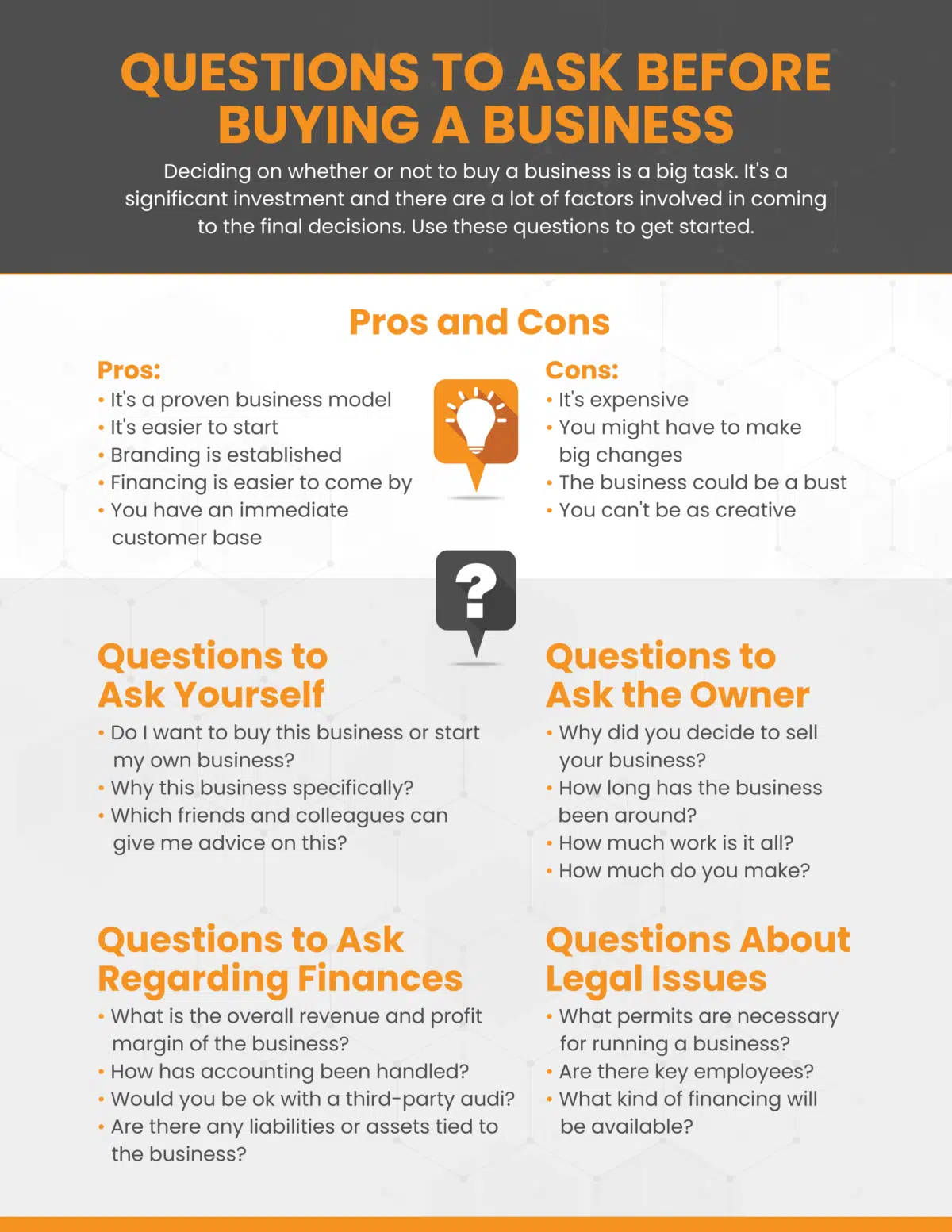

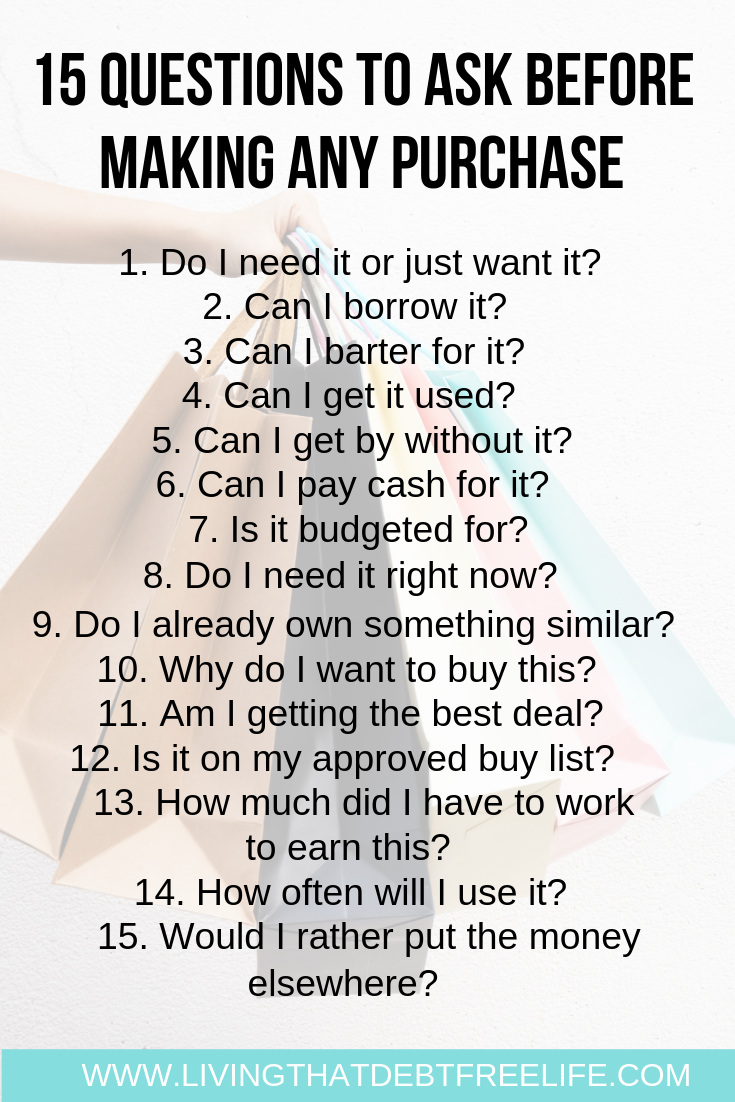

The dream of owning a business is a powerful draw for many, but leaping into entrepreneurship without due diligence can quickly turn that dream into a nightmare. Before signing on the dotted line, prospective buyers need to ask the right questions to ensure they are making a sound investment.

This article explores crucial questions to ask when considering the purchase of an existing business, covering finances, operations, legal compliance, and market dynamics. Thoroughly investigating these areas is critical to understanding the true value and potential risks associated with the venture. This diligence helps avoid costly surprises and increases the chances of a successful acquisition.

Financial Due Diligence: Unveiling the True Picture

One of the first and most important areas to scrutinize is the business's financial health. Ask for at least three to five years of audited financial statements. These statements provide a detailed overview of revenue, expenses, and profitability, offering insights into the business's historical performance.

Specifically, examine the balance sheet, income statement, and cash flow statement. Look for trends, inconsistencies, and any red flags that might indicate financial instability or creative accounting.

Inquire about the reasons behind any significant fluctuations in revenue or expenses. Understanding these changes is crucial for projecting future performance and assessing the sustainability of the business.

Operational Considerations: Understanding the Inner Workings

Beyond the numbers, it's essential to understand how the business actually operates. Request information about the business's key processes, customer base, and supplier relationships. Who are the major customers, and what is their retention rate?

Understanding customer concentration is vital. A business overly reliant on a few key clients is vulnerable if one of those clients leaves.

Similarly, assess the business's reliance on specific suppliers and the terms of those relationships. Secure supply chains are critical for maintaining operations.

Legal and Regulatory Compliance: Ensuring a Clean Bill of Health

Legal compliance is another area that demands careful attention. Obtain copies of all relevant permits, licenses, and contracts. Ensure the business is in good standing with all applicable regulatory bodies.

Inquire about any pending lawsuits, environmental issues, or intellectual property disputes. These legal burdens can significantly impact the value and viability of the business.

It is also critical to review the business's employment contracts and policies to understand any potential liabilities related to employee benefits or labor laws. Consider consulting with an attorney specializing in business acquisitions to ensure compliance with all applicable laws and regulations, this will help you when working with the Seller.

Market Analysis: Gauging Future Prospects

Understanding the competitive landscape and market trends is critical for assessing the business's future prospects. Conduct a thorough market analysis to identify opportunities and threats. Evaluate the business's market share, competitive advantages, and potential for growth.

Consider the impact of technological advancements, changing consumer preferences, and economic conditions. Is the business adapting to these changes, or is it falling behind?

It's important to verify the seller's claims about market size and growth potential with independent research from reputable sources. Don't just take the seller's word for it.

Employee Retention and Transition: A Smooth Handover

Employees are often the backbone of a business, and their retention is crucial for a smooth transition. Understand the employee structure, compensation packages, and morale. Talk to key employees, if possible, to gauge their commitment to the business.

Develop a plan for retaining key employees and ensuring a seamless handover of responsibilities. The loss of critical personnel can disrupt operations and damage customer relationships.

Ensure that existing employees understand their roles in the new business. Employee buy-in can significantly increase the chances of the new business surviving.

The Importance of Professional Advice

Navigating the complexities of buying a business is rarely a solo endeavor. Engage professionals such as accountants, lawyers, and business brokers to assist with due diligence and negotiations.

These experts can provide valuable insights and guidance, helping you to identify potential risks and opportunities. Their expertise can also help to ensure that the transaction is structured in a way that protects your interests.

Consider working with a business broker, like Transworld Business Advisors or Murphy Business Sales to get an even more detailed overview of the business being purchased.

Asking the right questions before buying a business is a critical step towards achieving entrepreneurial success. Thorough due diligence can help you avoid costly mistakes and increase the likelihood of a profitable and rewarding venture. By carefully examining the financial, operational, legal, and market aspects of the business, you can make an informed decision and embark on your entrepreneurial journey with confidence. Take the time to do your homework, seek professional advice, and be prepared to walk away if the deal doesn't feel right.

+(59).png)

![Questions To Ask Before Buying A Business 3 questions to ask before buying a business [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3. Infographics and cheat sheets/3 questions to ask yourself before buying a business.png?width=300&name=3 questions to ask yourself before buying a business.png)

+(1).png?format=1500w)