Questions To Ask When Purchasing A Small Business

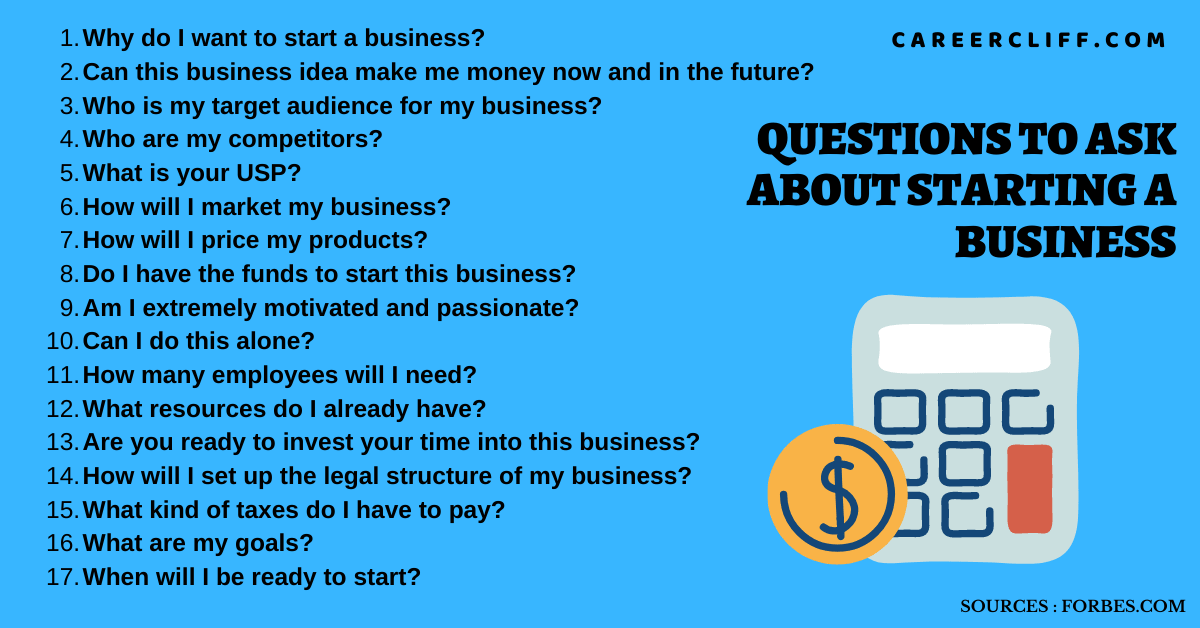

The dream of owning a small business – a local bakery, a thriving landscaping company, or a niche online store – pulses through the entrepreneurial spirit of many. But the path to ownership is fraught with potential pitfalls, and a failure to ask the right questions before signing on the dotted line can turn a dream into a financial nightmare.

Navigating the complex world of small business acquisitions requires meticulous due diligence and a comprehensive understanding of the business's true health and prospects. This article delves into the crucial questions potential buyers should ask to ensure a sound investment and a successful transition. We'll explore key areas like financial performance, legal compliance, operational efficiency, and market positioning, providing a framework for informed decision-making.

Financial Due Diligence: Unveiling the Numbers

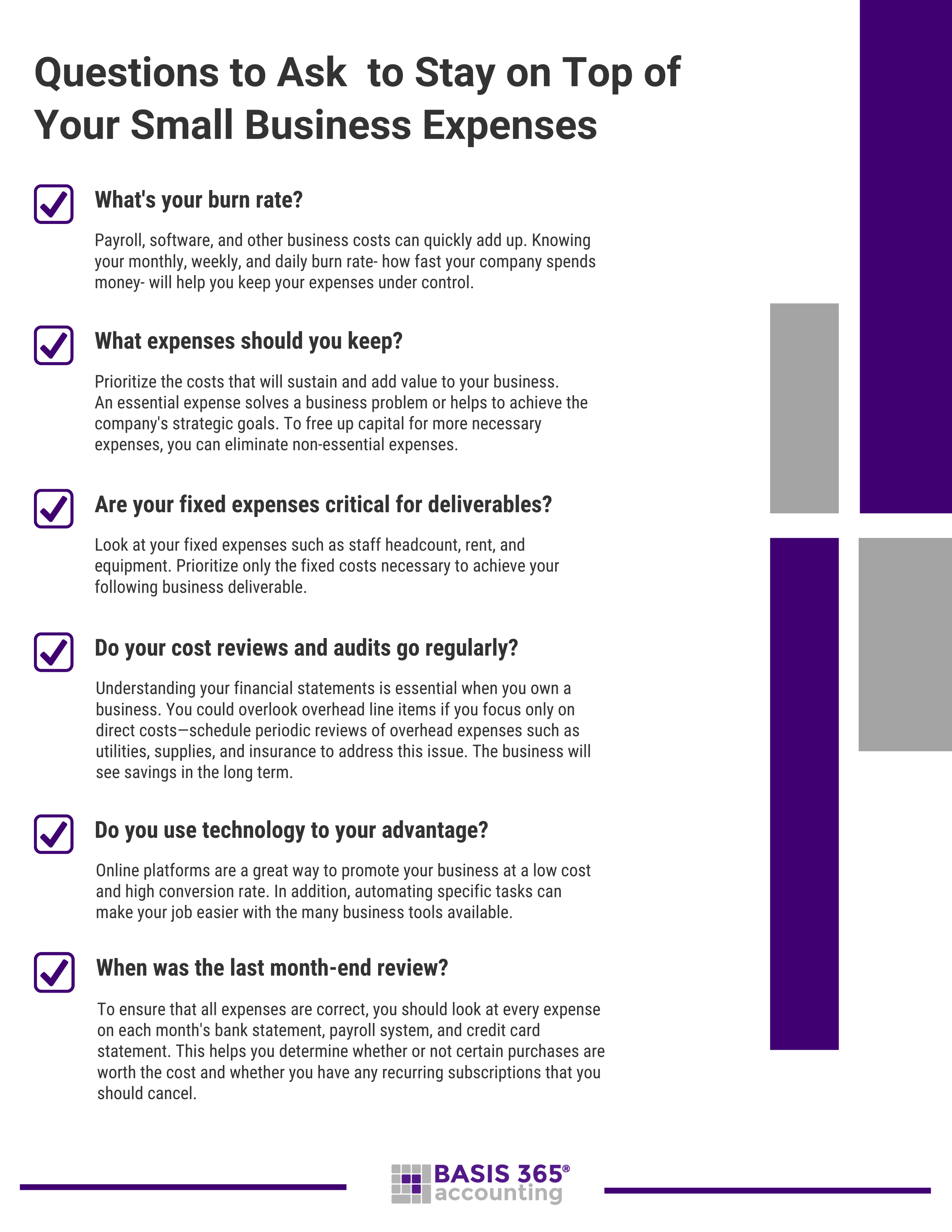

A thorough examination of the business's financials is paramount. Request at least three to five years of financial statements, including profit and loss statements, balance sheets, and cash flow statements.

Don't just accept the numbers at face value; scrutinize them. Are there any unusual spikes or dips in revenue? Investigate the reasons behind these fluctuations.

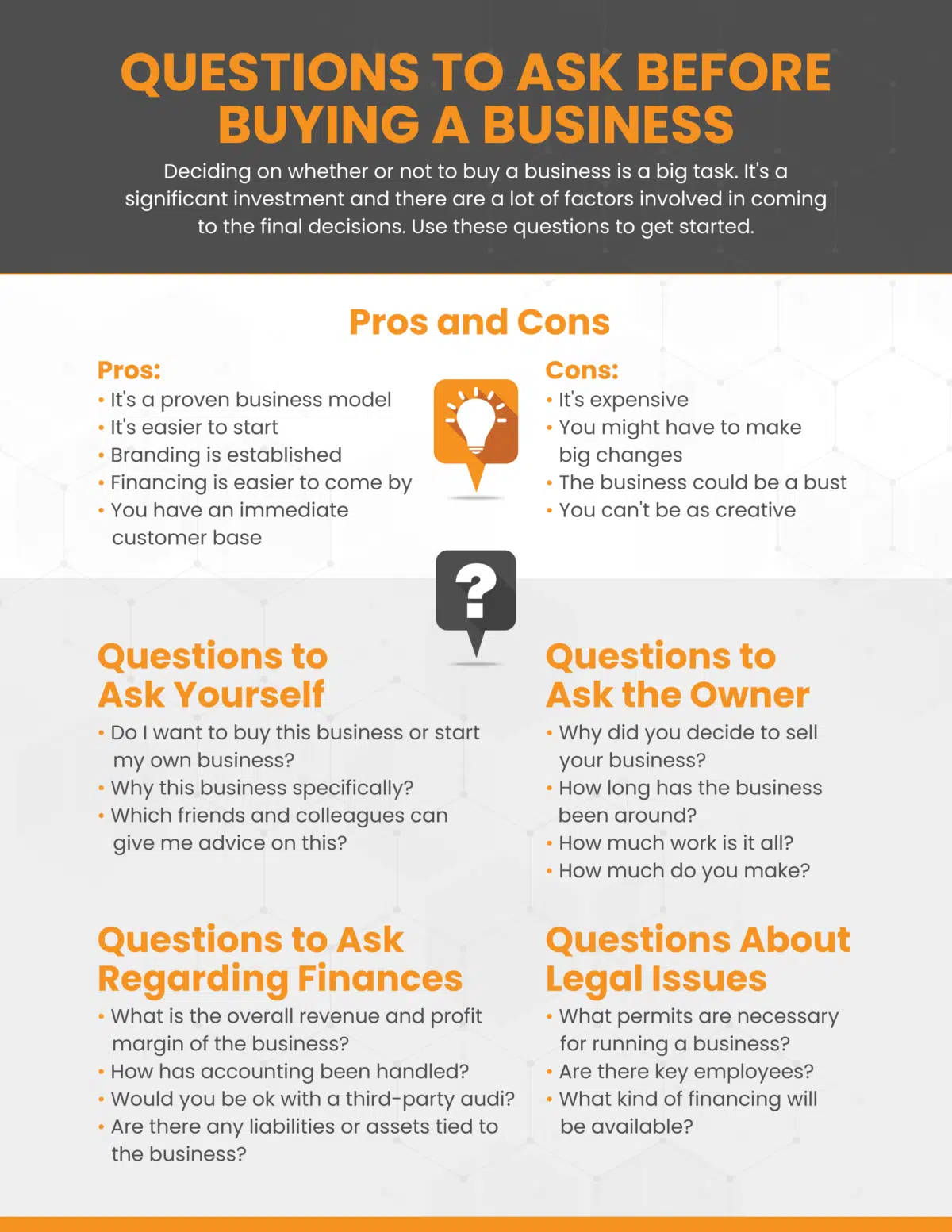

It is important to ask about the business's debt structure. Understand the terms of any outstanding loans, lines of credit, or leases. Identify all business liabilities and understand the obligations.

Also, inquire about the company’s assets and how assets are being valued. Are they using depreciation, and if so, is it reasonable?

Legal and Regulatory Compliance: Avoiding Future Headaches

Compliance with local, state, and federal regulations is crucial. Request documentation demonstrating adherence to labor laws, environmental regulations, and industry-specific requirements.

Are all licenses and permits up-to-date? A lapse in compliance can lead to fines, penalties, or even business closure.

Review all existing contracts with suppliers, customers, and employees. Understand the terms, renewal dates, and any potential liabilities. For example, is there any language in the lease that will limit your use of the location?

It is important to review any active or pending litigation against the business. Any potential liability will affect the business’s profitability.

Operational Efficiency: Understanding the Day-to-Day

Gaining insight into the business's day-to-day operations is essential for a smooth transition. Tour the facilities, observe employees, and understand the workflow.

How efficient are the current processes? Identify potential areas for improvement and cost reduction. Talk to current employees to gain insights on the day-to-day operations.

Ask about the current inventory management system. Is there a robust system in place to track inventory levels and prevent stockouts or overstocking?

Also, it is important to understand the technology used and how it is being used. Understanding this will save you time later on, and determine if you need to purchase new technology or software.

Market Positioning and Competition: Assessing Long-Term Viability

Understanding the business's place in the market is critical for long-term success. Analyze the competitive landscape and identify the business's strengths and weaknesses.

Who are the main competitors? What are their market shares? How does the business differentiate itself from the competition?

Analyze the business's customer base. Is it diverse and stable? Or is it heavily reliant on a few key clients?

How is the business perceived by its customers? Review online reviews and testimonials to gauge customer satisfaction.

Transition and Future Plans: Ensuring a Smooth Handover

A successful transition requires a well-defined plan. Discuss the seller's willingness to provide training and support during the handover period.

How long is the seller willing to stay on to help with the transition? Will they be available for ongoing consultation?

Understand the seller's motivations for selling the business. This can provide valuable insights into the business's future prospects.

Ask about their future plans. This can help you understand whether they will potentially open a competing business.

By asking these critical questions, potential buyers can gain a comprehensive understanding of the business they are considering acquiring. Thorough due diligence is an investment in the future success of the business and a safeguard against unforeseen risks. Remember to consult with legal and financial advisors throughout the process to ensure informed decision-making and a smooth transition to business ownership.