Questions To Ask Your Accountant When Starting A Business

Imagine the aroma of freshly brewed coffee mingling with the scent of possibility. You’re sitting across from your accountant, blueprints of your dream business spread between you. Excitement bubbles, but beneath the surface, a wave of questions churns: Am I truly prepared? Will my finances hold up?

Navigating the financial landscape of a new business can feel like traversing a minefield. To ensure a strong start and long-term success, engaging in a thorough discussion with your accountant is paramount. This article explores the key questions to ask, transforming uncertainty into informed confidence as you embark on your entrepreneurial journey.

Building a Foundation: Initial Inquiries

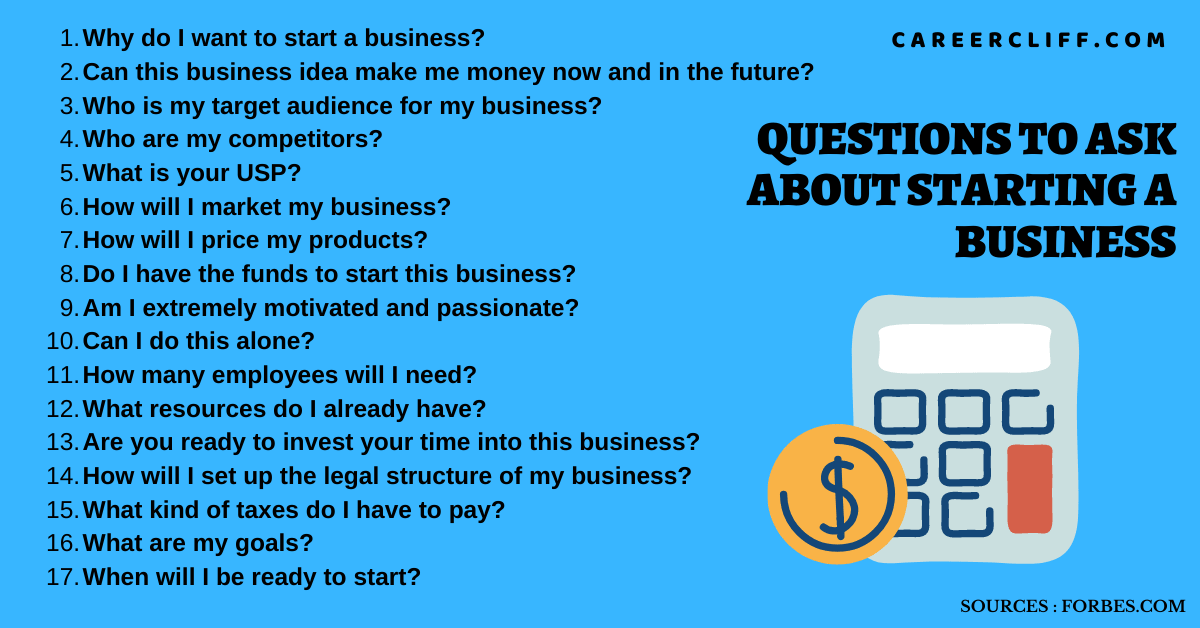

Before diving into specifics, start with foundational questions.

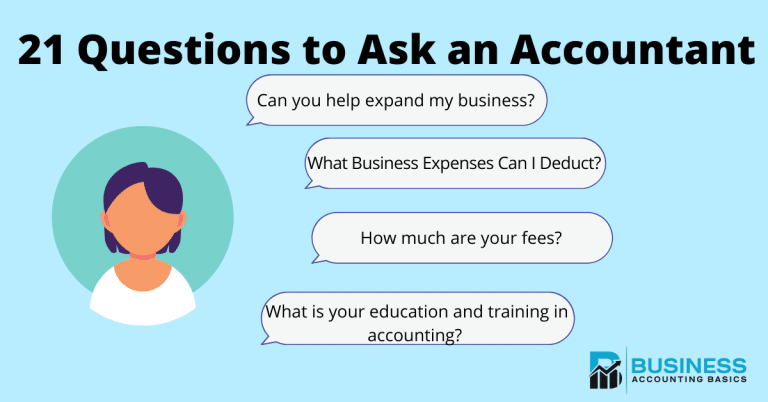

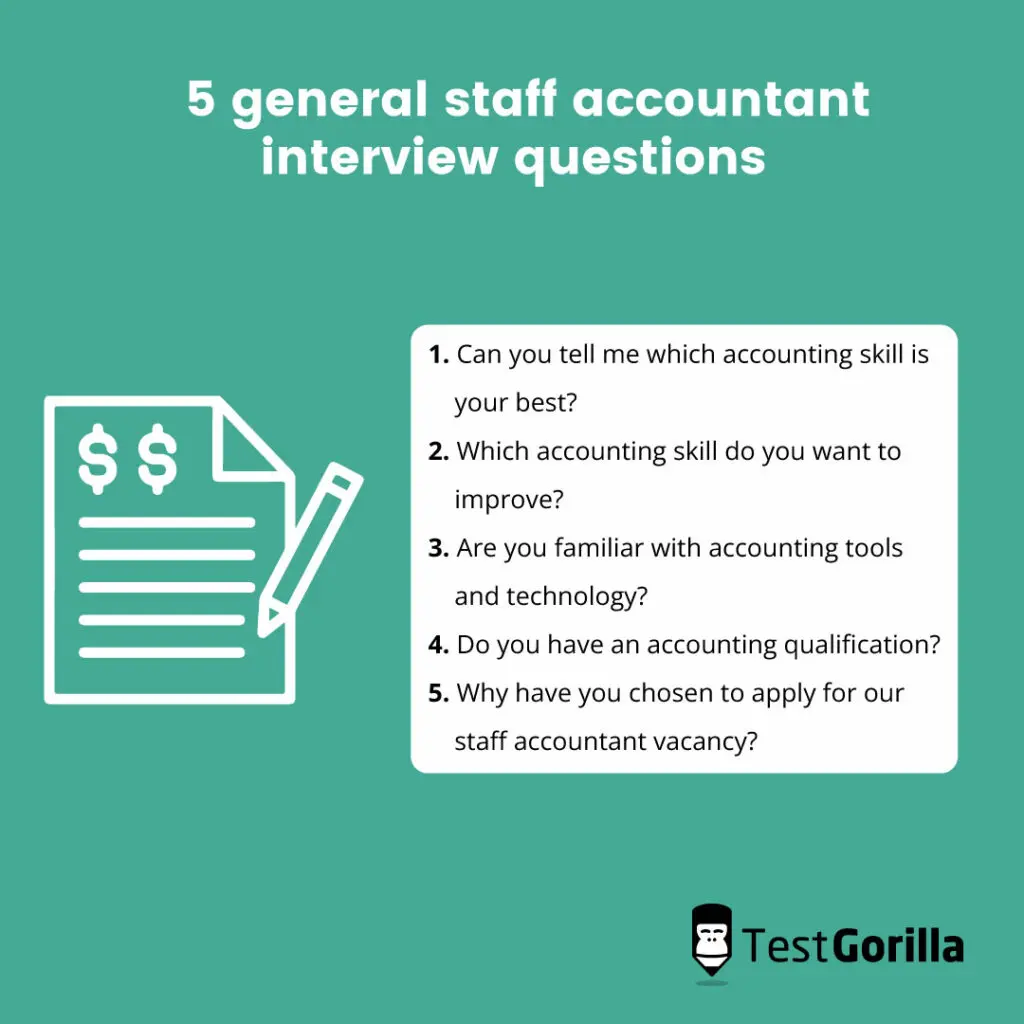

"What accounting software do you recommend for my business type and size?" Choosing the right software, from QuickBooks to Xero, can streamline bookkeeping and save time.

"How frequently should we meet, and what's the best way to communicate with you?" Establishing clear communication channels prevents misunderstandings and ensures timely advice.

Understanding Your Business Structure

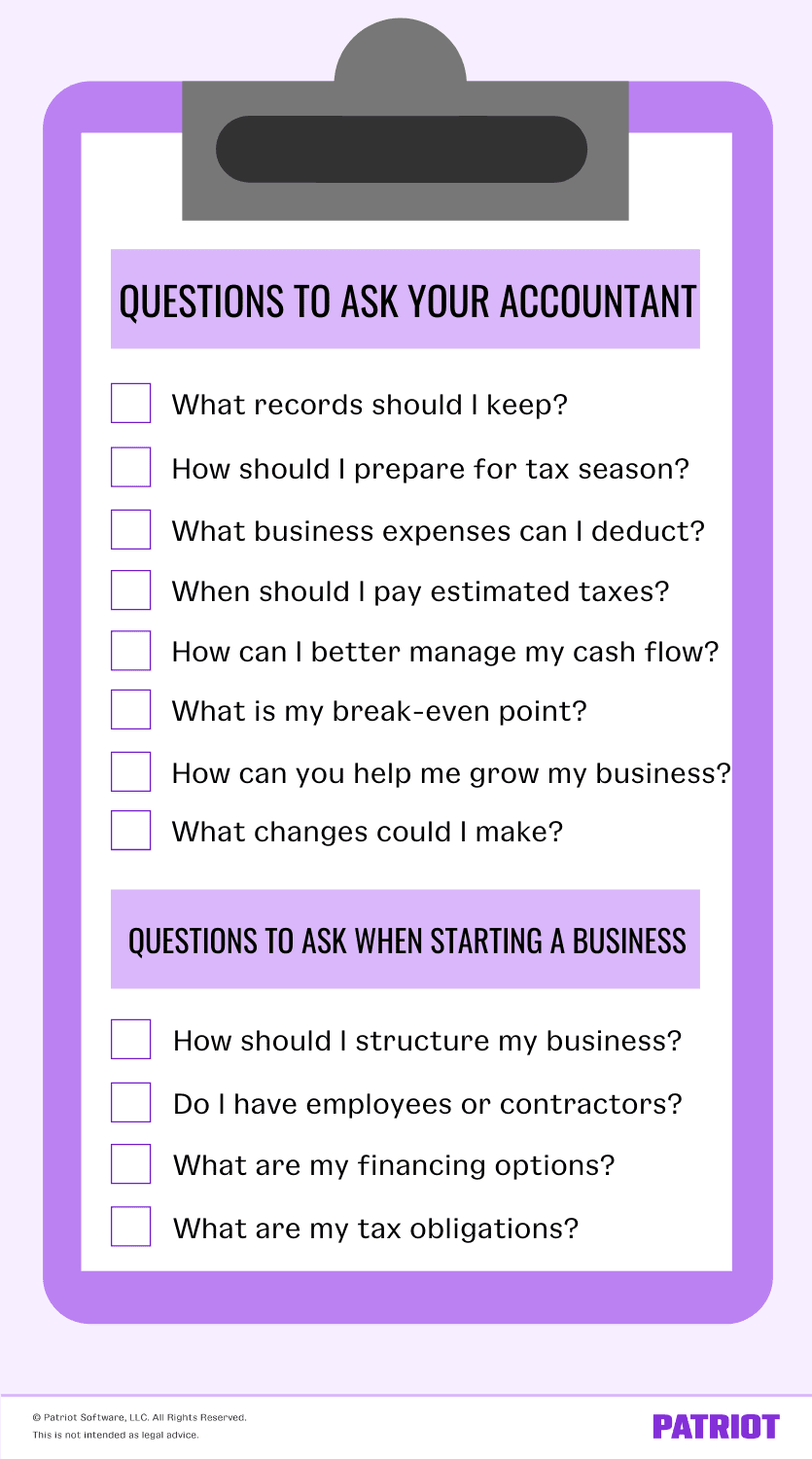

The legal structure of your business impacts everything from taxes to liability.

"What are the tax implications of different business structures (sole proprietorship, LLC, S-corp, etc.) for my specific situation?" This question helps you choose the structure that minimizes your tax burden and protects your personal assets.

According to the Small Business Administration (SBA), understanding the legal and tax ramifications of each business structure is a critical first step.

"How can I protect myself from personal liability?" Discussing liability shields helps prevent your personal assets from being at risk in case of business debts or lawsuits.

Cash Flow and Budgeting

Cash flow is the lifeblood of any business.

"How can I create a realistic budget and cash flow projection for my business?" Accurate projections are vital for managing expenses and identifying potential funding gaps.

"What key performance indicators (KPIs) should I track to monitor my financial health?" KPIs like gross profit margin and accounts receivable turnover offer valuable insights into your business's performance.

"What strategies can I use to manage my cash flow effectively, especially during the early stages?" This includes managing inventory, negotiating payment terms with suppliers, and accelerating customer payments.

Tax Planning and Compliance

Tax compliance can be complex, but proper planning can save you money and prevent penalties.

"What are the estimated tax payments I need to make, and when are they due?" Understanding your tax obligations upfront avoids surprises at tax time.

"What business expenses are tax-deductible, and how should I track them?" Maximizing deductions reduces your taxable income and saves you money.

The IRS provides extensive resources on deductible business expenses; your accountant can help you navigate these rules.

"How can I minimize my tax liability legally and ethically?" This involves exploring strategies like retirement plan contributions and tax credits.

Record Keeping and Financial Reporting

Accurate record keeping is essential for informed decision-making and tax compliance.

"What records should I keep, and how long should I keep them?" Proper record keeping simplifies tax preparation and provides a clear audit trail.

"What financial reports should I review regularly (balance sheet, income statement, cash flow statement), and how can I interpret them?" These reports provide a snapshot of your business's financial health and identify areas for improvement.

"How can I set up a system for tracking income and expenses efficiently?" Efficient systems ensure that you have accurate and up-to-date financial information at your fingertips.

Long-Term Financial Planning

Thinking beyond the present is crucial for sustainable growth.

"How can I develop a long-term financial plan for my business, including strategies for growth and profitability?" This plan should outline your financial goals and the steps you'll take to achieve them.

"What are some potential funding options for my business, such as loans, grants, or investors?" Understanding your funding options gives you the flexibility to adapt to changing market conditions.

"How can I plan for my business's future, including succession planning or selling the business?" Planning for the future ensures a smooth transition when you're ready to move on.

Leaving your accountant's office, you should feel empowered, not overwhelmed. You've laid the groundwork for a financially sound future.

By proactively addressing these questions, you transform your accountant into a trusted partner, guiding you through the complexities of business finance and paving the way for lasting success. Remember, the journey of entrepreneurship is a marathon, not a sprint. A strong financial foundation is the key to running the distance.