Quick Credit Connect Reviews Consumer Reports

Quick Credit Connect (QCC), a rapidly expanding fintech company, is under intense scrutiny following the release of a scathing Consumer Reports analysis. The report alleges deceptive marketing practices and potentially predatory lending terms targeting vulnerable consumers.

The report casts a harsh light on QCC’s business model, prompting immediate calls for regulatory investigation and consumer awareness campaigns.

Consumer Reports Findings: A Breakdown

Consumer Reports published its findings this morning after a three-month investigation. The investigation included surveys of over 1,000 QCC customers and a detailed analysis of loan agreements.

The report identifies several key areas of concern. These include high-interest rates, hidden fees, and aggressive debt collection practices.

“QCC is preying on individuals with limited financial options,” stated Maria Sanchez, lead researcher for Consumer Reports. "Our investigation revealed a pattern of deceptive marketing that misleads consumers about the true cost of these loans."

High-Interest Rates and Hidden Fees

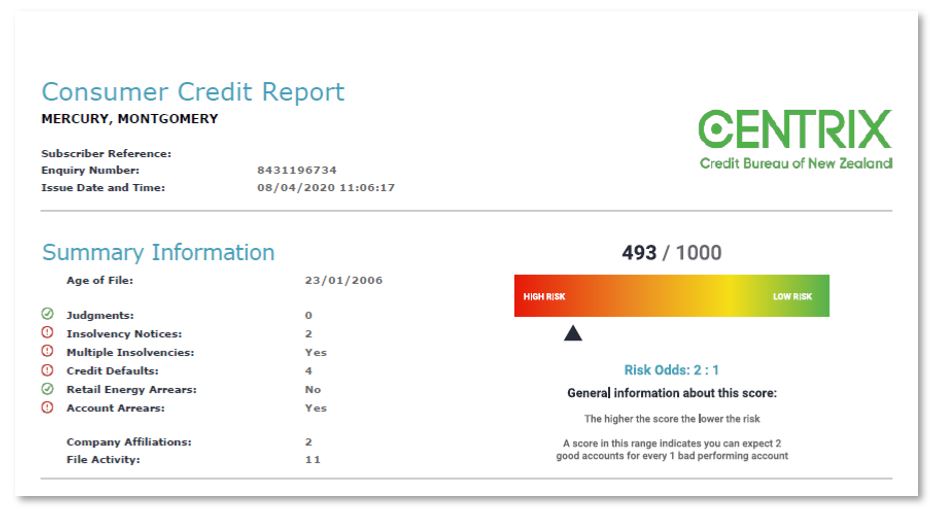

The report highlights that QCC’s annual percentage rates (APRs) frequently exceed 300%. This makes repayment incredibly difficult for borrowers, trapping them in a cycle of debt.

Furthermore, Consumer Reports found instances of undisclosed fees, including origination fees and late payment penalties. These fees significantly increase the overall cost of the loan.

"I thought I was getting a quick fix, but it turned into a nightmare," said one anonymous QCC customer interviewed in the report. "The fees kept piling up, and I couldn't keep up with the payments."

Aggressive Debt Collection Practices

Consumer Reports also details allegations of aggressive debt collection tactics employed by QCC. These include frequent phone calls, threats of legal action, and attempts to contact borrowers' employers or family members.

Such practices are potentially in violation of the Fair Debt Collection Practices Act (FDCPA). The FDCPA protects consumers from abusive and harassing debt collection tactics.

“We found numerous complaints about QCC’s debt collectors,” Sanchez added. “Their behavior is unacceptable and warrants immediate regulatory intervention.”

QCC's Response

Quick Credit Connect issued a statement this afternoon vehemently denying the allegations. They claim Consumer Reports’ analysis is “biased and inaccurate.”

The statement asserts that QCC is committed to providing transparent and responsible lending services. It also states that they comply with all applicable laws and regulations.

"We are confident that a thorough review of our practices will demonstrate our commitment to ethical lending," the statement read. "We are cooperating fully with any inquiries from regulatory agencies."

Regulatory Scrutiny and Potential Legal Action

The Consumer Reports findings have already caught the attention of several regulatory agencies. The Consumer Financial Protection Bureau (CFPB) is reportedly reviewing the report.

State attorneys general in California and New York have also announced investigations into QCC's lending practices. These investigations could lead to legal action against the company.

Consumer advocacy groups are urging affected individuals to file complaints with the CFPB and their state attorneys general.

Impact on Consumers

For consumers who have taken out loans with Quick Credit Connect, the Consumer Reports findings are a major cause for concern. They may be entitled to legal remedies if QCC has engaged in deceptive or illegal practices.

Consumers are advised to carefully review their loan agreements and keep records of all communications with QCC. They should also consider seeking legal advice from a qualified attorney.

The situation is rapidly evolving, and further updates are expected in the coming days. We will continue to monitor this developing story and provide updates as they become available.