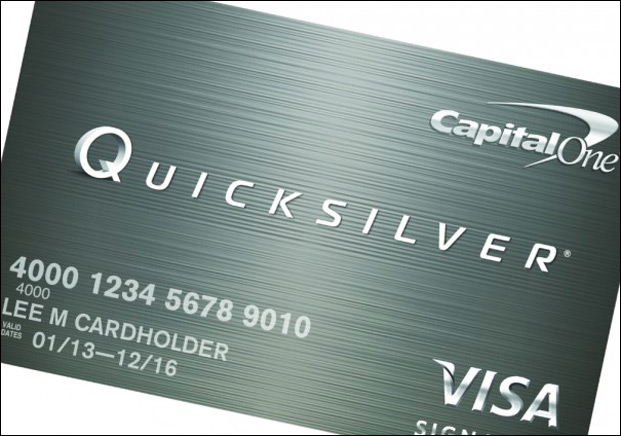

Quicksilverone From Capital One Credit Card

Capital One is reportedly discontinuing its QuicksilverOne credit card, leaving cardholders scrambling for information and alternative solutions.

The discontinuation, effective immediately for new applications, raises questions about the future of existing accounts and impacts consumers with fair credit seeking accessible rewards.

QuicksilverOne: What's Happening?

New applications for the QuicksilverOne card are no longer being accepted as of today. Capital One has confirmed this change, citing a review of their product offerings.

Existing cardholders are the focus now, with concerns swirling about potential account closures or forced product changes.

Impact on Current Cardholders

Capital One has stated that current QuicksilverOne cardholders will be contacted directly regarding their accounts. The details of these communications are critical.

The company's spokesperson emphasized that no immediate action is required from cardholders but urges them to monitor their email and mail for official notifications.

These notifications will outline any changes to account terms, potential upgrade options, or possible account closures.

What We Know About the Discontinuation

The decision to discontinue QuicksilverOne stems from Capital One’s strategic review. It's reportedly focused on streamlining their product line and offering more targeted credit card options.

The QuicksilverOne card, known for its accessibility to those with fair credit, offered a flat 1.5% cash back reward. This made it a popular choice for building or rebuilding credit.

Its $39 annual fee was a point of contention for some users, but its availability to a wider range of credit profiles made it a valuable tool for many.

Alternative Credit Card Options

Consumers seeking alternatives to QuicksilverOne should explore other secured and unsecured credit cards. Several companies offer similar rewards and credit-building opportunities.

Secured cards from Discover and Capital One itself (like the Secured Mastercard) may be viable options for those rebuilding credit. Unsecured options, depending on credit score, may include cards from Credit One Bank and similar issuers.

It's crucial to compare interest rates, fees, and rewards programs before applying for a new card.

Key Considerations for Cardholders

Monitor your credit score. Closing a credit card can temporarily impact your credit utilization ratio.

Pay down balances promptly to maintain a positive credit history.

Contact Capital One directly with any specific questions regarding your account. Do not rely solely on unofficial information.

Ongoing Developments

Capital One is expected to release further details regarding the transition plan for existing QuicksilverOne cardholders. Stay informed.

Financial experts are advising consumers to proactively review their credit card options and consider alternatives before any account changes occur.

We will continue to update this story as more information becomes available.

Be proactive, be informed, and protect your credit.

:max_bytes(150000):strip_icc()/capital-one-quicksilverone-cash-rewards-credit-card_blue-01c9f3eb0461451a9214e0f233f5d69d.jpg)