Ratio Of Liabilities To Stockholders' Equity

The relationship between a company's debts and its owner's investment, expressed as the ratio of liabilities to stockholders' equity, is under increasing scrutiny as economic uncertainties persist. This metric offers a glimpse into a company's financial leverage and risk profile, influencing investor confidence and strategic decision-making.

This article examines the significance of this ratio, exploring its implications for businesses and the broader economy. We will look at how it is calculated, interpreted, and the potential consequences of its fluctuations.

Understanding the Ratio

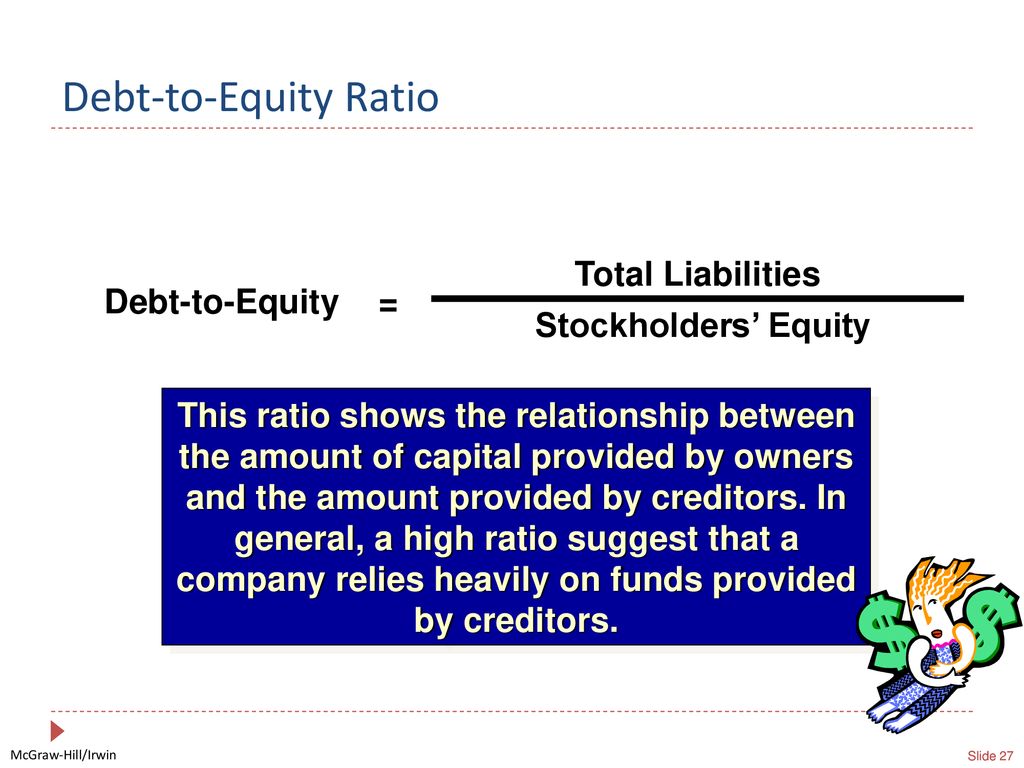

The liabilities to stockholders' equity ratio, often referred to as the debt-to-equity ratio, is a financial ratio that compares a company's total liabilities to its stockholders' equity. It essentially reveals the proportion of a company's assets that are financed by debt versus equity.

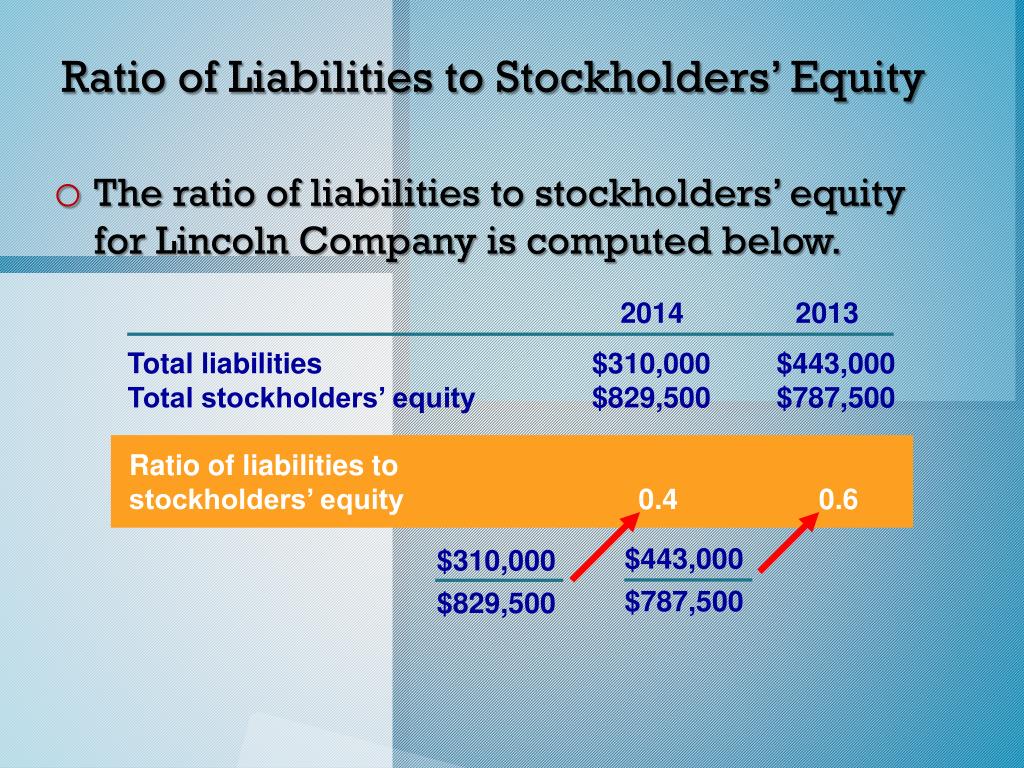

A higher ratio generally suggests that a company relies more heavily on debt financing, potentially indicating higher financial risk. Conversely, a lower ratio suggests a greater reliance on equity, which might indicate a more conservative financial approach.

How It's Calculated

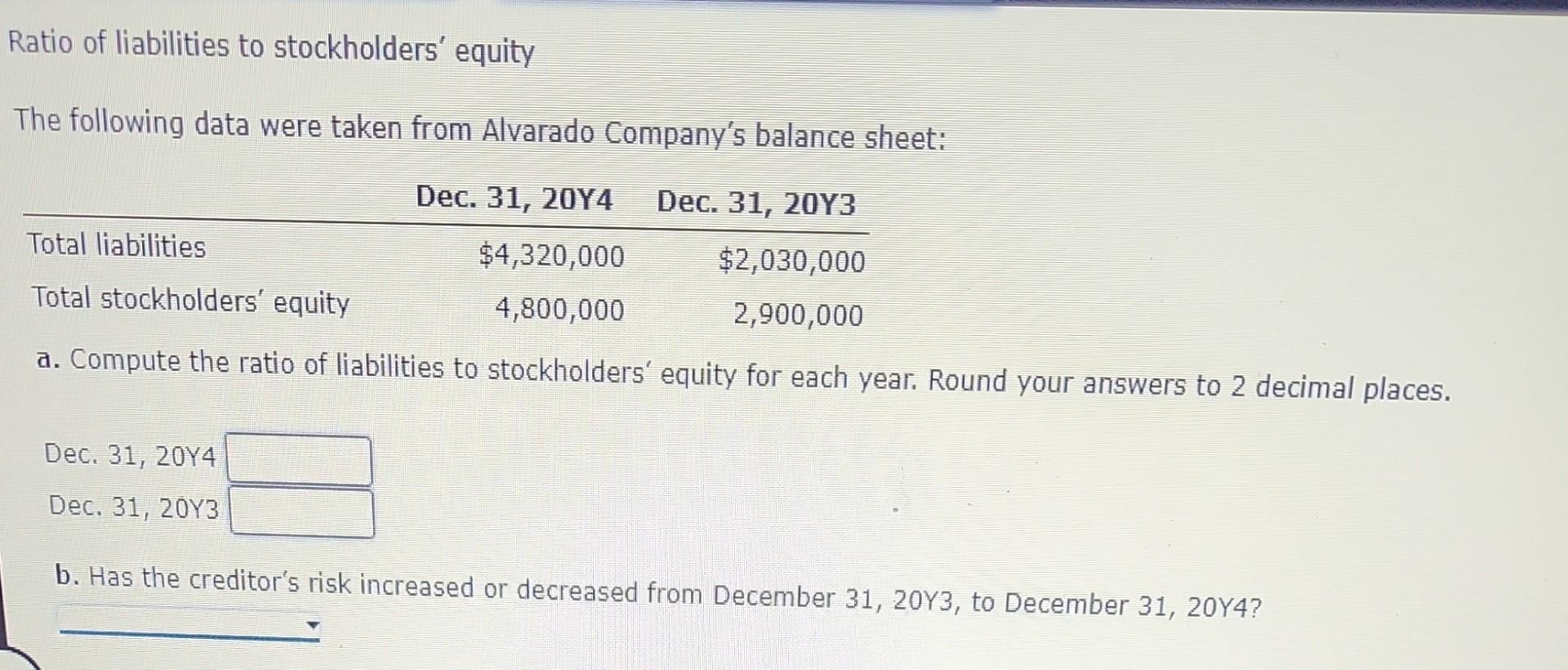

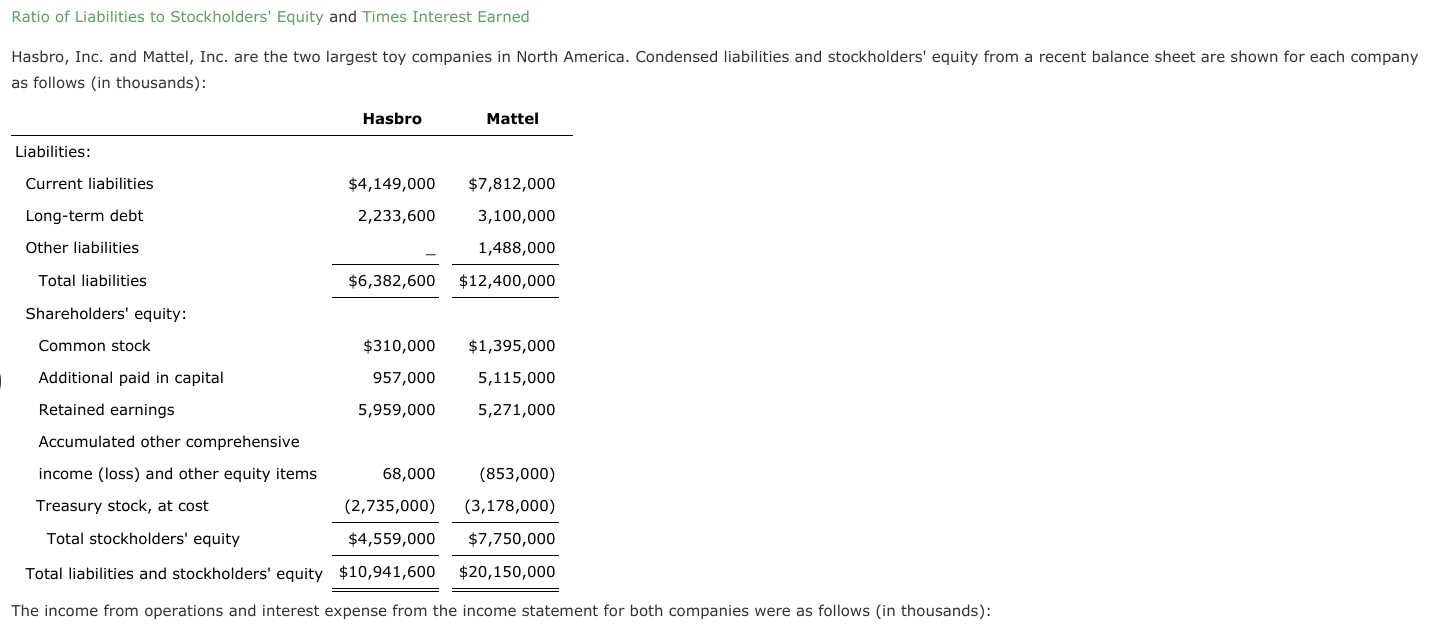

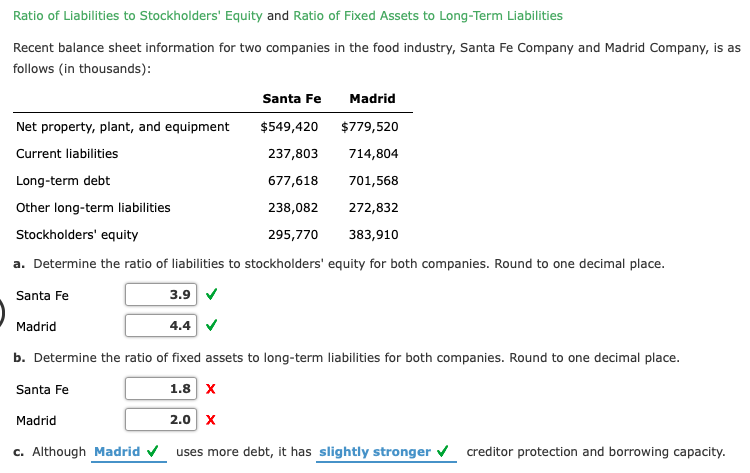

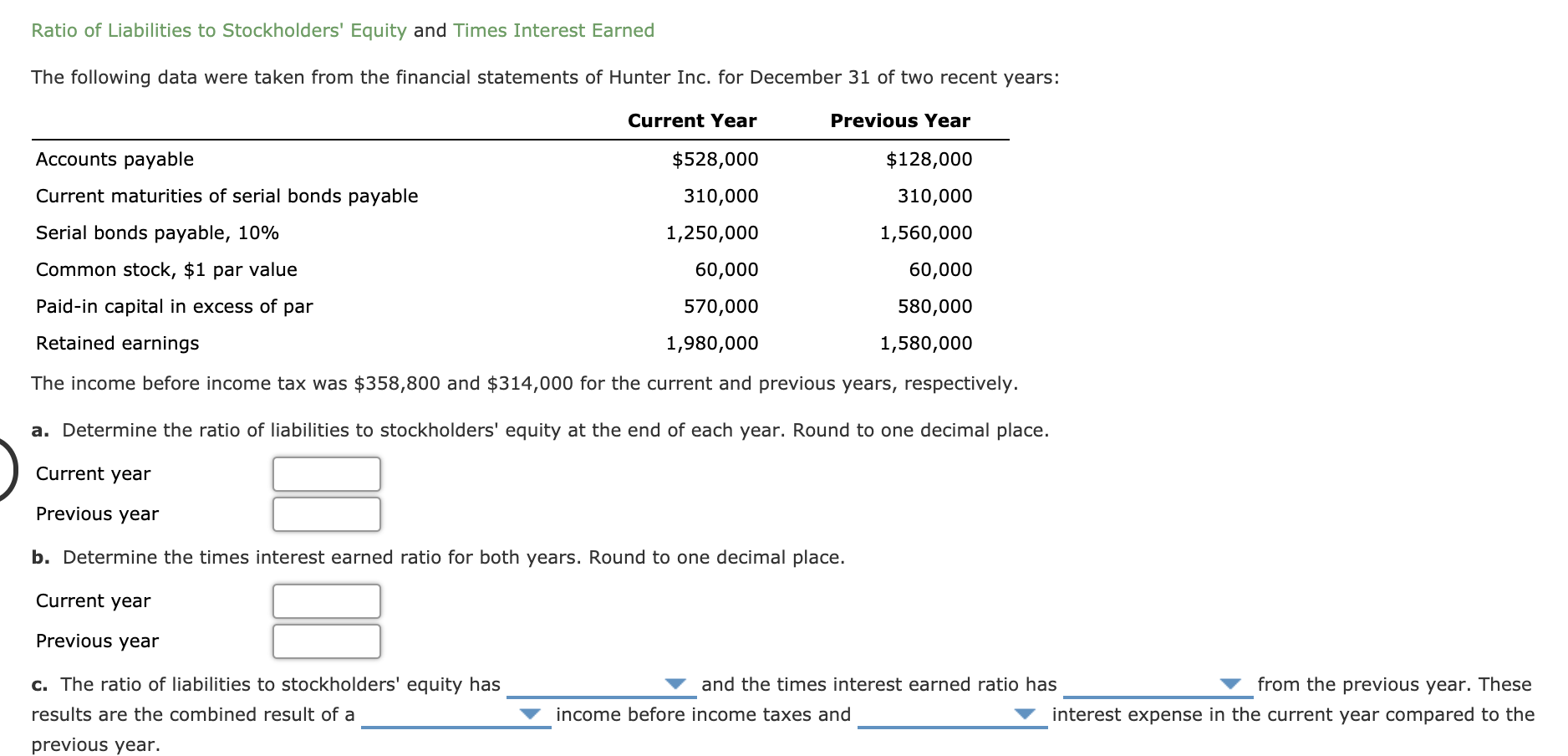

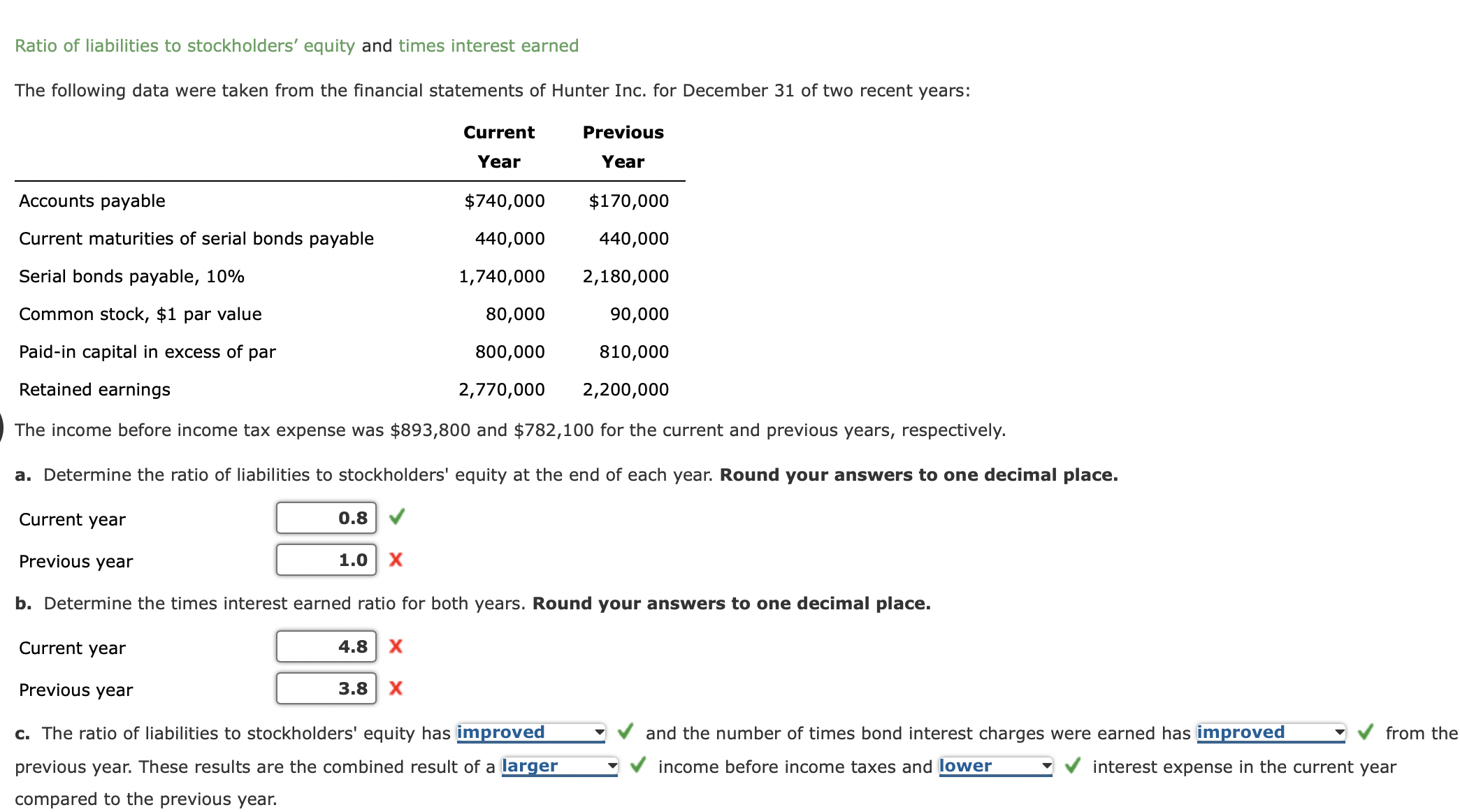

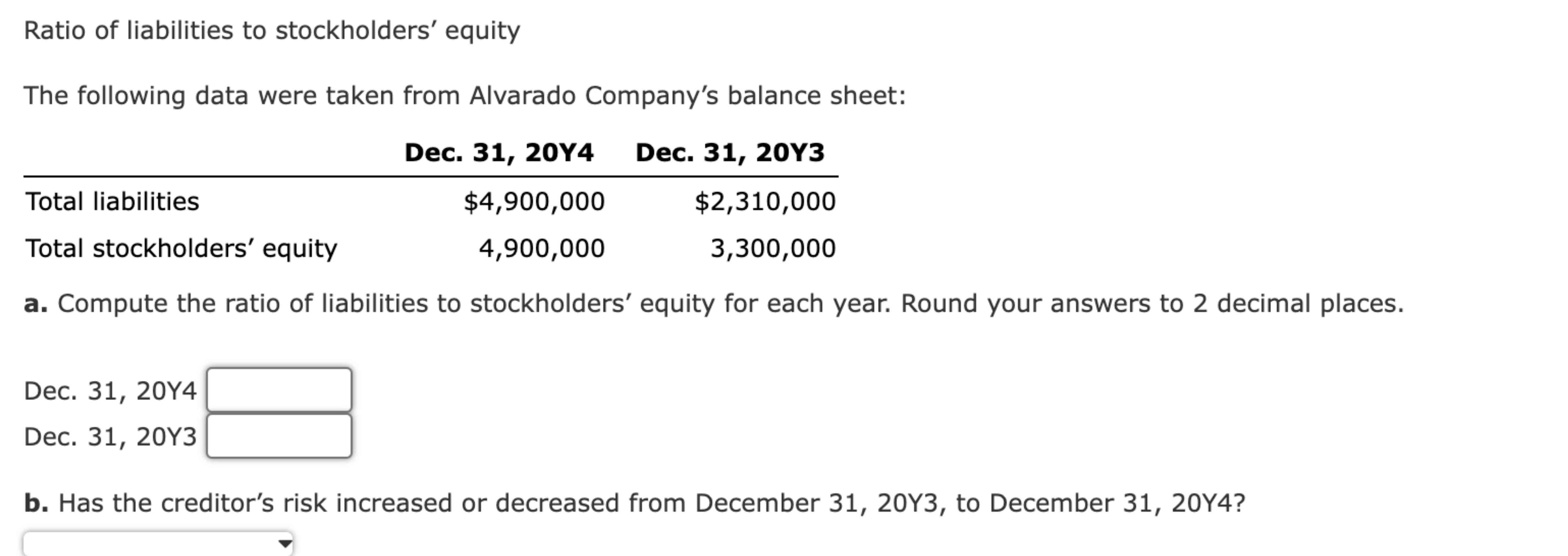

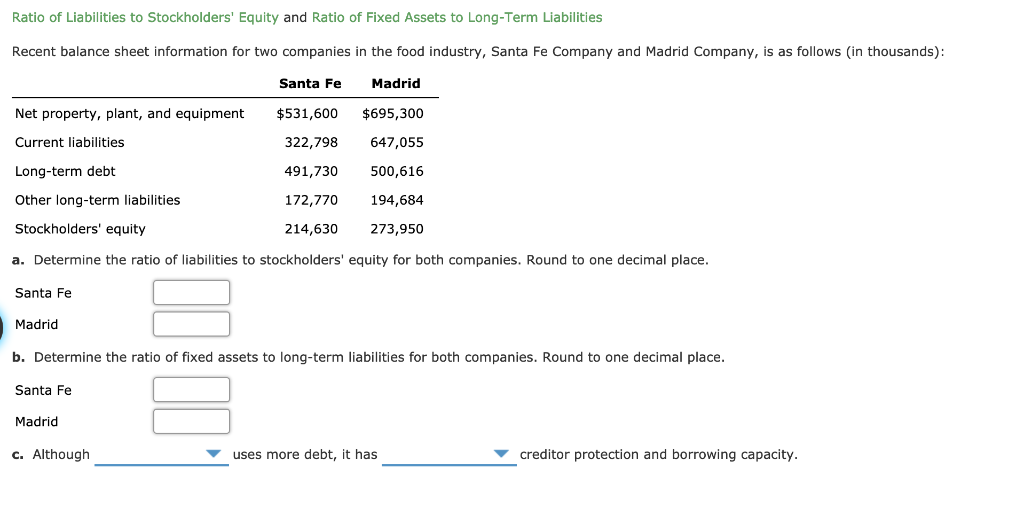

The formula for calculating the ratio is straightforward: Total Liabilities / Stockholders' Equity. Total liabilities encompass all financial obligations of the company, including accounts payable, salaries payable, short-term and long-term debt, and deferred revenue. Stockholders' equity, on the other hand, represents the owners' stake in the company, including common stock, preferred stock, and retained earnings.

Data for both figures is readily available on a company's balance sheet, a core financial statement providing a snapshot of its assets, liabilities, and equity at a specific point in time. Accurate and timely financial reporting is crucial for obtaining a reliable debt-to-equity ratio.

Significance and Interpretation

The debt-to-equity ratio serves as a valuable tool for various stakeholders. Investors use it to assess the risk associated with investing in a company.

Lenders use it to evaluate the creditworthiness of a borrower, and company management uses it to make informed decisions about capital structure.

A ratio that is too high can signal that a company is overleveraged and might struggle to meet its debt obligations. This situation can lead to a downgrade in credit rating, increased borrowing costs, and, in extreme cases, even bankruptcy.

However, a high ratio is not always inherently negative. Some industries, such as real estate and utilities, often have higher debt-to-equity ratios due to the nature of their operations and capital-intensive assets. The ideal ratio also depends on the specific company and industry, requiring careful benchmarking against industry peers.

A ratio that is too low might indicate that a company is not taking advantage of potential growth opportunities through borrowing. While a conservative approach can be beneficial in uncertain times, it can also limit a company's ability to expand and innovate.

Recent Trends and Economic Impact

Recent economic fluctuations, including rising interest rates and inflationary pressures, have significantly impacted the debt-to-equity ratios of many companies. As borrowing costs increase, companies with high debt levels face increased pressure on their profitability.

According to a recent report by [Hypothetical Research Firm Name], the average debt-to-equity ratio across various industries has increased by [Hypothetical Percentage]% in the past year. This increase reflects the challenges businesses face in navigating the current economic landscape.

The impact of these trends is particularly pronounced in sectors heavily reliant on debt financing, such as the housing market. Rising mortgage rates have made it more difficult for individuals to purchase homes, leading to a slowdown in the housing market and impacting the financial health of mortgage lenders and construction companies.

Case Studies

Consider Company A, a technology startup with a debt-to-equity ratio of 0.5. This relatively low ratio indicates that the company relies primarily on equity financing, likely reflecting its early stage and emphasis on growth over profitability.

In contrast, Company B, a well-established manufacturing company, has a debt-to-equity ratio of 1.5. This higher ratio suggests that the company leverages debt to finance its operations and expansion, a common practice in mature industries with predictable cash flows.

The differing ratios reflect the unique characteristics and strategies of each company. Analyzing these ratios in conjunction with other financial metrics provides a more comprehensive understanding of their financial health and risk profile.

Implications for Investors and Businesses

For investors, understanding the debt-to-equity ratio is crucial for assessing investment risk. A company with a high ratio might offer higher potential returns but also carries a greater risk of financial distress.

For businesses, managing the debt-to-equity ratio is essential for maintaining financial stability and attracting investors. Striking the right balance between debt and equity financing is a key strategic decision that can significantly impact a company's long-term success.

[Expert Name], a financial analyst at [Hypothetical Investment Firm], emphasizes the importance of considering the debt-to-equity ratio within the context of the industry and the company's specific circumstances. "A high ratio isn't always a red flag," she notes, "but it warrants careful scrutiny."

Conclusion

The liabilities to stockholders' equity ratio is a powerful indicator of a company's financial health and risk profile. By understanding its calculation, interpretation, and potential implications, investors, lenders, and businesses can make more informed decisions.

As economic conditions continue to evolve, monitoring this ratio remains essential for navigating the complexities of the financial landscape. Careful analysis and strategic management of debt and equity are crucial for long-term financial success.

.jpg)