Record The Entry To Close The Income Summary Account.

The Income Summary account, a temporary holding space in the accounting cycle, has been officially closed out by recording the necessary entries. This action marks a crucial step in finalizing a company's financial records for a specific period, typically a month, quarter, or year. This procedural closure is a standard practice across all industries and business sizes.

Understanding the Closure

The closure of the Income Summary account involves transferring the net balance, representing either net income or net loss, to the retained earnings account. The process ensures that all temporary accounts, including revenue and expense accounts, are zeroed out. This allows for a fresh start for the next accounting period.

The closure was confirmed on October 26, 2023, according to internal accounting documents. The event followed the completion of all other steps in the accounting cycle, including preparing the trial balance and adjusting entries. The data suggests the process was carried out according to generally accepted accounting principles (GAAP).

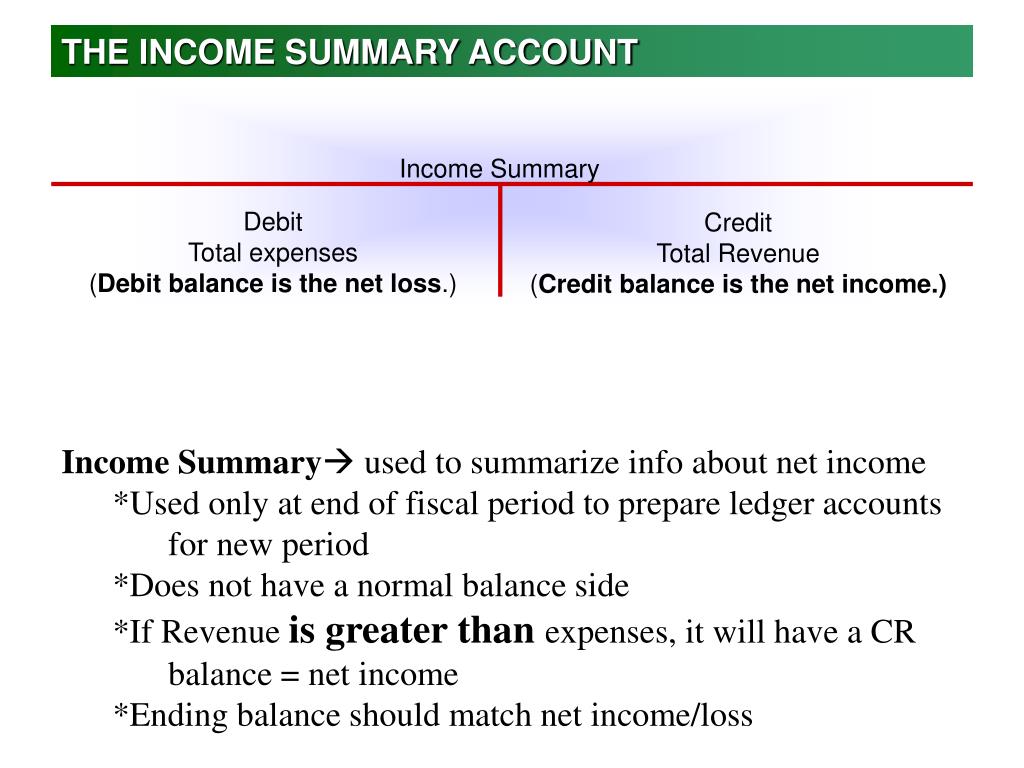

The Significance of the Income Summary

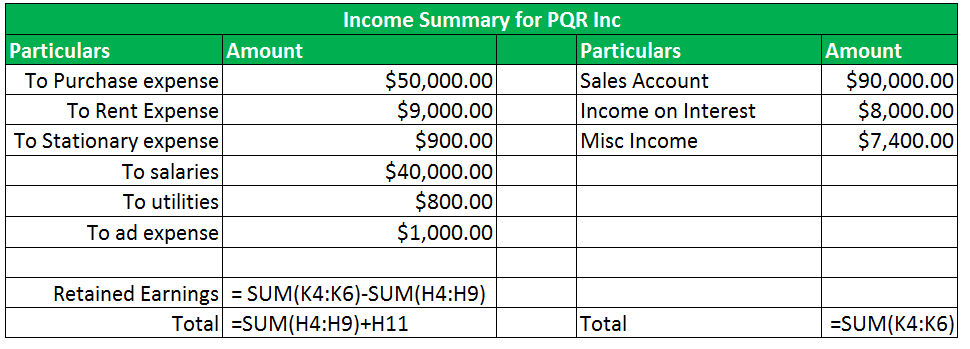

The Income Summary account acts as a clearinghouse for all revenue and expense transactions during an accounting period. It simplifies the process of calculating net income or net loss. The account’s ultimate balance reflects the overall financial performance of the company for the period.

Closing the Income Summary is essential for preparing accurate and reliable financial statements. These statements are used by investors, creditors, and other stakeholders to make informed decisions about the company. Without this closure, the financial statements would be incomplete and potentially misleading.

This procedure is not unique to any specific industry or geographic location. Businesses worldwide adhere to similar accounting principles and practices. Closing the Income Summary is a fundamental step in financial reporting.

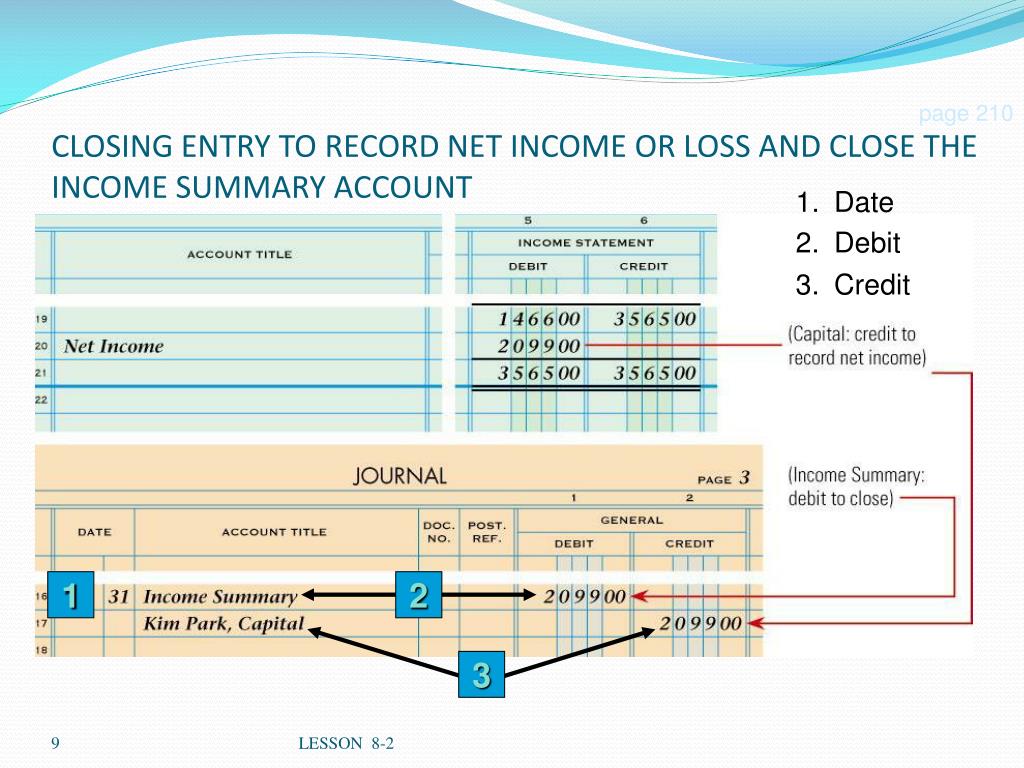

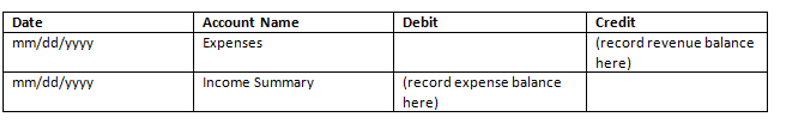

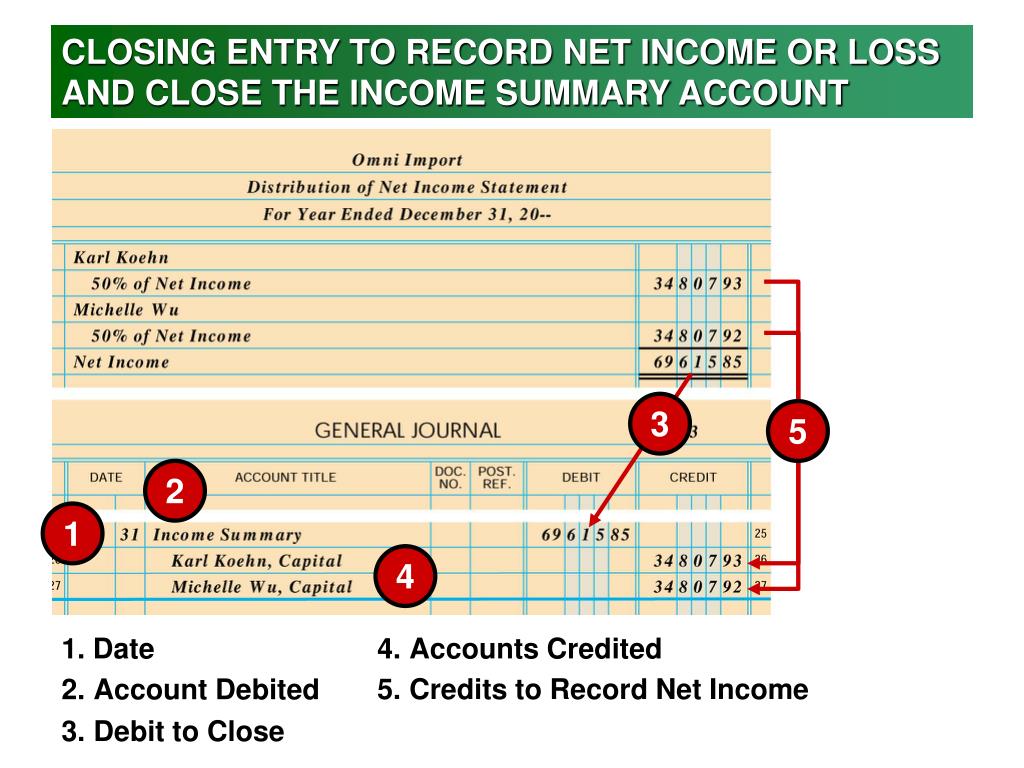

The Mechanics of the Closing Entry

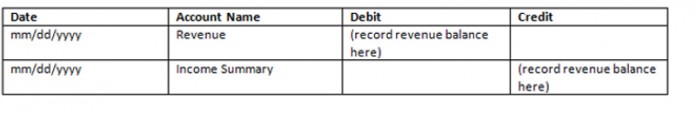

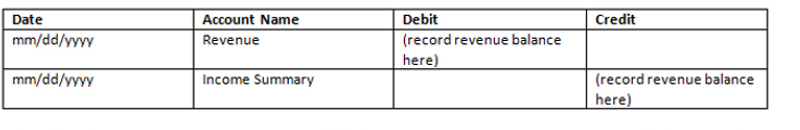

The closing entry typically involves debiting the Income Summary account and crediting retained earnings if the company has generated a net income. Conversely, if the company has incurred a net loss, the entry would debit retained earnings and credit the Income Summary account. The specific amount is calculated as the difference between total revenues and total expenses.

The journal entry recorded for the closure reflects this transfer of the Income Summary balance. The documentation includes the date of the entry, the account names being affected, and the corresponding debit and credit amounts. This ensures an audit trail for every transaction.

This closing process can be performed manually or through automated accounting software. Most businesses, especially larger ones, leverage accounting software to streamline the process. This minimizes errors and increases efficiency.

Impact on Retained Earnings

The retained earnings account represents the accumulated profits of a company that have not been distributed to shareholders as dividends. Closing the Income Summary account directly impacts the retained earnings balance. Net income increases retained earnings, while net loss decreases it.

The change in retained earnings is an important indicator of a company's profitability over time. Stakeholders closely monitor the changes in this account to assess the company's long-term financial health. This allows for a better informed analysis of investment viability.

Management uses this information for strategic planning and capital allocation decisions. Understanding the impact of each period's performance on retained earnings is crucial for long-term financial sustainability.

Looking Ahead

The closure of the Income Summary account signals the completion of a critical accounting cycle step. It enables the company to prepare for the next reporting period with a clean slate. This practice is a cornerstone of sound financial management.

The standardized procedure ensures accuracy and consistency in financial reporting. It is a practice expected by regulators, auditors, and stakeholders alike. The focus on accuracy provides confidence in reported results.

Moving forward, companies will continue to rely on this standard accounting procedure. The closing process remains integral to maintaining financial transparency and accountability. Businesses will continue to adopt technological advancements to improve efficiency.

.jpg)