Refinancing Student Loans Good Or Bad

The weight of student loan debt hangs heavy on millions of Americans, casting a long shadow over their financial futures. With rising interest rates and a complex landscape of repayment options, the question of refinancing those loans has become increasingly urgent. Is it a lifeline to lower payments and greater financial flexibility, or a risky maneuver that could ultimately cost borrowers more?

This article delves into the complexities of student loan refinancing, exploring the potential benefits and drawbacks, and offering insights into whether it's the right choice for your individual circumstances. We'll examine the perspectives of financial experts, borrowers who have refinanced, and those who chose to stick with their original loans. The goal is to provide a balanced overview, empowering you to make an informed decision about your financial future.

Understanding Student Loan Refinancing

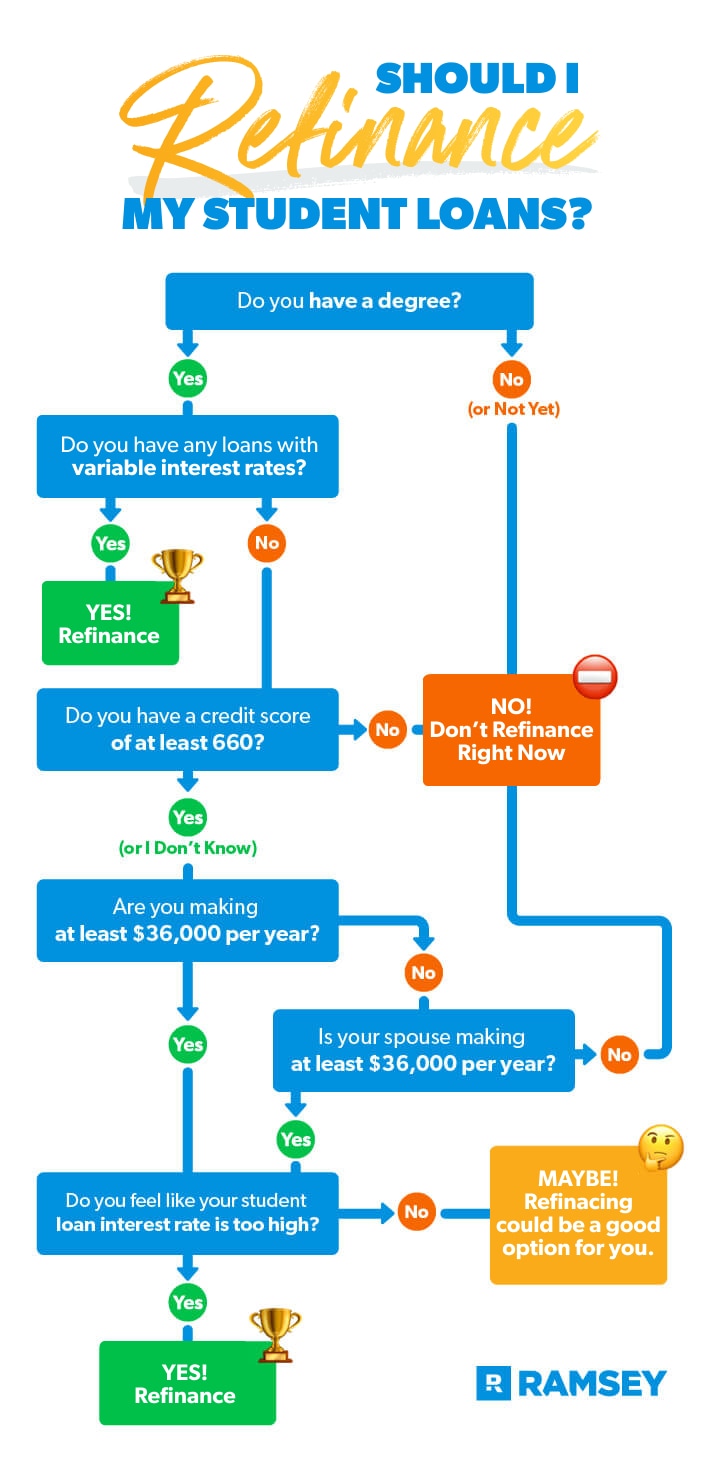

Student loan refinancing involves taking out a new loan, ideally at a lower interest rate, to pay off existing student loans. This essentially consolidates your loans into a single new loan with potentially more favorable terms. The potential benefits include lower monthly payments, a shorter repayment term, and the opportunity to switch from a variable to a fixed interest rate, or vice-versa.

However, refinancing isn't a one-size-fits-all solution. It requires careful consideration of your individual financial situation and a thorough understanding of the potential trade-offs.

The Potential Benefits

One of the most attractive aspects of refinancing is the possibility of securing a lower interest rate. This can translate into significant savings over the life of the loan. According to data from the Consumer Financial Protection Bureau (CFPB), even a small reduction in interest rate can save borrowers thousands of dollars.

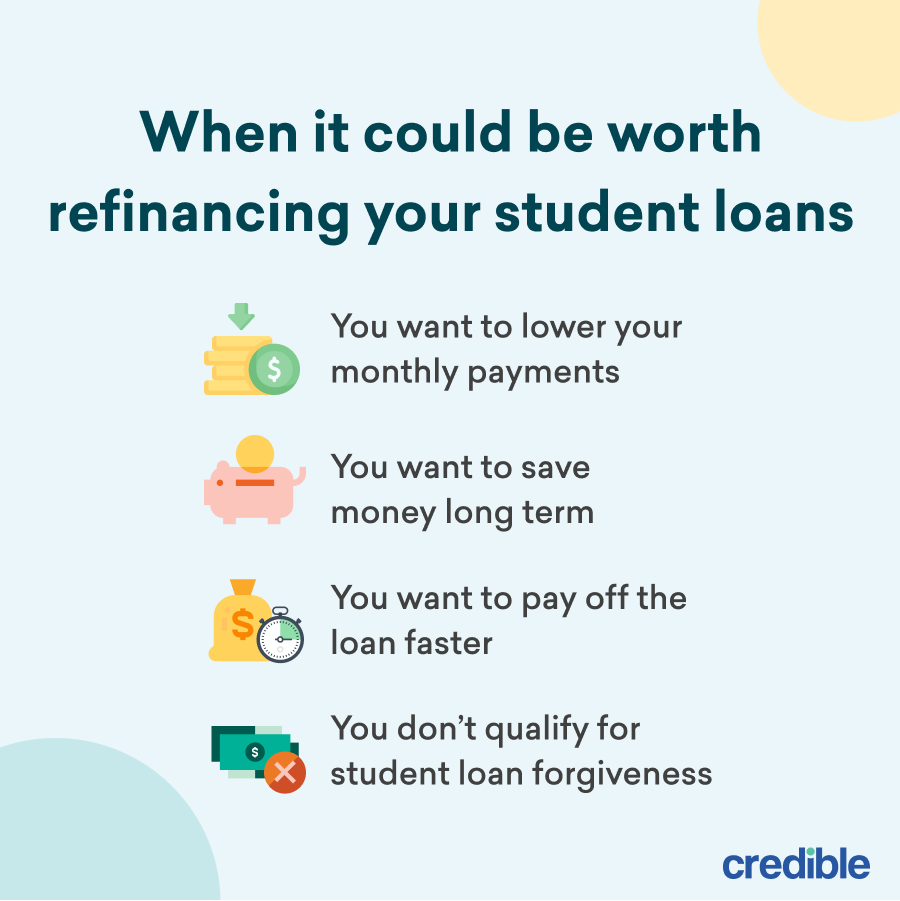

Refinancing can also simplify your finances by consolidating multiple loans into a single payment. This can make budgeting easier and reduce the risk of missed payments. Furthermore, borrowers can often choose a repayment term that better aligns with their financial goals, whether it's a shorter term to pay off the debt faster or a longer term to lower monthly payments.

The Potential Drawbacks

Perhaps the most significant drawback of refinancing federal student loans is the loss of federal protections and benefits. This includes access to income-driven repayment plans, which adjust monthly payments based on income and family size. Borrowers also lose access to potential loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) for those working in qualifying public service jobs.

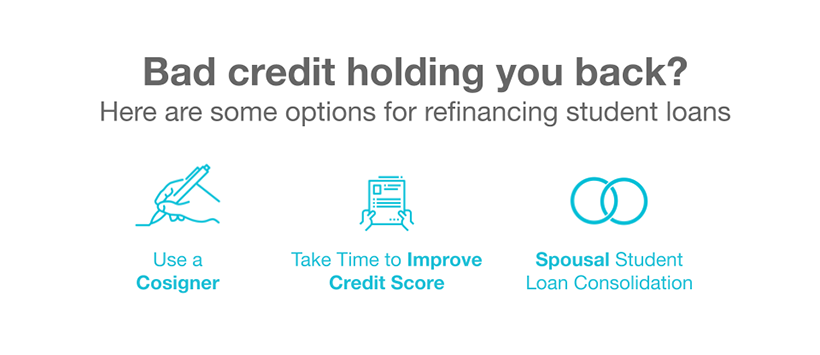

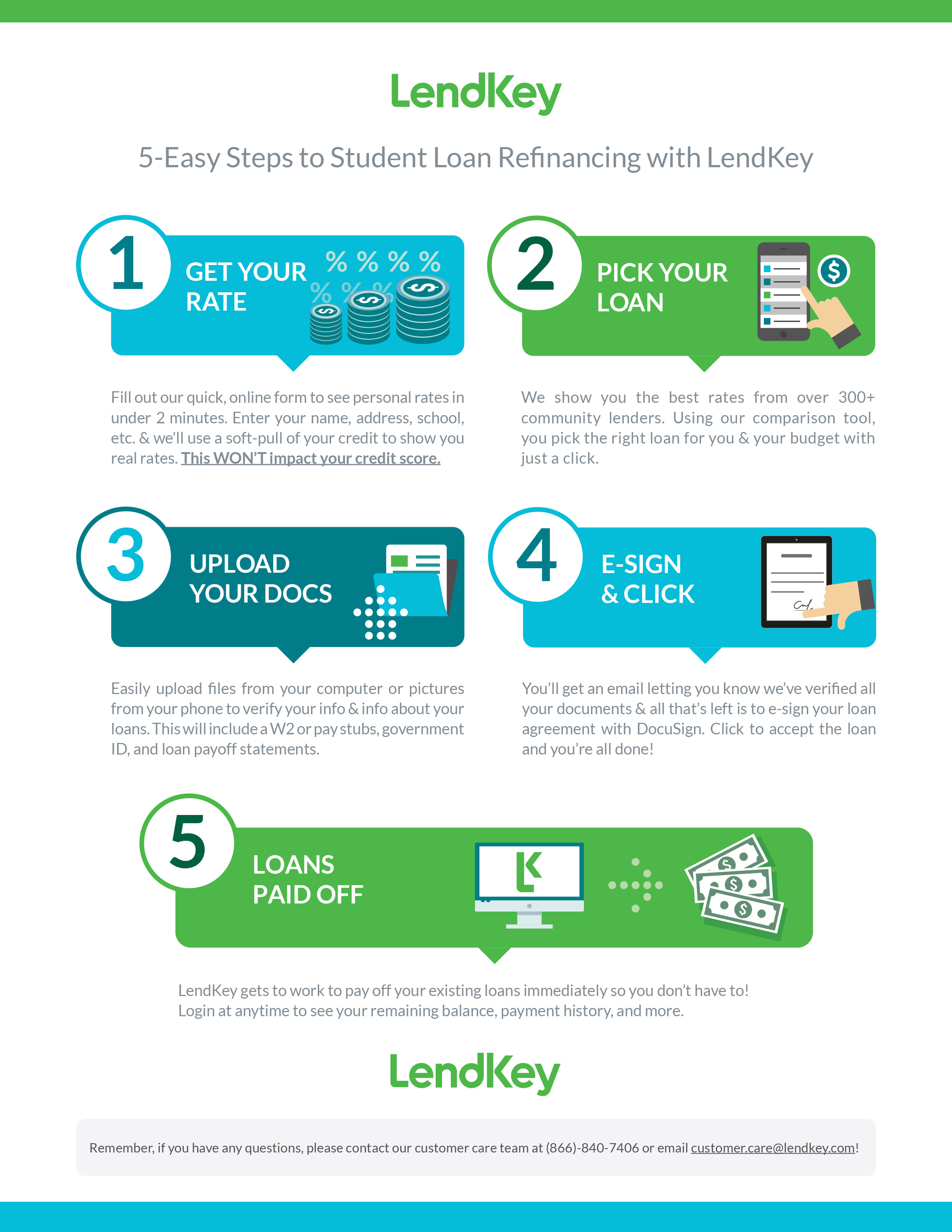

Refinancing is typically offered through private lenders, who don't provide the same safety net as the federal government. If you experience financial hardship, you may not have the same options for forbearance or deferment. Moreover, refinancing companies generally require a good credit score and a stable income, which may exclude some borrowers.

Weighing the Pros and Cons: A Borrower's Perspective

Sarah Miller, a recent graduate with a master's degree in education, initially refinanced her federal student loans to secure a lower interest rate. "At the time, it seemed like a no-brainer," she explains. "I was saving hundreds of dollars a month."

However, when the pandemic hit and Sarah lost her job, she regretted her decision. "I realized I had given up the protections that would have allowed me to defer my payments," she says. "I was lucky to find a new job quickly, but it was a stressful time."

On the other hand, David Lee, a software engineer, had a positive experience with refinancing. "I refinanced my loans after a few years of working and seeing my income increase," David says. "I was able to get a much lower interest rate, and I paid off my loans much faster than I would have otherwise."

Expert Opinions and Recommendations

Financial experts offer varied perspectives on student loan refinancing. Mark Kantrowitz, a leading expert on student financial aid, advises borrowers to carefully consider the potential trade-offs before refinancing federal loans. "If you're eligible for PSLF or think you might need income-driven repayment in the future, refinancing is generally not a good idea," Kantrowitz notes.

Other experts suggest that refinancing can be a smart move for borrowers with stable incomes and good credit scores who are confident they won't need federal loan protections. However, it's crucial to compare offers from multiple lenders and understand all the terms and conditions before making a decision.

"Always read the fine print," warns Lisa Johnson, a certified financial planner. "Understand the interest rate, repayment terms, and any fees associated with the loan."

The Future of Student Loan Refinancing

The landscape of student loan refinancing is constantly evolving. As interest rates fluctuate and new financial products emerge, borrowers need to stay informed and evaluate their options carefully. The Biden administration's student loan forgiveness initiatives and ongoing debates about student loan reform could also impact the attractiveness of refinancing.

Ultimately, the decision to refinance student loans is a personal one. It requires a thorough assessment of your individual financial situation, risk tolerance, and long-term goals. By weighing the potential benefits and drawbacks and seeking professional advice, you can make an informed decision that sets you on the path to financial well-being.

![Refinancing Student Loans Good Or Bad [INFOGRAPHIC] Should you refinance your student loans?](https://www.ihmvcu.org/images/default-source/images-for-money-smarts-blog/how-much-graduate-degree-holders-can-save-refinancing-infographic.png?sfvrsn=377dad0a_2)